Smart Money or Order Flow: What works better in 2024?

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

The two key strategies that currently dominate the crypto trading industry are Smart Money and Order Flow trading. But which one is really efficient and effective? In this article, we will take a detailed look at both strategies, compare their main advantages and disadvantages, and focus on the reasons for the option that we believe is the more efficient option for crypto traders in 2024.

KEY ISSUES:

What is Smart Money?

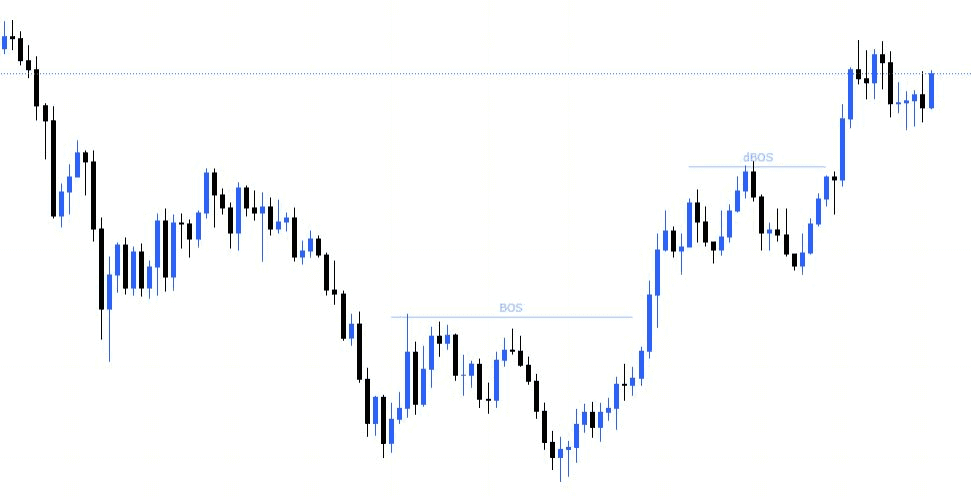

The Smart Money strategy is based on analyzing the movements of large cash flows in the market. Traders using the smart money concept try to predict price movements based on the actions of large market participants such as institutional investors, funds, and major players. This strategy can be effective in conditions when large cash flows really affect market dynamics. It’s not a smart money exchange, it’s more a platform based on the principles of the strategy.

- If you are a Smart Money trader, usually such traders believe that institutional players influence major market movements, meaning that they can identify potential trends long before they become apparent to smaller market participants.

- Smart Money trading can help to avoid overreactions to short-term volatility, as the focus is on larger cash flows that are usually less affected by volatile changes.

- Smart Money is a strategy that can help to pay more attention to fundamentals and news that can influence price movements, as institutional players often react to fundamental factors.

What is Order Flow?

