Bull vs Bear markets: how to determine and earn more

KEY TAKEAWAYS:

- What are the bull and bear markets in crypto?

- How to identify the bull and bear market?

- How to earn during the bull and bear market?

Have you seen a photo of the golden bull standing on Wall Street? It symbolizes all traders who are passionate about growth, they are also called bulls. Bears are always in favor of falling markets. What is the difference between the two markets, bull and bear? We are going to discuss it in this article.

What are the bull and bear markets in crypto?

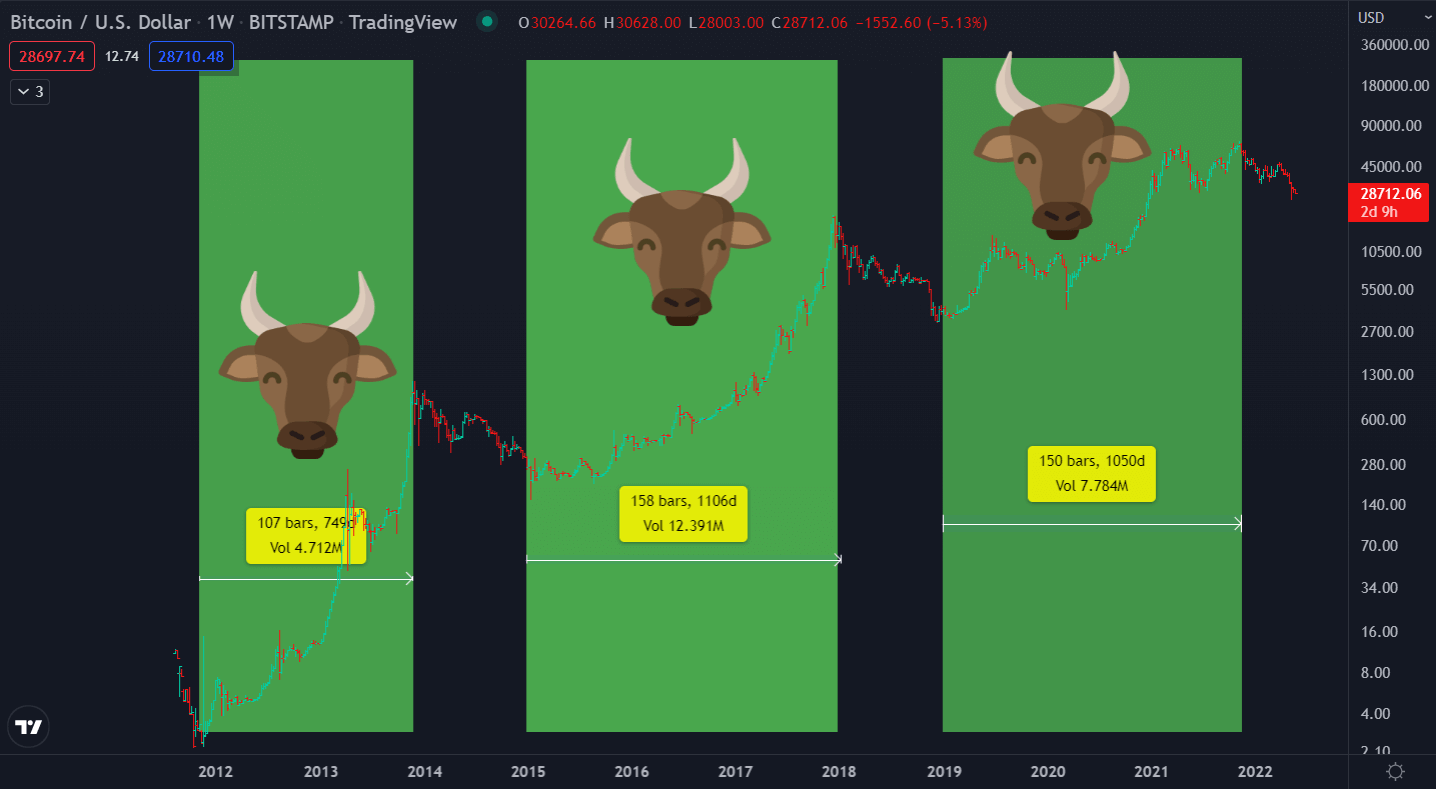

Bullish markets. This is the period in the cryptocurrency market, when the price of crypto is only growing. This is due to the optimism of most traders and investors who are willing to buy cryptocurrency more and more expensive. This encourages the price to rise. Usually, this period lasts 2-3 years and most cryptocurrencies have time to grow 50-100 times.

