Order Flow. How to use market data to predict price movements

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

Order Flow trading is a popular strategy used by professional traders to analyze the flow of market orders and its impact on the price of an asset. Unlike retail traders who rely heavily on technical indicators, order flow traders focus on observing buy and sell orders in the market. By studying the DOM, which displays limit orders at different price levels, traders can gain insight into the dynamics of the cryptocurrency market and make informed trading decisions. In this article, let's take a closer look at what order flow trading is.

KEY ISSUES:

What is Order Flow and how does it work?

Order Flow is the number of limit buy and sell orders pending execution at different price levels. The analysis of order flow allows traders to identify imbalances in supply and demand in the cryptocurrency market. Why do traders choose order flow trading? By tracking the flow of orders, traders can understand how other participants trade and how their actions affect the price. For example, a large volume of sell orders at lower prices with no corresponding buy orders may indicate an imminent price drop. Recognizing such imbalances allows order flow traders to predict short-term price movements and take advantage of trading opportunities.

Features of the Order Flow trading strategy

The Order Flow trading strategy is based on observing the flow of trading orders and their impact on the price of an asset. It complements other forms of market analysis such as technical analysis, sentiment analysis, and fundamental analysis. Order flow traders try to predict future price movements by analyzing the orders coming into the market. This strategy is especially useful for short-term traders such as scalpers and day traders.

The best Order Flow indicators

When studying which strategy to choose for order flow trading, using the right indicators can greatly improve your analysis and decision-making process. These indicators provide valuable information about market dynamics, helping you identify trading opportunities and make more informed trades.