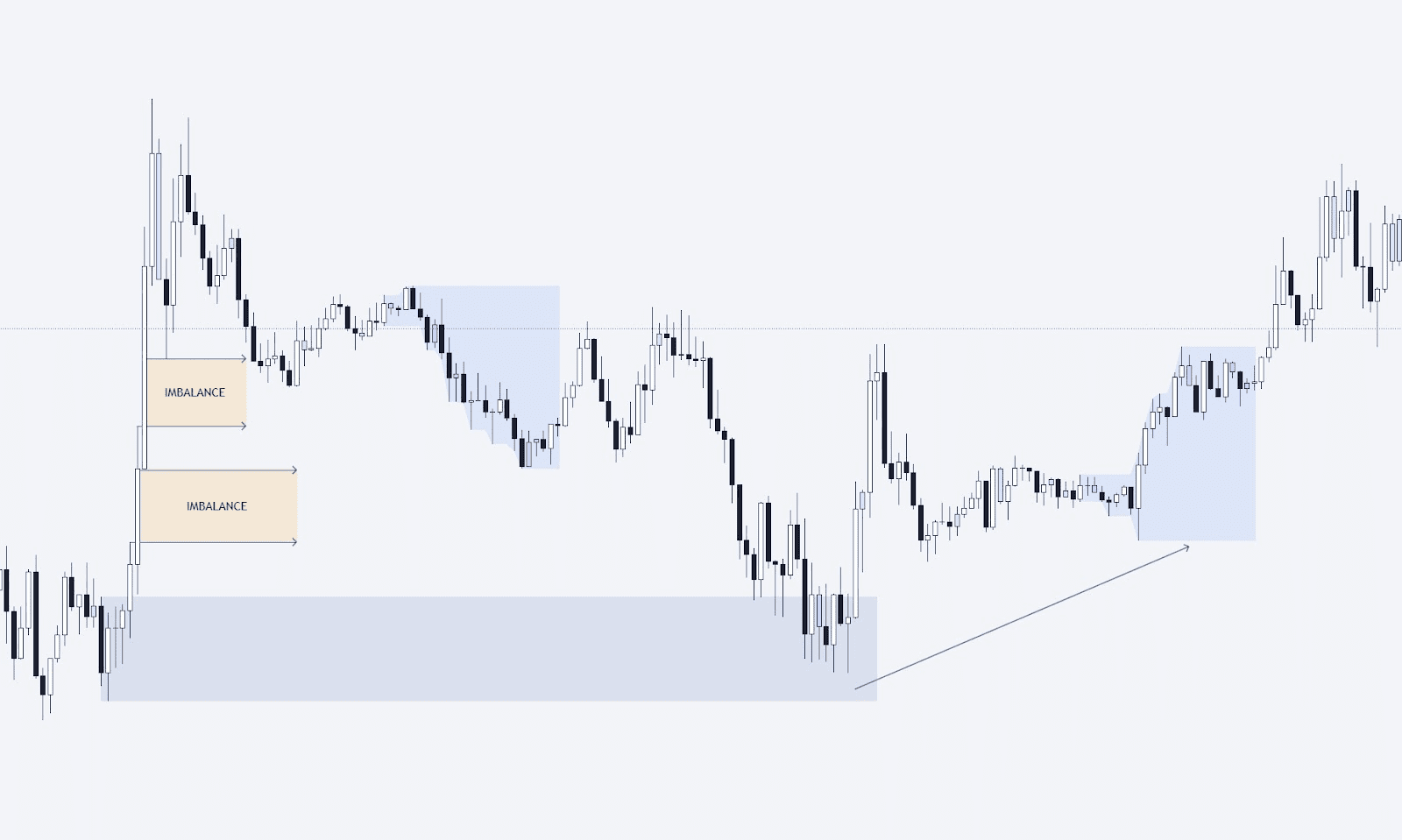

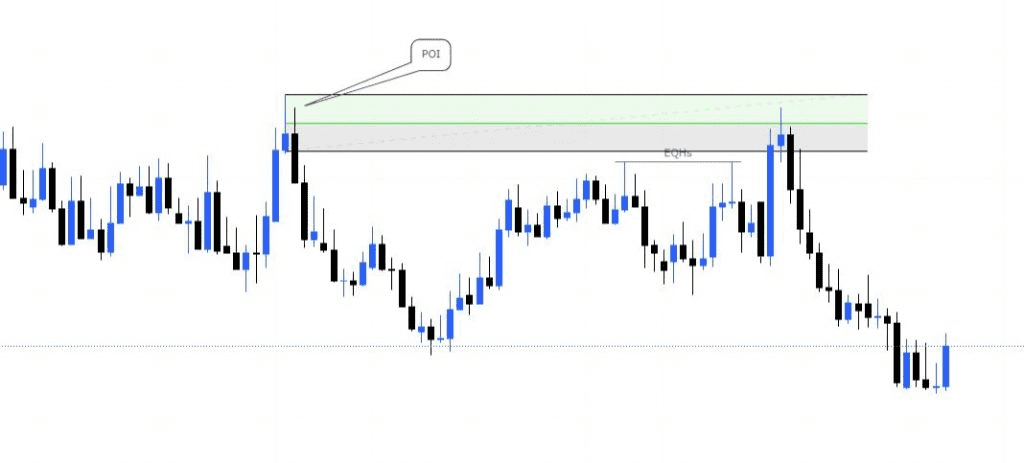

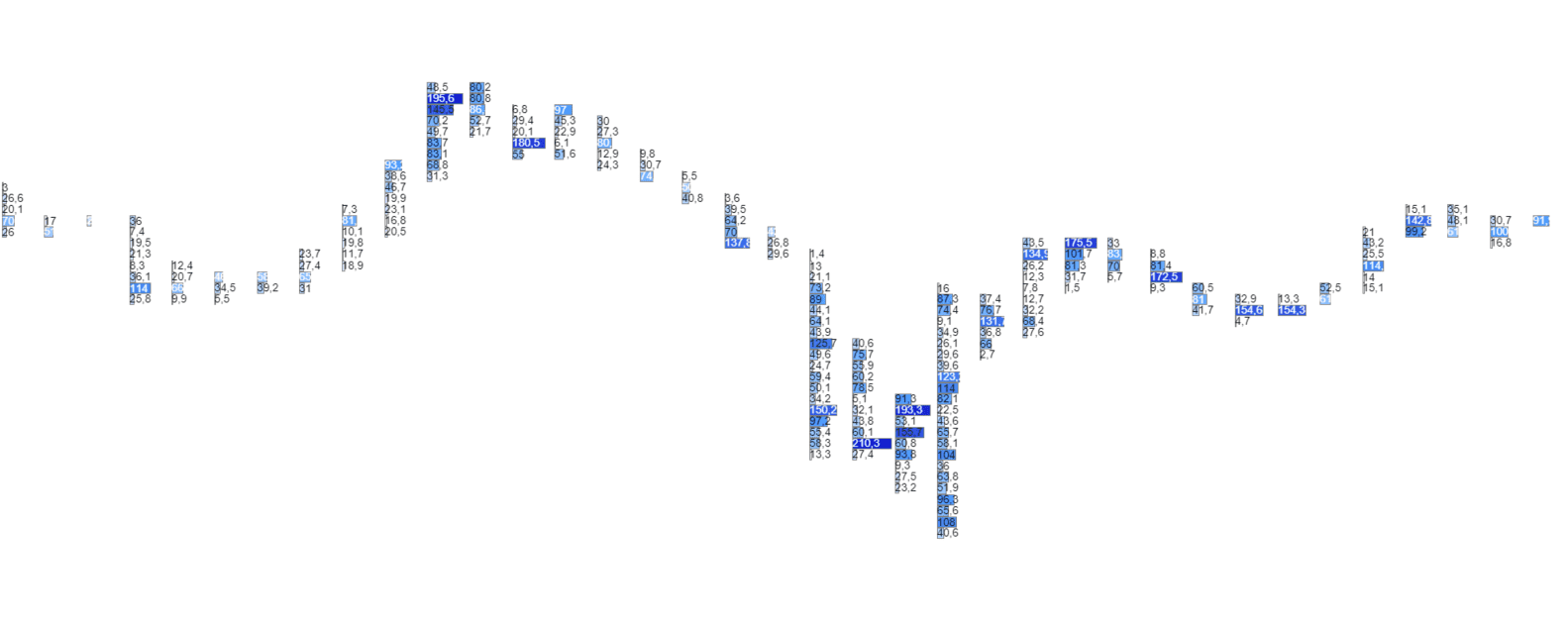

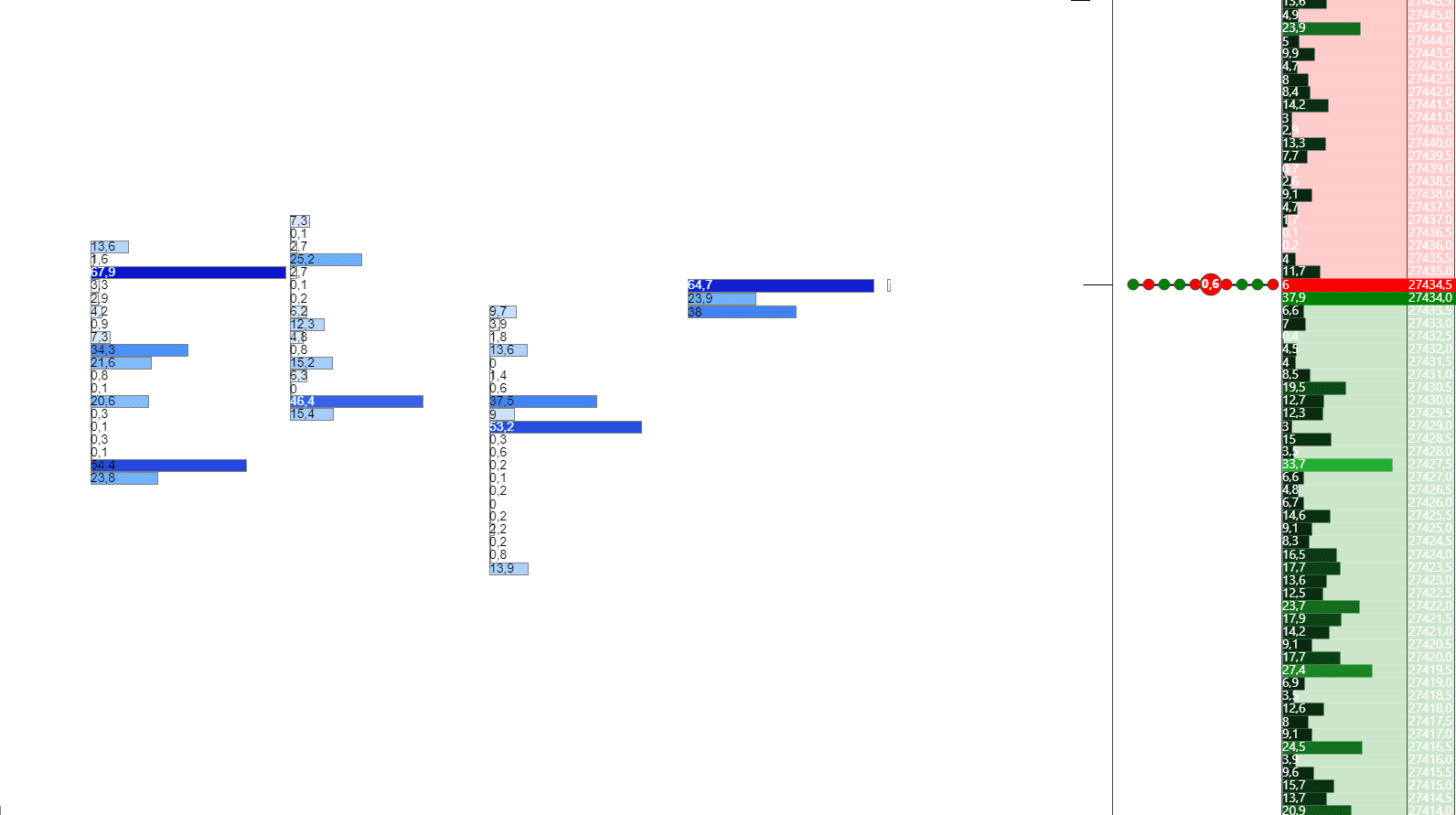

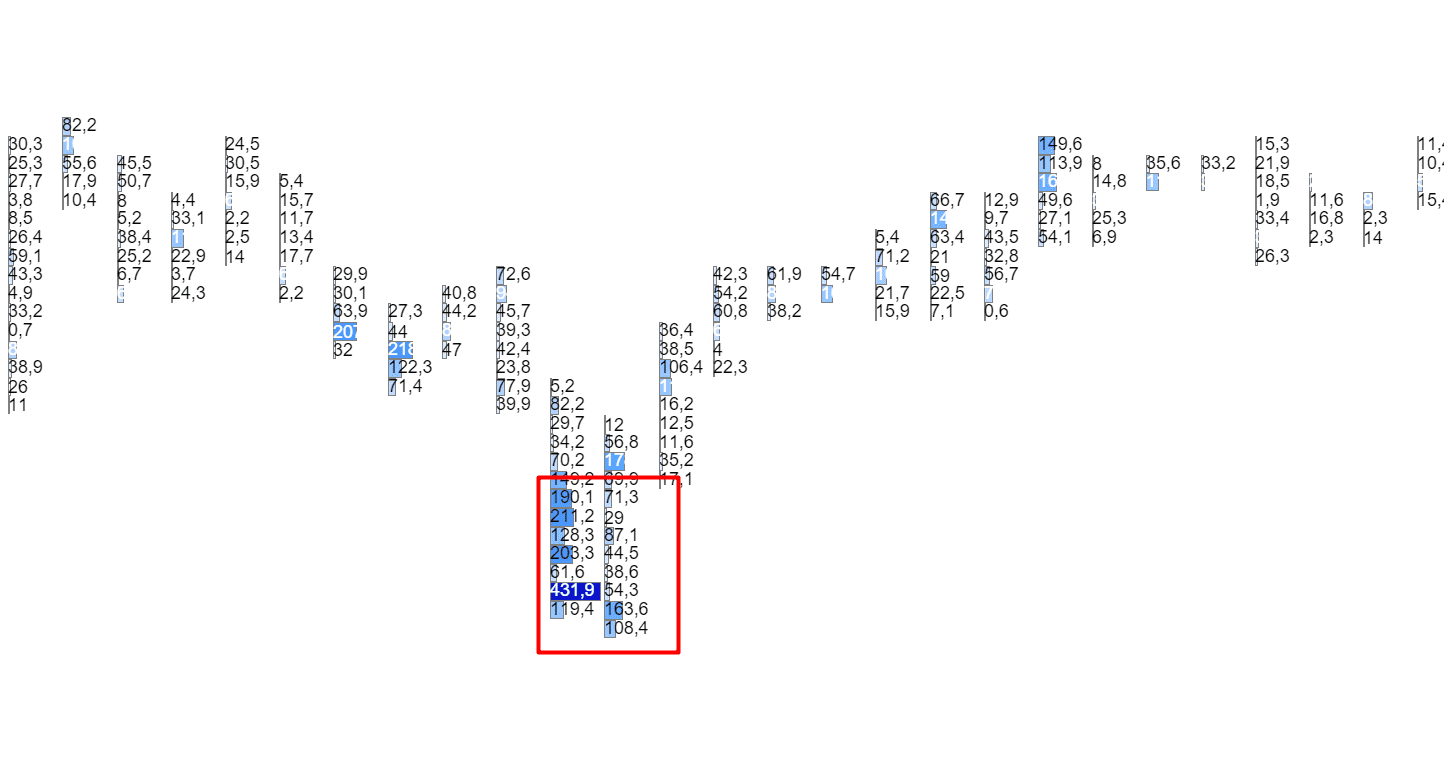

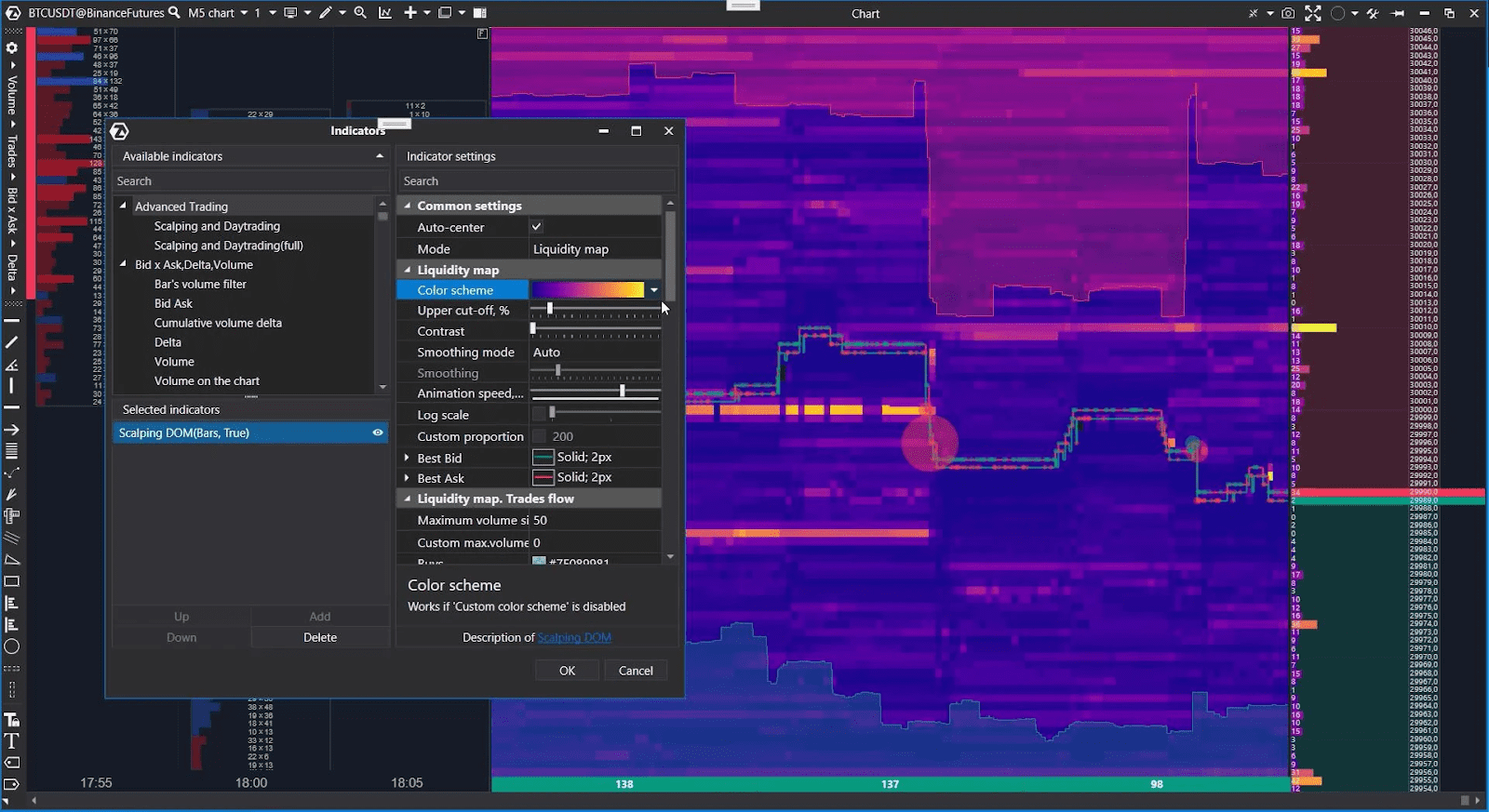

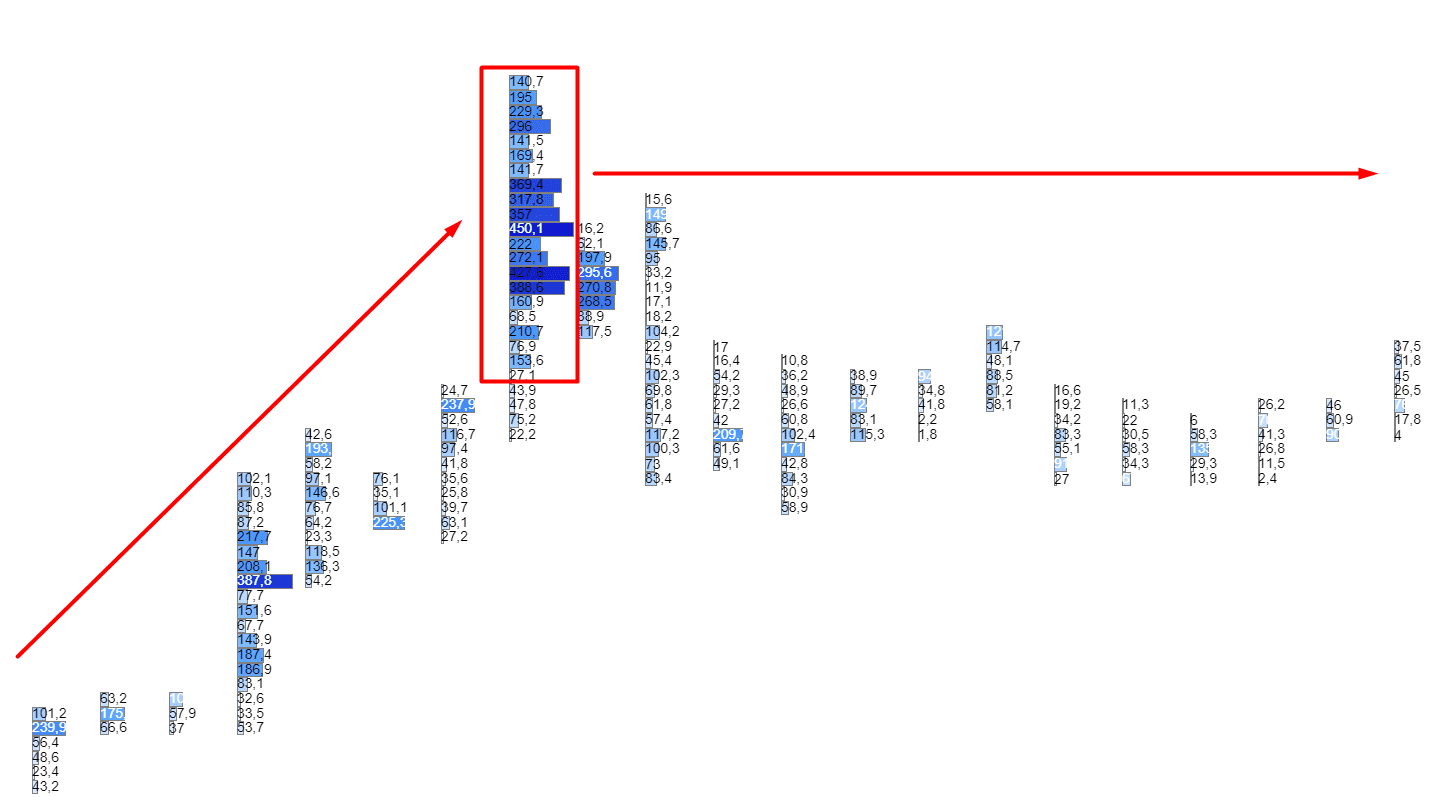

Order Flow trading strategy, on the other hand, focuses on analyzing the movement of orders in the market. Order Flow definition reveals its meaning – it allows traders to track the flow of buy and sell orders to understand the relative strengths of buying and selling pressure. The order flow footprint chart allows traders to dissect and analyze the precise timing, volume, and direction of trades, enabling them to identify significant order imbalances and trends that may otherwise remain hidden.

- An Order Flow trader can track the flow of orders in real time.

