Best platforms for trading CME futures

By Yuriy Bishko February 4, 2025

10+ years in crypto trading and investing, in asset management since 2019, co-founder of BikoTrading.

Developed personal highly profitable swing and scalping strategies for the crypto market.

KEY ISSUES:

Trading futures on the CME (Chicago Mercantile Exchange) requires high-quality software that will provide access to market data, fast order execution, chart analysis, and position monitoring. In this article, we'll take a look at several best trading platforms for futures and highlight their features that will help to overcome CME trading challenge.

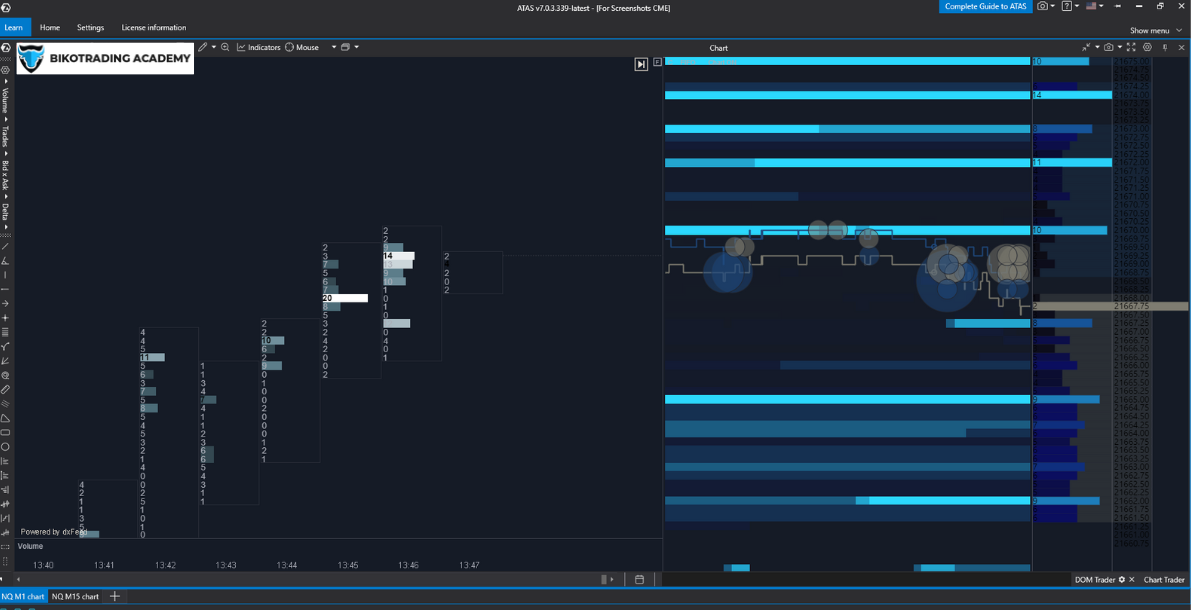

ATAS – the top futures trading platform

ATAS is one of the leading platforms for professional futures trading and it’s our best platform to trade CME futures. ATAS specializes in volume analysis, which allows traders to see the real picture of the market. The program offers tools such as Volume Profile, Cluster Search, and Footprint Charts that help identify key support and resistance levels.

The platform has an intuitive interface that is suitable for both beginners and experienced traders. ATAS allows you to build a variety of charts, analyze order flow, use advanced data filtering, and set up trade alerts.

By connecting to various liquidity providers, ATAS ensures minimal delays in order execution. The platform also works with brokers such as AMP Futures, Optimus Futures, and others. It also supports popular market data such as CQG and Rithmic.

Sierra Chart

Sierra Chart is a professional platform that is often used by futures traders due to its functionality for in-depth market analysis. The platform is known for its reliability and performance, even with a large flow of real-time data, and supports brokers such as AMP Futures, Interactive Brokers, CQG, Rithmic, and others.

Sierra Chart supports Order Flow, Volume Profile, TPO Chart, and Depth of Market (DOM) analysis, and allows you to automate trading by creating scripts on ACSIL. Experienced traders can create complex graphical indicators and customize them on their own.

Among the main advantages is the platform's cost-effectiveness, as it has a relatively low subscription fee, making it accessible to traders with any budget. It supports paying only for the necessary functionality, so users can optimize costs.

The main disadvantages are that the platform's interface is less friendly than its competitors and can be difficult for beginners, which requires time to set up and master.

