RSI indicator. Trading strategy and useful tips

By Yuriy Bishko October 29, 2024

10+ years of experience in trading and investing in the cryptocurrency market

Co-founder of BikoTrading

Developed personal highly profitable swing and scalping strategies for the cryptocurrency market

Engaged in asset management since 2019

KEY ISSUES:

When working on the financial markets, investor-traders need tools that allow them to move away from intuitive decisions and make them predictable in order to control their income.

The Relative Strength Index (RSI), developed in 1978 by J. Wells Wilder and described in his book New Concepts in Technical Trading Systems, helps to do this. Its main task is to estimate the momentum of price movements and identify potential trend reversals in advance.

Wilder believed that when prices rise very quickly, the underlying financial instrument/commodity can be sold profitably. Similarly, when prices are falling rapidly, it is possible to buy a financial instrument profitably.

What is RSI in crypto?

RSI is an indicator for measuring the size and speed of price changes (stock momentum). It is used to determine whether a stock is overbought or oversold. Also RSI day trading helps traders to react quickly to short-term market changes. Let's talk about it in more detail.

The RSI crypto index is one of the most popular indicators for assessing the state of the cryptocurrency market. The index is often used by traders who make money on price fluctuations. They look for signals of weakening or strengthening momentum in short- and medium-term price movements in the market. Trading on RSI provides traders with clear signals to make decisions about buying or selling an asset. Overbought or oversold conditions often immediately precede short-term trend reversals and initiate new trading opportunities.

