The Crypto Profits Race: Trader vs. Investor - Who Wins?

By Yaroslav Krasko

BikoTrading Academy

Most beginners entering the cryptocurrency market lack a clear understanding of trading versus investing, which is more profitable, as well as ways to earn on the cryptocurrency market and what style suits them best - trading or investing. If they do have an understanding of these concepts, it is usually accompanied by unrealistic expectations instilled by information channels, which daily publish screenshots of +1000% PNL.

In this article, I'll try to completely unpack this topic using real arguments and research, so that by the time you finish reading it, you'll have no further questions or doubts about where to start and what to choose for yourself.

KEY QUESTIONS:

- General Profit Statistics: Traders VS Investors

- Pros and Cons: Trading VS Investing

- Who makes more money: crypto traders or investors?

- What to choose: Trading or Investing?

General Profit Statistics: Traders VS Investors

The chart below shows a study comparing the profits of traders and investors over the last 20 years. The investors' profitability is marked in blue, while the traders' profitability is in red.

One might wonder: why is there such a large difference in profits? Are traders really not making money? In fact, they do make money, but the statistics from leading brokers and exchanges state that only 5% of traders earn, 5% of traders break even, and 90% lose all their money completely.

This is general statistics, but of course, there are professional traders who have spent 5 or more years of their lives and significant funds to find their own strategies and algorithms that now allow them to generate a stable 100 to 150% profit annually.

Below are the results from the official website of The World Cup Trading Championship. You can see for yourself and assess how much the world's best traders actually earn. These people have spent 5 to 10 years of their lives to achieve these results.

Some may experience cognitive dissonance: is 100 - 150% really the maximum a trader can make? In fact, yes, and these are indeed high profit indicators. Here's why: if you start trading with a balance of $2,000 - $3,000 and each year for 6 years you increase your capital by 150%, you will already have about $1 million in your account.

At the same time, if we go back to the first chart and evaluate the investors' results, an investor who just bought cryptocurrency, stocks, indices, and held onto their investments, made significantly more.

