What is PNL? How to calculate PNL?

By Yuriy Bishko October 29, 2024

10+ years of experience in trading and investing in the cryptocurrency market

Co-founder of BikoTrading

Developed personal highly profitable swing and scalping strategies for the cryptocurrency market

Engaged in asset management since 2019

In trading, numbers matter a lot and few numbers are as crucial as PNL. Whether you're an experienced trader or just starting out, it's important to keep track of and manage your profits and losses properly. Therefore, in this article, we will analyze what PNL is, what does pnl mean, and how to do profit and loss account to correctly evaluate the results of trades and the chosen strategy.

KEY ISSUES:

PNL (meaning profit and loss) is the best indicator for assessing a trader's financial success. The definition of PNL in crypto is the net result of all your trades, signaling that you have made a profit or suffered a loss for a certain period.

The profit and loss 880 encompasses all gains and losses from cryptocurrency trading, factoring in expenses like transaction fees, taxes, and other related costs. With the crypto PNL calculator, traders can easily determine their profits and losses in cryptocurrency trading. PNL monitoring helps traders understand their trading performance, make the right decisions on trades, and work on the development of strategies for future transactions.

- PNL gives a clear picture of the trade, allowing you to track progress over time.

- This is an opportunity to identify loss patterns and adjust strategies to reduce risks since the PNL crypto calculator provides traders with the ability to quickly evaluate the results of their trades.

- PNL data analysis helps to improve trading strategies and optimize entry and exit points. Daily PNL helps to monitor their progress and adjust strategies based on daily results.

- Accurate PNL data is necessary for tax reporting and ensuring compliance with financial regulations.

- Regular review of PNL helps maintain emotional discipline, preventing impulsive decisions.

How to calculate PNL?

Basic calculation of PNL

How is the PNL of futures trading calculated? Typically, PNL is calculated as the difference between the contract’s purchase price and its selling price. To figure out how to calculate PNL in crypto trading, it's essential to consider all associated costs and earnings from each trade. Here’s the basic formula for calculating PNL:

PNL = Total profit - Total loss

Where:

Total profit is the sum of profits from all profitable trades.

Total losses are the sum of losses from all losing trades.

However, in crypto trading, it is important to consider other factors such as transaction fees, taxes, and the time value of money to get a more accurate PNL.

Realized and unrealized PNL – what is it?

Realized PNL refers to the profit or loss that occurs when a position is closed. For instance, if you purchased Bitcoin at $30,000 and later sold it for $35,000, your realized PNL would be $5,000, minus any associated transaction fees.

Unrealized PNL can be calculated in the following way: profit or loss on open positions that have not yet been closed. For example, if you bought ether for $2,000 and the current price is $2,500, your unrealized PNL is $500.

How to do profit and loss statement properly? Master the market and trade with confidence! Register for our cryptocurrency trading course today and build a solid foundation for crypto trading.

✔ How the market works and what is behind price movements.

✔ The best moments to enter and exit trades.

✔ Powerful strategies and proven trading tools.

Create your own personalized trading plan and strategies tailored to your goals. Get PNL explained, calculate PNL and determine the necessary metrics with high accuracy. Join the Bikotrading Academy course right now and become proficient in chart analysis, ensuring profitable trading in any market conditions!

