Trading strategy on Open Interest and Delta

By Yuriy Bishko June 13, 2024

BikoTrading Academy

Among the many tools available, Open Interest and Delta have become powerful metrics that can provide valuable insights into market sentiment and price movements. In this article, we'll take a look at what Open Interest and Delta are, how to use the potential of Open Interest and Delta in trading to develop profitable trading strategies, and you'll learn about our best strategy, how we find reversals with insane accuracy, and the indicators we use.

KEY ISSUES:

Open Interest

Open Interest is the total number of remaining contracts outstanding in a derivatives market, such as futures. It represents the total number of contracts that have not yet been offset or settled by an opposite transaction. As the OI increases, the level of market participation increases, which indicates a greater potential for price volatility and trend continuation. It is very convenient to use this indicator on the ATAS platform, follow the link and get exclusive benefits and discounts thanks to our cooperation with the platform. We regularly share tips on how to set up Open Interest and how to connect the necessary tools.

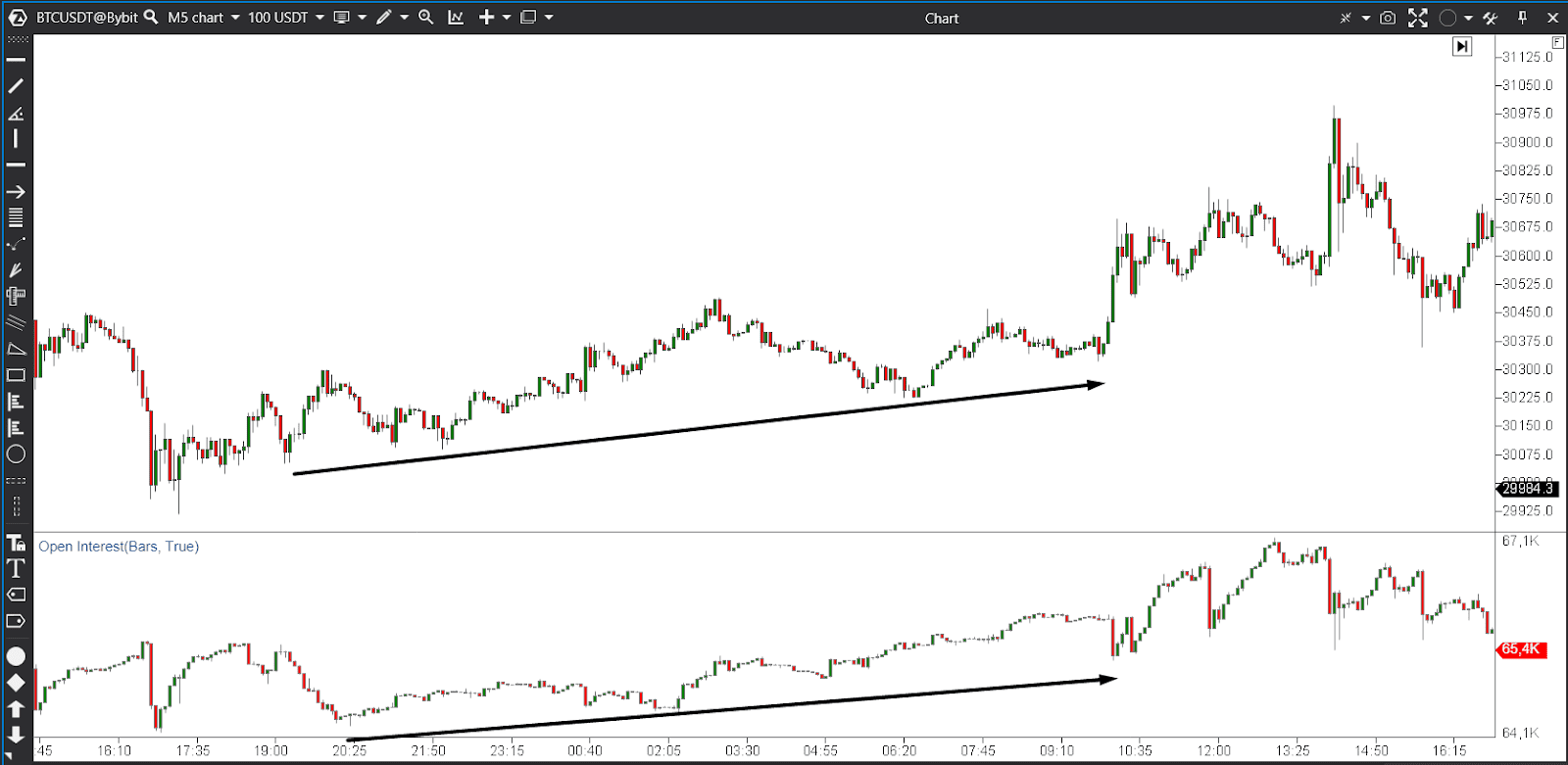

Open Interest and price convergence

When a cryptocurrency's OI increases significantly, it often indicates a strong trend in price movement. For example, a surge in OI accompanied by a price increase indicates bullish sentiment, indicating that more and more traders are opening long positions. Conversely, a sharp rise in the OI accompanied by a price decline may indicate bearish sentiment as more and more traders open short positions.

Open Interest and price divergence

Conversely, a significant divergence between OI and price can also provide valuable information. If the price of a cryptocurrency is rising and the OI remains relatively stable or declines, it may indicate that the market is being controlled by a small group of participants, which could potentially signal a price reversal. Likewise, if the OI is growing rapidly and the price remains stable or declines, this may indicate a potential breakout or trend reversal in the near future.

Delta

Delta is the rate of change of an asset's price relative to the price movement of the underlying asset. It provides an estimate of how much the asset price will change for each unit of change in the underlying asset. By analyzing Delta, traders can get an idea of how the market perceives potential price changes and adjust their trading strategies accordingly. To view Delta and Open Interest, you can use the TradingLite platform, which has a user-friendly interface and navigation.

How to trade the Open Interest and Delta strategy?

