What is Order Flow and how to trade CME futures with it?

By Yuriy Bishko January 20, 2025

10+ years of experience in trading and investing in the cryptocurrency market

Co-founder of BikoTrading

Developed personal highly profitable swing and scalping strategies for the cryptocurrency market

Engaged in asset management since 2019

KEY ISSUES:

Order Flow is a method of market analysis that allows traders to get an idea of the dynamics of buying and selling in real time. This approach is widely used for trading futures on the CME (Chicago Mercantile Exchange), as it allows you to better understand the intentions of market participants and find entry points with a high probability of success. In this article, we are also going to cover what is CME in trading, what is the best CME trading platform, and how to become a successful CME trader.

How Order Flow works

Order Flow displays the activity of market participants by analyzing:

- Order Book. Shows current limit orders for buying and selling. Limit orders allow you to see the areas where the market may find resistance or support due to the large volume of orders.

- Order Tape. Displays already executed market transactions, allowing you to assess whether buyers or sellers dominate the market.

- Delta. The difference between the volume of market buy and sell orders, which shows how active market participants are at a particular time.

- Iceberg orders. Special large orders, some of which are hidden. They help large market participants to gradually introduce large volumes without significantly affecting the price.

Thanks to these tools, traders can identify liquidity accumulations and areas where large volumes can stop price movement. Also, they can see potential pivot points where the activity of participants changes. And with its help, it’s easier to find impulsive movements, i.e. low liquidity spikes that often lead to strong movements.

Why order flow crypto trading is important for crypto traders

Cryptocurrencies and CME futures such as Bitcoin Futures have a lot in common. For example:

- Both cryptocurrency markets and futures are characterized by rapid price changes.

- Both markets have institutional investors who influence the direction of price movement.

- Crypto Order Flow helps to recognize the manipulations or intentions of large players, which is critical for effective trading.

Crypto traders can use crypto order flow trading analysis to understand how liquidity and large orders affect price movements, adapting their approach to more structured markets such as CME.

How to start using Order Flow for CME futures trading

Choose the right software. The most popular platforms among crypto order flow software include ATAS, Sierra Chart, Bookmap, NinjaTrader, Quantower. Always choose platforms that support CME data and stream analysis. To easily do order flow trading crypto, you need access to Level 2 and Time & Sales streaming data.

Also, learn key patterns, for example, imbalance shows when demand exceeds supply or vice versa, absorption indicates large orders that keep the price from moving, and stop order activation often precedes reversals or strong impulses. To do this, first work on demo accounts or on the CME trading simulator to practice strategies without risking capital loss. And most importantly, analyze historical data to study market behavior.

