MACD: How to set and use it to make money on the crypto market

By Yuriy Bishko October 22, 2024

9+ years of experience in trading and investing in the cryptocurrency market

Co-founder of BikoTrading

Developed personal highly profitable swing and scalping strategies for the cryptocurrency market

Engaged in asset management since 2019

KEY ISSUES:

What is MACD in crypto?

Let's talk about how to set the MACD for assets and what you need to do it.

The Moving Average Convergence Divergence (MACD) was created in the late 70s by Gerald Appel, a world-renowned author, lecturer, and founder of the investment consulting company Signalert Corporation.

MACD crypto trading is a popular method of analyzing market trends, as this indicator allows you to react to price changes in time. The main task of the index is to estimate and predict price fluctuations. This information helps traders make investment decisions. They can assess the strength of a trend, predict changes in trend direction, and receive signals to sell or buy assets.

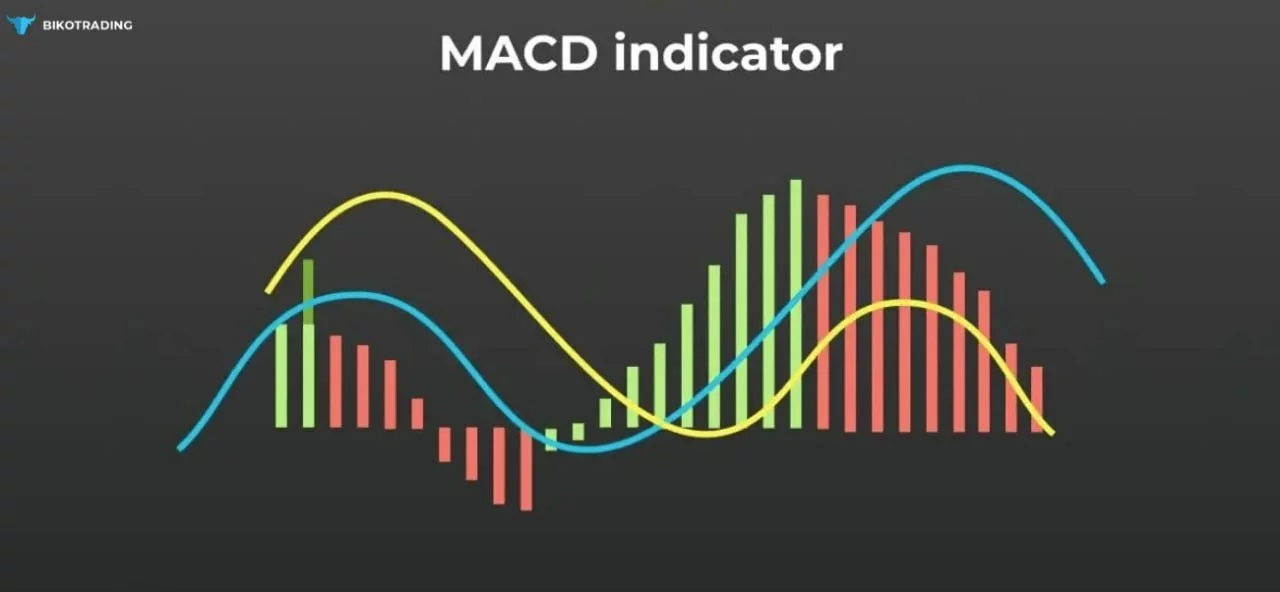

The MACD indicator belongs to oscillators because the indicator's chart is displayed on a separate scale from the price chart. MACD consists of three main parts:

- The main line is the difference between two average price values for a certain period of time (usually 9, 12 hours, or 26 minutes, hours, or days).

- Moving average – the average value of the main line for 9 days. It helps to understand when the trend may change.

- A histogram is a graph representing the difference between the signal and the main line. The stronger the trend, the larger the histogram.

Next, we will explain in more detail how to use MACD, crypto trading approaches with it, and useful techniques with MACD for crypto.

What is the main indicator line?

Appel suggested drawing the difference between the short and long-moving averages as a line on a scale separate from the price chart. This is the main line of the indicator.

It has been mathematically proven that in a strong uptrend, a short moving average with a shorter period of coverage is not only higher than a long moving average (a moving average with a longer period) but also grows at a faster rate. The chart will show a divergence of the moving averages. If the trend is weakening or reversing, the short and long-moving averages will converge.

If the uptrend is strong enough, the main line is above the zero level and moves upward. The short-moving average is higher than the long one, and there is a divergence between them. If there is a strong downtrend, the main line is below the zero level and moves downward. The greater the distance from the zero level, the stronger the trend.

A slowdown or reversal of an uptrend is indicated when the main line is above zero, but the direction itself changes from upward to downward. In this case, moving averages converge. If the main line is below zero, but changes direction to the upside, the downtrend slows down.

Now let's figure out how to understand whether the trend is slowing down or changing. The signal line will help you with this.