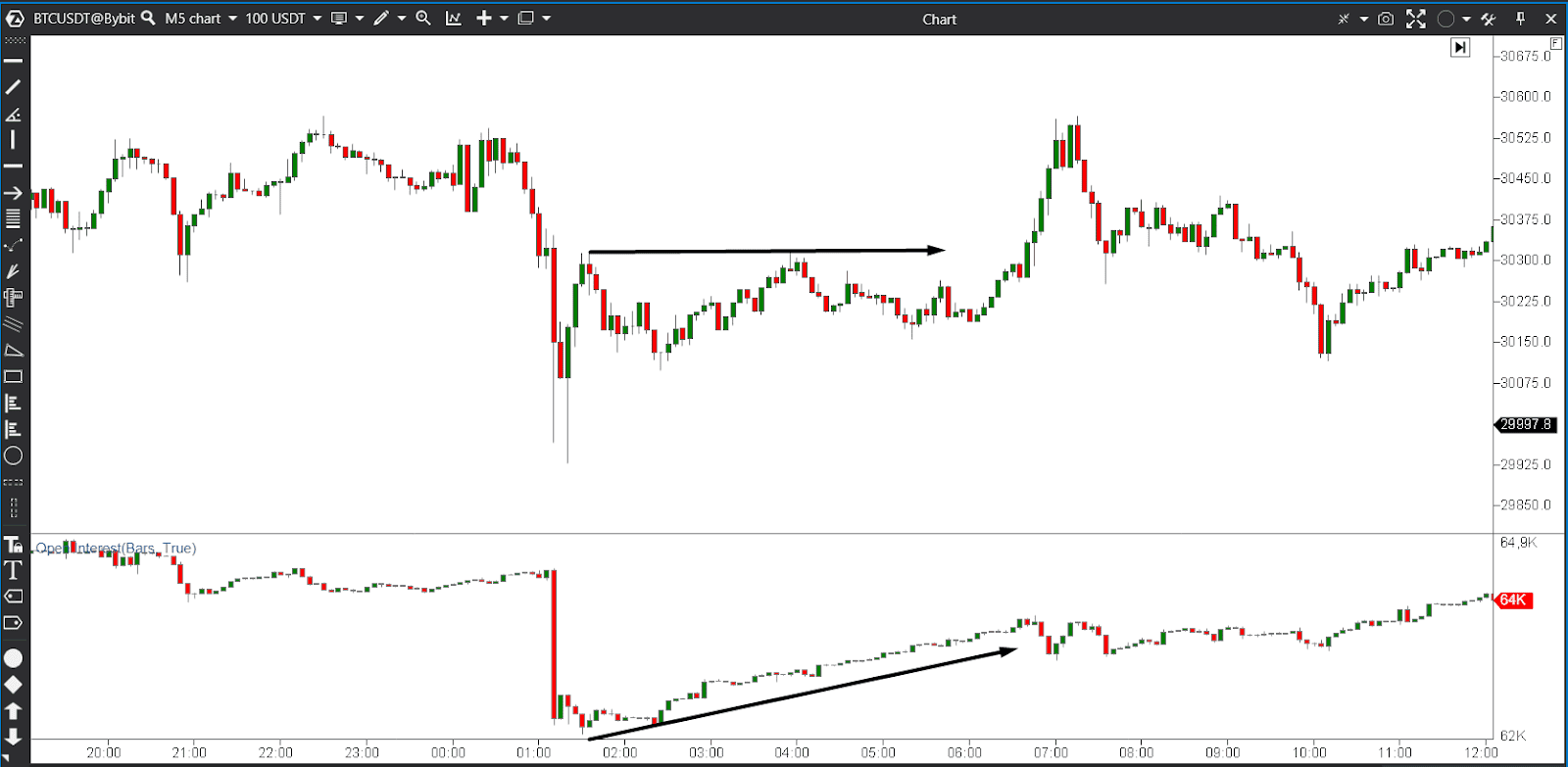

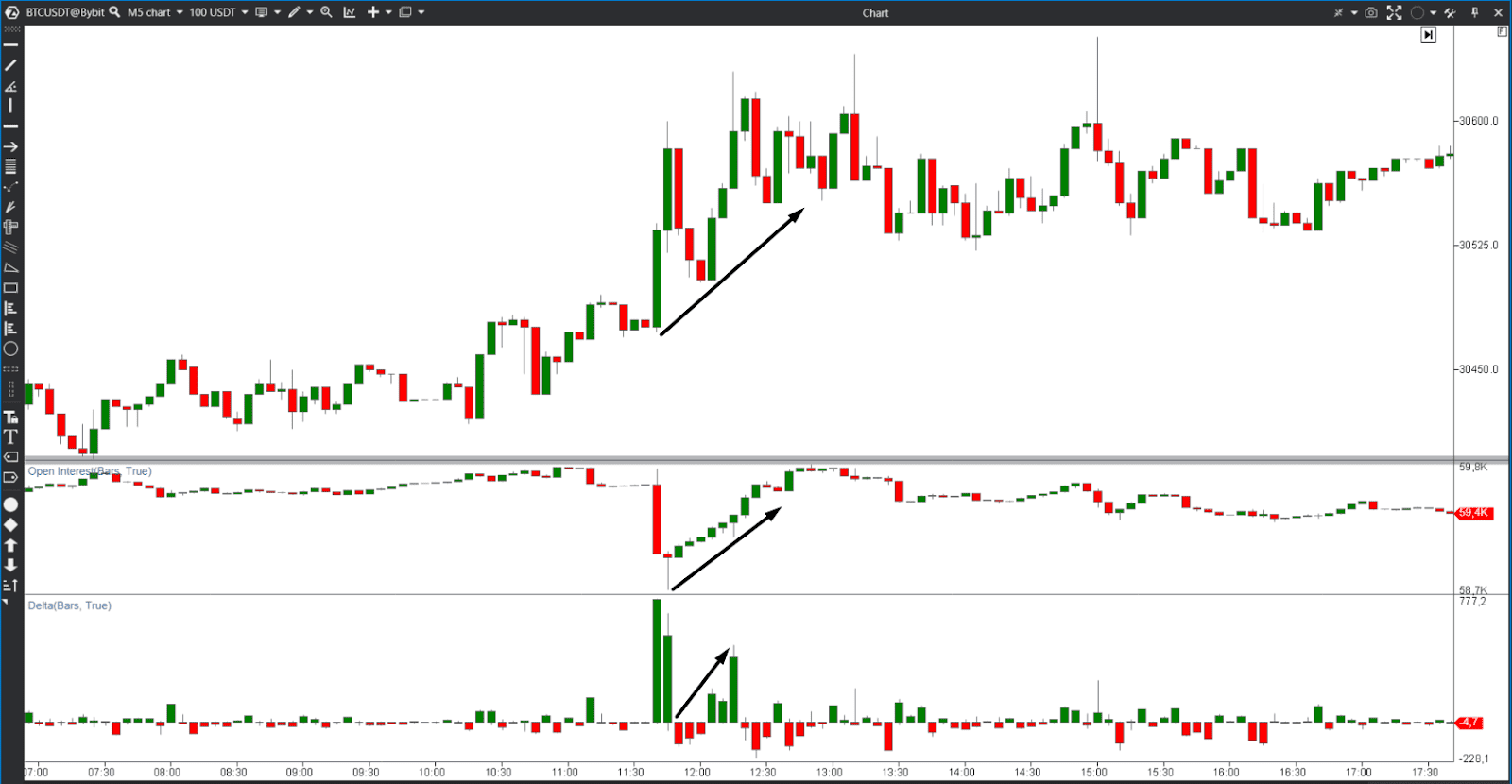

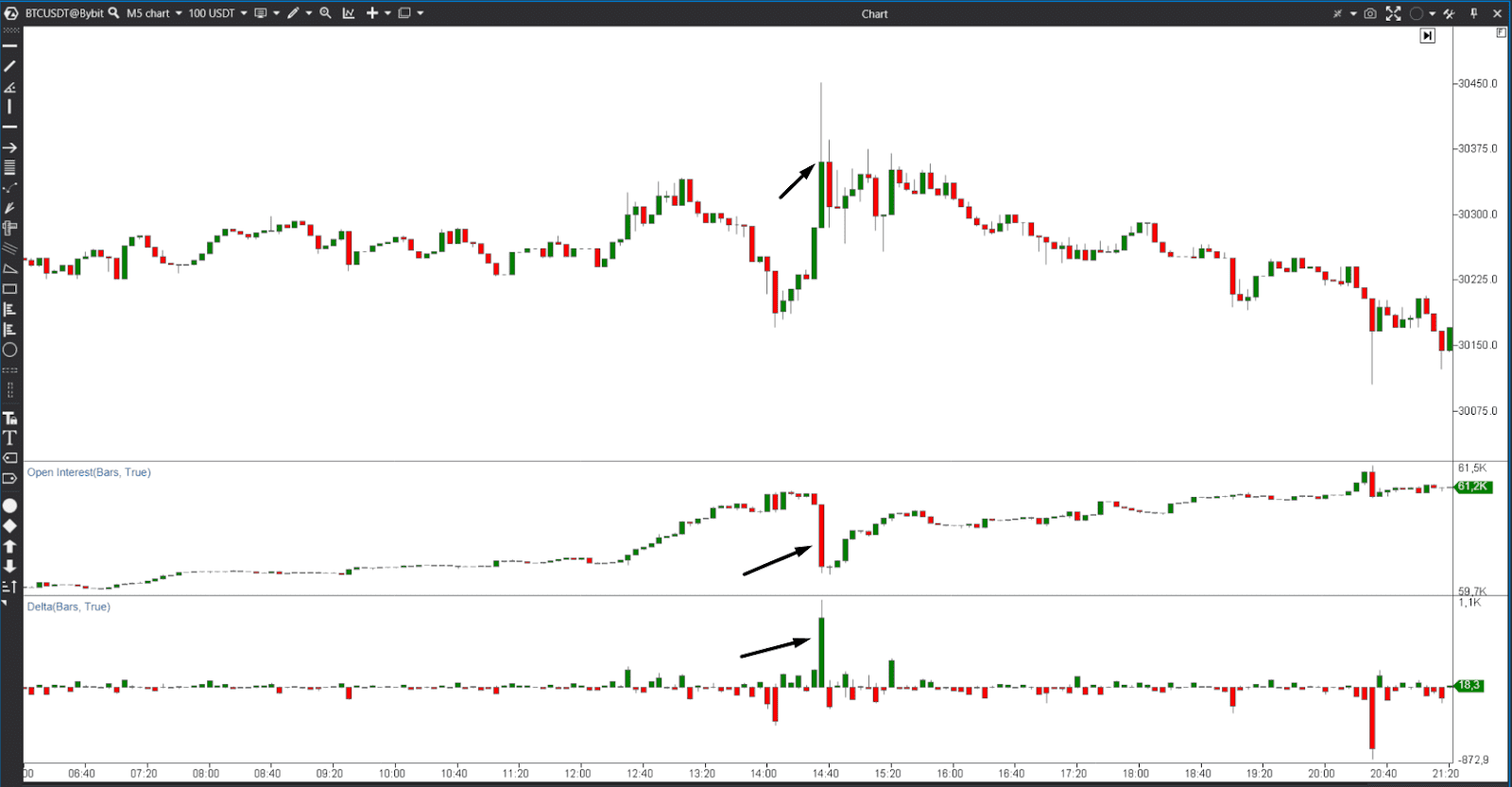

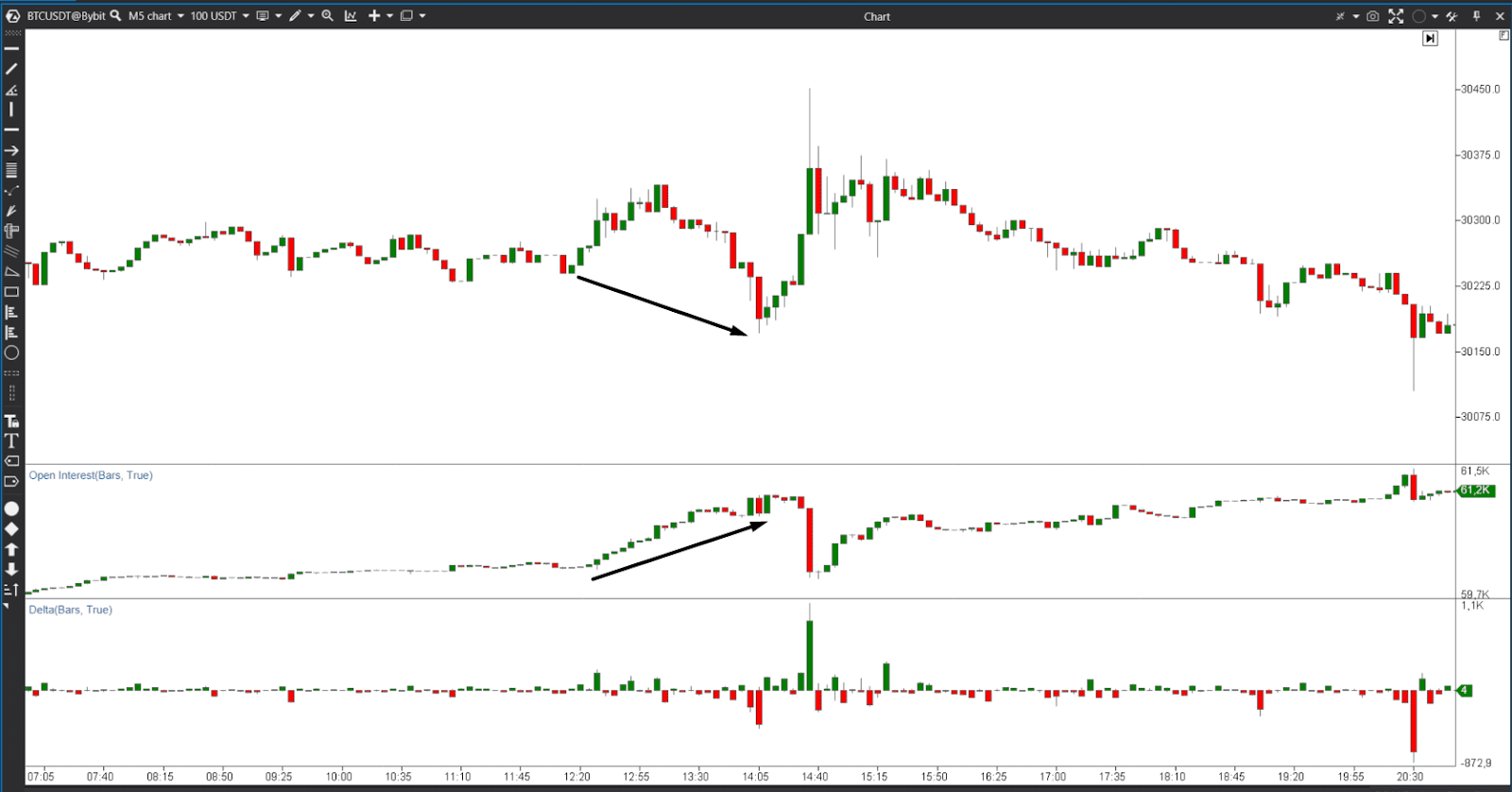

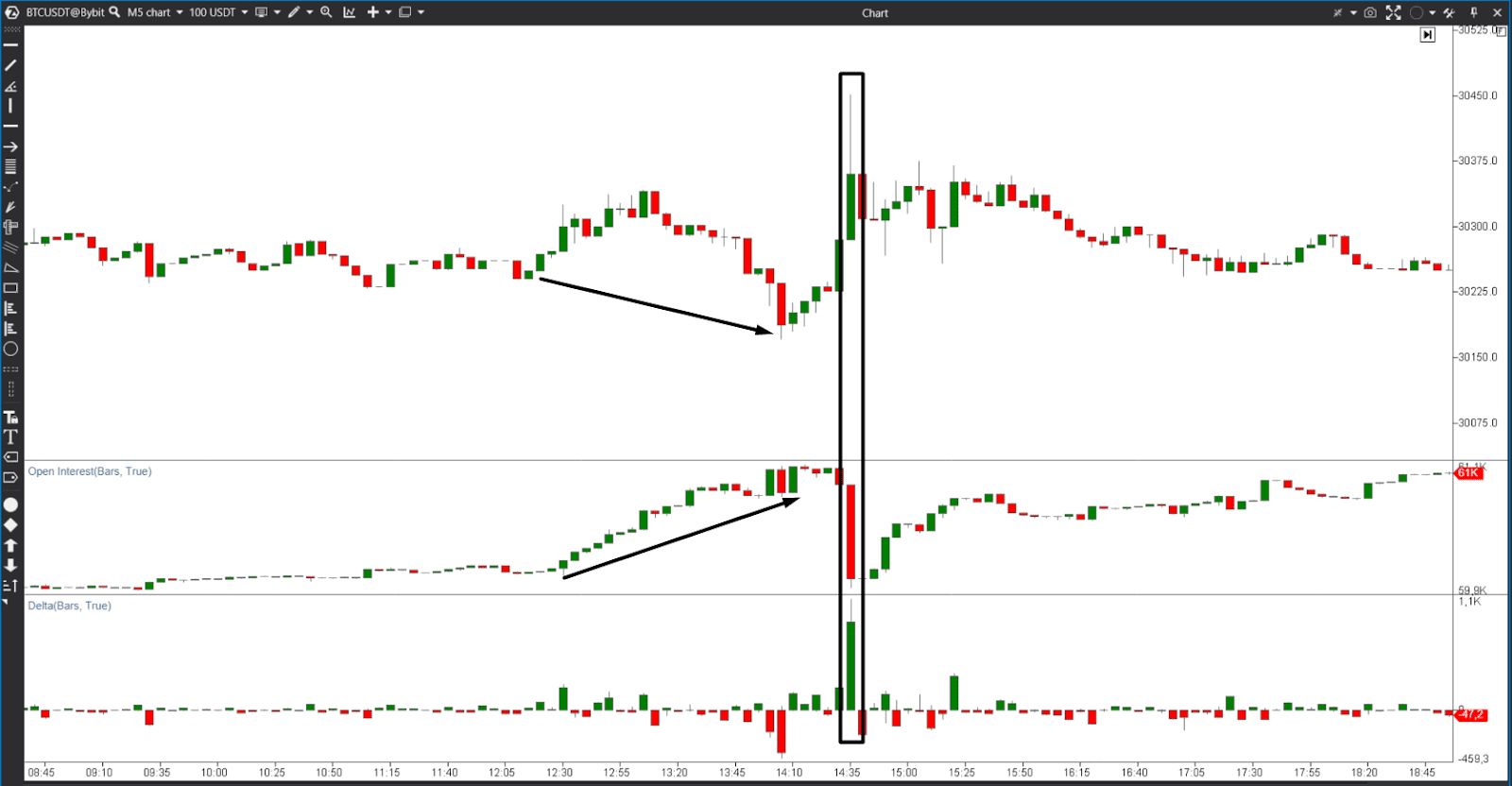

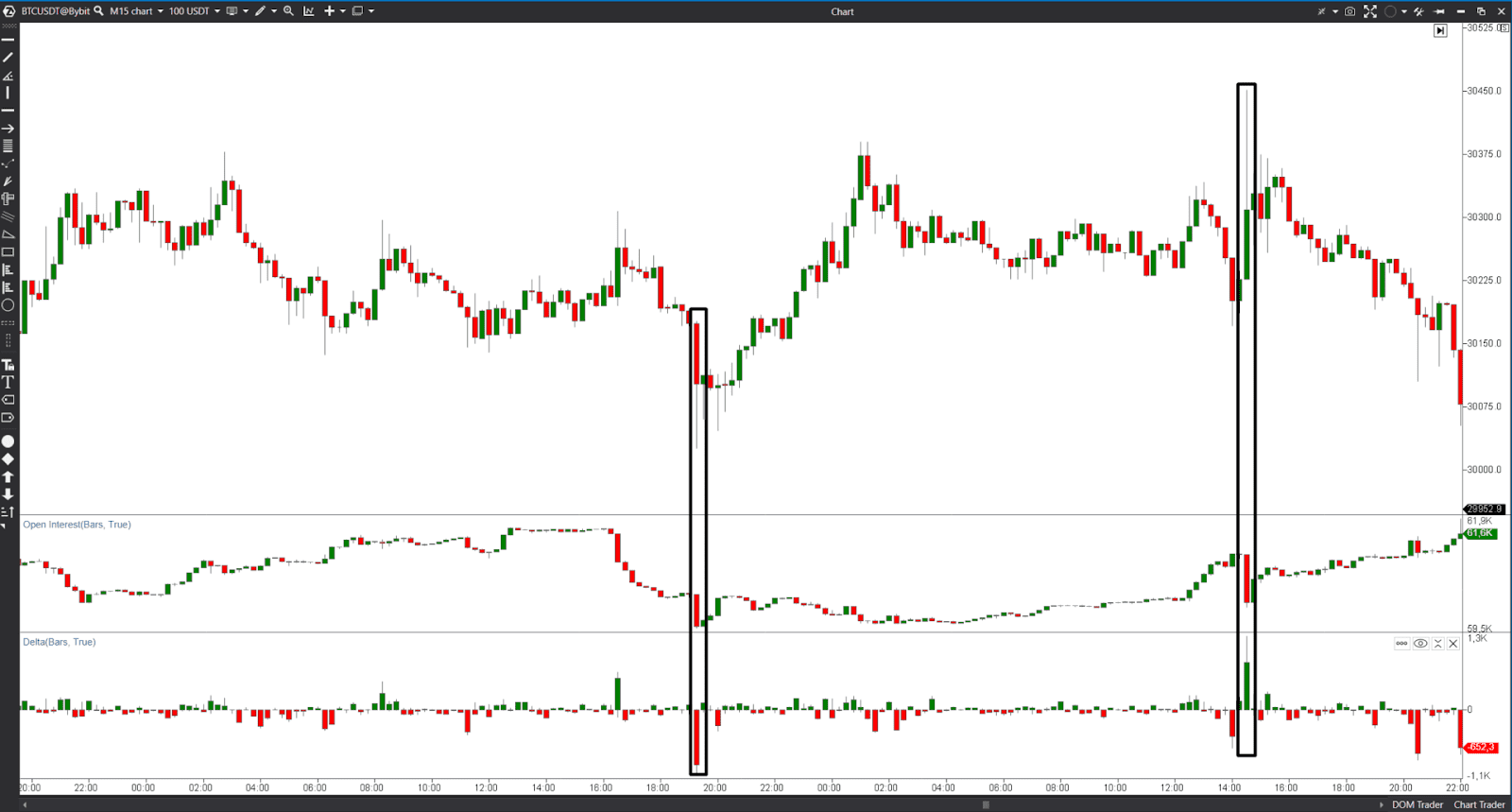

Pay attention to this picture. What do we see here? That's right, first of all, you have two main indicators: Delta and Open Interest. So how do you use Open Interest in trading? The Open Interest shows you the number of open contracts on the exchange. When I open a trade, the Open