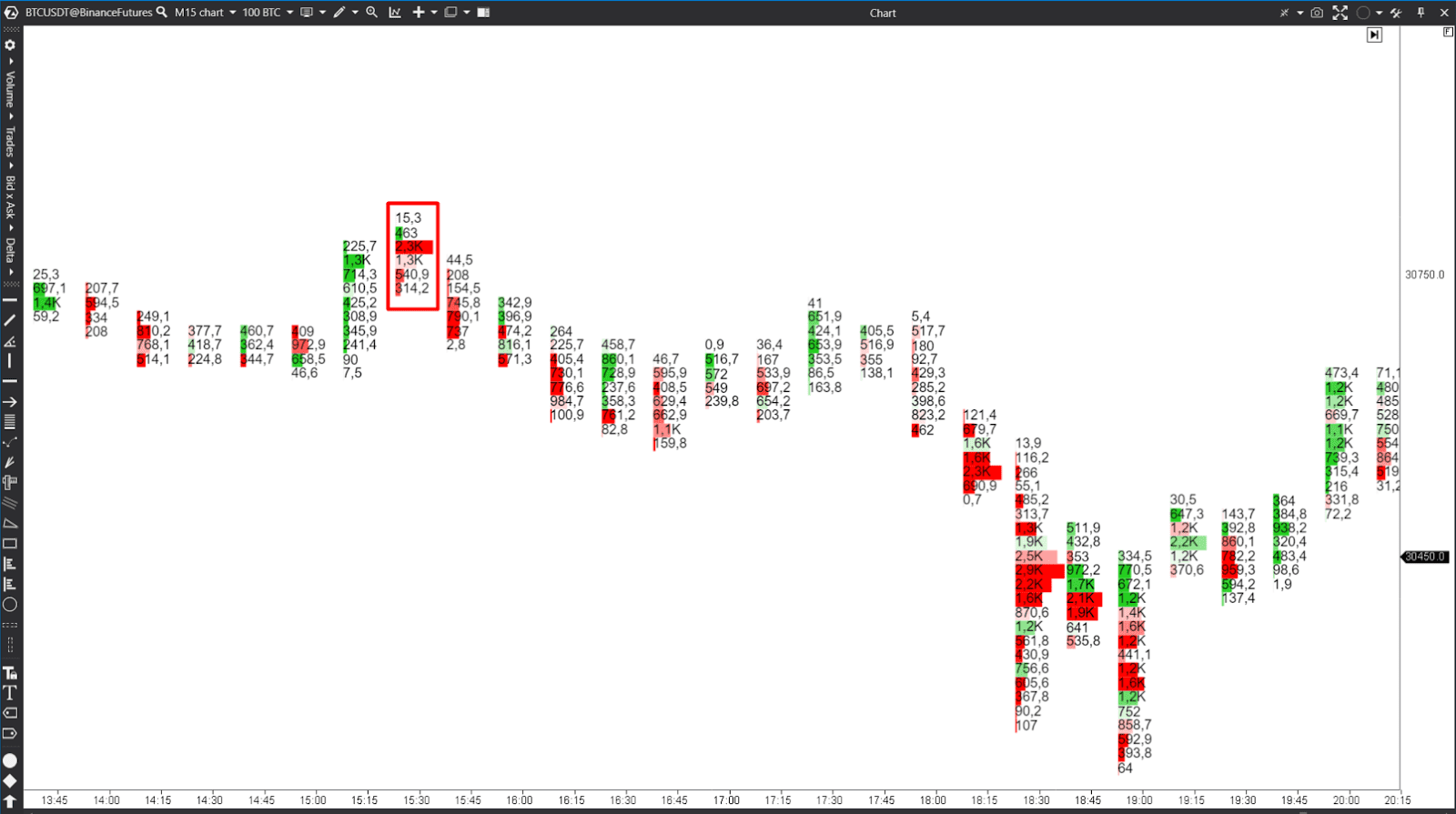

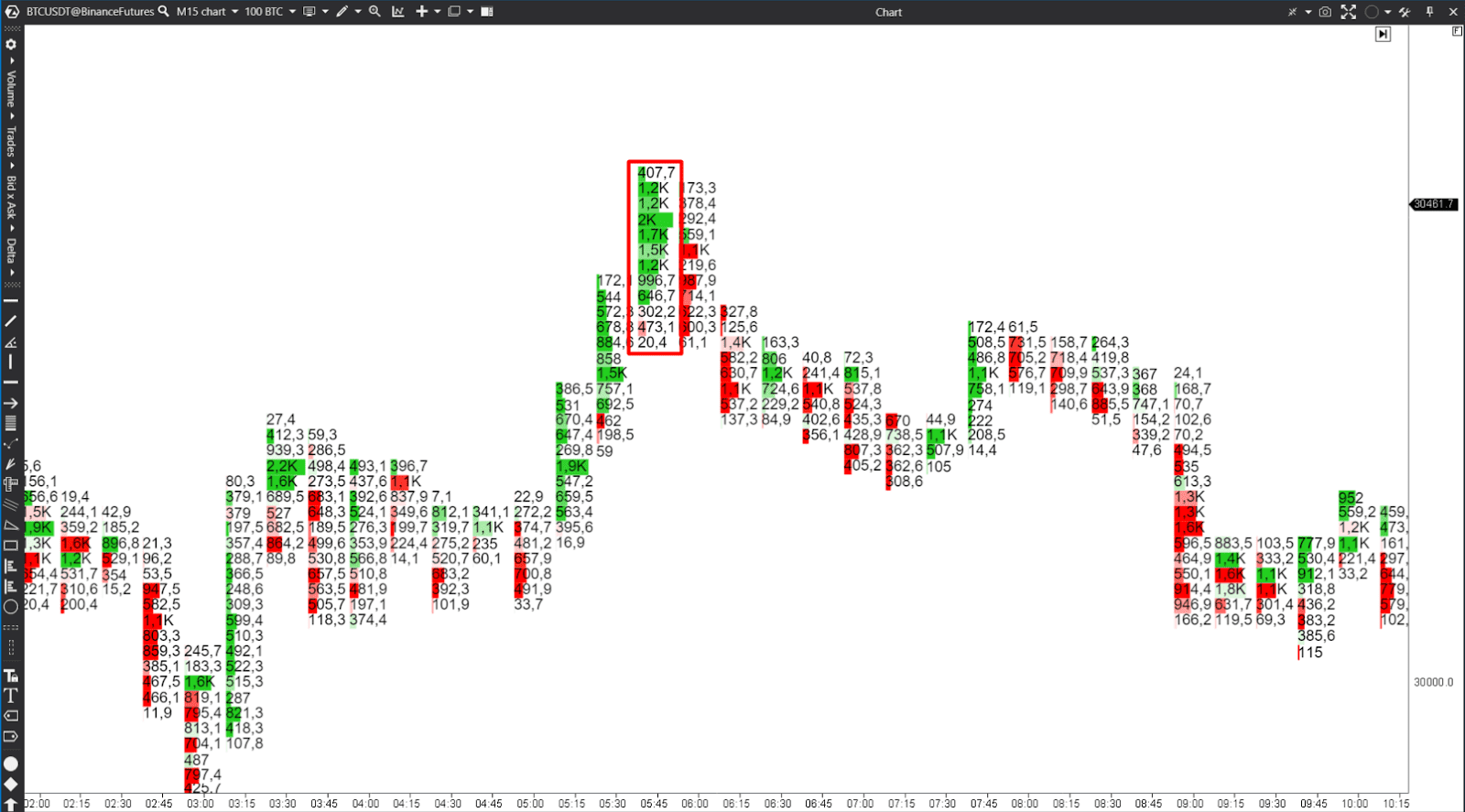

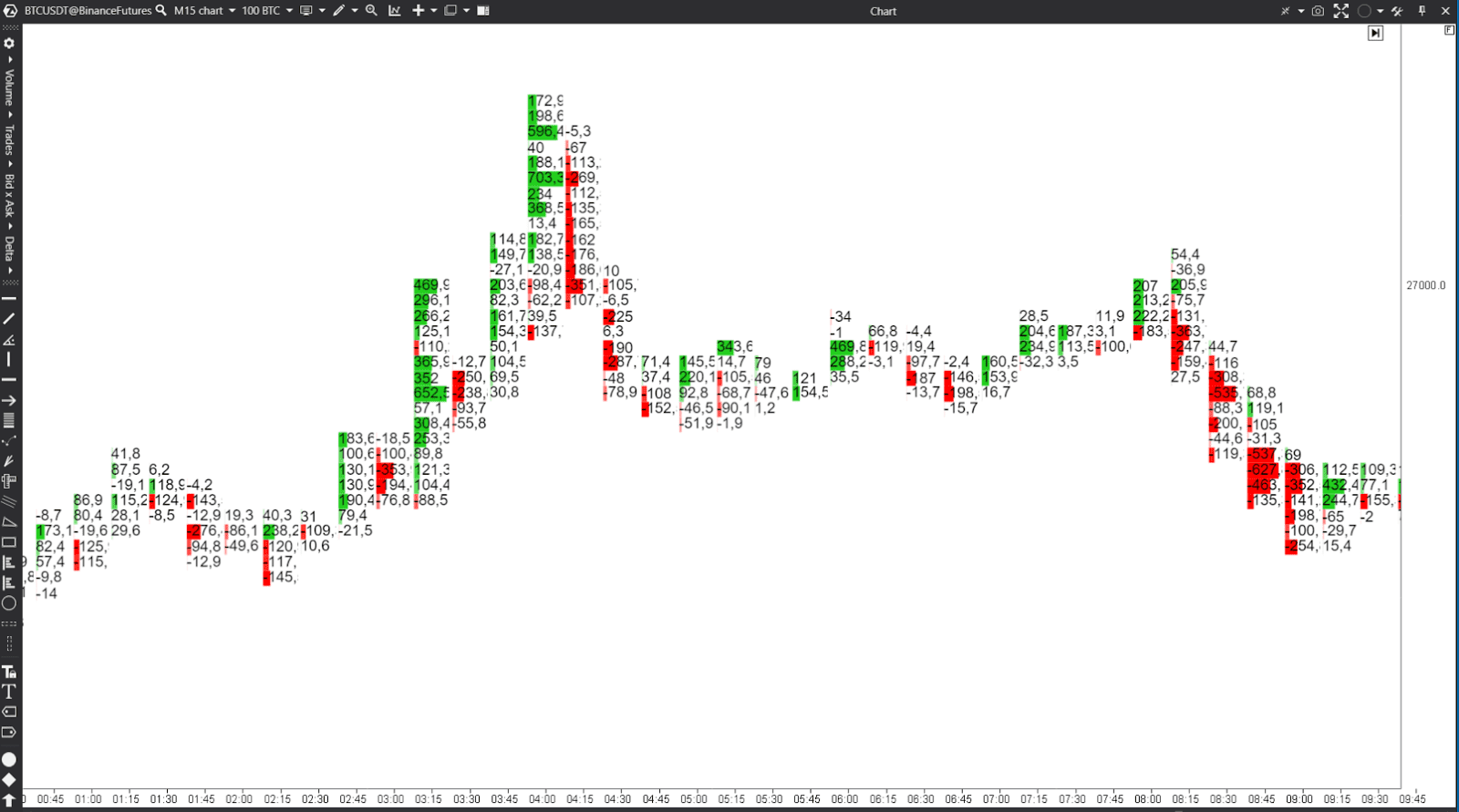

Footprint

Footprint charts offer a detailed visualization of the market orders traded on the bid and ask side for each price level. This is one of the factors to consider when trading in order flow. They provide important information about the intensity of buying and selling at different prices. By analyzing the bid/ask footprint charts, you can determine which side of the market is more aggressive and get an idea of the general sentiment.

In addition, Volume Delta on footprint charts calculates the difference between buying and selling power based on the volume of trades at bid and ask prices.

