How to use Cumulative Delta in trading

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

Gaining an edge over the market is of paramount importance for professional traders. Cumulative Delta is an effective analysis technique that provides valuable information about the buying and selling pressure in the crypto market, helping traders make better decisions about opening trades. In this article, we will take a look at what Cumulative Delta is and show how it can be used effectively in crypto trading.

KEY ISSUES:

What is Cumulative Delta?

Cumulative Delta focuses on analyzing the flow of buy and sell orders in the market. Its purpose is to determine the strength and direction of this order flow, providing a clearer picture of market sentiment. By understanding how to use the Cumulative Delta indicator, traders can determine whether the market is dominated by buyers (positive delta) or sellers (negative delta).

Unlike the regular delta, which shows the difference between market buy and sell orders for each candle/bar, the Cumulative Delta provides a broader perspective, reflecting the overall balance of market buys and sells from a certain starting point, for example, from the beginning of a trading session or contract.

How to read Cumulative Delta correctly

Positive Cumulative Delta

A positive Delta indicates that more market participants are placing buy orders than sell orders. This indicates bullish sentiment and potential upward price movement. Professional traders can consider this as a buying opportunity or as a signal to hold existing long positions.

Negative Cumulative Delta

Conversely, a negative delta indicates a greater number of sell orders than buy orders. This confirms bearish sentiment and the possibility of a downward price movement. Experienced traders can interpret this as a signal to sell or open short positions.