What is the signal line of an indicator?

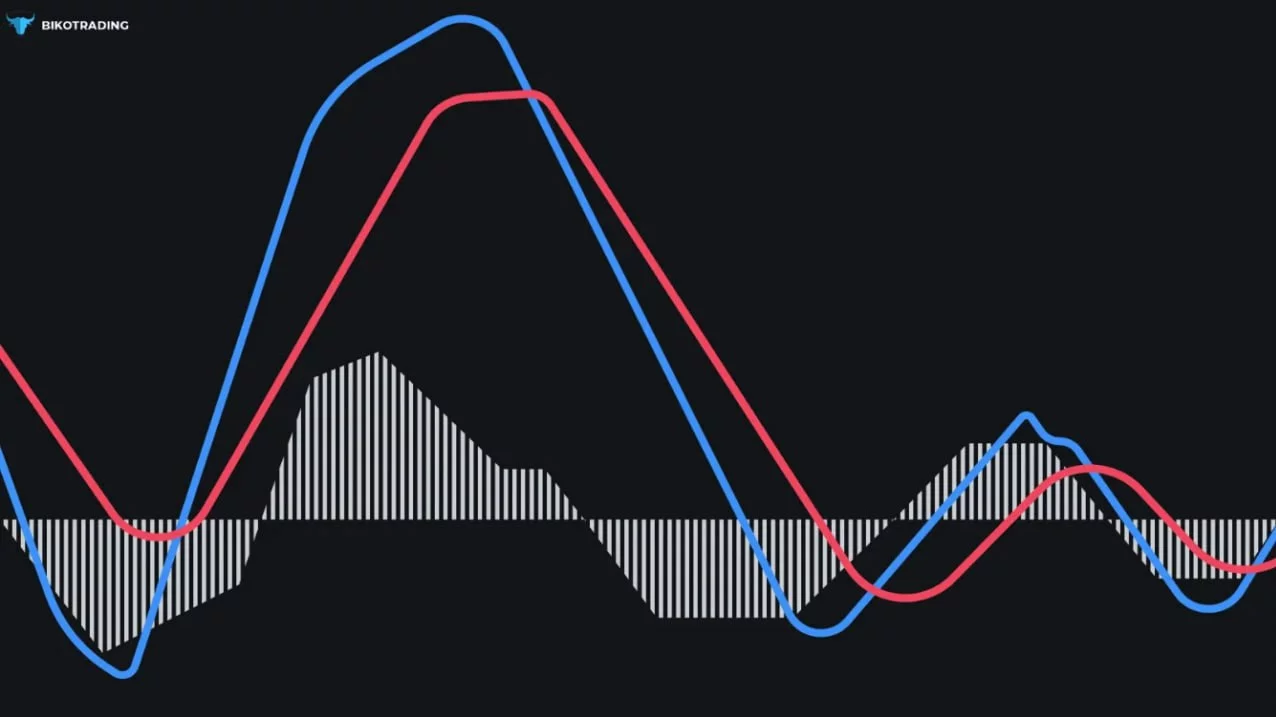

The MACD signal line is an exponential moving average of the MACD main line. The crossing of the main signal line is an indicator of the trend change of the main line.

If the main line, which is above the zero level, crosses the signal line from top to bottom, the downtrend starts. If it is below the zero level and the crossing occurs from the bottom up, the trend is uptrend.

However, if you only watch the signal line cross the main line, it is easy to miss the resumption of the previous trend. Let's take a closer look. For example, when the signal line was below the zero level, it was crossed by the main line from the bottom to the top, which indicates the beginning of an uptrend. But if the main line does not have time to cross the zero level, and the uptrend turns into a downtrend again, the signal line may show a reversal of the trend with a huge delay.

This can be avoided by using the third element of the MACD chart – the histogram. Then trading on MACD will be successful!

What is a histogram?

A bar chart shows the difference between a baseline and a signal line. The start of the columns is at the zero level, and the columns themselves are drawn above or below the zero level. If the main line is above the signal line, the histogram is higher; if the main line is below the signal line, the histogram is below zero.

If the trend is uptrending, the MACD settings for crypto will show that the current price is higher than the average price for the period. In an uptrend, the histogram shows the price chart above the blue line, while in a downtrend, it is the other way around. If the line crosses, the trend changes, and traders should buy or sell cryptocurrencies depending on the direction of the crossing. Let's talk about these crypto MACD settings further.

How to make money on the MACD chart?

Determining the best MACD settings for crypto is not always easy, as the settings can vary depending on market volatility and the chosen strategy. If you want to use the MACD indicator, the strategy will also be different. Let's analyze it one by one.

1. Trading at the intersection of MACD lines

The MACD line crossover is based on the analysis of the interaction between the main MACD line and the signal line. You already know that when they cross, the trend is likely to change. This is a signal to buy or sell an asset.

How does MACD scalping work with this strategy?