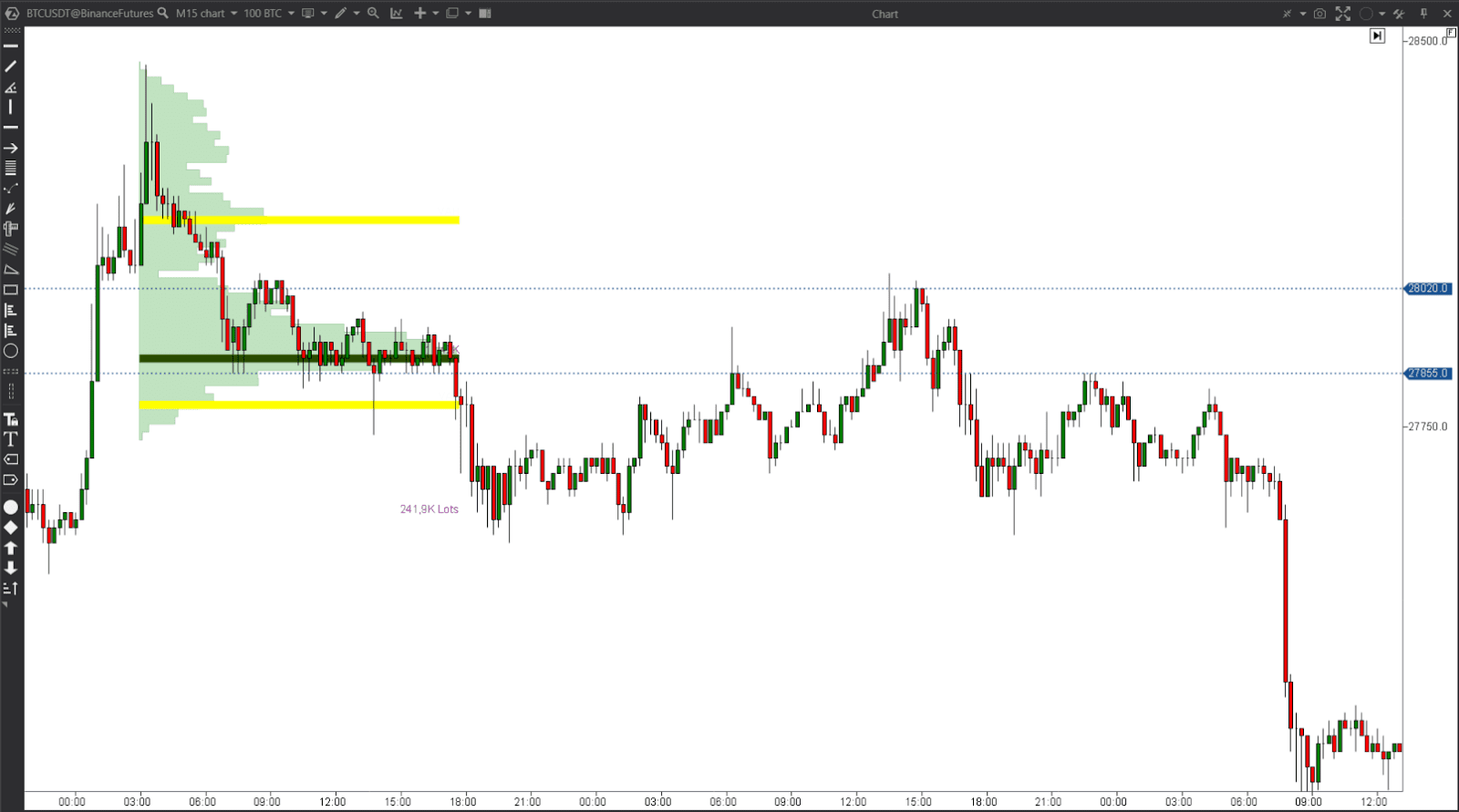

Volume Profile

The volume profile indicator displays the distribution of trading volume at different price levels within a certain time frame. By analyzing the volume profile, you can identify areas of high and low liquidity, significant support and resistance levels, as well as areas where the price is likely to experience a stronger reaction. The volume profile helps traders understand which levels market participants are most interested in and where potential imbalances may occur. This information helps to improve the overall accuracy of trading decisions.

