ICO, IDO, IEO: Crypto Investing Guide with Best Practices

By Alex Dehtiarov

BikoTrading Academy

Are you ready to dive into the thrilling world of cryptocurrency fundraising and make your fortune? As the crypto market evolves, the innovative methods of Initial Coin Offerings (ICO), Initial DEX Offerings (IDO), and Initial Exchange Offerings (IEO) have taken center stage, offering lucrative opportunities for investors. Buckle up as we embark on an exhilarating journey, unraveling the mysteries of these powerful fundraising mechanisms, and unveiling the secret strategies to maximize your profits in the ever-evolving crypto landscape. Let's get started!

KEY ISSUES:

First Steps in Crypto – What is ICO?

In 2017-2018, Initial Coin Offering (ICO) revolutionized investment, becoming a popular, cost-effective alternative to traditional Initial Public Offerings (IPOs). Talking about cryptocurrency, ICO investors buy project tokens instead of company shares, with token prices driven by supply and demand on cryptocurrency exchanges. If you consider participating or want to register for ICO think of it as a crowdfunding campaign for a blockchain startup.

Before launching, ICO teams create websites, draft compelling white papers, and develop strategic roadmaps. Despite their quick, affordable appeal, the lack of regulation led to an influx of fraudulent ICOs, with up to 80% failing to meet expectations or being outright scams. This trend severely damaged investor trust in the ICO crypto landscape.

Discover the Meaning of IEO in Crypto

Initial Exchange Offerings (IEOs) emerged in 2018-2019 as a secure, user-friendly alternative to ICO in crypto, with cryptocurrency exchanges acting as intermediaries. In crypto IEOs streamline the tokenization process, offering a simpler investment experience and reduced fraud risk through project verification.

IEO crypto projects partner with established cryptocurrency exchanges to launch and distribute new tokens. Exchanges vet projects before hosting IEOs, potentially offering a layer of security for investors. However, IEOs might have stricter participation requirements compared to ICOs and IDOs.

Exchanges manage IEO infrastructure, audience, and promotion, benefiting token issuers by providing an extensive client base as potential investors. However, IEOs have limitations, such as price manipulation due to exchange-imposed restrictions on token prices or user sales volumes. Understanding IEO meaning will help you assess the trade-off between potential security from exchange vetting and stricter participation requirements in IEOs.

What is IDO? Hidden Treasures of Decentralized Exchanges

It’s also important what IDO means in crypto. Initial DEX Offerings revolutionize fundraising by combining coin sales and listings on decentralized exchanges (DEXs), bypassing the need for cryptocurrency exchange vetting. IDOs use liquidity pools and automated market makers (AMMs) for asset trading, unlike centralized exchanges such as Binance or Coinbase, which rely on market makers and order books. Investors connect their wallets to the DEX platform to participate in the offering. IDOs promote greater accessibility and potentially fairer distribution compared to traditional ICO and IEO crypto phenomena.

Liquidity pools enable direct asset exchanges without waiting for buyers or sellers, catering to specific asset pairs. IDO crypto projects primarily run on Uniswap (Ethereum), but alternative blockchains like Solana, Polkadot, and Binance Smart Chain (BSC) are gaining traction, providing cost-effective network fee alternatives.

How to make 150-400% in a month investing in altcoins?

I want to show you our results so that you can see how profitable buying altcoins with great potential and low capitalization can be.