Order Flow strategies for trading on CME futures

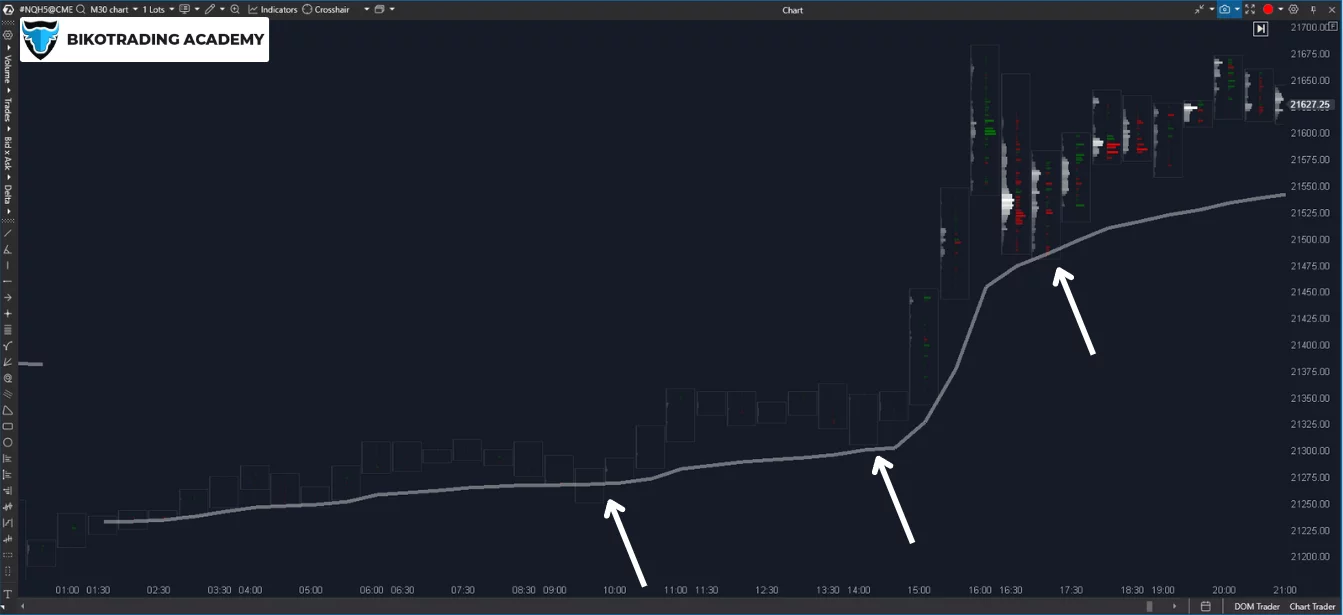

1. Search for liquidity zones to identify areas with the highest concentration of buy or sell orders. To do this, identify areas of high liquidity (Value Area) using the Volume Profile. Watch the price reaction to these areas: whether the price moves further or stops and reverses. Use these levels as entry or exit points.

2. Breakout trading, i.e. entering the market after an important support or resistance level has been broken.

3. In this case, use delta analysis to confirm the strength of the breakout: a large positive or negative volume indicates support for the movement. Next, make sure that the volume increases on the breakout. Low volume may indicate a false breakout. Place stop losses below or above the breakout zone depending on the direction of the trade.

4. Trading on reversals to identify places where the price changes direction due to the activity of large players. To do this, identify the absorption of large orders (Absorption) using Footprint Charts. Keep an eye out for Stop Runs, which can signal the exhaustion of momentum. Also use delta to confirm a reversal: a change from negative to positive or vice versa.

5. Trend trading is when you enter the market in the direction of the current trend with the confirmation of a Flow Order. Determine the direction of the trend using cluster volume analysis. Enter CME trades after corrections confirmed by an imbalance in the direction of the trend. Also, use dynamic levels to determine the points of addition to a position.

