Step-by-step guide on how to read clusters on CME futures

By Yuriy Bishko January 27, 2025

10+ years of experience in trading and investing in the cryptocurrency market

Co-founder of BikoTrading

Developed personal highly profitable swing and scalping strategies for the cryptocurrency market

Engaged in asset management since 2019

KEY ISSUES:

Clusters (or cluster charts) are a powerful tool for market analysis, especially on CME futures. Clusters help you see the deep details of market trades, identify volume flows, and assess the behavior of major players. In this article, we are going to learn how to read clusters on crypto CME futures.

What are clusters?

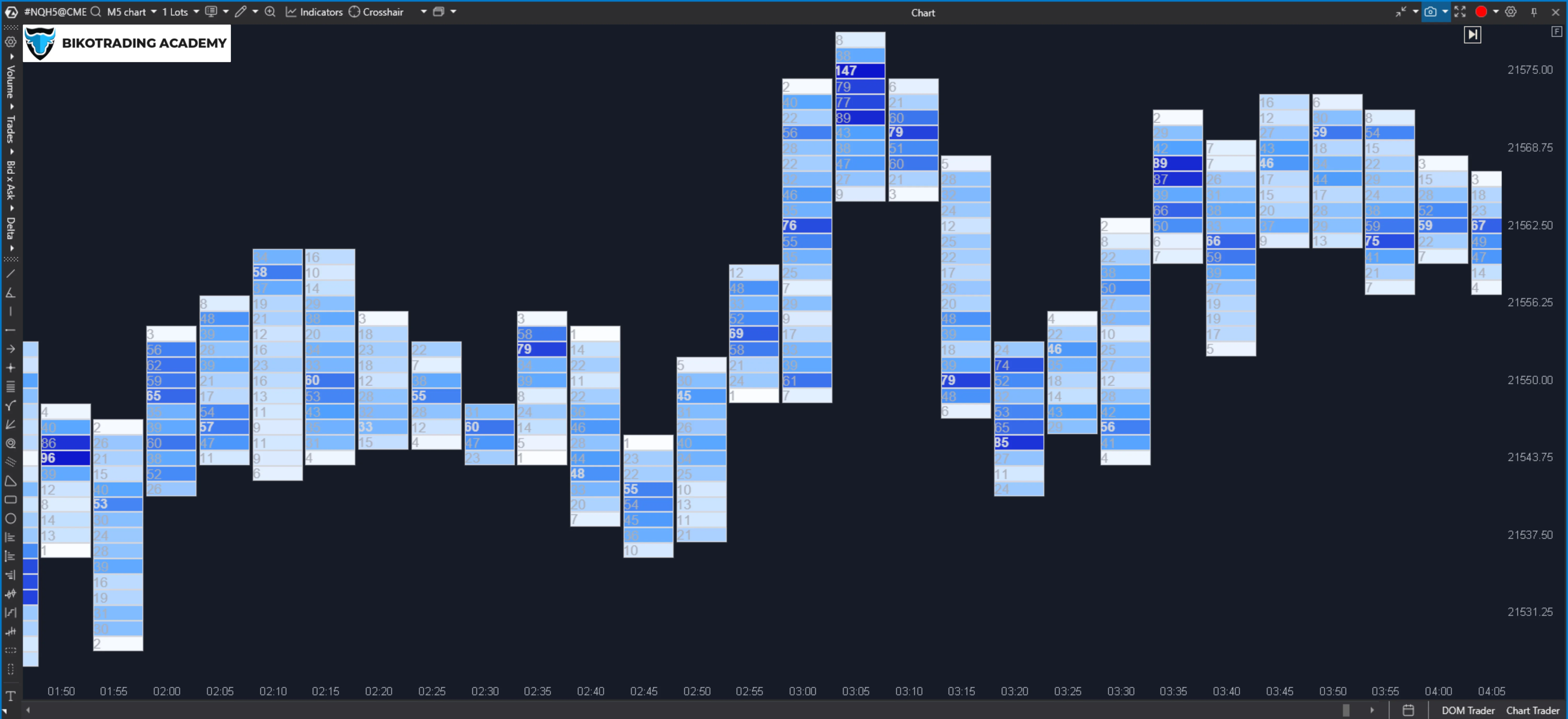

A cluster is a graphical tool that shows the volume of trades at each price level. Unlike standard candlesticks, a crypto cluster charts show:

- The number of contracts of CME crypto futures (volume) that were executed at a certain price level.

- The distribution between buyers and sellers, i.e. the Bid/Ask balance.

- The aggressiveness of trades, which is determined by the type of order execution (market or limit).

Why are clusters important for crypto traders?

If you want to trade Bitcoin and Ethereum crypto futures, CME offers them as a popular choice for hedging and speculation. They reflect the behavior of professional market participants such as institutional investors. The use of clusters allows you to:

- Understand the market structure and identify levels where volumes accumulate.

- Detect manipulations in the form of large orders that hide the true intentions of traders.

- Improve entry and exit points by analyzing support and resistance levels based on the information that you get from volumes.

How to work with cluster charts

1. Choose the right platform for analysis

- ATAS – the best choice according to the Bikotrading team

- Sierra Chart

- Bookmap

- NinjaTrader

All these tools allow you to do CME futures crypto analysis and use cluster charts.

2. Customize the display of clusters

Bid/Ask mode shows the volumes of executed buy (Ask) and sell (Bid) trades for each price level.

With Delta you will see the difference between Bid and Ask at a certain level.

Volume Profile will let you see the most active levels.

3. Analyzing the main patterns

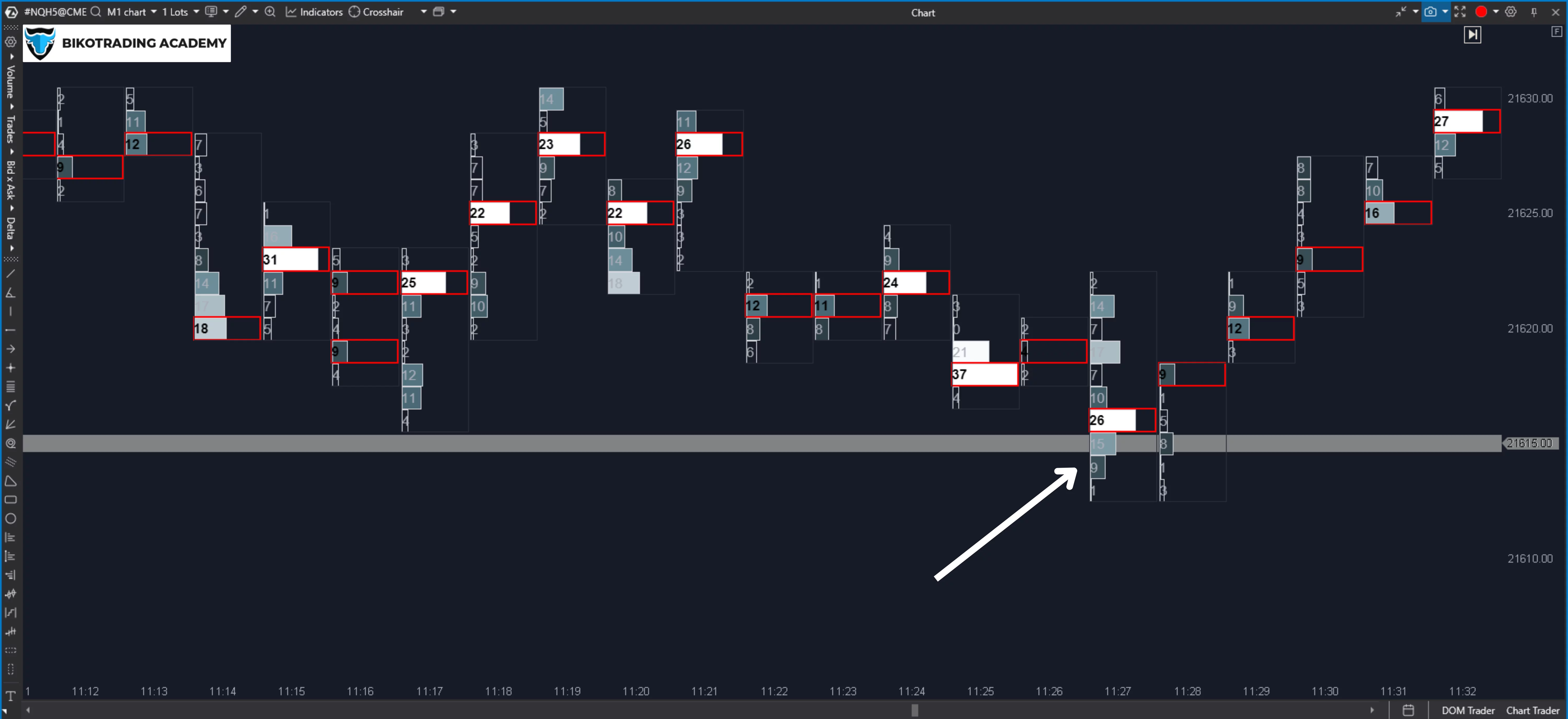

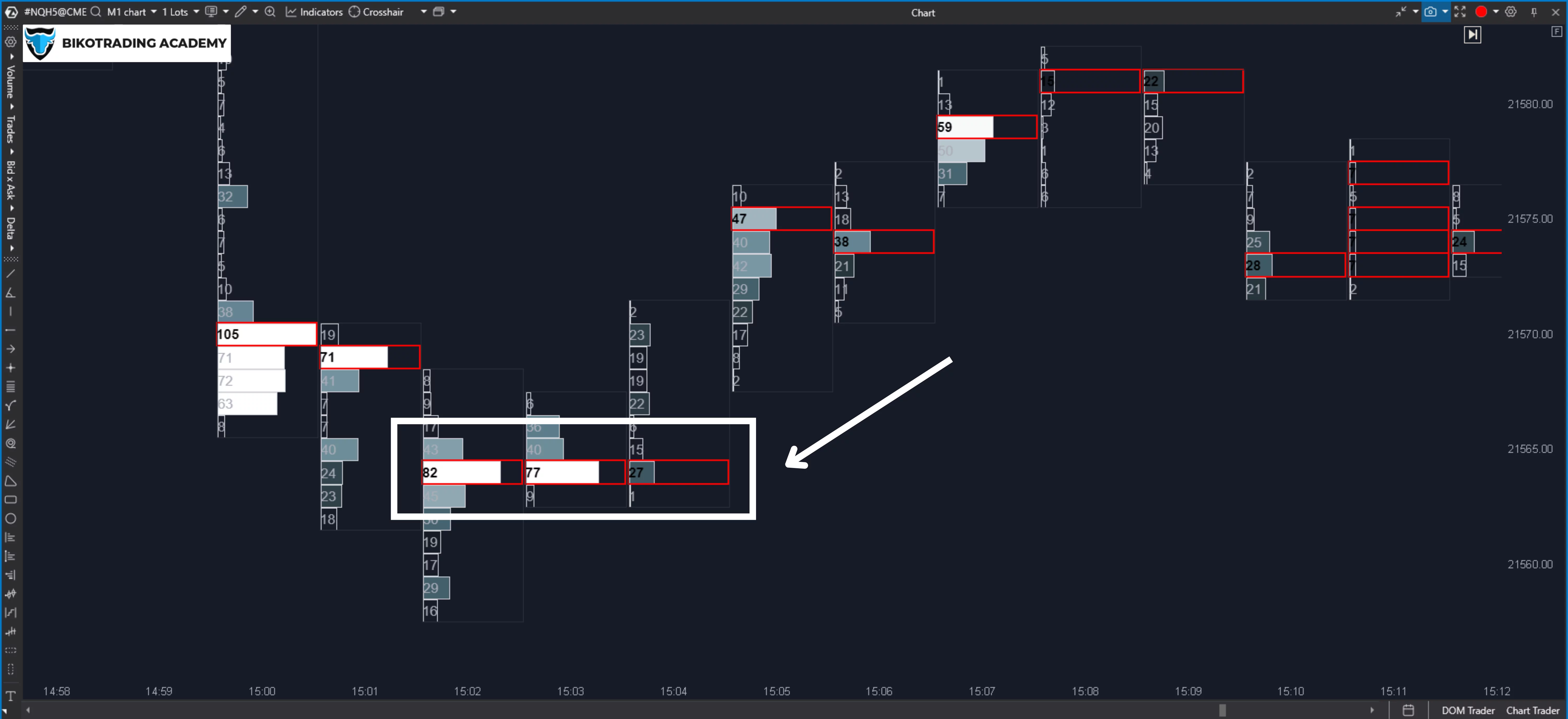

An imbalance is a situation where one side of the market (buyers or sellers) dominates a certain price level. For example:

- Bid significantly exceeds Ask – a sell signal.

- Ask significantly exceeds Bid – a buy signal.

Point of Control (POC) shows the most traded price level. It often becomes a key support or resistance level.

Cluster Rejection is a level where the volume drops sharply after significant activity, which may indicate a reversal zone.

4. Advanced price cluster trading

The heatmap shows the levels at which the largest clusters of orders were located. This allows you to understand where market participants are most active.

Cumulative Delta helps to track the difference between buying and selling in the dynamics, which allows you to identify trends or their completion.

5. Integrate with other tools

BTC cluster crypto analysis is greatly enhanced when using additional tools. Here's how it works:

Support and resistance levels. By combining clusters with support and resistance levels, traders can determine whether a particular level is important to the market. For example, if there is a significant cluster of purchases (large Bid volume) at a support level, it may indicate that the market is ready to rebound upwards.

Open Interest indicator. This indicator shows the total number of open contracts. If the cluster chart shows a significant volume at the level of growing open interest, this may indicate the formation of a new trend.

Volume analysis. The use of clusters in combination with the volume profile allows you to more accurately determine the “value areas” and POC (Point of Control) levels with volume cluster trading, which are key to making more efficient cluster trading decisions.

Candlestick patterns. Integration of clusters with candlestick patterns, such as pin bars or engulfing patterns, allows you to confirm a reversal or trend continuation signal. For example, a cluster of sales on a candlestick with a long upper wick can be a strong signal for shorts.

Trend indicators. Using clusters in conjunction with trend indicators such as EMA or VWAP helps to better assess the market context. For example, if a buying cluster is concentrated above the VWAP, it can confirm the strength of a bullish trend.

News and events. It is important to consider the external context, such as economic news or changes at the macro level. For example, if a significant cluster is formed after the publication of important news, this may confirm its impact on the market.

6. Practical approach to analysis

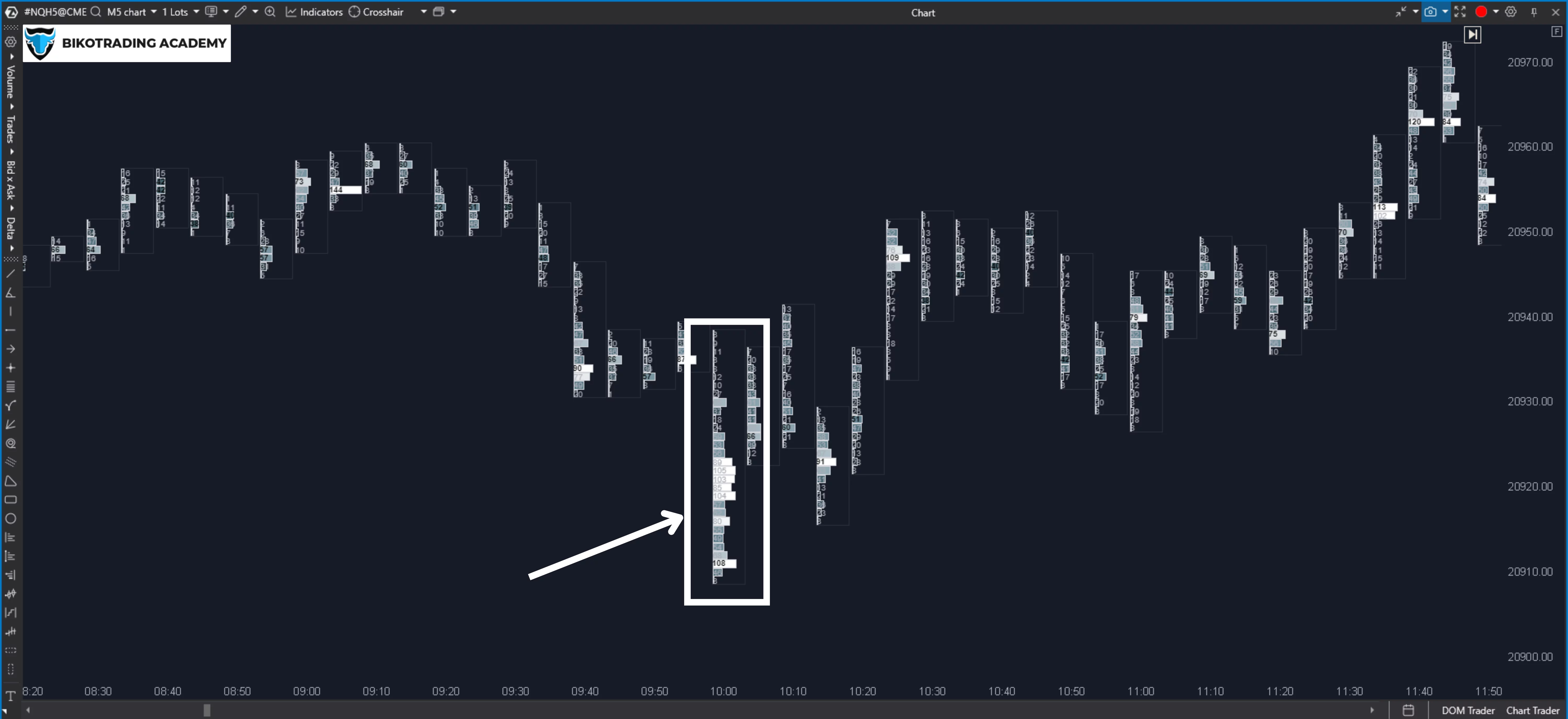

Choose a timeframe, taking into account that clusters work well on medium- and short-term charts (for example, M5, M15).

Look for key levels and determine where the volumes are the highest (POC, maximum Delta).

We check the context, taking into account the current trends, news, and market behavior.

Filter out the noise. It is important not to focus on small volumes or random bursts of activity.

Looking to improve your CME crypto futures trading? Join our private CME trading club and get the tools and support you need to succeed:

- Stay ahead of the market with clear analysis of the S&P 500 and Nasdaq 100.

- Trade the best crypto currency futures supported by CME.

- Know exactly where to enter and exit your trades with our instructions.

- Watch and learn from our experienced traders during live trading sessions.

- Connect with traders in a group chat to share ideas and tips.

- Get individual sessions with skilled traders to improve your cluster trading strategy.

Fill out the form, and we’ll reach out with all the details. Let’s take your trading to the next level!

Tips for crypto traders using cluster analysis trading:

- Don't ignore the context, always analyze cluster charts in combination with fundamental factors (for example, news or market events).

- Start with simulations and test your strategies on demo accounts.

- Do not overload the chart, choose key metrics to avoid information overload.

- Take into account the trading hours, as the highest volumes on CME are observed during the opening and closing of the US session.

Conclusion

We really recommend to integrate clusters into the trading strategy. They will help you to see how buyers and sellers are interacting at any given moment and you will see the market situation better. By analyzing cluster data, you can also spot critical price levels where buying or selling pressure is building. Moreover, clusters provide you with a better understanding of where the market may move next. If you integrate clusters into your trading strategy, you will get a unique advantage in understanding market behavior.