- Using special Order Flow software you can reveal the hidden volume of orders that is not always displayed on the market surface. This can be information about large volumes that are not yet indicated as limit orders.

- The availability of order flow indicators allows you to use different strategies and approaches depending on the market situation. This flexibility allows you to quickly change and adapt your strategy.

- Traders often use order flow VWAP to assess the effectiveness of their trading strategies, especially in intraday trading.

- And most importantly, the Order Flow provides a large amount of data on order movement that can be analyzed using various tools and platforms.

Join our Order Flow trading course, developed using real trading cases and effective tools for even better trades! In this course, you will learn the Order Flow strategy step by step with our leading traders. And most importantly, you will trade together with a mentor, analyze your own trades, and improve your strategy. Our experts are always at your side, ready to help with any questions and market situation.

Why does using Smart Money fail to replace Order Flow?

Availability of necessary data for analysis

Smart Money trading strategy has several drawbacks, one of which is the limited access to data on large cash flows and actions of institutional players. Traders may misunderstand the true intentions of the market due to a misperception of the actions of large players, and they are actually trading in the shadow of smart money, not following the real market influencers.

The focus of Smart Money online on large cash flows may lead to situations where the market may be overbought or oversold on a short-term basis, as large players may enter orders of significant volumes. This can cause excessive volatility and instability. Moreover, Smart