How to make a Fundamental analysis of the Crypto market?

By Yaroslav Krasko Updated November 01, 2022

BikoTrading Academy

Fundamental analysis is a type of analysis in which various internal and external factors are investigated, with the help of these factors the fair price of shares, business, cryptocurrency, etc. is determined. Simply put, fundamental analysis determines whether an asset is undervalued or overvalued.

Fundamental indicators of cryptocurrencies

If during the analysis of stocks and companies we can analyze such indicators as: income, revenue, profit, creditworthiness, etc. then in the case of cryptocurrency it is impossible to do so. But even without these metrics, it is possible to conduct a fairly accurate fundamental analysis of the cryptocurrency market.

Onchain metrics

Almost 99% of altcoins are completely correlated to Bitcoin (repeating the dynamics of Bitcoin movement), so below there will be metrics that apply not only to Bitcoin, but all coins without exception!

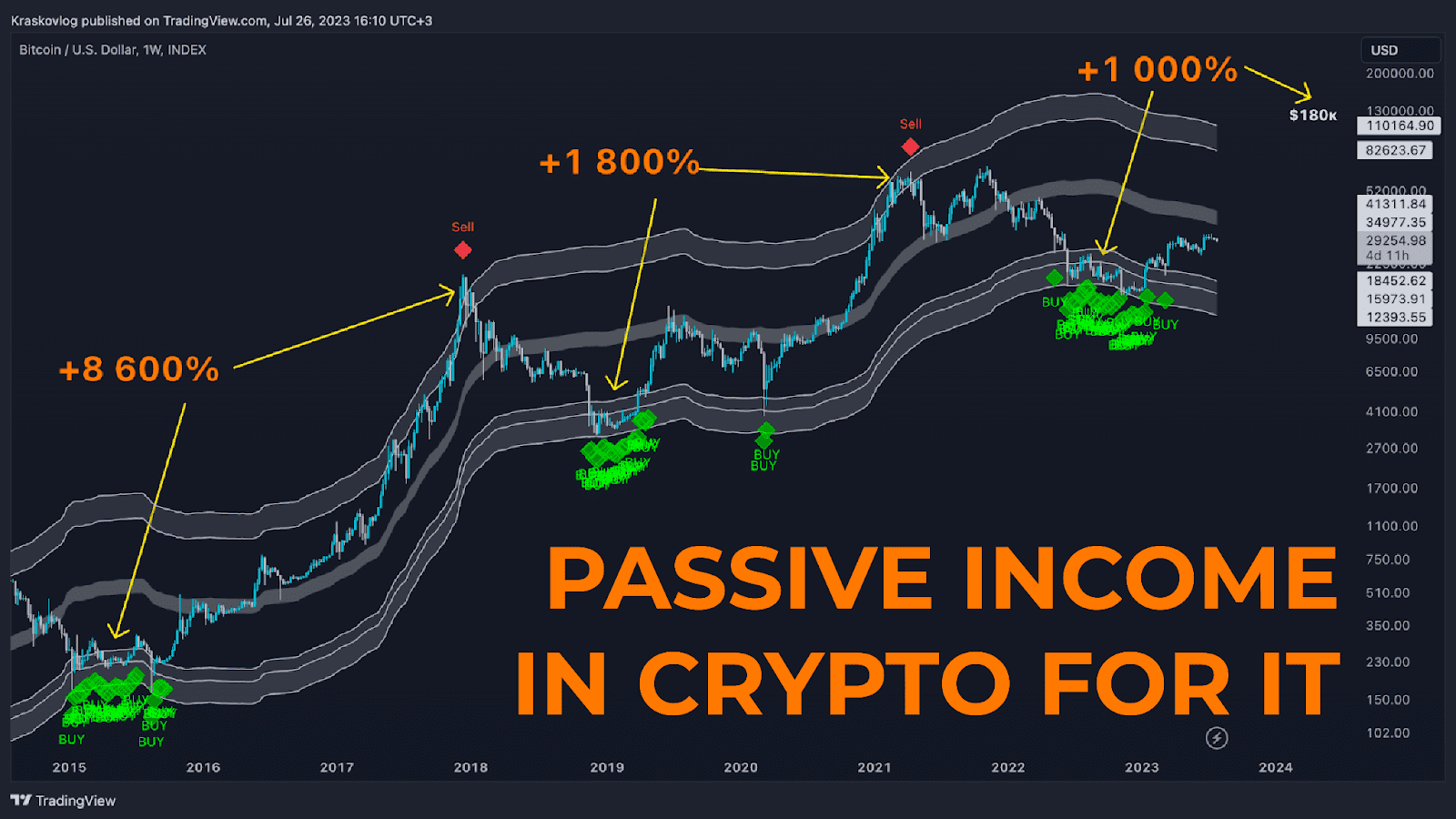

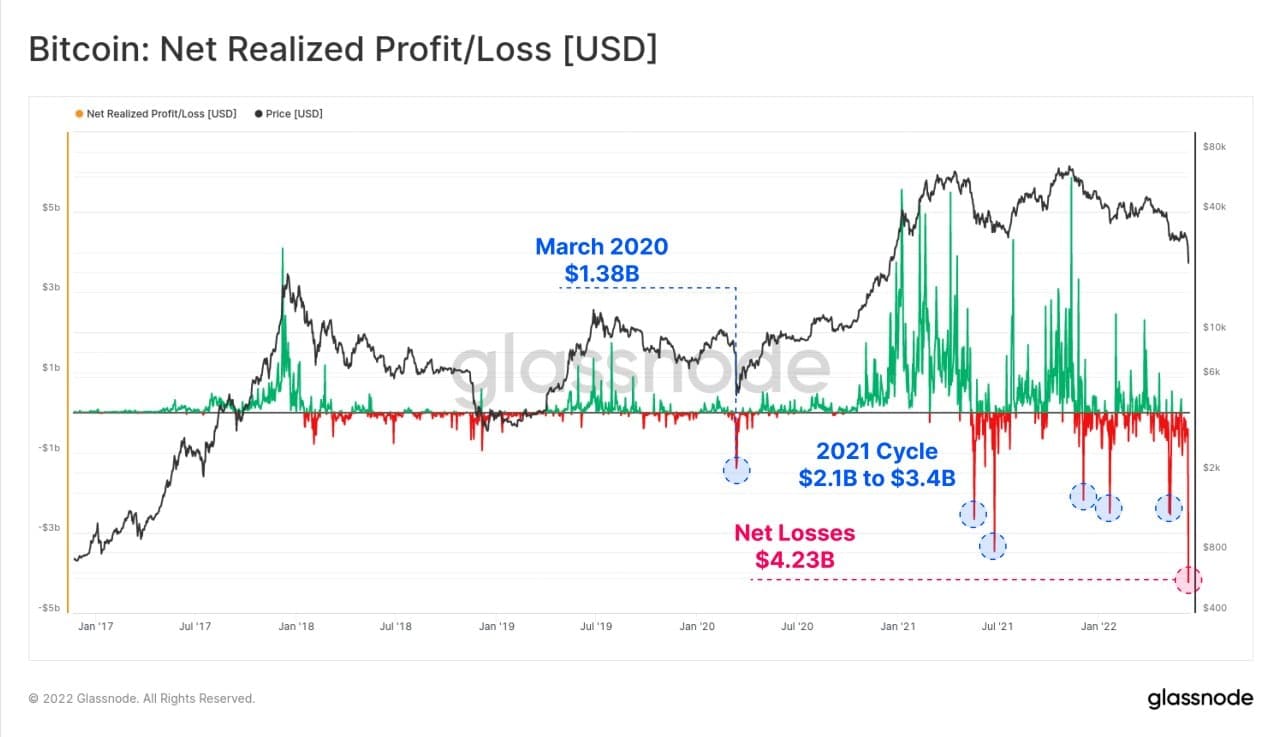

Net Realized Profit/Loss is a metric that calculates net profit or loss (in US dollars) for all coins spent over a period of time. As you can see in the chart, the maximum and minimum marks of this indicator were good enough opportunities to record profits or start buying cryptocurrency.