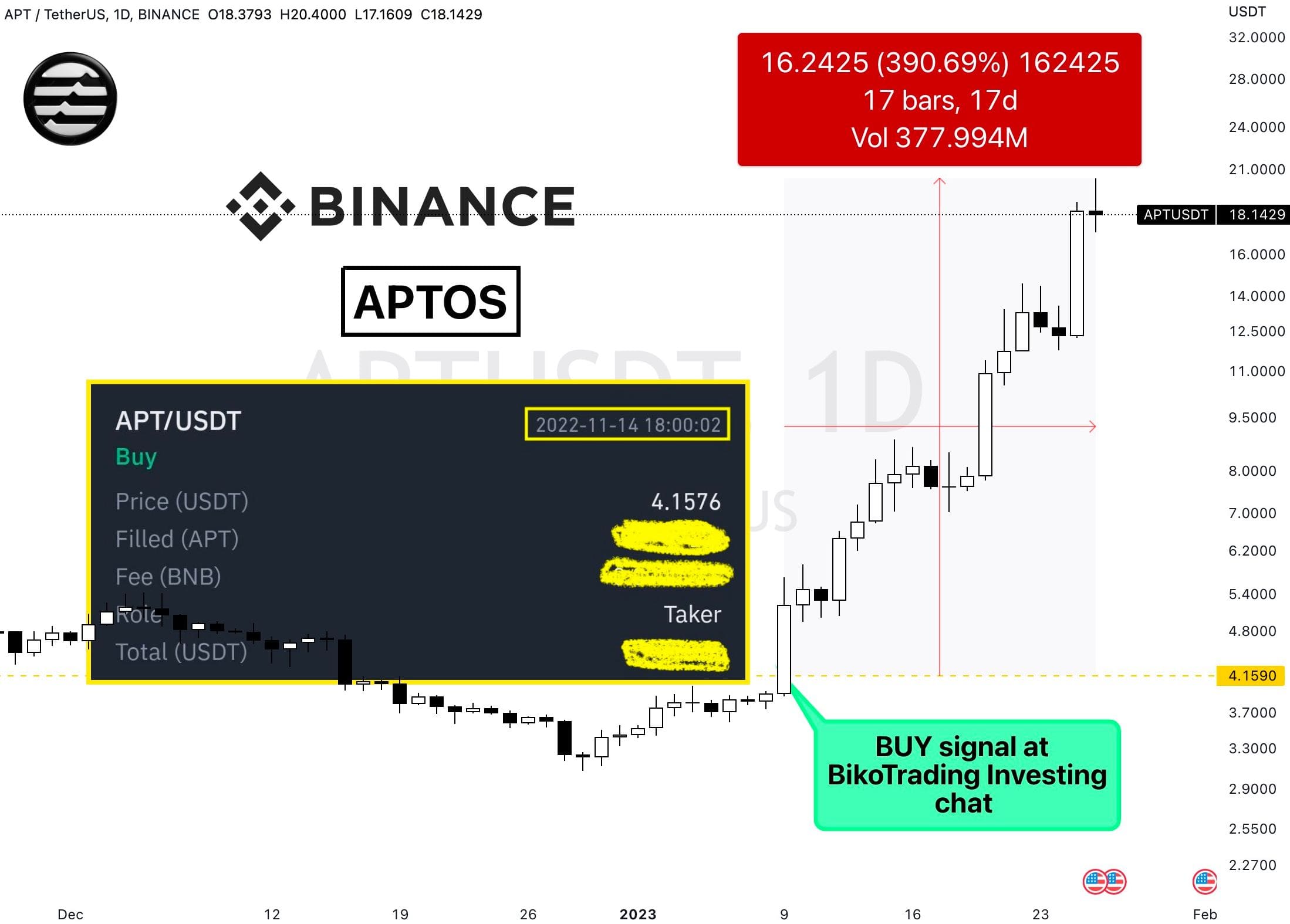

APT

Aptos (APT) brings us +400% in just 17 days of growth. How is this possible? Because of its low initial value (capitalization). Before the growth, its capitalization was only $0.6 billion. For example, it takes years for Bitcoin (BTC) or Ethereum (ETH) to grow by 400%, while such unique altcoins can grow 4 times in just 2 weeks.

On the chart, you can see the price of our purchase and the results we got from this APT growth.