Money trading ignores other factors that also affect market dynamics, such as technical analysis, geopolitical events, and other non-corporate factors. Order flow swing trading enables traders to gauge market sentiment and anticipate price reversals, helping them make profitable and low-risk trading decisions. Using Order Flow, TradingView analysis gets more precise.

Also, with Smart Money analyzing the actions of large players can be a complex and time-consuming task that requires a trader to analyze data in depth and understand market dynamics.

Learn more about Smart Money and Order Flow in the video:

Information value

The concept of Smart Money indicates interest in a particular asset from large players, but it does not provide details about specific orders or the direction of their movement. Understanding Order Flow provides traders with more accurate and detailed information as it allows them to see the orders themselves and their volumes. The trader can determine where the significant supply or demand is located and how it can affect the price movement.

Reaction to news and detection of manipulations

By analyzing the flow of orders in Order Flow, a trader can see which specific orders appear on the market and what volumes they have. You can find out if there is a strong interest in buying or selling a certain asset after the publication of important news. If large volumes appear in one direction (for example, many sell orders after negative news), this may indicate a possible negative market sentiment. Smart Money, on the other hand, analyzes large cash flows without taking into account specific orders on the market.

If you are using ATAS, order flow trading is definitely a strategy to apply! Traders can identify key order flow patterns, such as significant volume imbalances or aggressive buying/selling, to spot potential entry and exit points. Follow the link to join ATAS and get bonuses from the Bikotrading team! This trading platform offers a unique set of features that beginner and professional traders use, so don’t hesitate, open our free YouTube playlist with all the necessary instructions for ATAS setup, and let’s trade together!

Conclusion

Although both strategies have their advantages and can be effective in certain conditions, we believe that the Order Flow strategy is more practical and safer, particularly in the cryptocurrency market, and provides more accurate and detailed information. This approach is also more flexible in the choice of strategies and instruments and better adjusts to different market circumstances. This strategy allows us to obtain accurate information on how orders are changing in the market and to react quickly to changes.

.png)