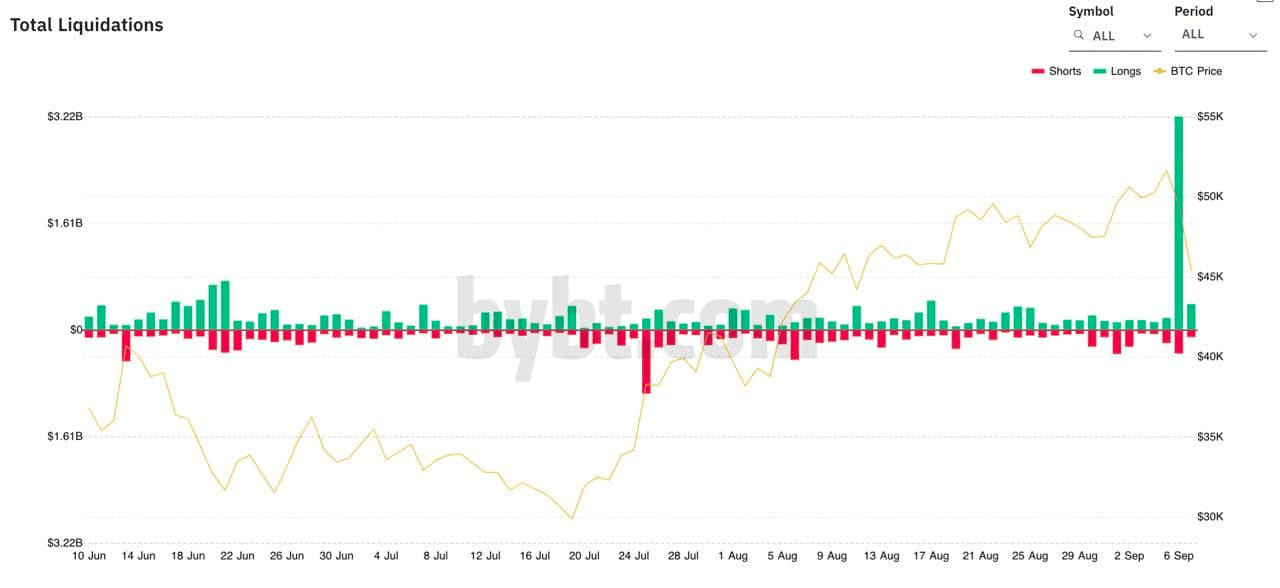

Liquidations - participants in the cryptocurrency market often use leverage to increase their profits. Sometimes there are periods of sharp declines or growth in the market. At this time, most market players are being liquidated. Maximum liquidation marks have always, historically, been a good opportunity to capture profits or buy cryptocurrencies.