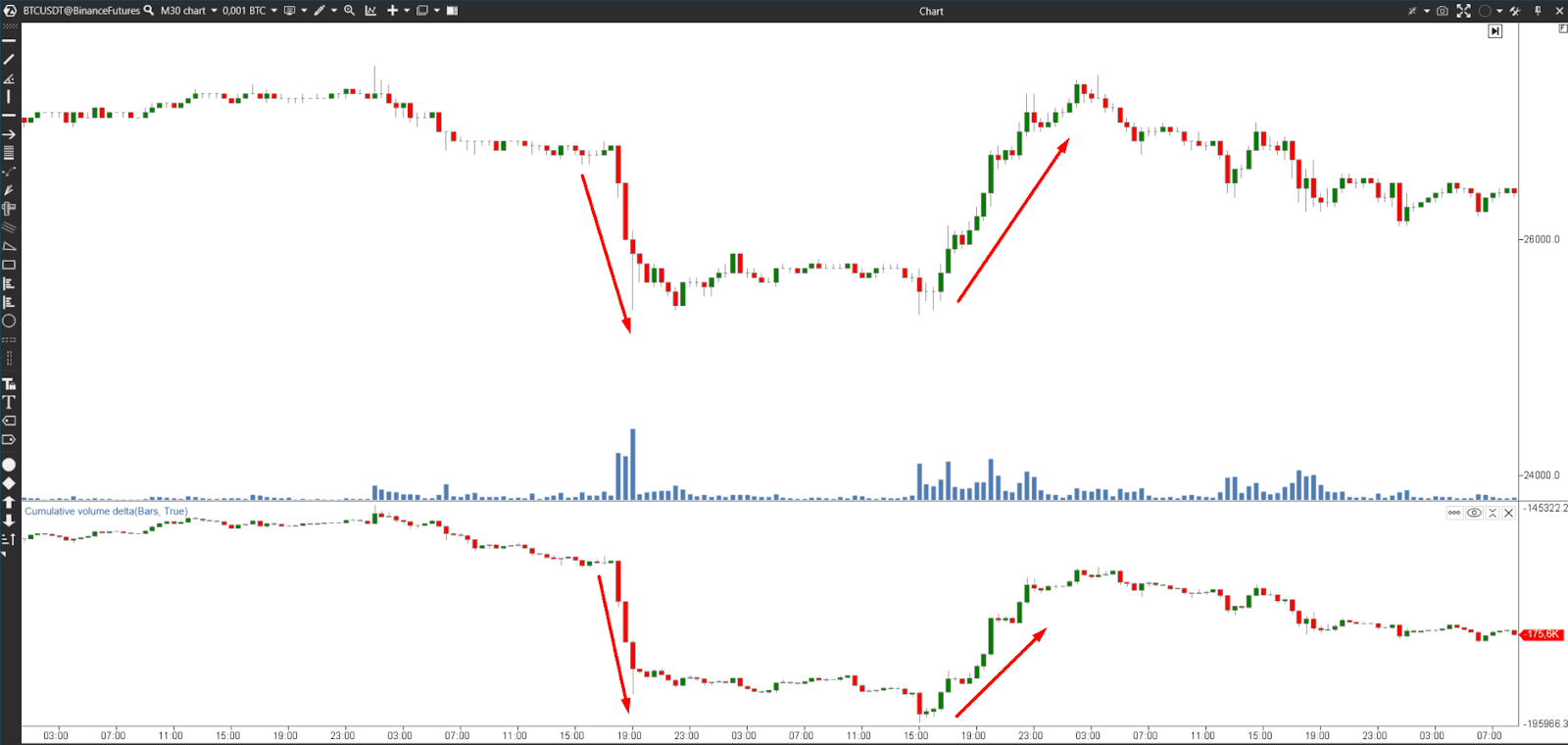

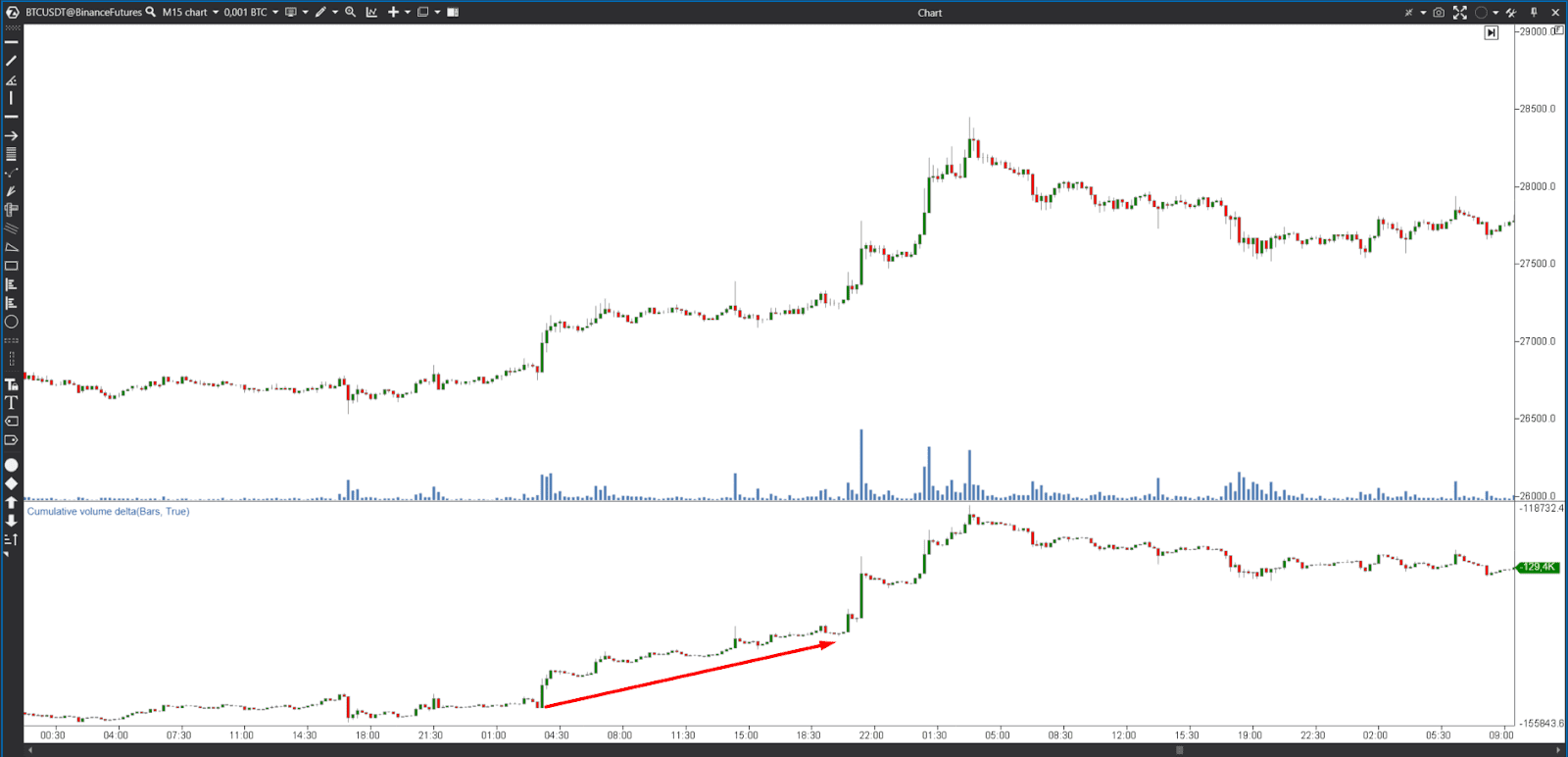

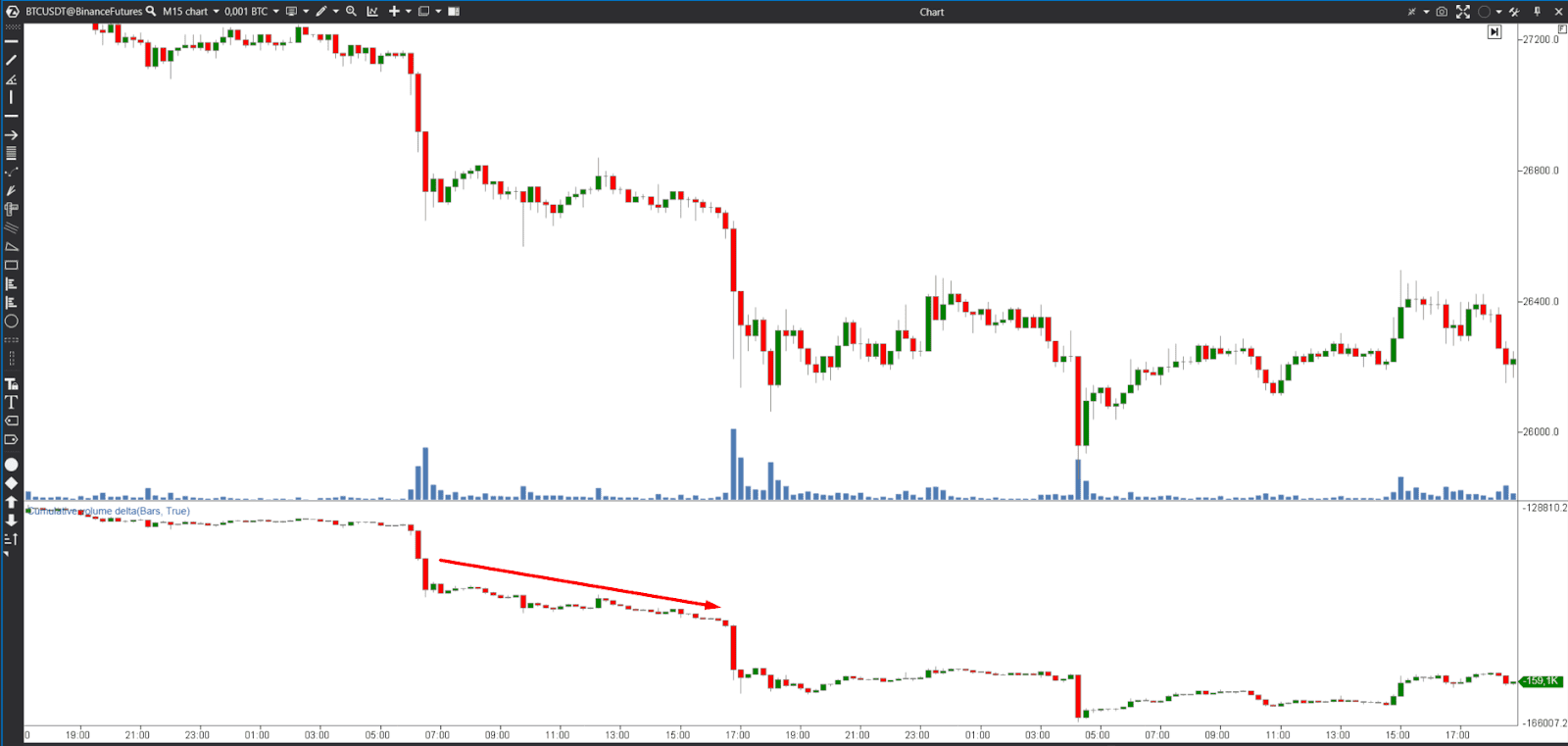

Divergence

Divergence occurs when the price of an asset moves in one direction while the Cumulative Delta moves in the opposite direction. This can be an early warning signal of a potential trend reversal. Traders can consider this pattern as an opportunity to enter or exit a trade.

How to use Cumulative Delta in cryptocurrency trading?