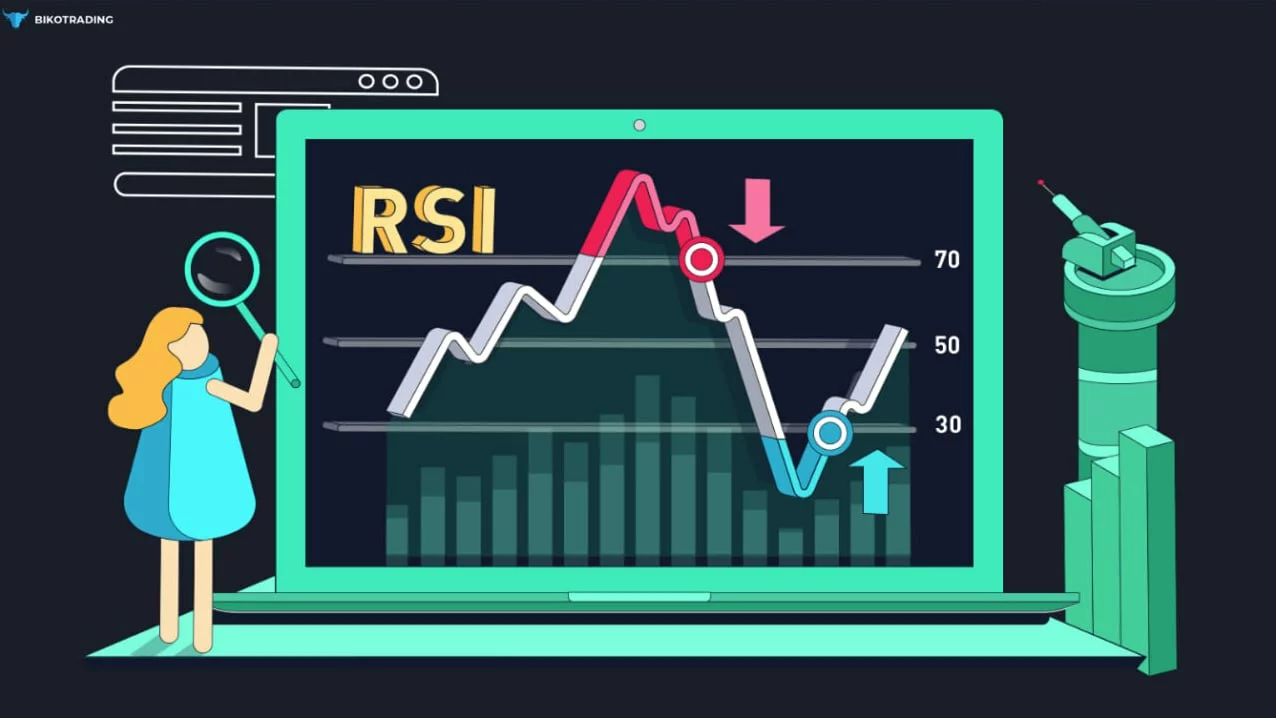

The RSI crypto indicator ranges from 0 to 100. If the value is above 70, the asset is usually overbought, and if it is below 30, it is oversold.

Overbought is a condition when the price of a stock or cryptocurrency has risen rapidly and is rising by many positions. Perhaps the asset has become the subject of speculation, or perhaps demand for it has suddenly increased due to certain market events. During this period, traders often sell assets before the price starts to decline.

The oversold condition describes the opposite situation when the value of an asset declines strongly and quickly. In such periods, traders, on the contrary, start buying these assets.

How to calculate the RSI indicator?

RSI indicator in crypto is a momentum-based oscillator. This means that as an oscillator, this indicator works within a range or a set range of numbers or parameters.

RSI crypto meaning is to measure speed and price changes to assess possible reversal points. RSI crypto trading strategy is based on the use of the indicator to identify possible entry and exit points for trades.Now let's figure out how to set up RSI correctly. First, determine the previous time period to be analyzed. Usually, it is two.

Then, add up the average profits and divide by the average losses for the time period you have chosen. The result is in the range from 0 to 100 and is plotted on the chart and shows the same relative strength.

The index can be broken down into a simple formula:

RSI = 100 - [100 / (1 + (Average price change up / Average price change down)]

The RSI chart helps investors to consider the current value of the indicator in relation to past values, i.e. to measure momentum in relative terms. RSI crypto trading strategy is based on the use of the indicator to identify possible entry and exit points for trades. Also crypto RSI charts help traders visualize overbought and oversold zones of an asset. This means that it is possible to predict the period when a stock is able to reverse its prevailing trend.

How to use RSI in crypto trading to identify potential trading signals?

With the help of a crypto RSI chart, traders can better understand market dynamics and make more informed decisions. As mentioned, investors usually identify an oversold stock when its RSI is below 30. When the index starts to rise above this mark, it is a potential bullish entry signal for them.

The overbought condition is called when the RSI crosses below 70. For technical specialists, this can be a potential exit signal.

But the RSI strategy has exceptions. If, for example, the RSI of a cryptocurrency consistently reaches 70 or below 30 without correctly predicting a change in the price trend, it may be appropriate to adjust the upper limit to 80 and/or the lower limit to 20 to get more reliable trading signals.