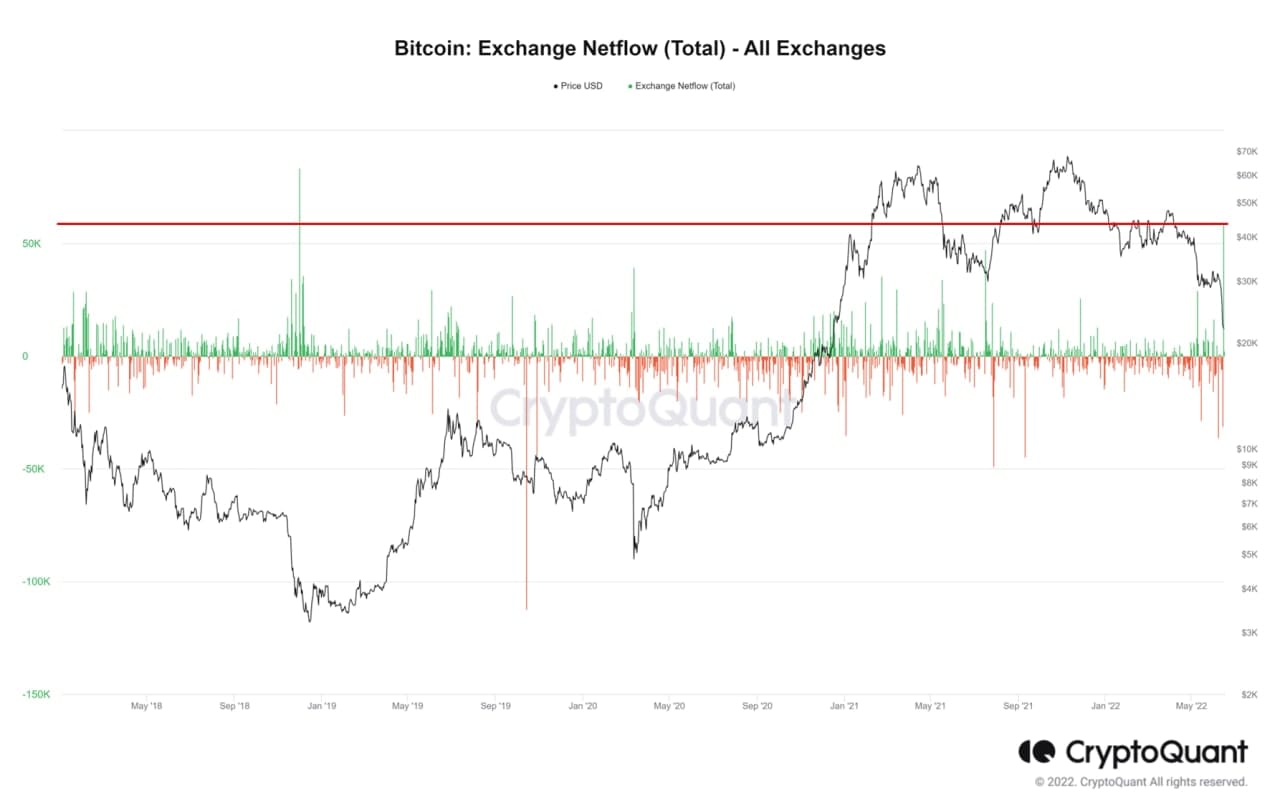

Exchange Netflow - no less important indicator in the cryptocurrency market is the control of inflows and outflows of coins on the exchange. The influx of large amounts of coins on the stock exchange during a period of strong growth and excitement often leads to a fall (this means that big players sell). In periods of severe decline, on the contrary, this is a very positive figure!