Quantower

Quantower is a modern, flexible platform that provides a wide range of tools for market analysis and trading. Quantower offers the ability to add or disable various modules (charts, DOM, order flow analysis) to customize the platform to your own needs.

The platform offers the following analytical tools:

- Market Depth for analyzing orders.

- Tools for volume analysis such as Footprint Charts, Volume Profile, and Order Flow.

- Support for customized indicators.

- You can work with different markets (futures, stocks, cryptocurrencies).

The interface is intuitive, with a modern design, suitable for both beginners and experienced traders. There is a free version with basic functionality and paid versions for advanced needs.

TradingView

TradingView is a cloud-based platform that is ideal for technical analysis and collaboration with other traders.

Among its advantages, we highlight the ease of use and access to the platform through a browser or mobile application. The platform also has a very large library of indicators (over 100), as well as the ability to create your own indicators in Pine Script. Moreover, it is a huge social network of traders for the exchange of ideas and discussions.

Our team additionally uses TradingView because of its user-friendly charts with the ability to draw, analyze trends, and set alerts. It's also great for beginners, as there is a free version with basic functionality and paid subscriptions (Pro, Pro+, and Premium) with advanced features.

But it’s important to remember about limitations for futures. TradingView is more focused on technical analysis than professional order execution that’s why it can’t be called the best platform for futures trading. Although the platform supports connectivity to multiple brokers (e.g. CQG), its futures functionality is inferior to specialized platforms such as ATAS or Sierra Chart.

Still have the question: where can I trade futures? Join the Exclusive Bikotrading CME Traders' Club and take your trading on CME futures to the next level with exclusive benefits:

- Get detailed insights into the S&P 500 and Nasdaq 100.

- Identify optimal entry and exit points with ease.

- Learn the best futures trading platform and where to buy futures.

- Trade alongside professional traders in real time with live trading sessions.

- Participate in an active group chat for market updates and guidance.

- Enjoy 1-on-1 strategy sessions with experienced traders.

Ready to get started? Fill out the form, and our team will reach out with all the details to join!

So which platform to choose?

We always advise you to choose a platform, CME futures platform especially, that fits your goals, trading style, and level of experience. When trading CME futures, test the selected platforms in demo mode to evaluate their functionality and create a kind of CME trading simulation regime. And work with platforms that support your chosen broker and market data.

For beginners

If you are just starting out in futures trading, choose top futures trading platforms with an intuitive interface that will help you master the basics of market analysis.

- ATAS is an excellent choice for learning the market through the analysis of volume and order flow. Due to the simplicity of the interface and the availability of video tutorials, ATAS allows you to quickly master the key aspects of trading.

- If you need a convenient tool for technical analysis, choose TradingView. This is a cloud-based platform with an easy-to-use interface, access to a large number of indicators, and the ability to communicate with other traders.

For active traders

Experienced traders looking for tools for in-depth market analysis and efficient trade execution should pay attention to the following trading futures software:

- ATAS is the best platform to trade futures due to its advanced tools for volume analysis, Volume Profile, and Footprint Charts.

- Sierra Chart is suitable for traders who work with large amounts of data and Order Flow. The platform provides the most accurate analysis, but its interface may take more time to adapt.

- Quantower is an ideal choice for traders looking for tools for market monitoring, chart customization, and Depth of Market analysis. It’s lso popular due to its flexibility, a modern interface, and support for various markets.

For technical analysis and mobility

For traders who focus on technical analysis or work from different devices, we recommend the following futures trading programs:

- ATAS is a top platform for traders who focus on volume analysis, order flow, and professional market monitoring. It provides deep functionality for working with volumes, an intuitive interface, and high order execution speed.

- Thanks to cloud access, the TradingView platform allows you to work from any device. A huge library of indicators, the Pine Script feature, and social interaction with other traders make it ideal for those who want to be part of a trading community.

For professional market analysts

For traders who need tools for detailed market analysis, professional work with order flow, and process automation, here is the best trading platform (futures-focused):

- ATAS is still the best choice for working with volumes and fast order execution.

- Sierra Chart offers low subscription cost, high speed, and advanced functionality which make this platform also the top choice among professional traders.

Conclusion

For trading CME futures, ATAS is the perfect choice as a CME trading platform since it offers the most powerful tools for market analysis, order flow monitoring, and volume management. If you're looking for an alternative with a wide range of automation features, consider Quantower. For those who value simplicity and social interaction, TradingView is a great choice. Remember, the choice of platform depends on your goals, trading style, and budget. It is recommended that you first test several platforms in demo mode to find the one that best suits your needs.