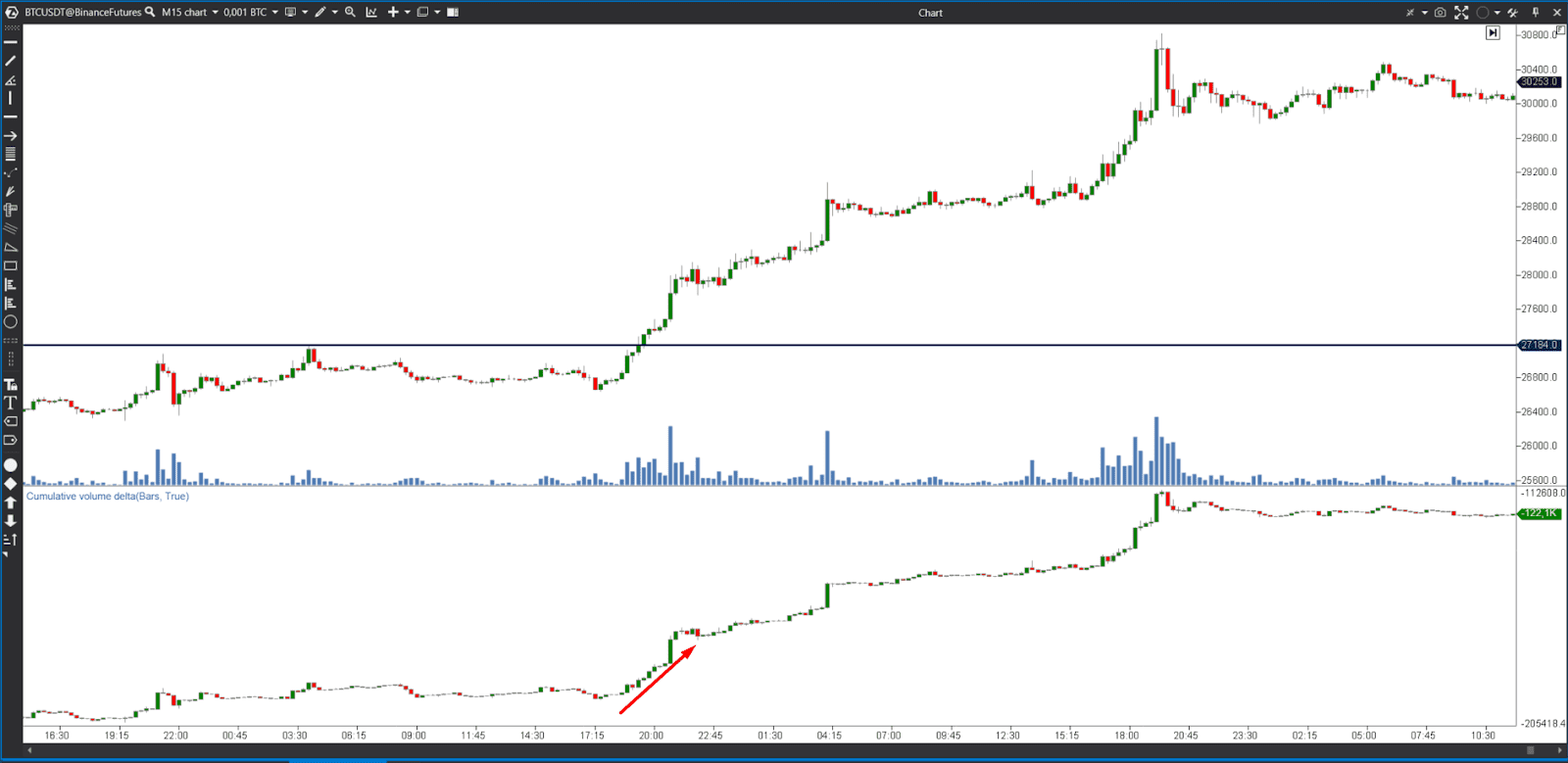

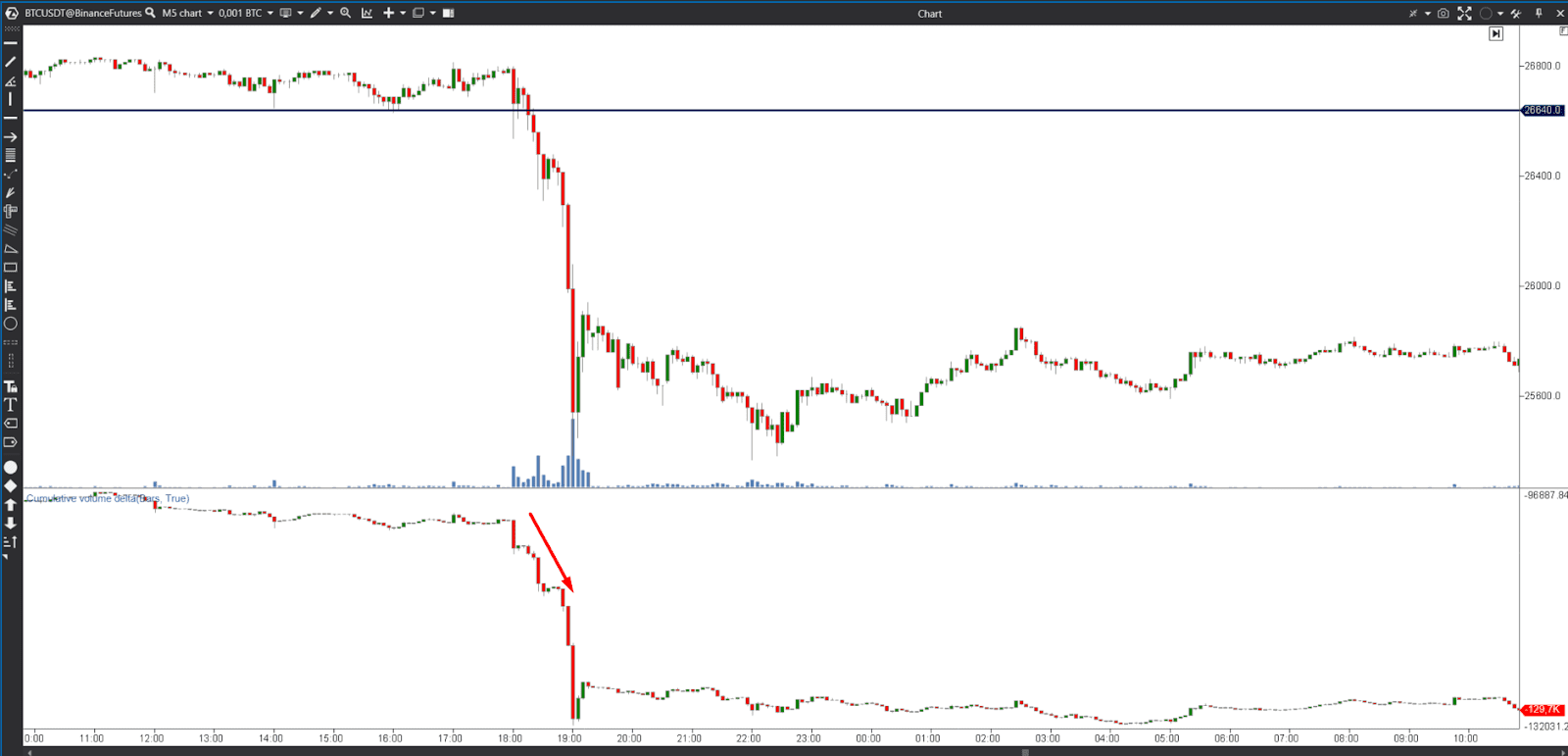

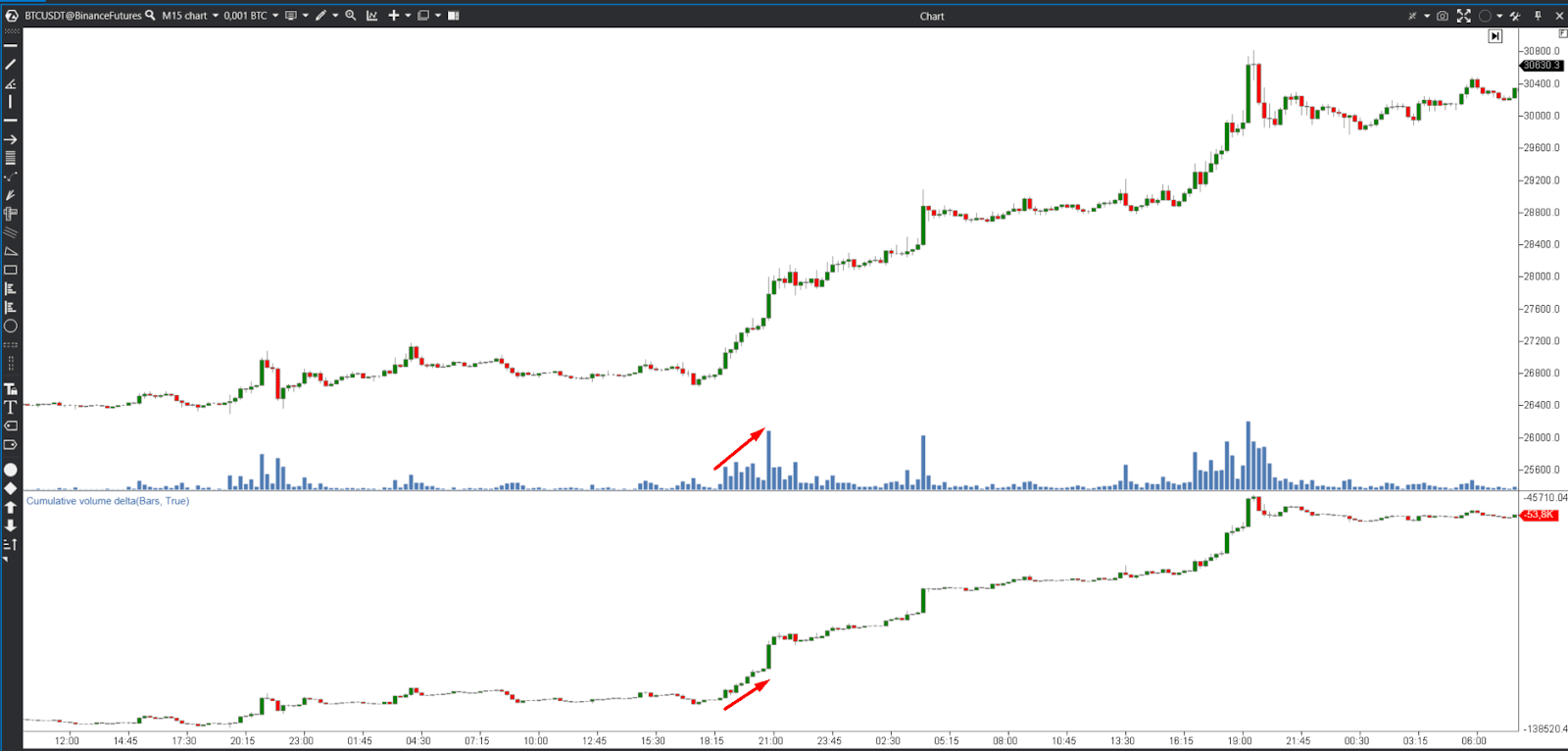

Identifying breakouts

By studying the value of the Cumulative Delta along with the changes in price movement during a potential breakout, traders can determine the strength and sustainability of an asset's price movement.

Positive Cumulative Delta. If the price of an asset breaks above a key resistance level and the corresponding Cumulative Delta values show a significant increase in positive delta, this indicates a surge in buying pressure. In this case, market participants are more inclined to buy, which could potentially lead to a steady upward movement. We read it as a signal to open a long position.

Negative Cumulative Delta. Conversely, if the price breaks below a critical support level and the Cumulative Delta values show a noticeable increase in negative delta, this indicates an increase in pressure from sellers. Market participants are more inclined to sell, which can potentially lead to a steady downward movement. We interpret this as a signal to open a short position.