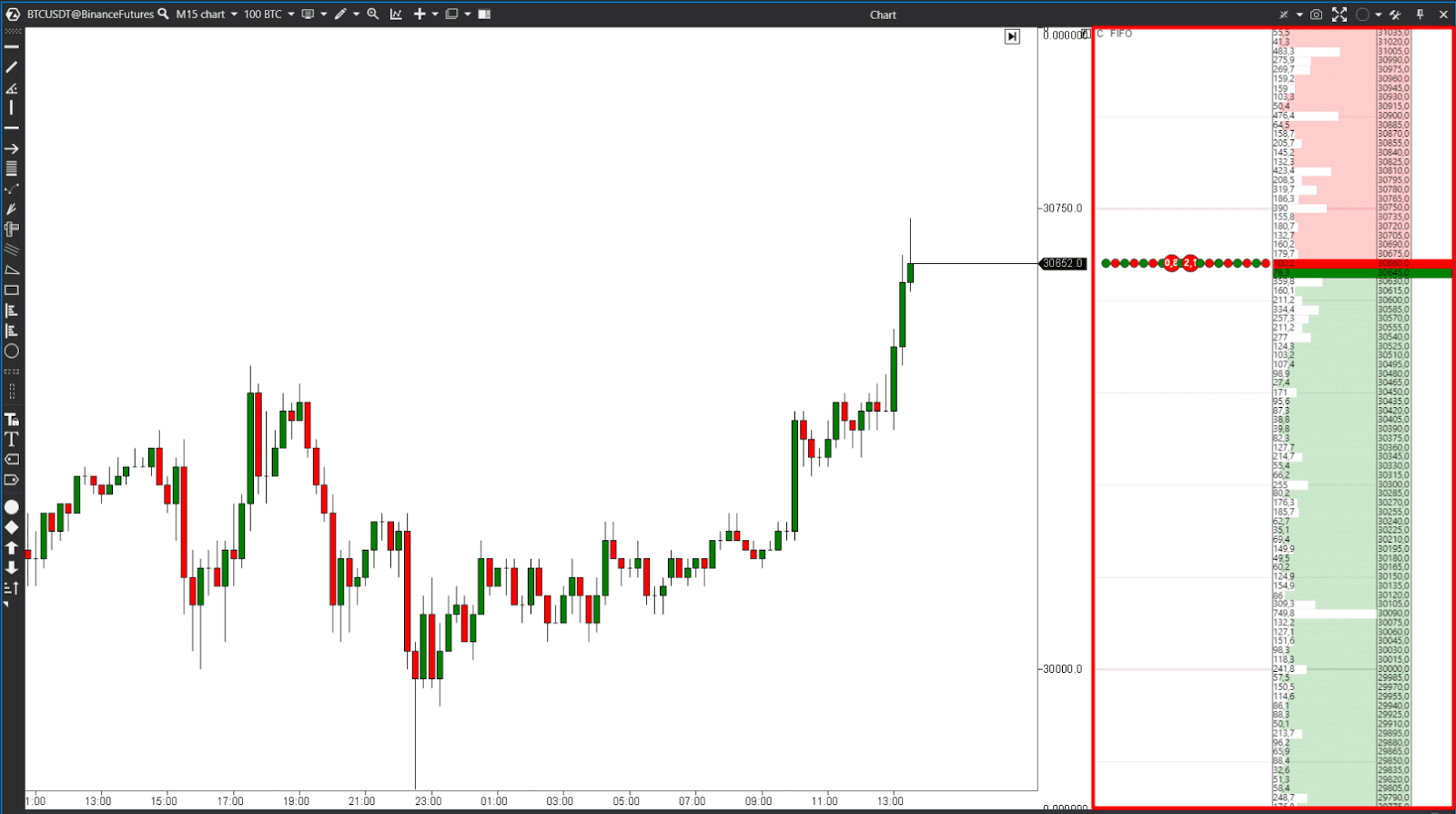

DOM

Often referred to as DOM or Level 2 data, the Depth of Market shows the limit orders to buy and sell in the market. It provides a detailed overview of the order book and allows you to assess liquidity at different price levels. By analyzing the DOM, you can identify areas of strong support or resistance, assess the aggressiveness of buyers and sellers, and the overall market sentiment.