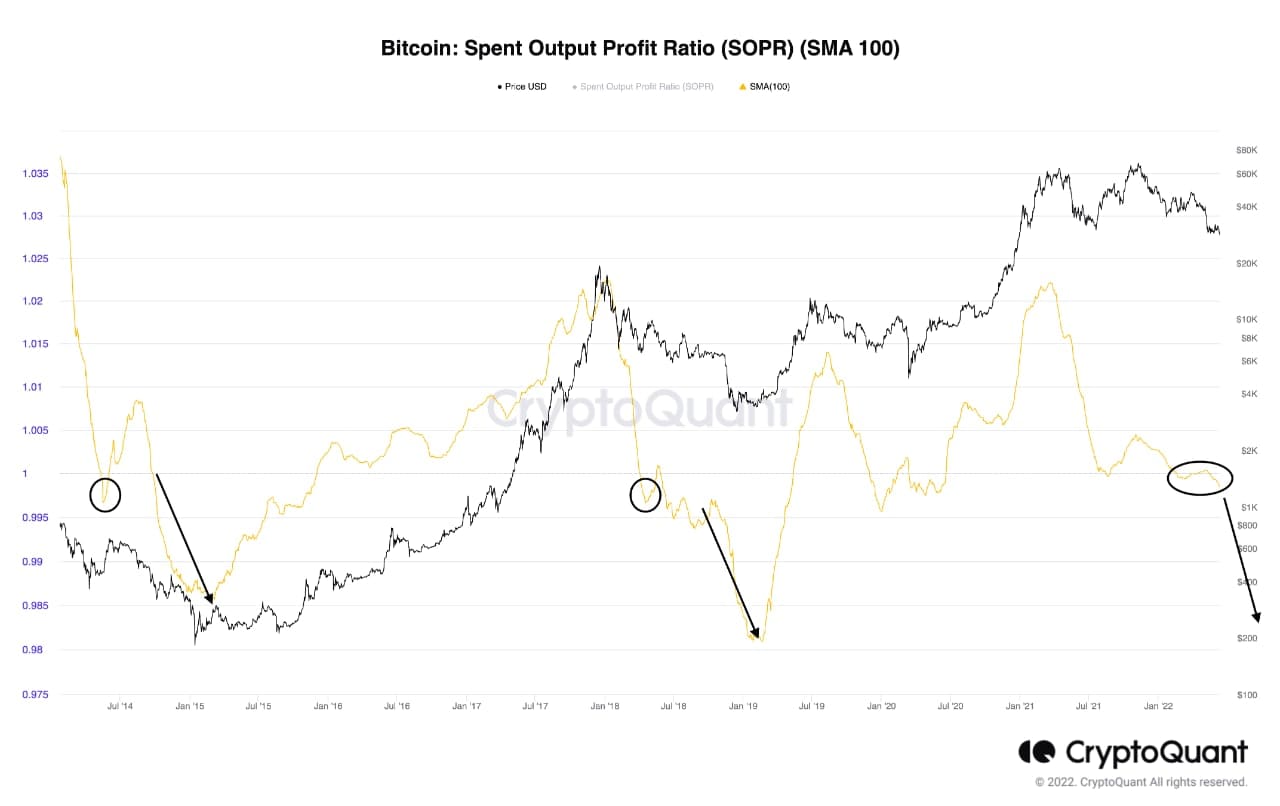

SOPR (Spent Output Profit Ratio) - shows the level of realized profit of all coins moved in the blockchain. It gives an idea of the profits and losses received over a period of time, and also allows you to determine the mood in the global market.

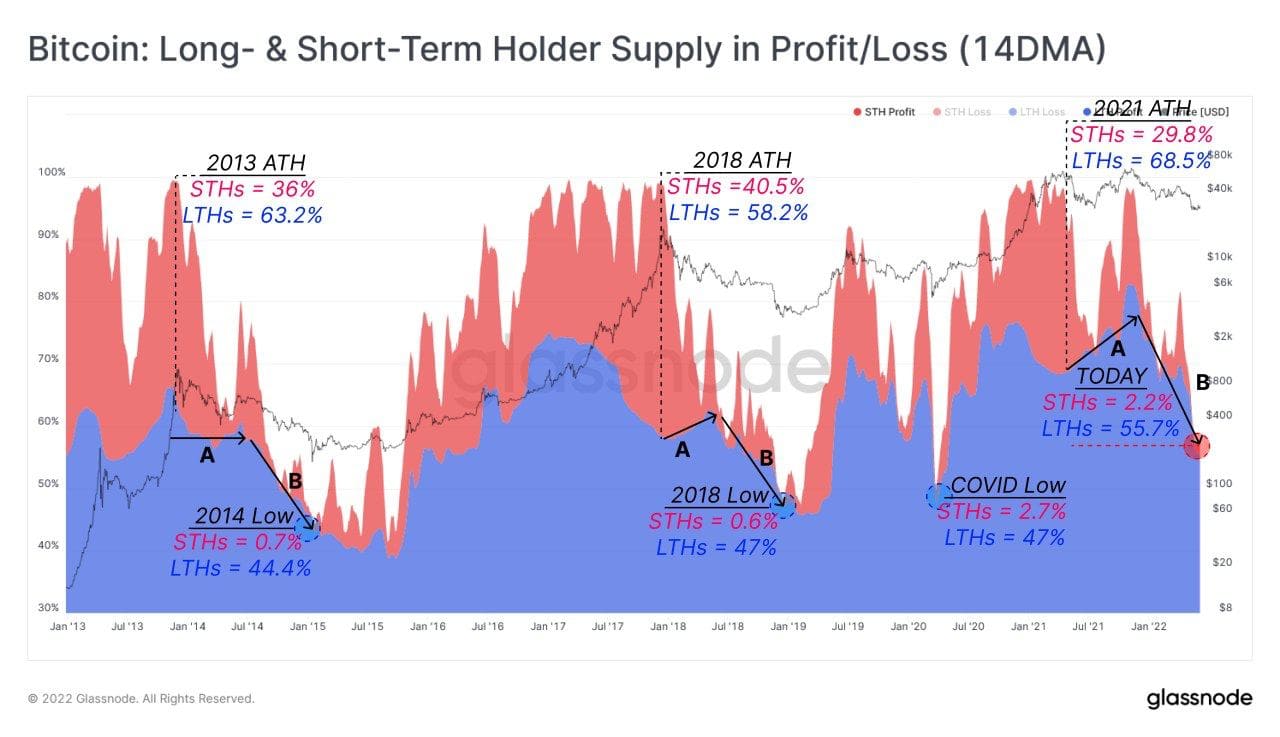

The ratio of long-term and short-term holders to profit - as you can see, the level when short-term and long-term holders are at maximum loss are good marks for buying and vice versa.

