How to identify trends in CME index market using Volume Profile?

By Yuriy Bishko February 4, 2025

10+ years in crypto trading and investing, in asset management since 2019, co-founder of BikoTrading.

Developed personal highly profitable swing and scalping strategies for the crypto market.

KEY ISSUES:

The CME index market is one of the key centers for global financial and derivatives markets. To make a good analysis and have efficient CME trading, it is worth using tools that provide a comprehensive overview of information. In this article, we show how the volume profile helps to identify trends with the CME index market analysis, especially in crypto trading.

What is a volume profile?

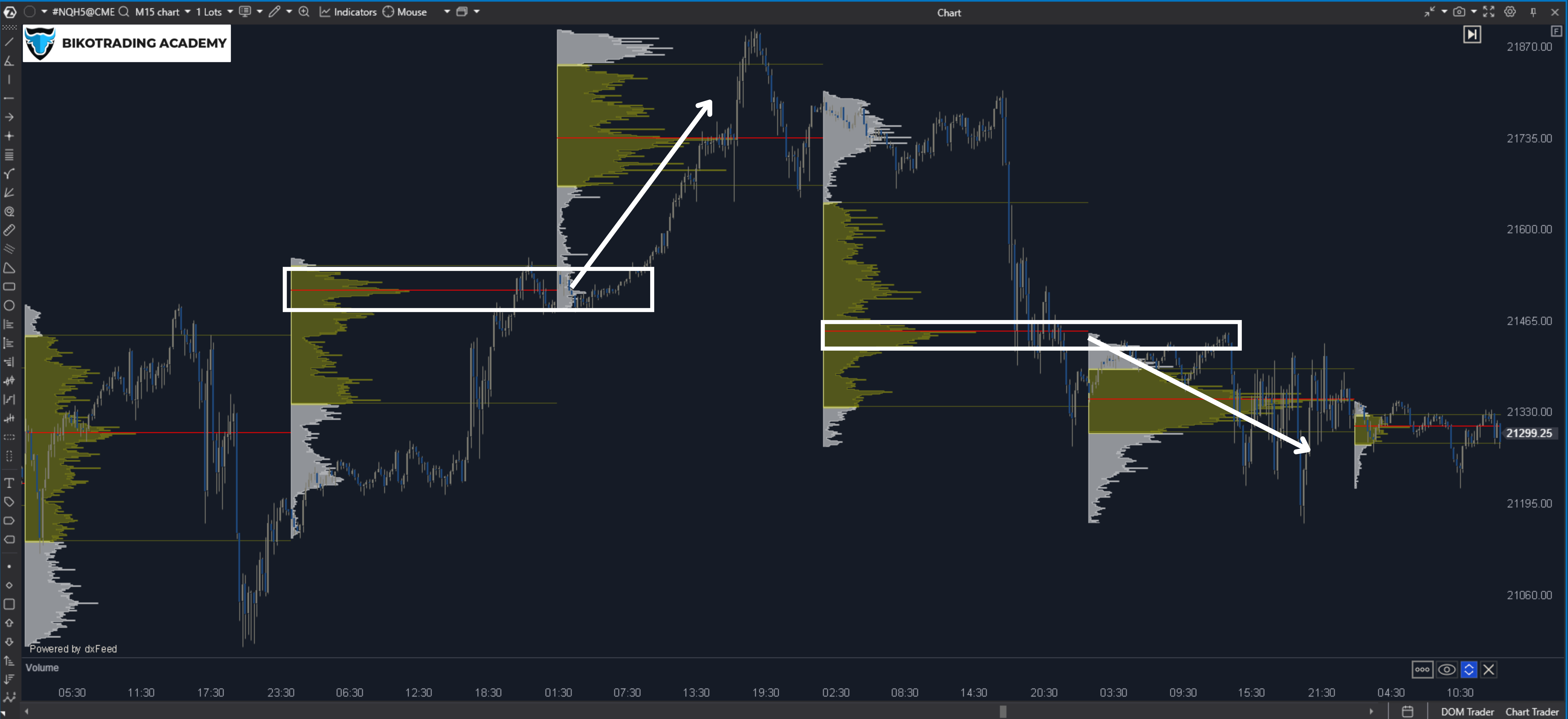

A Volume Profile chart analysis is a technical tool that displays trading volume at certain price levels. Unlike traditional volume, which shows the total number of contracts traded per unit of time, Volume Profile indicators illustrate where exactly these contracts were made on a vertical price scale.

Key elements of the volume profile:

- POC (Point of Control) – the price level with the highest trading volume.