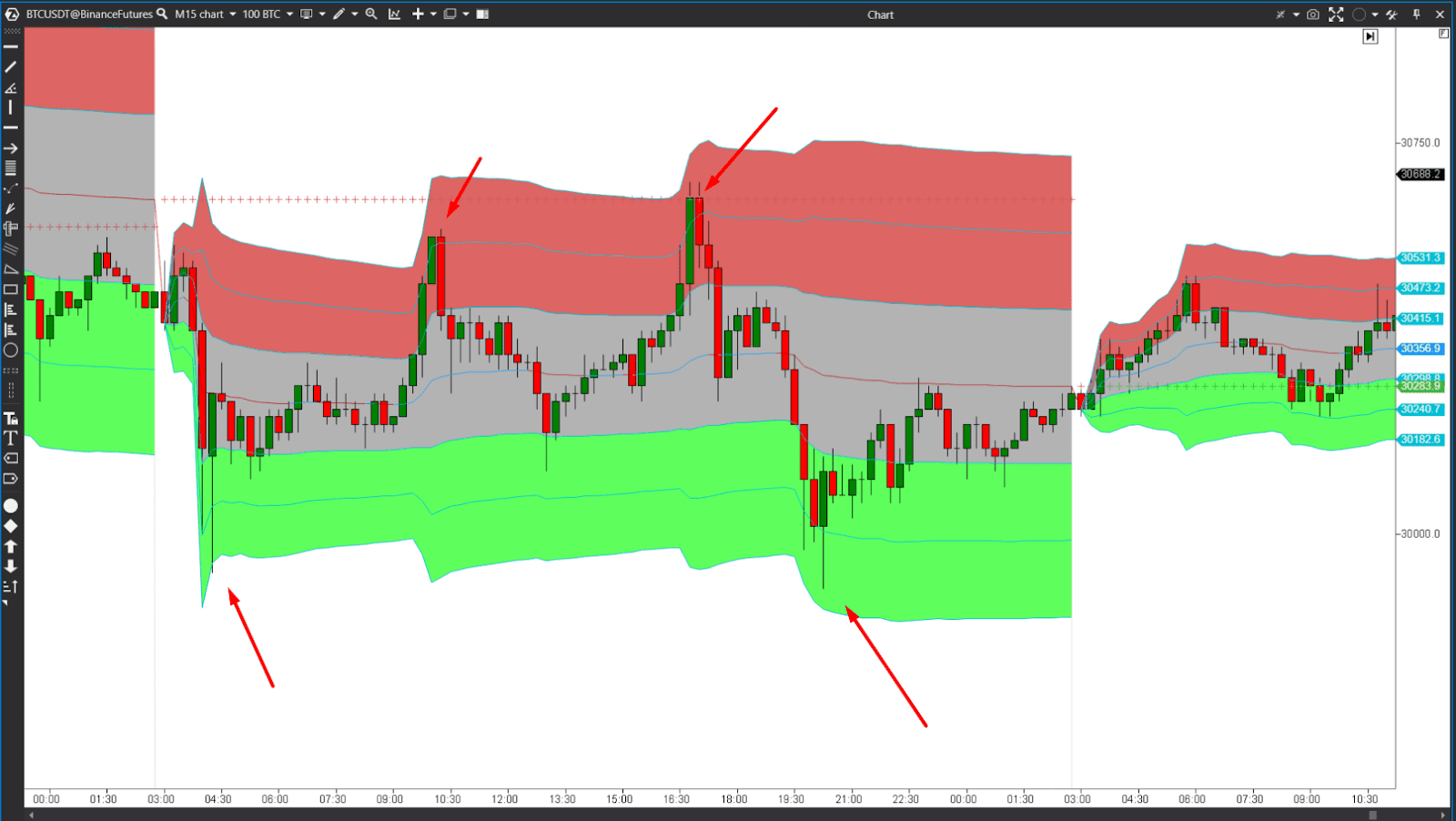

VWAP indicator

The Volume Weighted Average Price (VWAP) indicator calculates the average price of an asset based on both volume and price. Institutional traders often use the VWAP to determine optimal entry and exit points, as it provides an indication of liquidity and average price levels. By comparing the current price to the VWAP, crypto traders can determine whether the price is above or below the average. This indicator helps to coordinate your trades with large funds and increases the chances of trading in the same direction as institutional players.