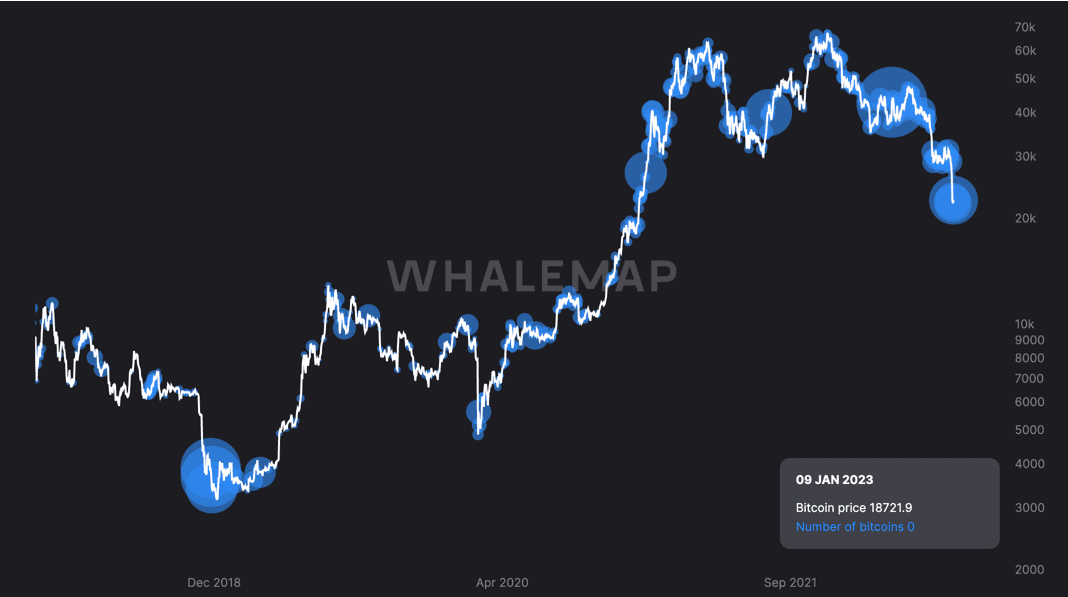

HODLer Outflow/Inflow Instruments - a tool that shows periods of moving coins from the wallets of big players. Big players tend to make almost no mistakes, so controlling what big players do can most likely help determine where it is better to sell and buy cryptocurrency.

Team, Roadmap and Whitepaper

Each crypto project has its own idea, goals, technology and team. By reading the whitepaper you can analyze the technology and goals of the project, assess the scale and potential of cryptocurrency. After analyzing the project team, you can explore the experience of participants and their success in past projects. The project roadmap will give you the opportunity to assess what stage the crypto project is at and whether the team is meeting its goals.

Competitors

Additionally, what you should do after checking your whitepaper, team, and roadmap is research the competitors. It is worth checking all such projects and making comparisons. Perhaps the technology of the project is not unique for a long time, and this area is oversaturated with such cryptocurrencies.

Liquidity and volume

High liquidity allows you to quickly sell or buy cryptocurrency. If this figure is low, you simply will not be able to sell your coins, or you will have to wait a long time for a buyer. With the help of volume you can determine the level of liquidity.