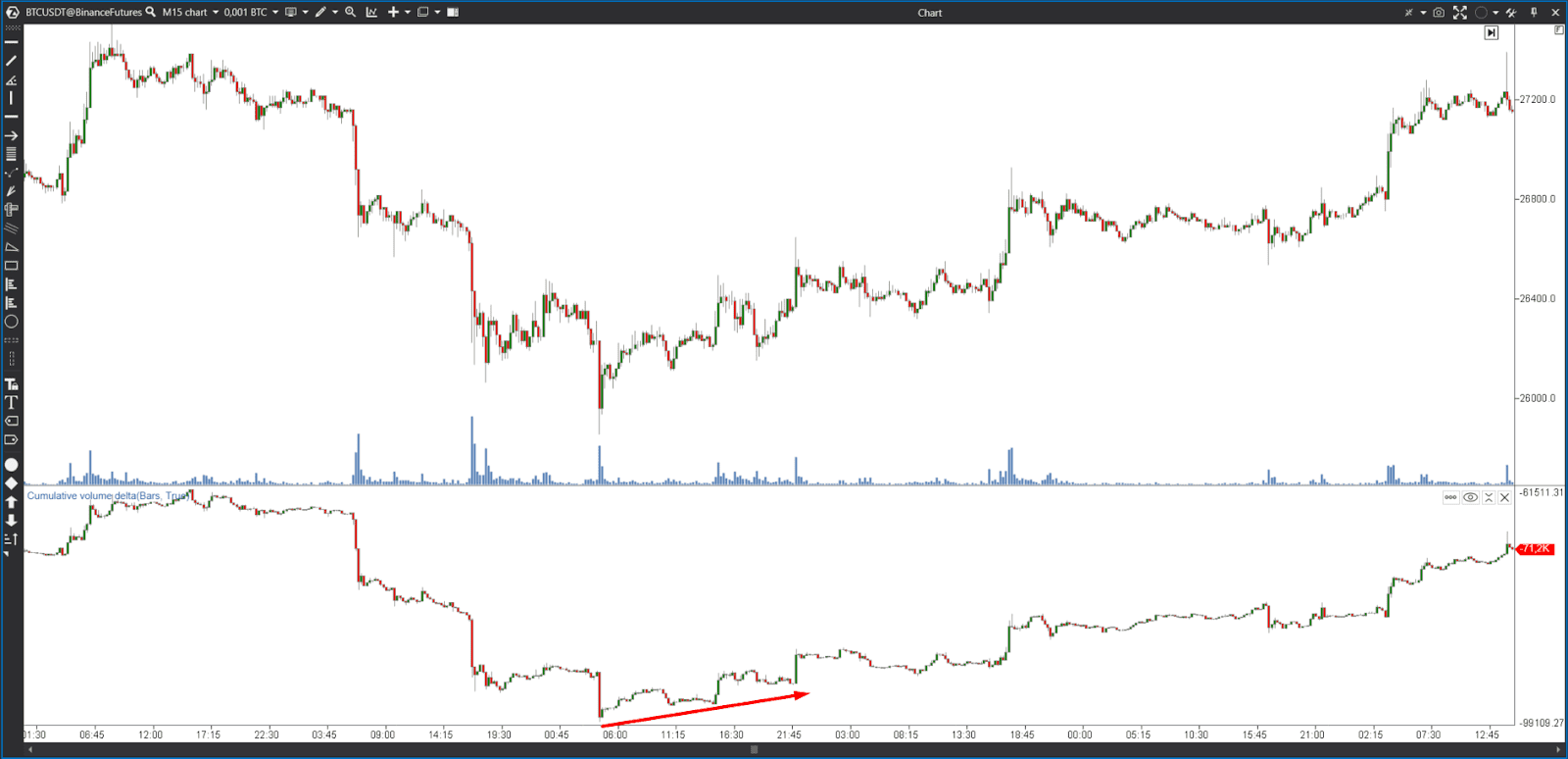

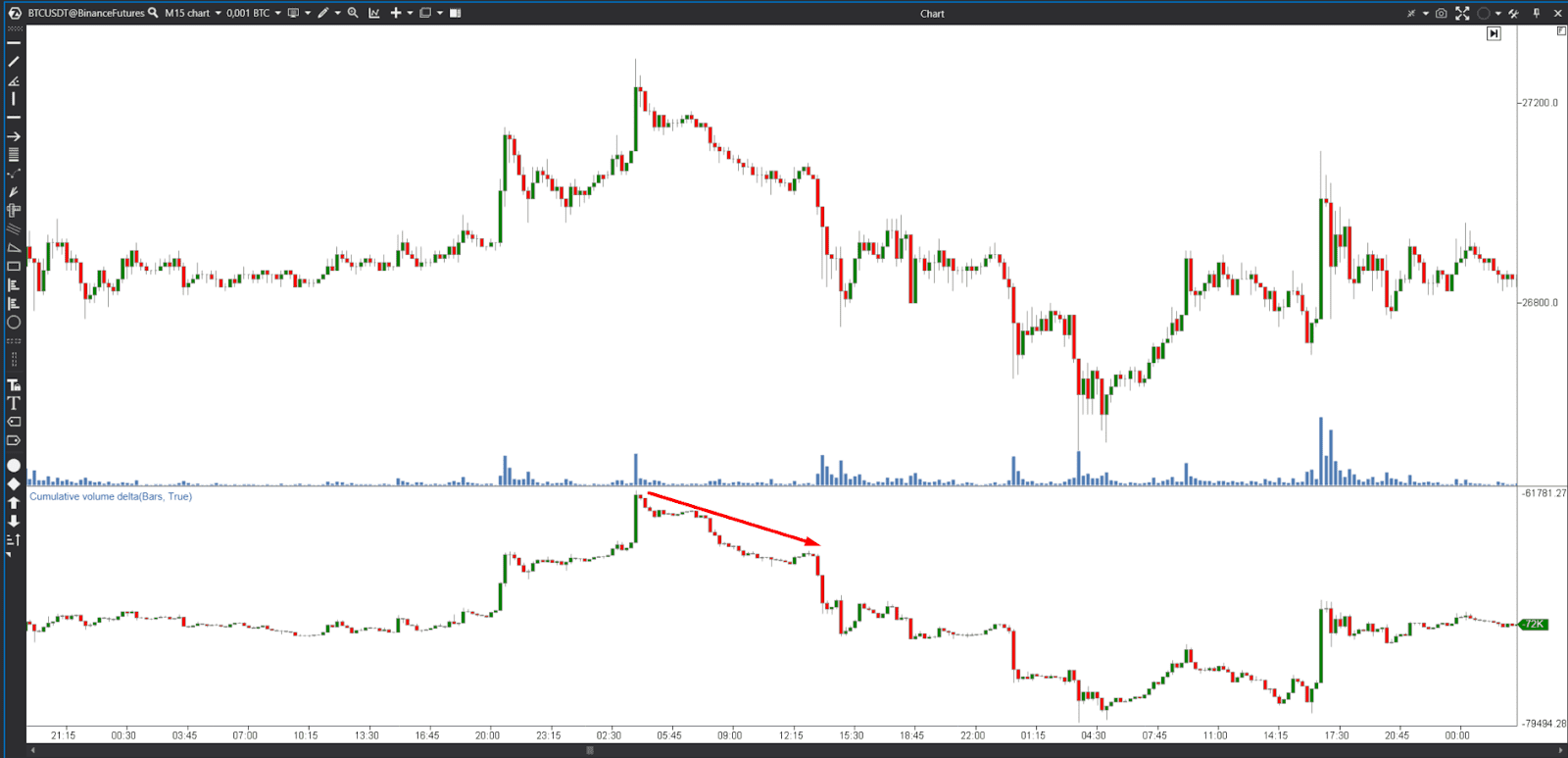

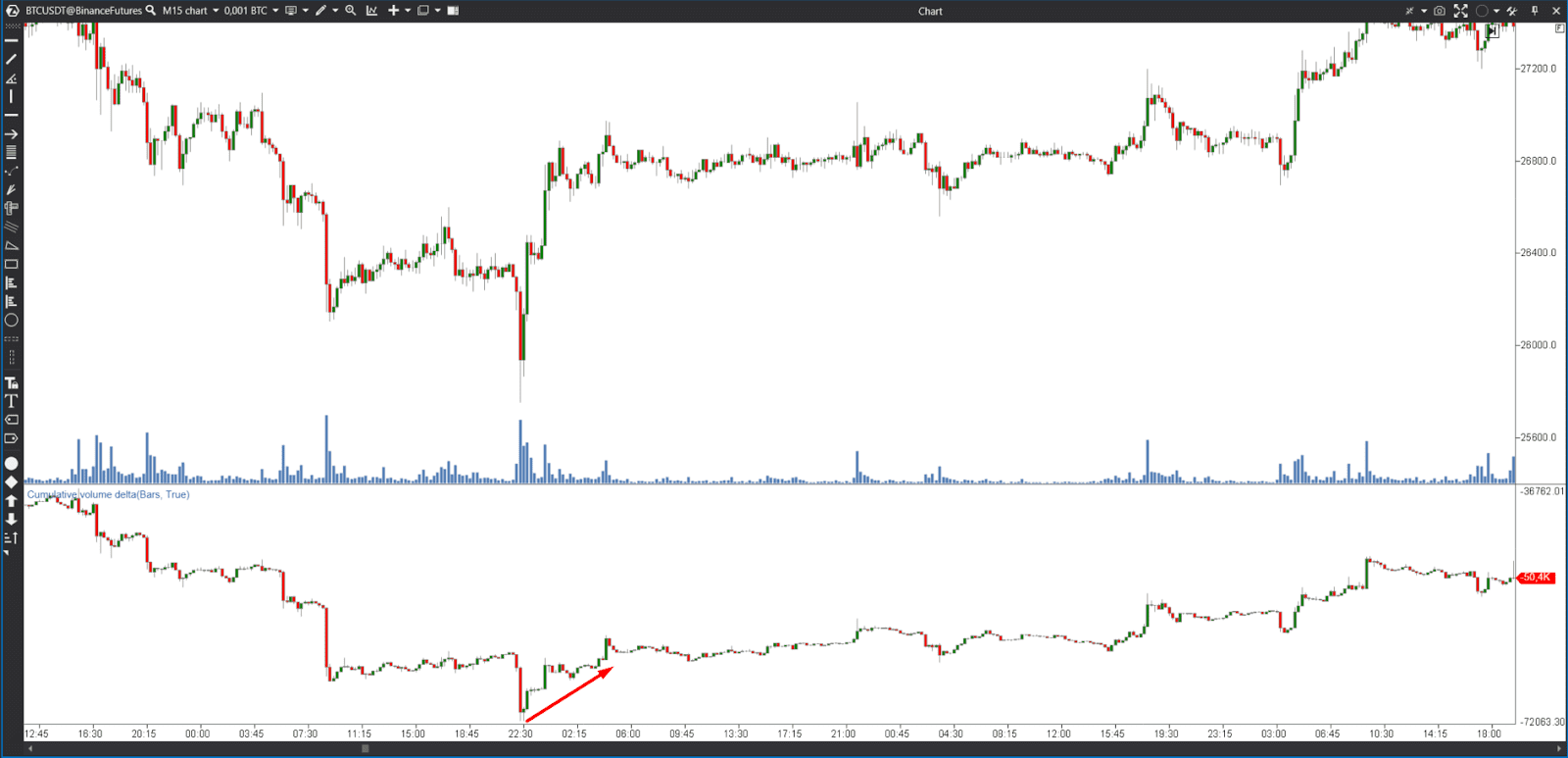