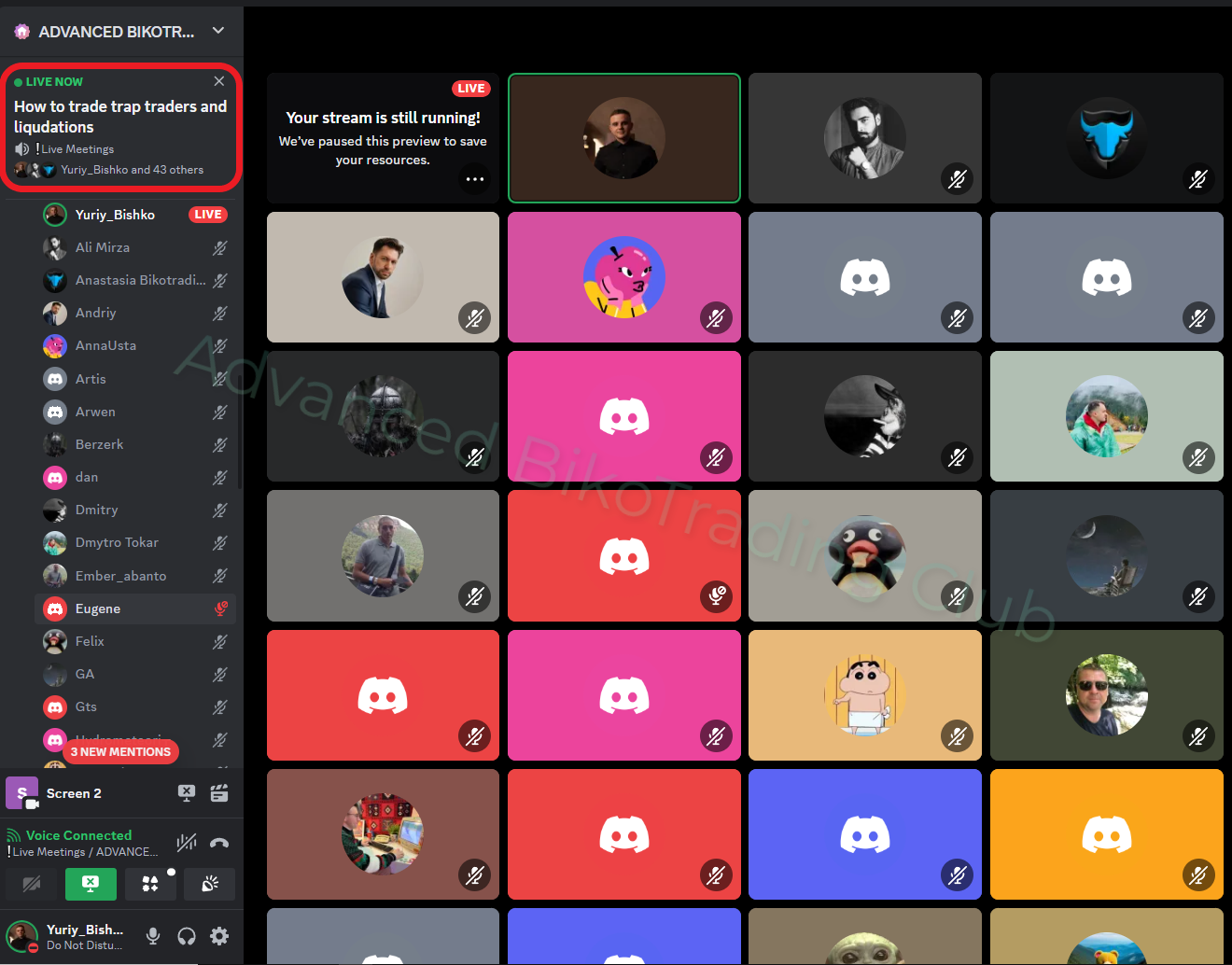

Take your trading to the next level with the support you need to succeed in the Bikotrading CME Traders' Club:

- Stay ahead of the game with insights into the S&P 500 and Nasdaq 100.

- Know exactly when to enter and exit your trades with confidence.

- Learn by doing as you trade alongside experienced professionals.

- Connect with like-minded traders in a group chat where you can share tips and ideas.

- Get 1-on-1 strategy sessions tailored to your trading style and goals.

This is a great to grow as a trader with access to tools, knowledge, and a supportive community. Fill out the form, and we’ll reach out with all the details to help you get started. Let’s trade smarter, together!

Advantages of Order Flow for CME futures:

- It helps to see what is happening behind the scenes of the price chart.

- Analysis of large participants and the ability to track their actions.

- Confirmation of signals and opening and closing of orders.

- Adaptation to different markets as it is suitable for cryptocurrencies, futures, and stocks.

Conclusion

Crypto Order Flow chart is a powerful tool for traders who want to understand market dynamics in detail. Training and practice will help to maximize the potential of this method. If you want to know how to trade on CME, follow Bikotrading team to learn more about it. Join the Private Bikotrading CME Traders' Club. This is a closed community of traders that provides access to educational materials, analytics, and support from experienced professionals. Here you can share experiences, get advice, and find new opportunities for growth in the world of financial markets.