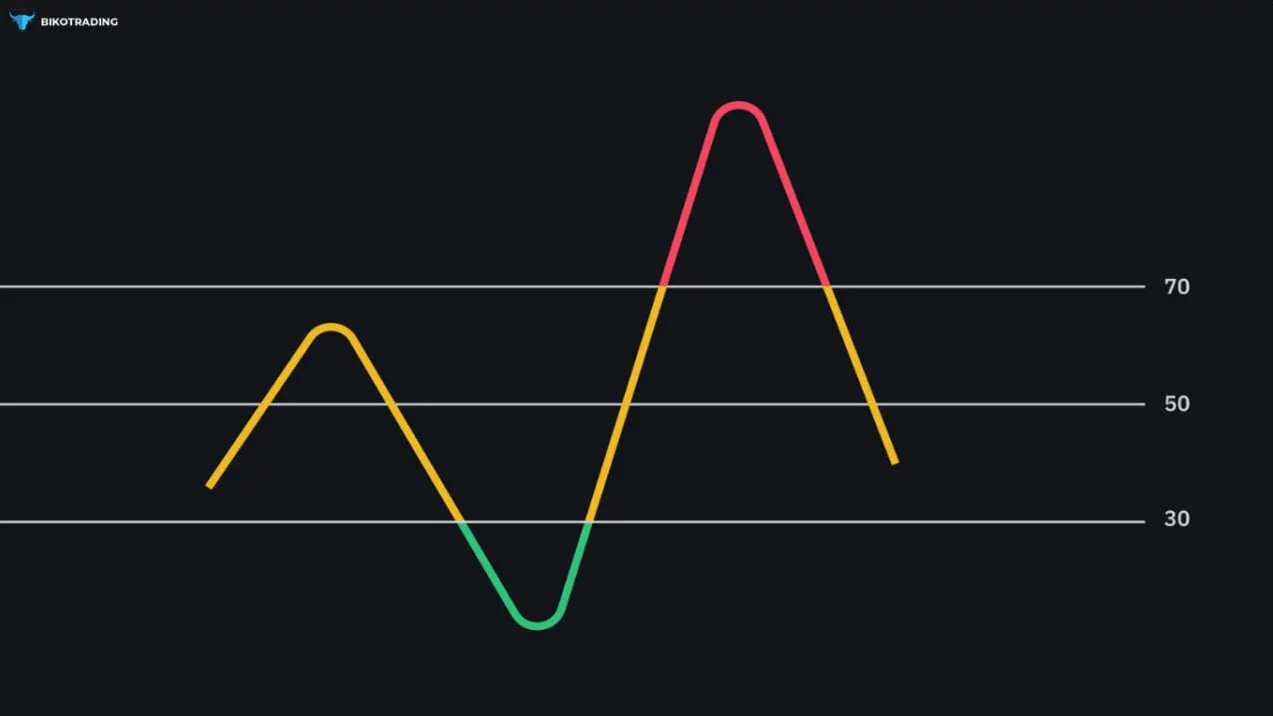

A trend reversal can be confirmed by the RSI when the RSI divergence is demonstrated. This is a condition when the price of a stock moves in one direction and the RSI moves in the opposite direction.

For example, when the stock price falls below the lows and the RSI rises above the lows, this condition is called a bullish divergence. It indicates that the downward momentum is weakening, and a bullish reversal may occur in the near future. It is at this point that the reverse cross above 30 acts as an entry signal for investors.

There is another type of divergence – a bearish RSI divergence. In this case, the stock shows higher highs and the RSI shows lower ones. This indicates that the upward momentum is getting slower and a bearish reversal may be ahead. In this case, an indicator below 70 can serve as an exit signal.

Thus, the RSI divergence occurs when there is a difference between what the price action indicates and what the RSI indicates and predicts an imminent reversal. A bullish RSI divergence is when the price sets a low, but the RSI sets a higher low. A bearish RSI divergence is when the RSI reaches a lower high and the price reaches a new high. According to Wilder, a bearish divergence creates a selling opportunity, while a bullish divergence creates a buying opportunity. In general, this is how RSI trading strategies work.

If you want to know how to minimize risks using the full arsenal of trading and learn absolutely everything about the RSI, come to Bikotrading Academy for training. Our comprehensive course will give you in-depth knowledge of technical indicators like RSI and more, allowing you to develop strategies that adapt to various market conditions.

- Personalized mentoring from experienced traders.

- Hands-on practice with real-world trading scenarios.

- In-depth understanding of MACD, RSI, crypto indicators.

- Risk management strategies to help you minimize losses.

- Ongoing support and access to exclusive trading resources.

- Customizable trading plans.

Conclusion

Investors can more easily look for potential trading signals if they use RSI trading techniques to identify divergences and determine potential overbought and oversold conditions. Crypto chart with RSI allows you to combine classic price analysis with technical indicators for more accurate market forecasting. However, this is not a 100% guarantee of success. The RSI cannot take into account external events that can dramatically change the price of shares: economic news, earnings, and other fundamental aspects. In addition, the RSI can remain oversold or overbought for long periods of time. Therefore, while RSI is a valuable tool for identifying potential trading opportunities, it should always be used in conjunction with other analysis methods and a solid risk management strategy.