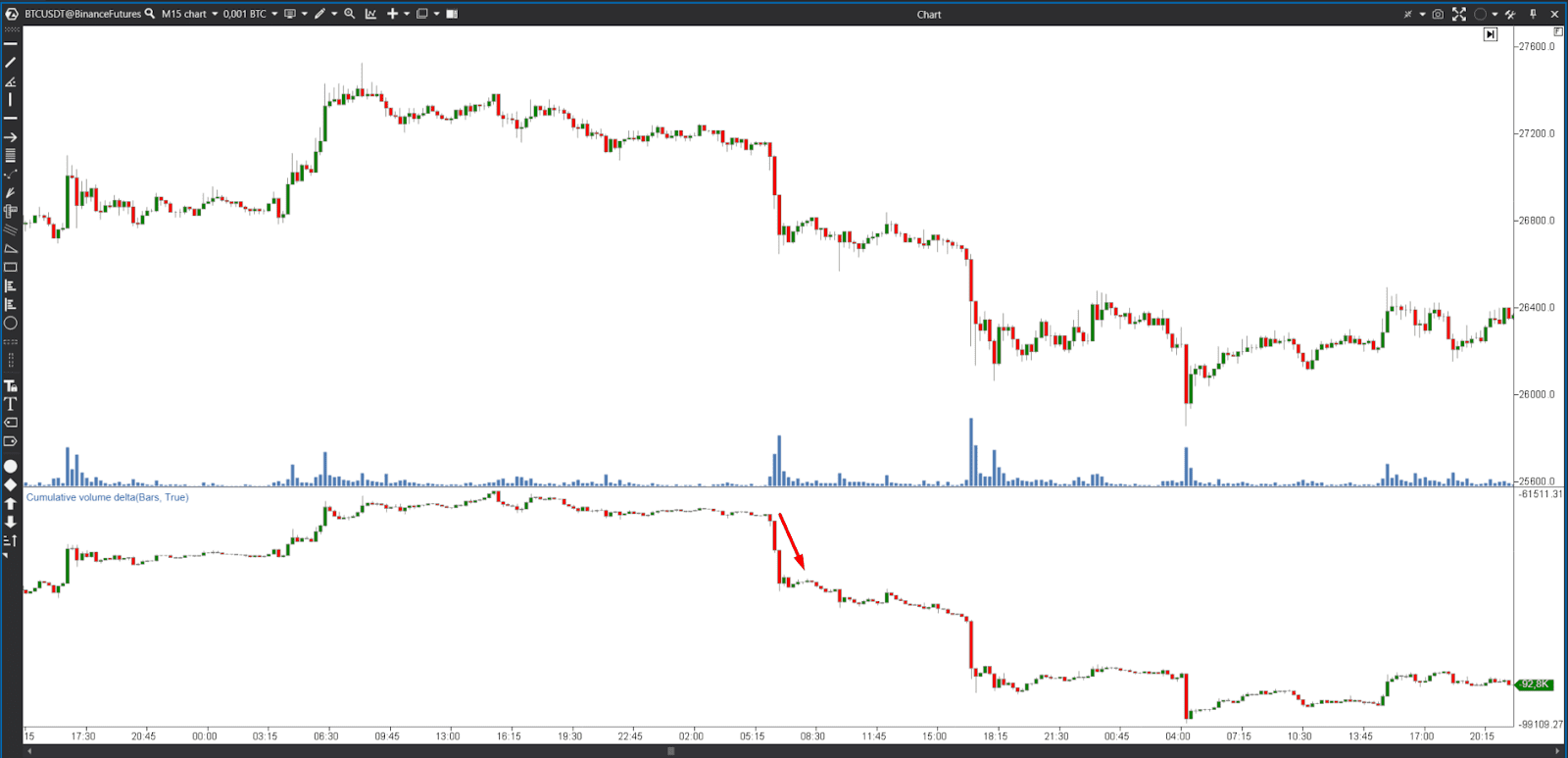

Identifying reversals

Cumulative Delta in crypto trading helps to recognize trend reversals.