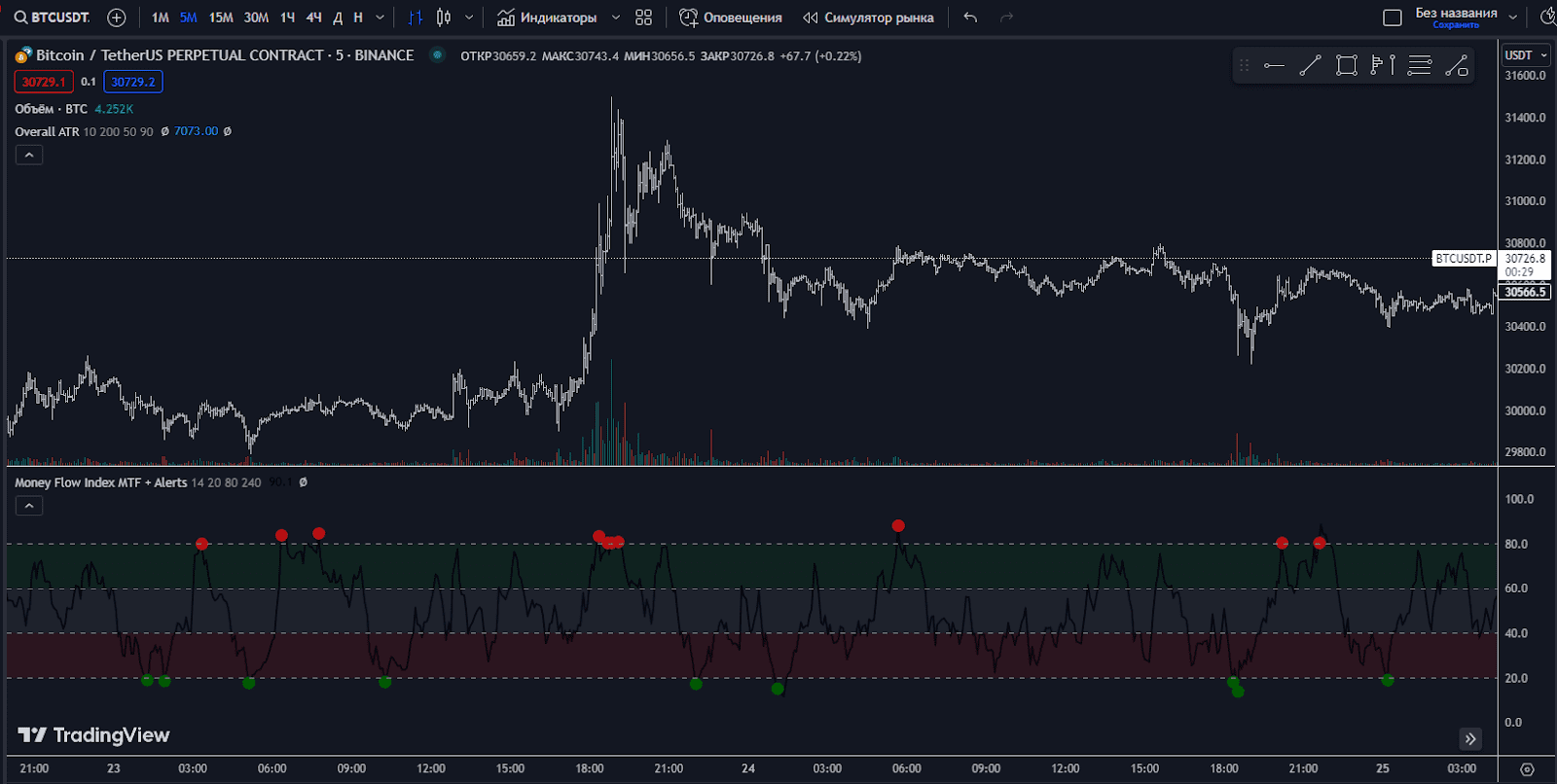

Money Flow Index

The Cash Flow Index combines price and volume to measure buying and selling pressure in the market. It is similar to the Relative Strength Index (RSI), but includes volume in its calculations. The MFI helps to identify overbought and oversold conditions, as well as discrepancies between price and trend. By analyzing the MFI together with other order flow indicators, you can get a more complete picture of market sentiment and potential trend reversals.

Why do crypto traders choose order flow trading?

Trading order flows is crucial as it provides insight into the direction of price movement. By joining the dominant players in the market, traders increase their chances of profitable trading. Mastering order flow trading simplifies the trading process and leads to stable profitability without relying on complex instruments.

- Order flow analysis helps to understand market dynamics by observing buy and sell orders, identifying imbalances in supply and demand, and assessing market sentiment.

- Traders detect early trading signals, such as changes in liquidity, which can precede significant price fluctuations.

- With this strategy, you can determine the exact entry and exit points by assessing the strength of support and resistance zones based on the aggressiveness of buyers and sellers.

- By trading order flow, traders identify low liquidity or potential price volatility, which allows them to manage risks more effectively by determining position size and setting appropriate stop-loss levels.

- Order flow analysis provides real-time market transparency, allowing traders to keep abreast of market activity.

Conclusion

Order Flow trading is a simple and effective approach to trading the markets. To get a better understanding of how order flow works, we recommend watching a detailed video on this strategy. By analyzing the flow of buy and sell orders, traders can gain a deeper understanding of market dynamics, identify trading opportunities, and make more informed trading decisions in the highly volatile and rapidly evolving cryptocurrency markets.