Interest increases. If I close a trade, the Open Interest falls. At the same time, Delta is the difference between what people do with market orders. If I buy, the Delta goes up. If I sell, the Delta goes down.

Why are we looking at both of these indicators together? Because they show liquidations. If you see that the price, for example, in a trending moment, suddenly accelerates and you see something like this huge positive Delta and a huge drop in Open Interest, it means that short sellers have been liquidated.

Why here? It has to do with short sellers. If you have a short trade, for example, you open a short position to get out of it, if the price goes against you, you are forced to buy back in to cover your losses. And many people did that. If you look at this growth in Open Interest, a lot of people opened short trades right in the middle of this range, and they were liquidated. And quite often after that, the price reverses.

The main reason why this is happening is because for the big players, for the whales, to get out of positions, they need liquidation. Because imagine if you bought BTC to cover your loan, you have to sell it to someone. And when you sell, it's good for the liquidated. They are forced to buy it back at a high price. This is how whales do it.

We use the ATAS platform integrated with the Bybit exchange to analyze Open Interest and Delta. For our students and subscribers, we offer a lucrative opportunity to join us in the world of crypto trading by registering on the Bybit exchange and receive nice bonuses and additional tools.

Why is it important to take into account the Open Interest and Delta indicators?

The Open Interest and Delta indicators are especially valuable for identifying market reversals and determining the optimal points of exit from trading in the cryptocurrency market. By closely monitoring Open Interest and analyzing its deviations from price movements, you can predict potential reversals in market sentiment. In addition, Delta analysis gives an idea of changes in market sentiment, which allows traders to adjust their positions accordingly and exit trades at the right time. Incorporating these indicators into trading strategies enables crypto traders to make timely and informed decisions, increasing overall trading success.

Conclusion

Open Interest and Delta are valuable indicators that can provide valuable insights into market sentiment and price movements in the cryptocurrency market. By understanding and incorporating these indicators into advanced trading strategies, crypto traders can improve their decision-making process and increase their overall trading efficiency.