Positive Cumulative Delta. During a downtrend, if there is a gradual increase in the positive delta while the price remains relatively stable or starts to rise, this indicates a change in pressure from buyers. Sellers' pressure is weakening, which can potentially lead to a trend reversal. We read it as a signal to exit short positions or even open long positions.

Negative Cumulative Delta. Conversely, during an uptrend, if the Cumulative Delta increases and the price remains relatively stable or starts to decline, it may indicate that the buyer pressure is weakening, which could potentially lead to a trend reversal. We consider it a signal to exit long positions or even open short positions.

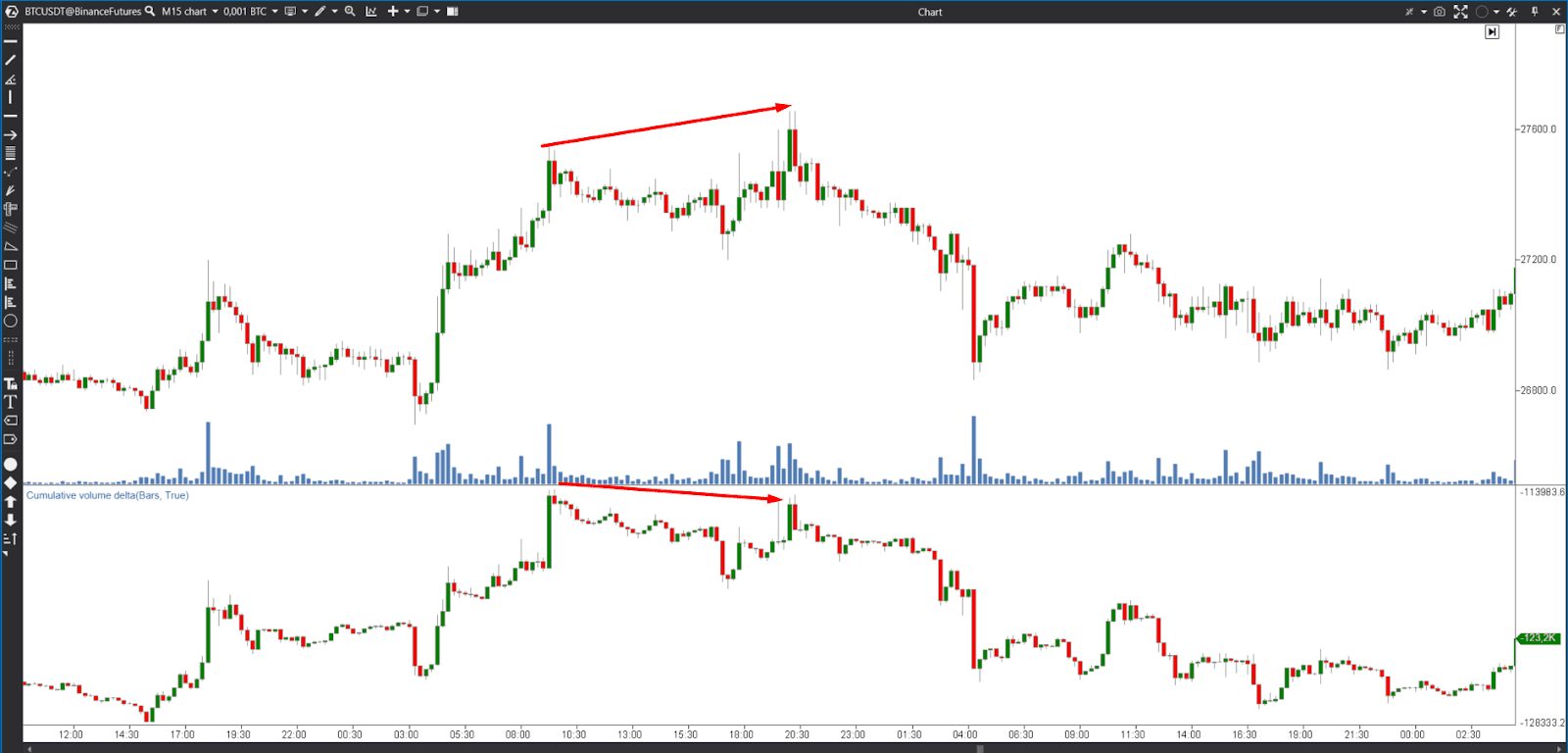

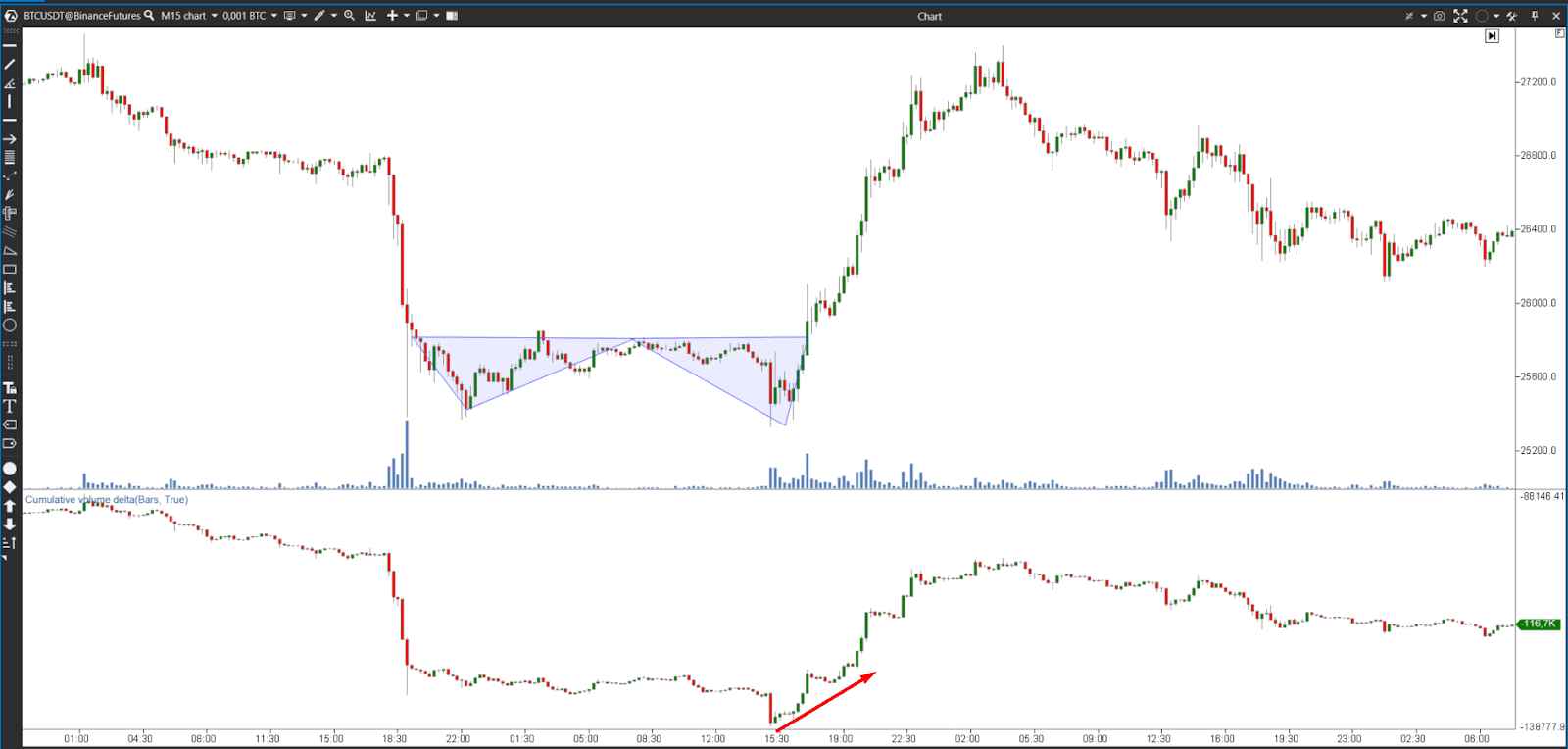

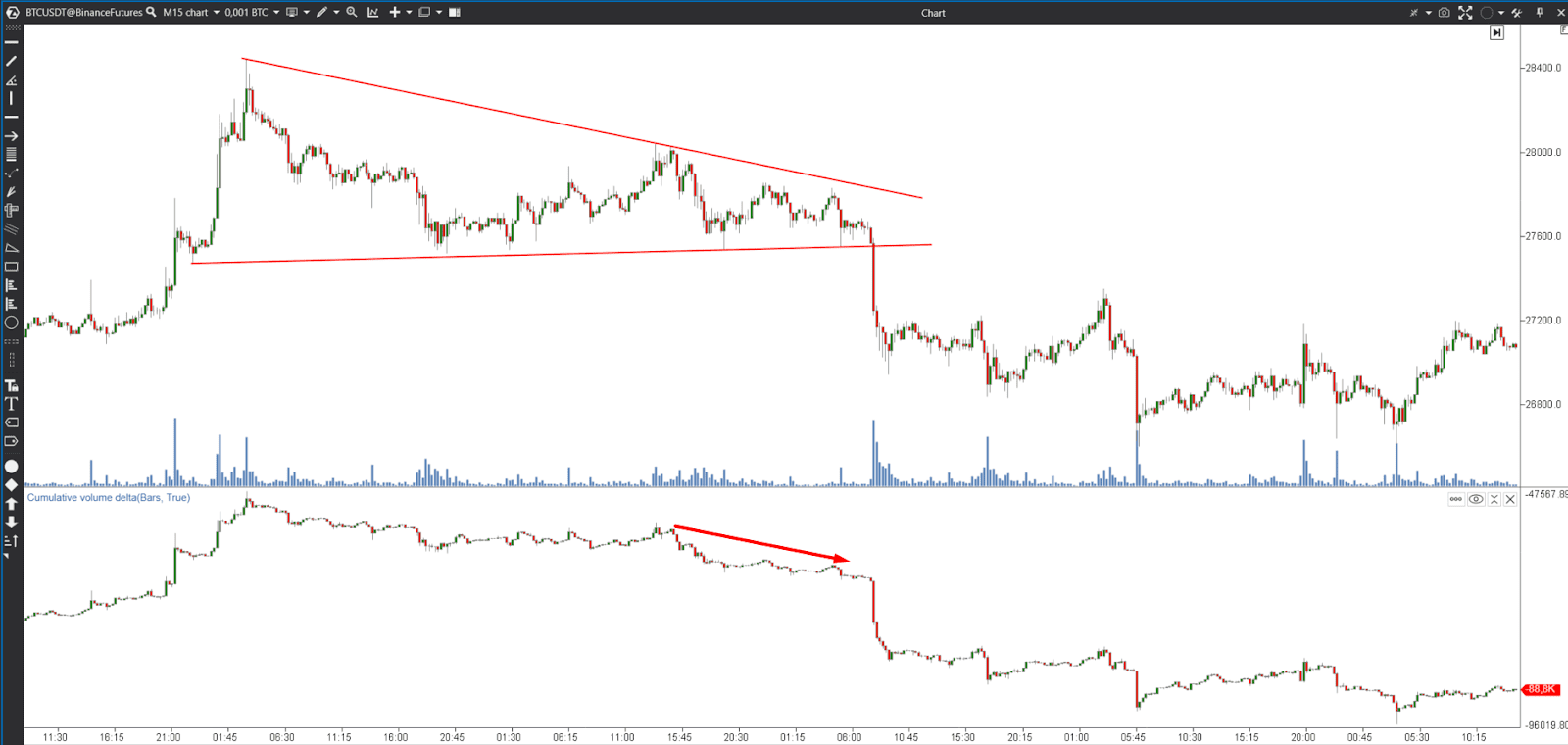

Confirmation of price patterns

By understanding how to read the Cumulative Delta correctly and combining it with classical technical analysis, we get additional confirmation of price pattern formation.

Positive Cumulative Delta. If the price pattern is bullish, we look for positive values of the Cumulative Delta during the formation of the pattern. A positive Cumulative Delta indicates a higher concentration of buying pressure, which means that market participants are actively accumulating long positions and supporting the bullish direction of the pattern.

Negative Cumulative Delta. For bearish price patterns, we look for negative values of the Cumulative Delta during the formation of the pattern. A negative Cumulative Delta indicates a higher concentration of selling pressure, indicating that market participants are actively taking short positions and confirming the bearish nature of the pattern.

Volume analysis

Cumulative Delta gives an idea of the volume imbalance. If a sudden surge in volume is accompanied by a positive delta, it indicates aggressive buying activity. Conversely, if a high volume is accompanied by a negative delta, it indicates aggressive selling. This combination allows you to assess the strength of market movements and potential reversals.

Order flow analysis

By tracking the Cumulative Delta, traders can monitor the activity of institutional investors and large market players.

Positive Cumulative Delta. Significant positive values of the Cumulative Delta indicate aggressive pressure on the market from institutional investors, which potentially signals the beginning of an uptrend or the strengthening of an existing trend.

Negative Cumulative Delta. Conversely, significant negative values of the Cumulative Delta indicate intense selling pressure from institutional investors. This indicates a potential downward trend or a continuation of the existing one.

Conclusion

Cumulative Delta is a powerful tool for crypto traders that provides a deeper understanding of the flow of buy and sell orders in the market. By understanding what the Cumulative Delta indicator is, traders can make informed trading decisions, identify potential breakouts or reversals, and gain an advantage in the highly dynamic crypto market. Don't forget to combine Cumulative Delta analysis with other technical indicators and strategies for a comprehensive approach to trading.

.png)