- HVN (High Volume Nodes) – areas with high trading volume.

- LVN (Low Volume Nodes) – areas with low trading volume.

- VA (Value Area) – a zone where 70% of trading takes place.

How to use the volume profile to identify trends?

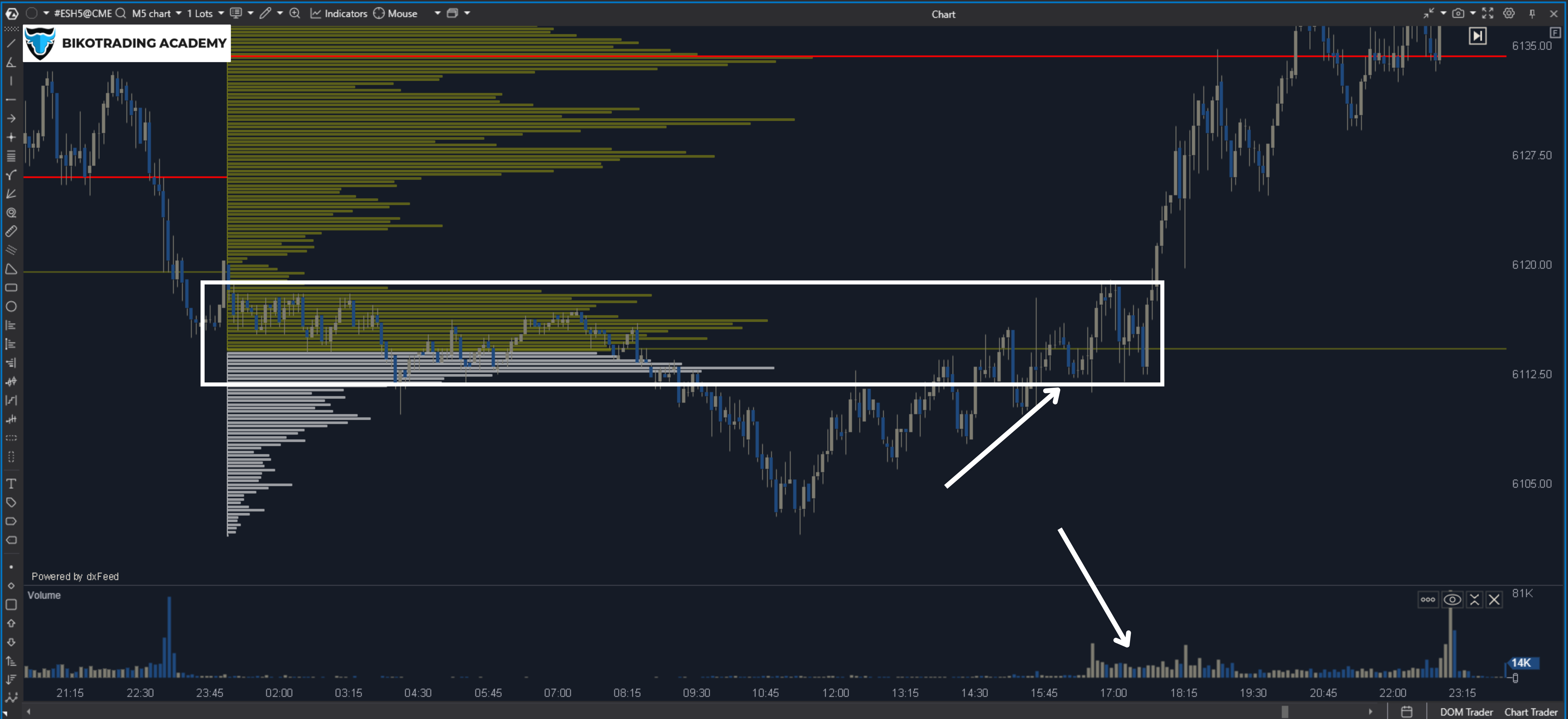

1. Identify key support and resistance zones

Price levels with high trading volume (such as POC and HVN) usually serve as important support or resistance zones when doing CME futures trading with Volume Profile. If the price is above these zones, the market is inclined to an uptrend. If it is below, it may signal a downtrend.

High Volume Nodes (HVNs) are areas where the largest trading volume took place. They are important levels because they indicate where the market has “negotiated” the price between buyers and sellers. If the price approaches the HVN from above, it is a support zone. If it approaches it from below, it is a resistance zone.