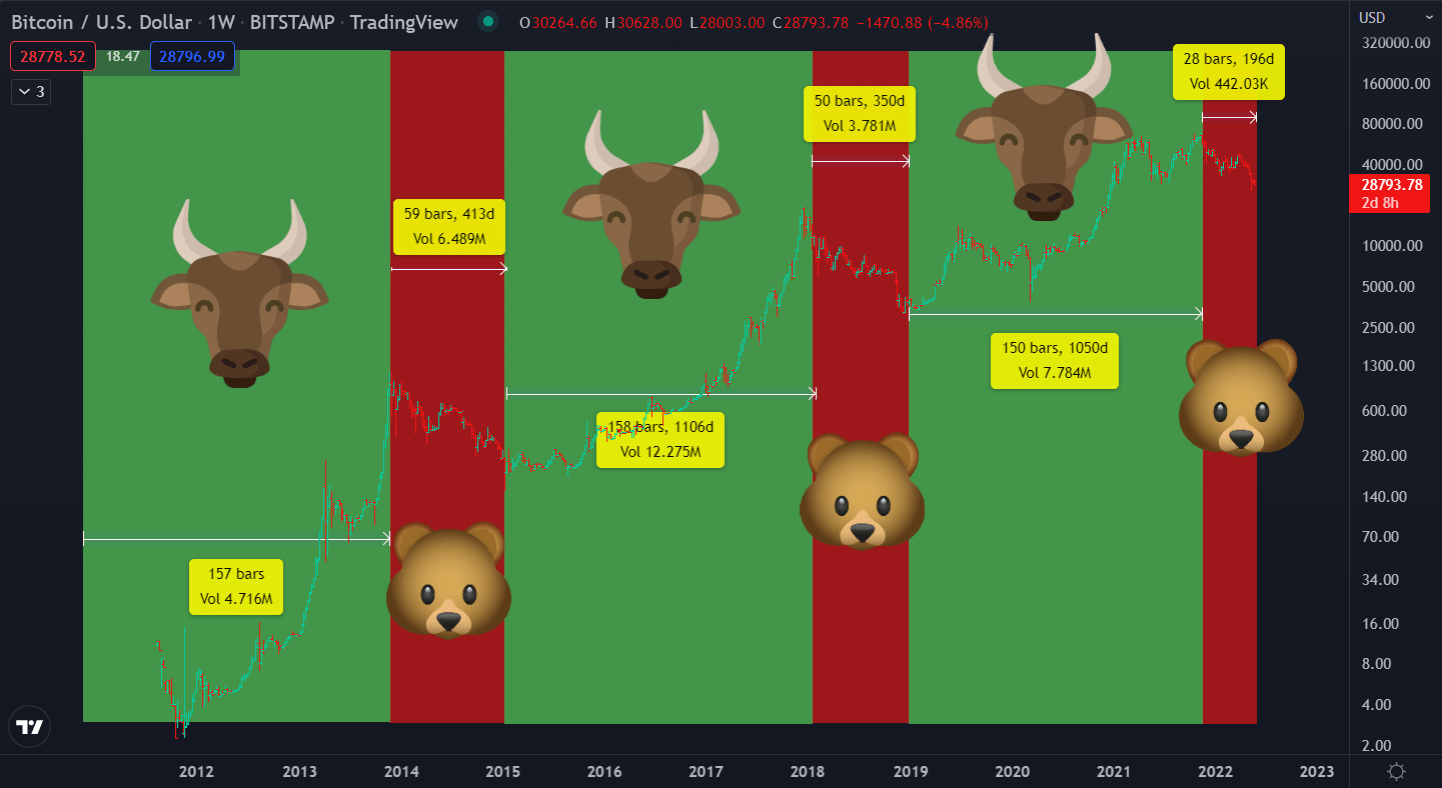

Bitcoin is believed to have had three bullish markets:

1. 2012-2014, 749 days.

