Why news is fake? Making sense of news headlines

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

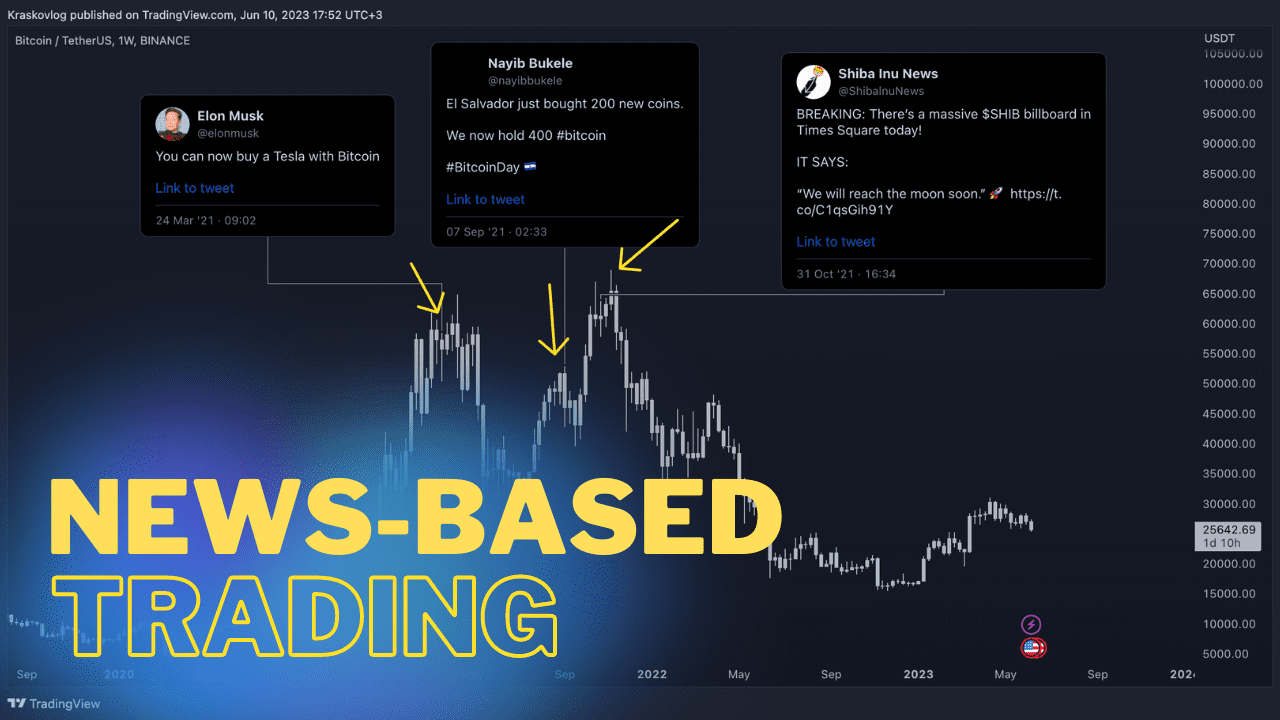

Cryptocurrency trading is a thrilling and highly volatile activity that often leaves traders glued to their screens, eager to make the right move at the right time. News is a double-edged sword in the world of crypto trading, capable of causing great excitement and despair. However, before you make your next trading decision based on a news headline, it's essential to understand that news alone doesn't dictate the market. In this article, we'll talk about why prices move and how to discern the genuine impact of news in the cryptocurrency trading world.

KEY ISSUES:

Supply and demand drive prices

First and foremost, it's crucial to understand that the fundamental driver behind cryptocurrency price movements is supply and demand. Prices rise when there's increased buying activity and fall when selling intensifies. News, in and of itself, does not possess the power to buy or sell assets. For example, a news article claiming someone will sell 20,000 Ethereum due to negative news about the Ethereum Foundation cannot cause such a sale, that's impossible because they don't have those coins. However, such crypto news predictions can impact specific groups of people, such as those in banks and institutional environments, as well as retail traders like you and us.

Distinguishing meaningful news

The most critical question to ask is which news is genuinely meaningful and impactful in the crypto market. There are two primary types of news that can have a notable influence: super-positive news and super-negative news. Medium-level news typically has a less significant impact.

During a bull market, super-positive news can be a trap. Consider the case of El Salvador's purchase of cryptocurrencies, particularly Bitcoin, during the 2021 bull run. This news triggered a buying frenzy among retail traders, but it was actually a sign to sell. After El Salvador's purchase, the price of Bitcoin dropped by 30% and later plummeted an additional 60% to 70%. This demonstrates that following super-positive news during a price surge can be counterproductive.

The meme coin trap

Meme coins have become a trend in the cryptocurrency space. When a particular coin becomes the talk of the town, it often signals the need for caution. Take, for example, Shiba Inu, a coin that experienced significant hype but eventually saw a significant drop in value. The reason behind this phenomenon lies in liquidity – for traders to profit, they need to sell their coins to others. When everyone is buying, it might be a sign that an exit point is approaching, and super-positive news can serve as a warning.

Influencers and their pitfalls

Crypto influencers can be both a blessing and a curse. During a bull market, it's clear which assets will experience significant gains, and influencers often promote these assets. However, such crypto news and predictions can create traps. Following an influencer's advice without fully understanding the market can lead to losses, as demonstrated by an individual's all-in call on Cardano causing a drop in its value.

Learn more about fake news and how to avoid it in our video

Market maker tactics

Market makers often exploit positive news to buy coins at lower prices, which can intimidate retail traders into selling. If a project you hold coins in suddenly gains extensive positive media coverage, it may be a signal to consider selling or even explore short positions to capitalize on market-maker tactics.

Contrarian opportunities

On the other side, when bad news circulates following a significant price drop, it can present an opportune time to buy. For instance, negative reports in mainstream media claiming the end of crypto often precede an unexpected rise in prices. When bad news fails to trigger further price declines, it might be a signal to consider buying.

By the way, we use the Bybit exchange for trading. Join the Bybit exchange through our referral program and get exclusive bonuses and instruments from the Bikotrading team. By signing up with us, you'll gain access to special tools that will help you boost your trading experience on the Bybit platform.

Another type of news to keep an eye on is crypto regulation news. When governments talk about making rules for cryptocurrencies, it can have a big impact on the market. Sometimes this news can make prices go up, and sometimes it can make prices go down. It's essential to understand how regulation news affects your investments.

Conclusion

To navigate the market of crypto, fake news must be detected and filtered wisely, taking into account the context, timing, and impact on different market participants. Avoid the hype, and always maintain a broad perspective. Remember that supply and demand are the true drivers of prices, and news should be seen as a complementary factor, not the sole determinant of your trading decisions. If you found this information helpful, join our Order Flow course and learn how to analyze the market properly and open accurate trades with much bigger potential.