Point of Control (POC) is the most important level where the volume is maximum. This level shows the point around which the price fluctuated the most. The POC often shifts upwards in the uptrend, which confirms demand. In a downtrend, the POC shifts downward, indicating the advantage of sellers.

Pay special attention to the price behavior near the HVN or POC. If the price tests these levels and returns to the trend, it is a signal to enter.

2. Analysis of breakdowns through LVNs

Low Volume Nodes are usually the “weak points” of the market. When the price breaks through an LVN, it is often accompanied by a significant momentum and can signal the beginning of a new trend.

LVNs are areas with low trading volume where the price moved quickly and the market did not have time to “accumulate” the trade. If the price approaches the LVN with a high volume in the current session, it can be a sign of a breakout. A breakout of the LVN is usually accompanied by a sharp increase in volume, which confirms the momentum.

- Wait for the breakout to be confirmed by the candle closing above/below the LVN.

- Use a stop loss slightly above/below the broken level, depending on the direction of the trade. The goal is the HVN above/below the broken zone.

For example, if the S&P 500 futures breaks through the LVN with a strong upward momentum, it may signal a rise to the next HVN.

3. Identification of accumulation or distribution

Areas with a long price stay and high trading volumes (HVN) often indicate a phase of accumulation (before growth) or distribution (before decline). By observing the change in volumes in these areas, you can predict the direction of future market movement.

Areas of accumulation (consolidation) are formed when the price moves in a narrow range around the HVN and trading volumes are concentrated. This indicates that the market is looking for a balance between buyers and sellers. After the accumulation, there is usually a strong impulse movement in the direction of the dominant force. Distribution phases look similar, but usually signal preparation for a decline.

- If the price moves in a range around the HVN, get ready to exit.

- Watch for changes in volume: an increase at the breakout signals the beginning of a trend.

- Use a stop loss outside the consolidation to avoid false breakouts.

4. Trend signals through POC shifts

The POC changes depending on where the trading volume is concentrated. Its dynamics allows you to determine the trend.

- An upward shift of the POC along with rising prices signals an uptrend.

- A downward shift of the POC indicates a downtrend.

- If the POC remains stable in the range, it may indicate consolidation. Get ready for a possible strong movement after it is over.

Take your trading to the next level with our exclusive Bikotrading CME traders' club and resources, including:

Take your trading to the next level with our exclusive Bikotrading CME traders' club and resources, including:

- Get in-depth breakdowns of the S&P 500 and Nasdaq 100.

- Defined areas for accurate trade entries and exits, and use the most profitable CME trading hours.

- Learn how to identify crypto trends and how to use volume profile in trading.

- Join live sessions with experienced traders to learn and grow.

- Connect with like-minded traders in our exclusive group chat.

- Enjoy individual sessions with our experts to improve your trading strategy.

Fill out the form today, and we will reach out with all the information you need to get started!

Strategies for using the volume profile in the CME index market

With Volume Profile, CME analysis will be much more informative and help to predict potential market movements. For example, if the S&P 500 is at a key POC level and rebounds upward, this can affect the growth of Bitcoin or other cryptocurrencies that have a high correlation with stock indices.

Also, breakouts on CME indices through LVN often reflect changes in institutional investor behavior. If you see such a tendency in the crypto market, look for opportunities for entry. Here are some strategies on how to identify trends in crypto with the help of Volume Profile.

Strategy 1: Trading from POC and VA levels

Identify the current POC and Value Area on the daily or weekly volume profile.

If the price moves away from the POC and returns back to it, it may be an entry opportunity.

Use Value Area High (VAH) and Value Area Low (VAL) as additional levels for targets or stop losses.

Strategy 2: Trading on LVN breakouts

Identify areas with Low Volume Nodes.

After that, watch for breakouts of these zones with confirmation of an increase in volume.

Enter in the direction of the breakout and use the nearest HVN as a target level.

Strategy 3: Using the volume profile on multiple timeframes

Analyze the volume profile on larger timeframes (e.g. weekly) to determine global support and resistance zones.

Move to smaller timeframes (daily or hourly) to refine entry points.

Watch for coincidences between HVN zones on different timeframes – this increases their significance.

Conclusion

The volume profile is an indispensable tool for identifying trends and key areas of the CME indices market. If you develop the right volume profile trading strategy, do the analysis of support and resistance zones, POC shifts, and work with LVN and HVN, you will more accurately understand the market structure. With the help of these tools, traders can identify key levels, determine trends, and assess the strength of market impulses. Join the Bikotrading CME traders' club, learn the best strategies, and take advantage of every price movement on the market when trading on CME.