2. 2015-2018, 1149 days.

3. 2019-2022, 1050 days.

Also, you can see all the bull markets of Bitcoin in the picture.

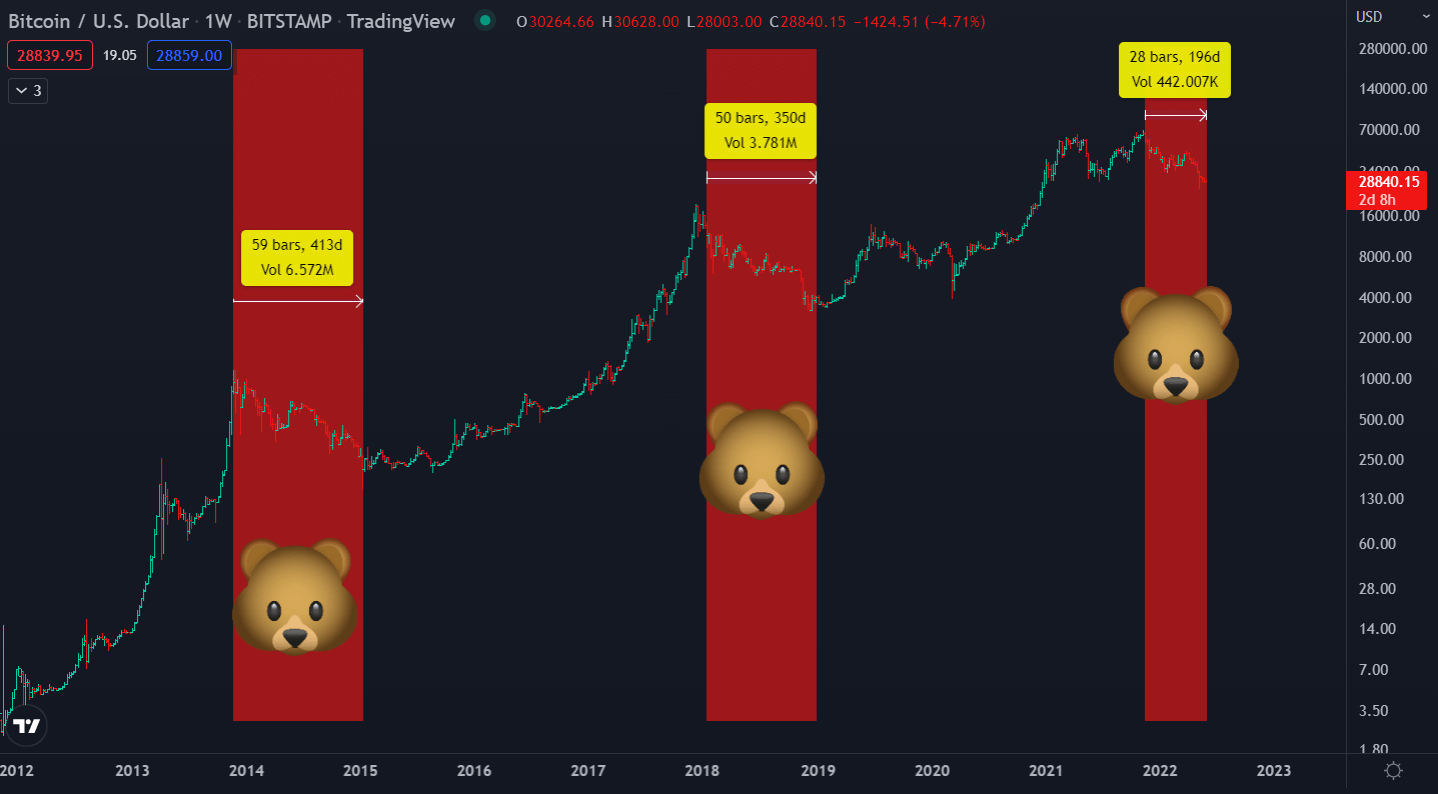

Bearish markets. The period in the market when the price of cryptocurrency is just falling. It is associated with pessimism of traders and investors, cataclysms, unstable world situation, a period when most people in the market are scared. Usually it lasts up to 1-2 years.

Bitcoin has already had two full-fledged bear markets:

1. 2014-2015, 413 days.

2. 2018-2019, 350 days.

3. 2022. It started 196 days ago.

As you can see from the picture, the bear market is shorter than the bull market. But why? This is due to economic "collapses". The