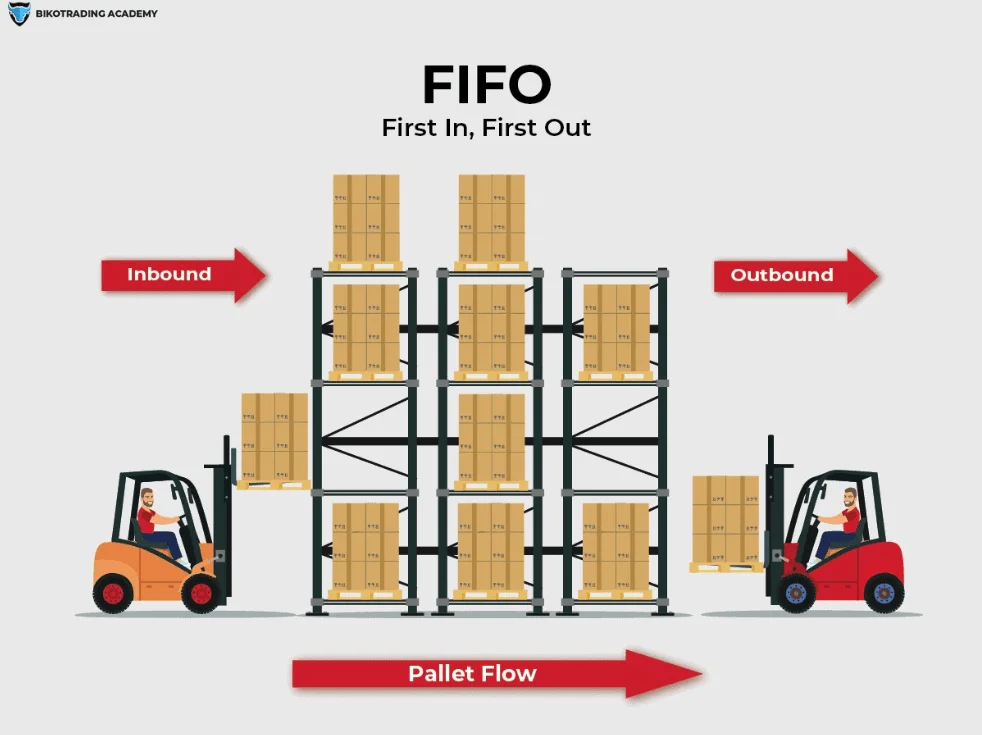

First in, first out (FIFO)

FIFO (First-In, First-Out) operates under the assumption that the earliest assets purchased are the first ones to be sold. Commonly applied in tax reporting, this method can influence the calculation of PNL based on the sequence of trades.

FIFO (First-In, First-Out) operates under the assumption that the earliest assets purchased are the first ones to be sold. Commonly applied in tax reporting, this method can influence the calculation of PNL based on the sequence of trades.

For example, you have the following trades:

Bought 1 BTC for $30,000

Bought 1 BTC for $35,000

Planning to sell 1 BTC for $40,000

PNL calculation:

FIFO works on the principle that the oldest goods (or assets) are sold first. You first consider the purchase prices of the assets you bought earlier. From the last sale price, subtract the price of the first purchase:

($40,000 - $30,000) × 1 - Fees = $10000 - Fees

Last in, first out (LIFO)

LIFO (Last-In, First-Out) assumes that the most recently acquired assets are sold first. This can be advantageous in certain market conditions and has different tax consequences than FIFO.

For example, you have the following trades:

Bought 1 BTC for $30,000

Bought 1 BTC for $35,000

Planning to sell 1 BTC for $40,000

PNL calculation:

Subtract the value of the last assets acquired from the sale price. This calculation shows the realized gain or loss for the trade.

($40 000 - $35 000) × 1 - Fees = $5000 - Fees

Factors affecting PNL on crypto markets

P and L trading allows traders to analyze their financial performance and draw conclusions about future trades. Price fluctuations can have a significant impact on both realized and unrealized PNL. For example, low liquidity can lead to slippage, which affects the execution price of trades. And news, regulatory changes, and broader economic factors can affect market sentiment and therefore your PNL.

High commissions usually reduce profits or increase losses, especially if you trade frequently. The use of leverage can increase both profits and losses, making it harder to control your PNL.

The effectiveness of your trading strategy directly affects the P&L. Trading intraday, swing trading, or long-term holding, have different profits and different results for PNL.

Conclusion

P&L, crypto, and analysis are essential components of preparing for trading and developing a trading strategy. The PNL calculator crypto provides traders with the ability to quickly evaluate the results of their transactions. It is very important to understand the components of the PNL, use the right tools for tracking, implement effective strategies, and avoid common mistakes. But remember that PNL is not just an indicator, but a reflection of your trading acumen. Constant learning, disciplined trading, and strategic planning are the keys to maximizing your PNL and achieving your financial goals in the dynamic world of crypto trading.

Start training and learn the secrets of successful trading from experts!

Want to make money on the cryptocurrency market but don't know where to start? Join our exclusive training and learn everything about crypto trading from our professionals!

We will show you the best techniques and strategies for trading on the crypto market that will help you to increase your capital in a short period of time. Our experts will answer all your questions related to the crypto industry and give you access to the latest techniques and tools in trading.

But that's not all! During the training, you will be able to discuss your ideas and strategies with other traders and learn best practices from them.

Don't miss your chance to change your life forever and become a successful crypto trader! Start training right now and earn real money from your first trades!