When the main MACD line crosses the signal line from the bottom to the top, the short-term trend starts to gain strength relative to the long-term trend. It's time to buy cryptocurrency.

When the signal line crosses from top to bottom, the short-term trend changes direction to a downtrend. This is a signal to open a sell position.

The main advantages of the strategy include its ease of use, which is understandable even for beginners. It also provides fairly clear signals.

Among the disadvantages are possible errors in the case of short timeframes or markets with low volatility (we talked about such cases earlier when discussing reversal trends). As we mentioned, sometimes signals come with a delay. This situation can be avoided if you combine MACD with other indicators. For example, RSI. We talked about it in another article. The MACD RSI crypto strategy will minimize your risks.

Join our crypto trading course and learn all the key tools for successful trading, including trends, indicators, and various strategies of using MACD for trading. Our course helps to form a solid basis for both who have joined the market and who has experience in trading.

- After completing the program, you will learn how to read MACD, crypto market data easily, open profitable trades with confidence, and quickly identify trends.

- We'll help you understand price changes and predict their direction, using reliable patterns, setups, MACD settings for intraday trading.

- You will be able to independently develop and improve your trading strategies in accordance with your goals.

- The course covers various technical indicators, such as MACD, their use and inclusion in strategies.

Follow the link to leave an application, and join the training that will take your trading to the next level!

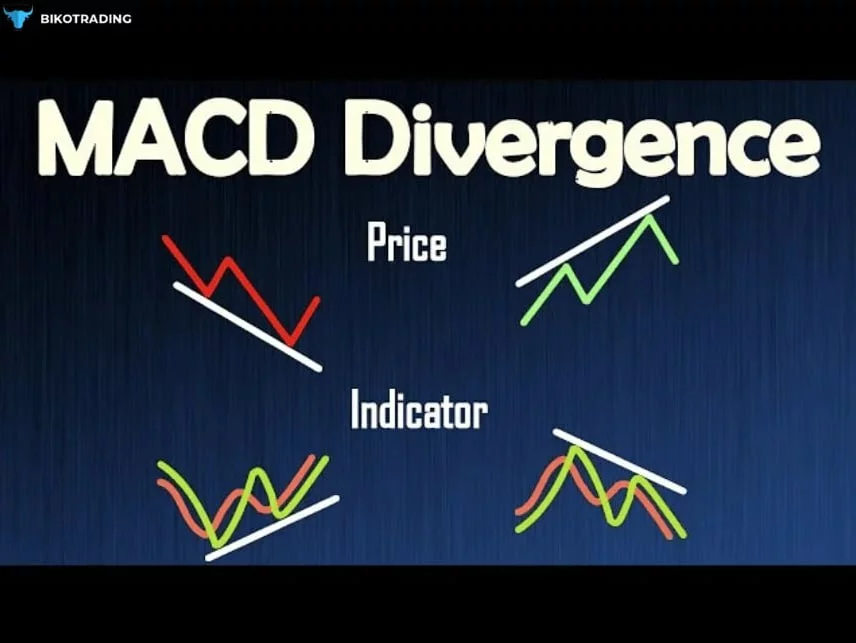

2. MACD divergence

MACD divergence occurs when the direction of price movement on the chart and the direction of MACD movement do not coincide. This may indicate that the current trend has weakened and a reversal may occur in the near future.

There are two types of divergence:

- Bullish divergence. The price reaches a new low, but the MACD remains higher. This means that the downtrend has weakened, and a reversal to an uptrend may occur. Even if the price goes down, the downward momentum becomes weaker.

- Bearish divergence: It occurs when the price reaches a new high but the MACD remains lower. This demonstrates a weakening of the uptrend, a possible decline. It can be a signal to sell.

To use the Bybit indicator in MACD trading strategies, determine whether there is a discrepancy between the price and the MACD. To do this, analyze the new highs or lows of the price and compare them with the dynamics of the MACD movement. If a divergence is detected, confirm the signal by analyzing the chart or other indicators. For example, if the divergence is bullish, check for the formation of candlestick reversal patterns. This is also a sign of a trend change. When the signal is confirmed, you can open a position.

The advantages of the strategy are accurate signals and the ability to avoid false signals due to delays. Divergences, however, are more difficult to identify. And it is not a fact that the reversal will happen immediately after the signal, sometimes it can take time.

To avoid mistakes, it is also recommended to use the RSI index if you want to trade with MACD. The MACD RSI divergence reduces the risks during trading at times if the indicators work together.

Conclusion

MACD is a powerful tool for market analysis in both strategies – based on the crossing of MACD lines and the use of divergence. Also MACD trading techniques help traders to determine the moments of entry and exit from positions, providing a deeper analysis of market conditions. If you keep in mind the risks and play it safe with the help of auxiliary indicators, a trader can reduce risks and increase the efficiency of his trading. Stay with Bikotrading and achieve success regularly, not when you get lucky.