crisis in the economy comes quickly, and the recovery can take years. Bullish markets occur during such "recoveries". It usually takes more time to rebuild the economy, but as we can see in the picture, trading can bring more profit.

How to identify the bull and bear market?

There are many ways to distinguish the market. For example, some traders believe that the crypto market is in the bear market if it has fallen by 40%, and if it has grown by 40%, then it is the bull market. I have a more effective method and I will share it with you.

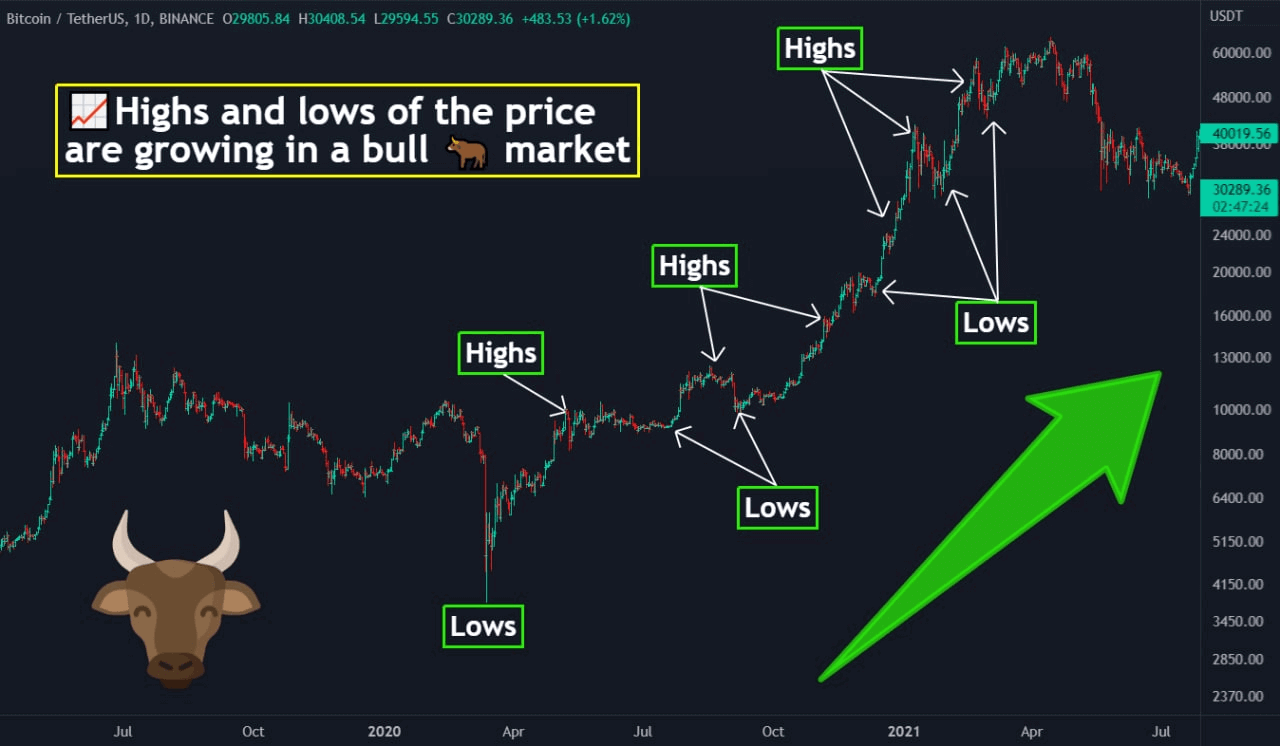

To determine the bull market, it is necessary to look at the formation of price highs and lows. They constantly grow.