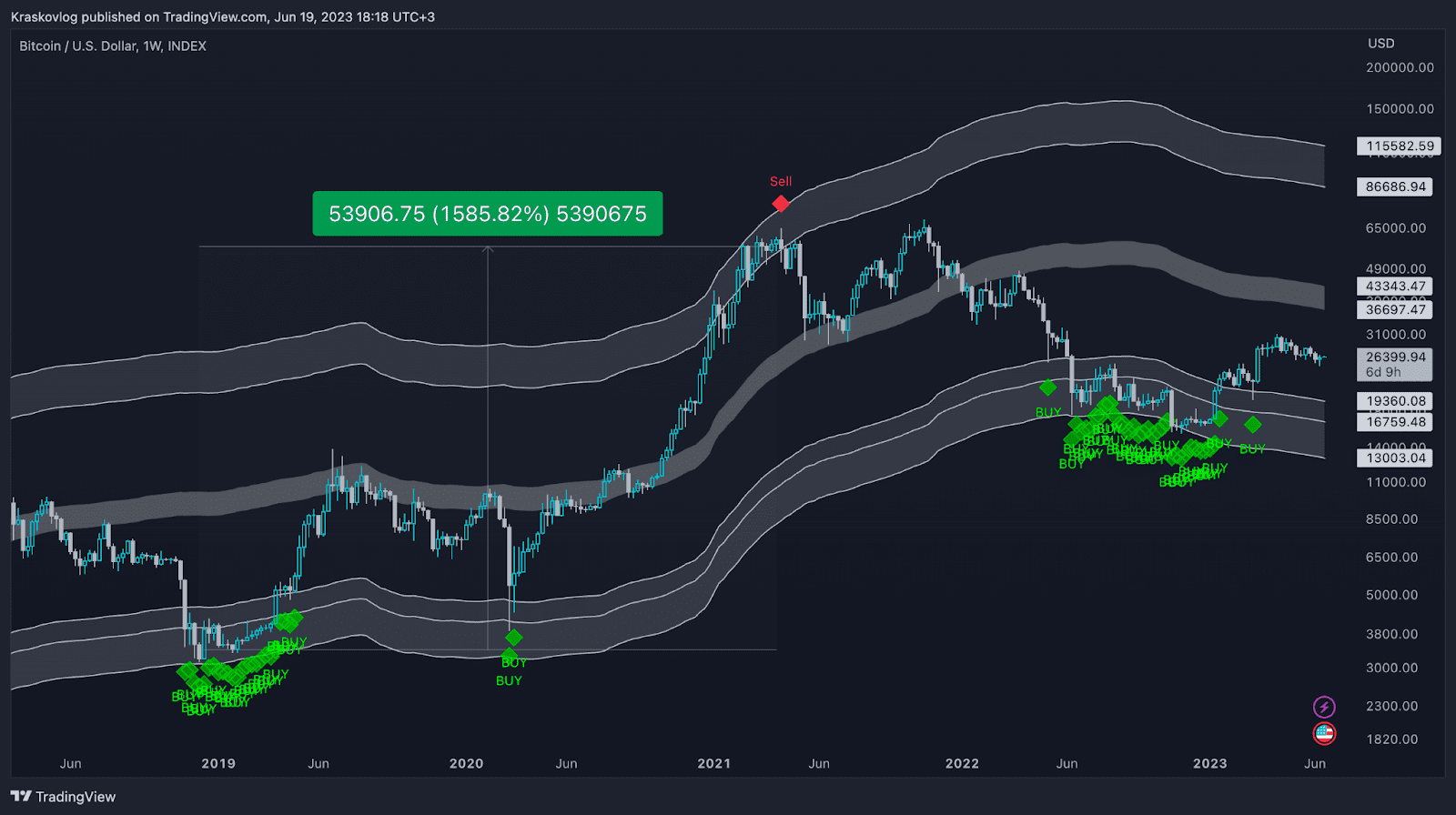

For example, in the cryptocurrency market, an investor who understands how to invest properly could have increased their capital by 1500% during 2019 - 2021, by investing in Bitcoin.

Of course, it's not all straightforward. Investors also lose their money and need to understand how to determine the best time for investing, as well as the best time to take their profit. They need to use suitable systems and strategies for investing.

Above, our own development - a free version of the Greenwich indicator - is presented. This system helps an investor determine the most favorable time to invest in the cryptocurrency market, as well as the best time to take profit. This system is absolutely free, and you can receive it by filling out this form. Once the form is filled out, access to the system will be sent to your email address.

Pros and Cons: Trading VS Investing

So, we've already worked out what % of traders actually make money, compared the income of traders and investors, and explored how much % profit traders and investors can make. Now it's time to evaluate all the pros and cons of trading and investing.

Trading, pros:

- Consistency: You can consistently earn a profit almost every month.

- Independence from general market trends: If a trader skillfully uses their skills, they can make money on both market rises and falls.

- Flexibility: Traders can quickly respond to changes in market conditions and use this to make a profit.

- Leverage: Traders can use various financial instruments, such as leverage, which increase potential profit but also risk.

- Emotional satisfaction: For many people, trading can be more emotionally satisfying than investing since it requires active participation and can bring quick "wins".

Trading, cons:

- High risk: Trading requires a good understanding of the market and a willingness to take high risks.

- Stress: Traders often have to work under high pressure and volatile market conditions.

- Time-consuming: Trading is a full-time job that requires a lot of time and constant market monitoring + it will take several years to find strategies and gain the necessary skills for successful trading.

Investing, pros:

- Greater profitability in the long run: this is well demonstrated by the example of the Bitcoin chart and the use of the free Greenwich indicator.

- Freedom of action: you don't need to monitor charts 24/7, it's enough to check the main indicators a few times a month, which will take a maximum of 15 - 20 minutes. You can carry on with your life without distraction, or easily combine it with your main activity.

- Minimal time spent on training: compared to trading, which requires several years of life to learn, in investing it's enough to determine the main metrics once and just occasionally monitor them.

- Risk minimization: Medium-term investments can reduce the risk associated with market volatility. The price may go down, but tomorrow it can return to its previous values, while a trader can get a Stop Loss and lose their money.

- Absence of liquidation: An investor can lose 5 - 10% of funds if the investment was unsuccessful. At the same time, a trader can completely get their account liquidated due to the use of leverage.

- Less stress: Investing is less stressful than trading, especially if the investor has a diversified portfolio or investment strategies.

Investing, cons:

- Waiting: Investments typically yield profits in the medium-term perspective, so investors may need patience.

- Dependence on general market trends: If the entire market is in a downtrend, the investor may have to wait 6 - 12 months to get new good investment opportunities. During this time, a trader can make money on the price drop.

Conclusion

So, having finished this article, you can already draw some conclusions and figure out what suits you more - trading or investing. There is no one ideal option for everyone, it's all individual. For example, I prefer investing and medium-term trading, when I open 2 - 3 deals a month, while some members of our team have chosen active trading for themselves. Evaluate all the pros and cons and choose the best option for yourself. If you still can't decide, try combining both approaches.