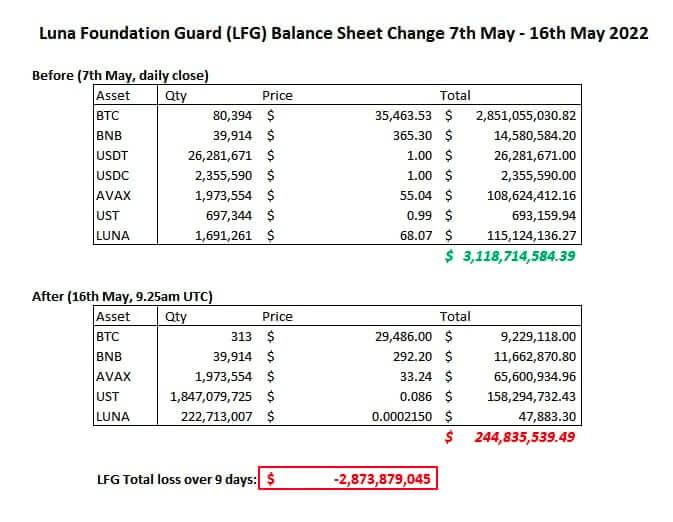

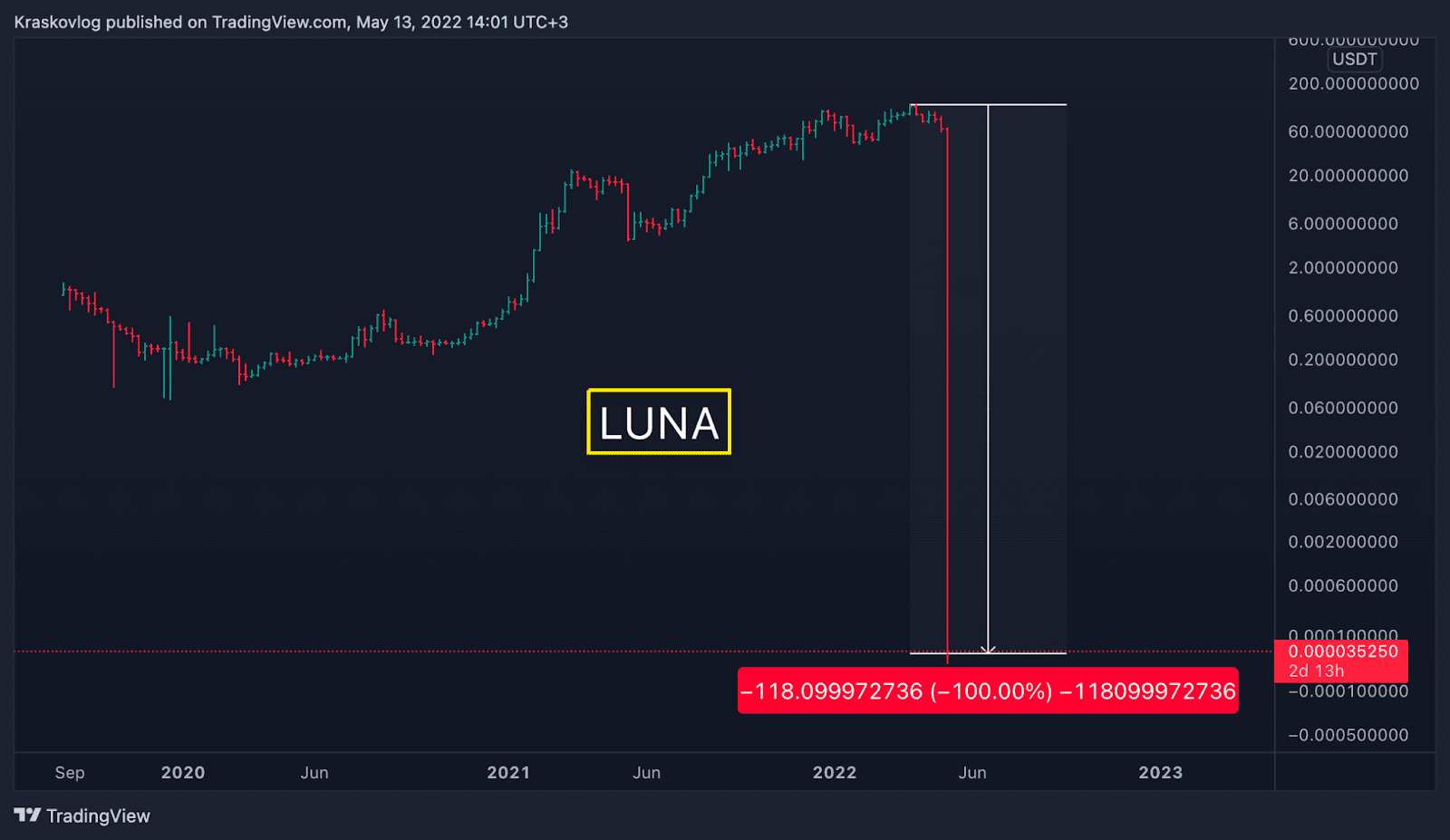

Reserves - recently, coin staking has become one of the main sources of income, some projects offer to stake coins and get more than 20% of profits. At this stage, it is very important to check the real reserves of coins.

The recent high-profile story with the Terra Luna project showed that insufficient collateral can lead to a complete collapse of the cryptocurrency in just a few days. A large number of participants who had invested money in the staking simply lost all of their funds.

Summary

Fundamental analysis, in contrast to technical, can reveal the real situation of cryptocurrency, and show strengths and weaknesses. At the same time, a large number of traders will combine fundamental and technical analysis together, which makes it possible to more accurately determine the direction of price movements and find undervalued diamonds among tens of thousands of different projects.