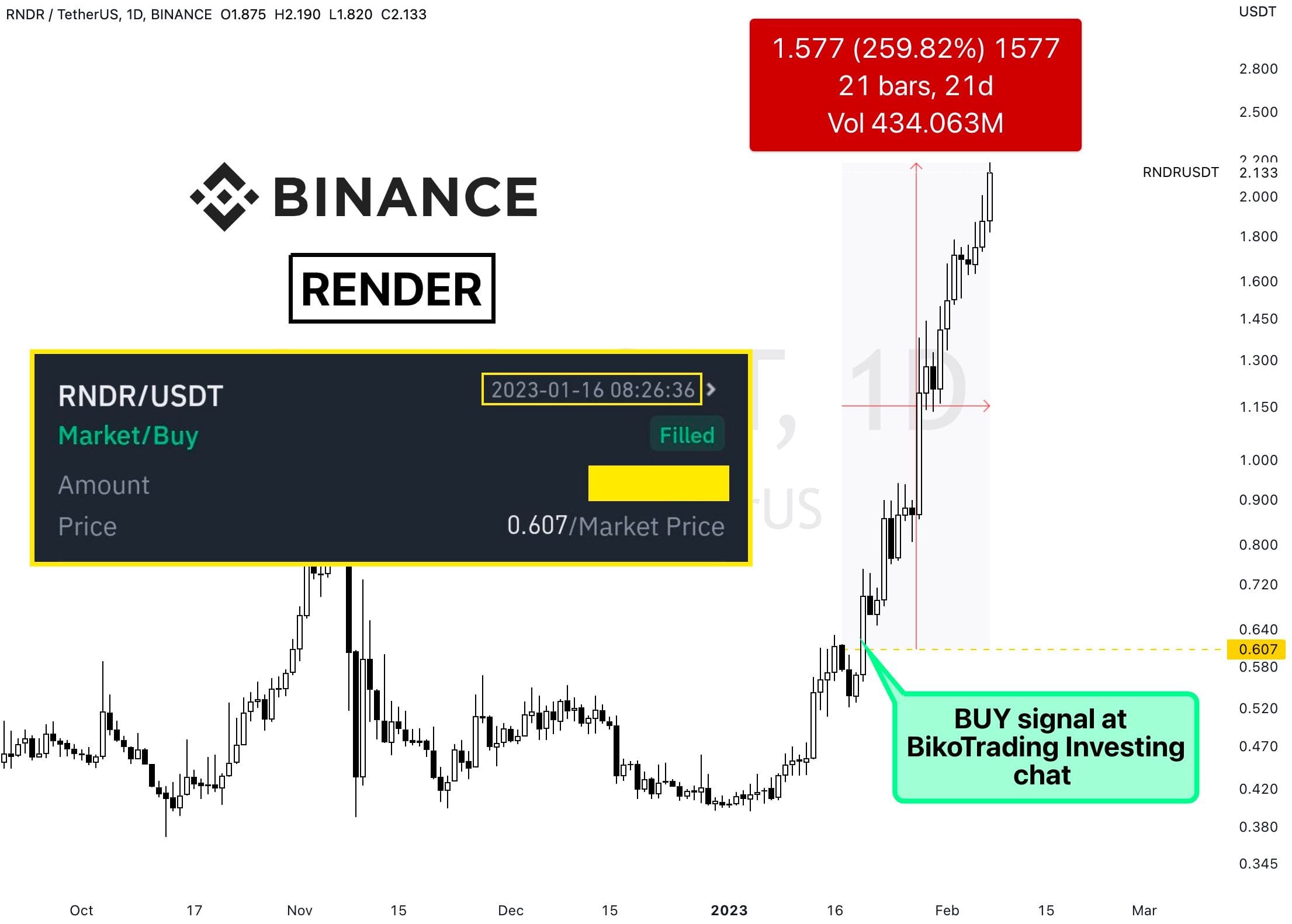

RNDR

The next example is Render (RNDR), which has grown by +260%. The coin, with a total value of $350 million, almost tripled our deposit and reached $900 million in just 3 weeks!

Such growth is possible only on altcoins with great potential and low capitalization, which we select for members of the Altcoin community. Don't miss out! Use the links below and unlock the secrets to earning on altcoin growth with our community!

Summary

As the world of cryptocurrency evolves, investment models like IEOs and IDOs are rapidly advancing, offering new opportunities for innovative projects. However, it is crucial to approach these platforms and projects with due diligence.

Before investing, thoroughly examine the white paper, documentation, team members' background, and developers' experience. Seek feedback from fellow crypto enthusiasts to make well-informed decisions in the dynamic crypto investment landscape.

GET IT TODAY: