News-Based Trading: How News Acts as the Best Indicator in the Cryptocurrency Market

By Yaroslav Krasko Updated February 29, 2024

BikoTrading Academy

Many beginners, when they first start trading in the cryptocurrency market, pay intense attention to the news, trying to guess future trends and, of course, get rich on it. But here's the paradox: trading on the news, unfortunately, often leads to significant financial losses. But why?

KEY ISSUES:

News as a Means of Manipulation

At first glance, news seems like the perfect indicator to determine future market behavior. But there's a catch. Big players - those with significant capital - use news as a tool to manipulate the market. They create liquidity for their buying or selling actions, capitalizing on the emotional reaction of retail traders to important news.

For instance, if negative news breaks, retail traders, in fear, will sell their cryptocurrency, trying to save their money. At this point, big players buy this cryptocurrency at a discounted price. After this, the price sharply "reverses" and starts to grow, leaving the sellers puzzled about what's happening.

A similar situation happens when positive news is published. It's important to understand that the primary factor influencing the price movement in the cryptocurrency market is not the news itself, but the players' reaction to it.

Examples of News Manipulation

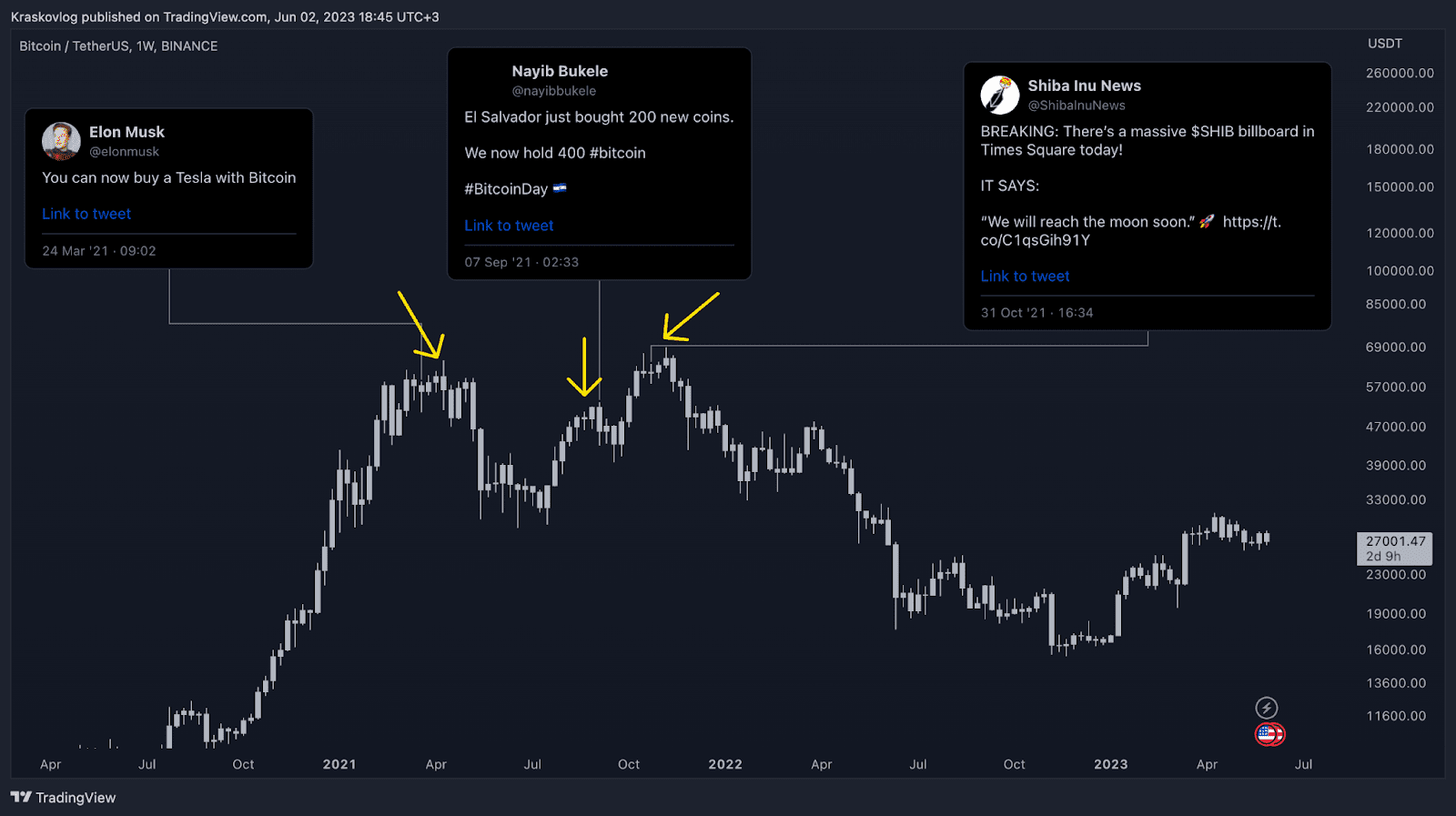

1. Elon Musk and Bitcoin: Elon Musk announced that Tesla would start accepting Bitcoin as payment. On the graph, it's clear that this happened at the market's peak. However, not long after this, the price sharply dropped by 50%.

2. Salvador and Bitcoin: When Salvador announced the purchase of Bitcoin for its reserves, the market took it as very positive news. Despite this, the price of Bitcoin notably decreased.

3. Meme Cryptocurrency at Times Square: After the meme cryptocurrency Shiba Inu appeared at Times Square, its price also declined. When the news went viral in online communities, there was euphoria and greed in the cryptocurrency market. By looking at the graph, we can evaluate what happened next. Bitcoin fell by 70%. Altcoins fell by 90%.

Here are examples of when market panic due to bad news results in a recovery and a strong rise in prices.

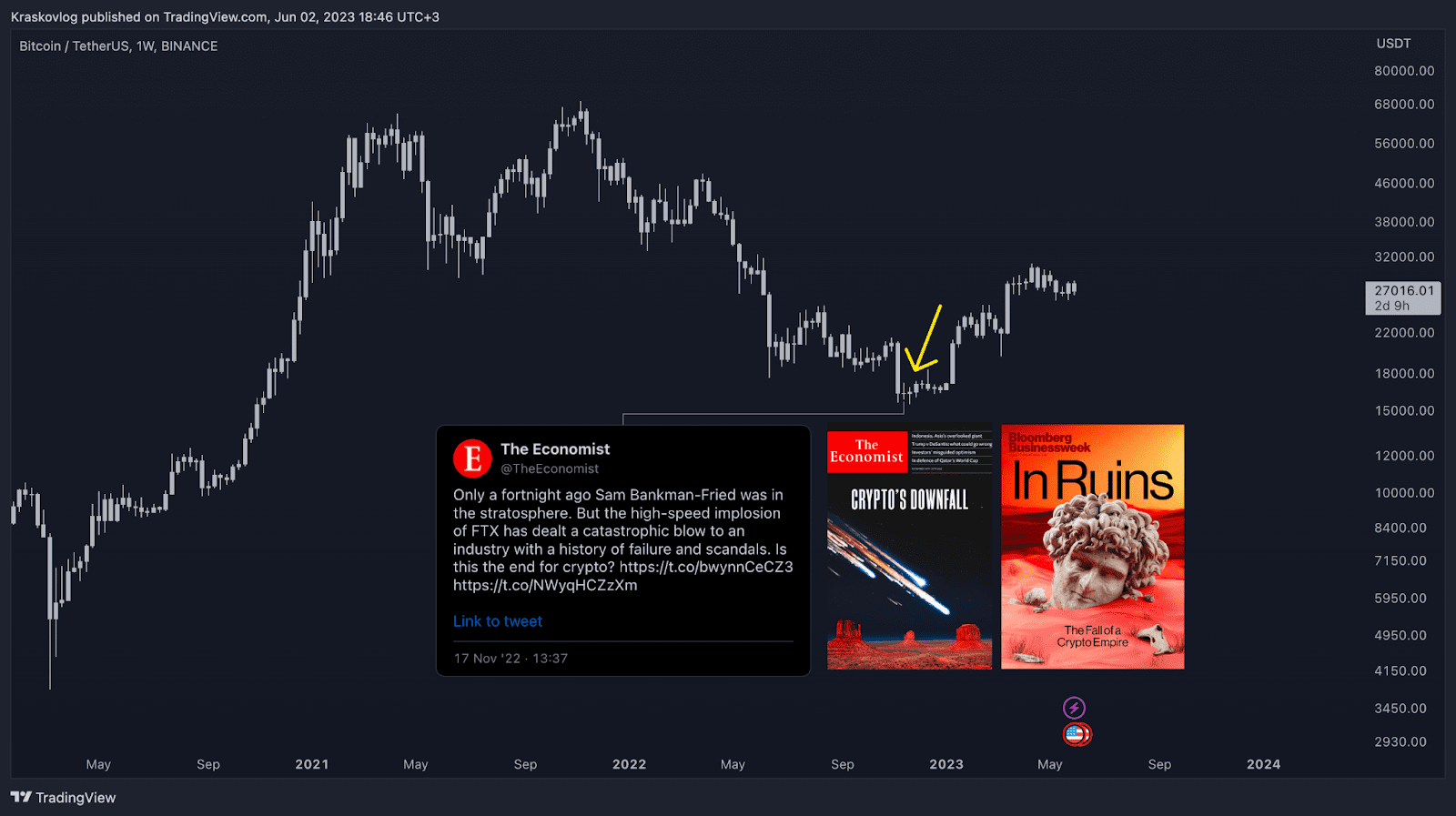

1. The crash of the cryptocurrency exchange FTX: When this event happened, cryptocurrencies suffered significant losses, and the price of Bitcoin rapidly dropped to $16,000. This news sparked panic among traders, and many of them sold off their assets in hopes of salvuing their investments. This created an ideal situation for "big players" in the market to buy cryptocurrency at low prices. After this, the price of Bitcoin started to rise, which bewildered those who sold in panic times.

2. Bad news in The Economist and Bloomberg: After the above-mentioned crash, these authoritative publications released articles with screaming headlines about the "end of cryptocurrencies". These news led to further panic sales in the market, but, as in the previous case, the price eventually began to rise. After which the market showed a rapid price increase by 100%.

These examples show how news can be used for manipulations in the cryptocurrency market. Despite the fear and joy that such news cause, it's important not to give in to emotions and understand that big players can use such situations to their advantage. It's crucial to have a clear trading strategy and a balanced risk management system to protect your investments during such periods.

But don't lose heart, a reliable indicator does exist and we are giving it to you for free

It's clear that relying solely on news in cryptocurrency trading isn't advisable. The main thing is to have a clear trading strategy, a risk management system, and reliable tools.

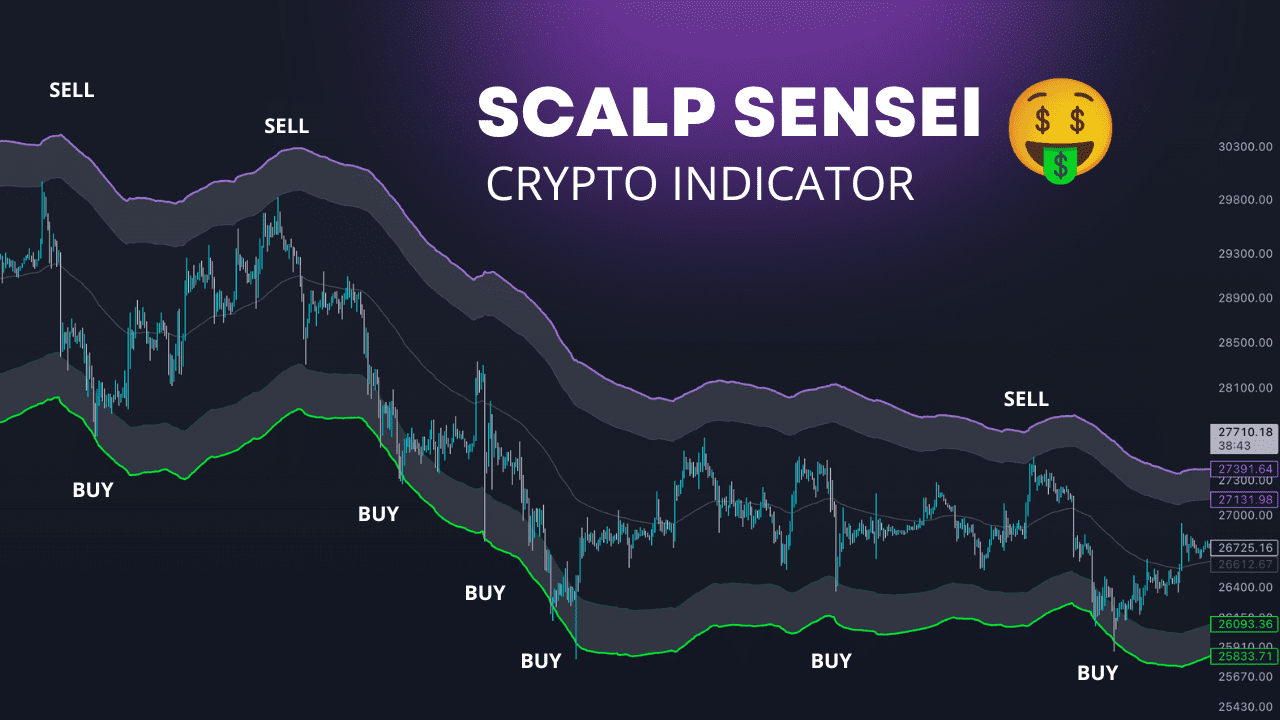

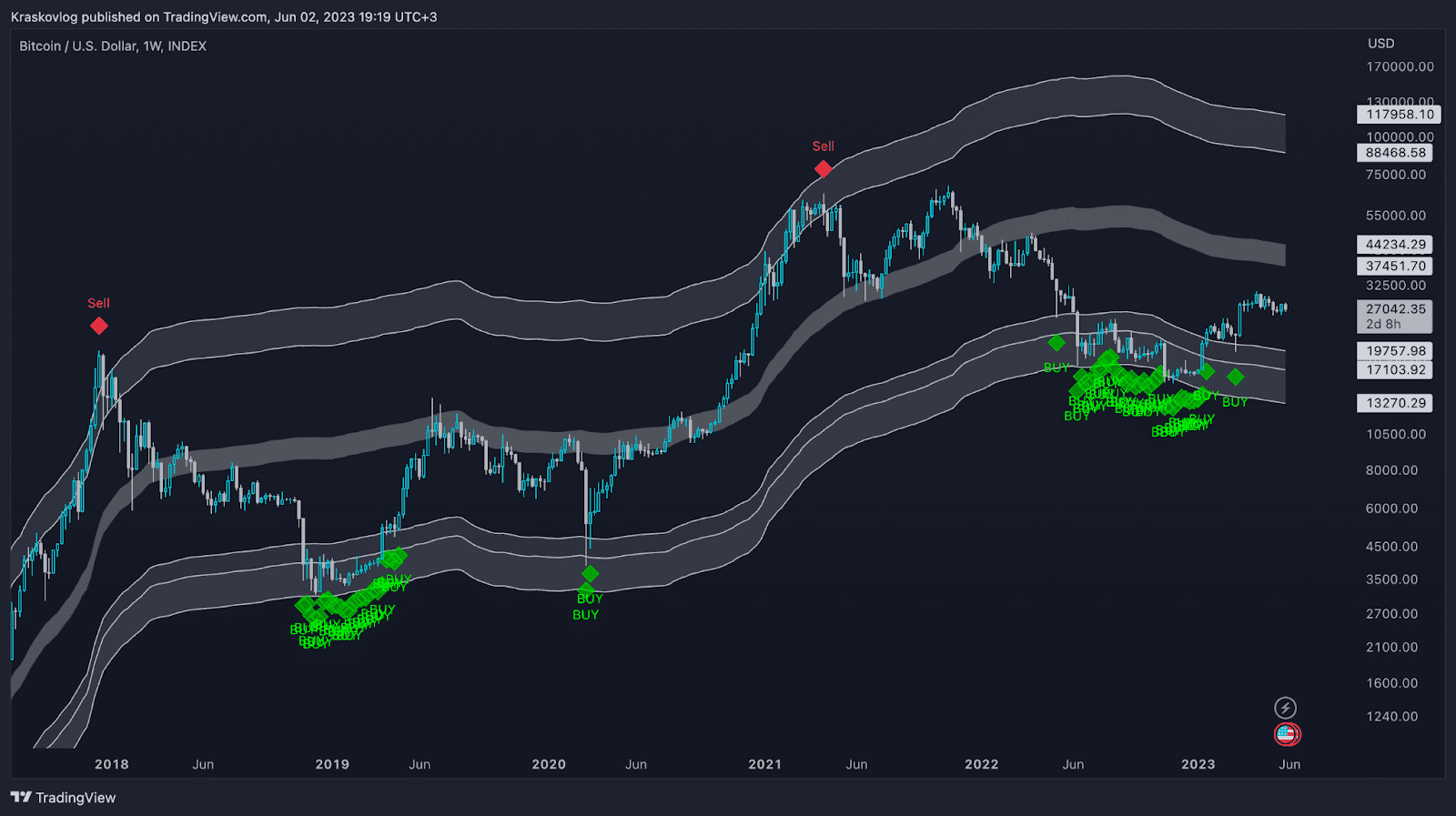

We recommend you the Free version of the Greenwich indicator.

This indicator helps identify places where the cryptocurrency is undervalued and worth investing in, as well as places where it is overvalued and it's time to take profit.

Fill out the form to get this indicator for free.