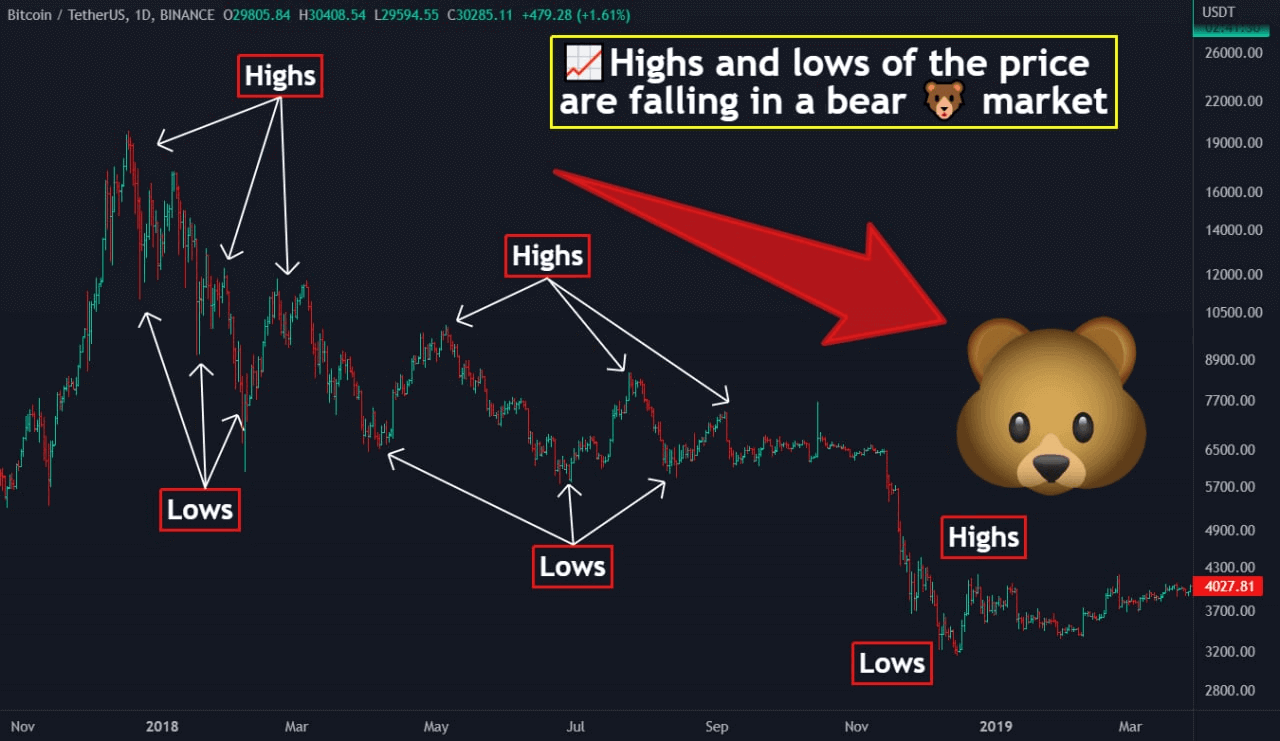

To determine the bear market, you need to look at the price change. In the bear market, highs and lows constantly fall.

How to earn during the bull and bear markets?

You have already identified a global trend and are ready to make money. What's next? The value of cryptocurrency increases during the bull market and decreases during the bear market. The advantage of trading is that you can earn both on the rise and fall of the market through futures trading.

Futures trading allows you to open the following trades:

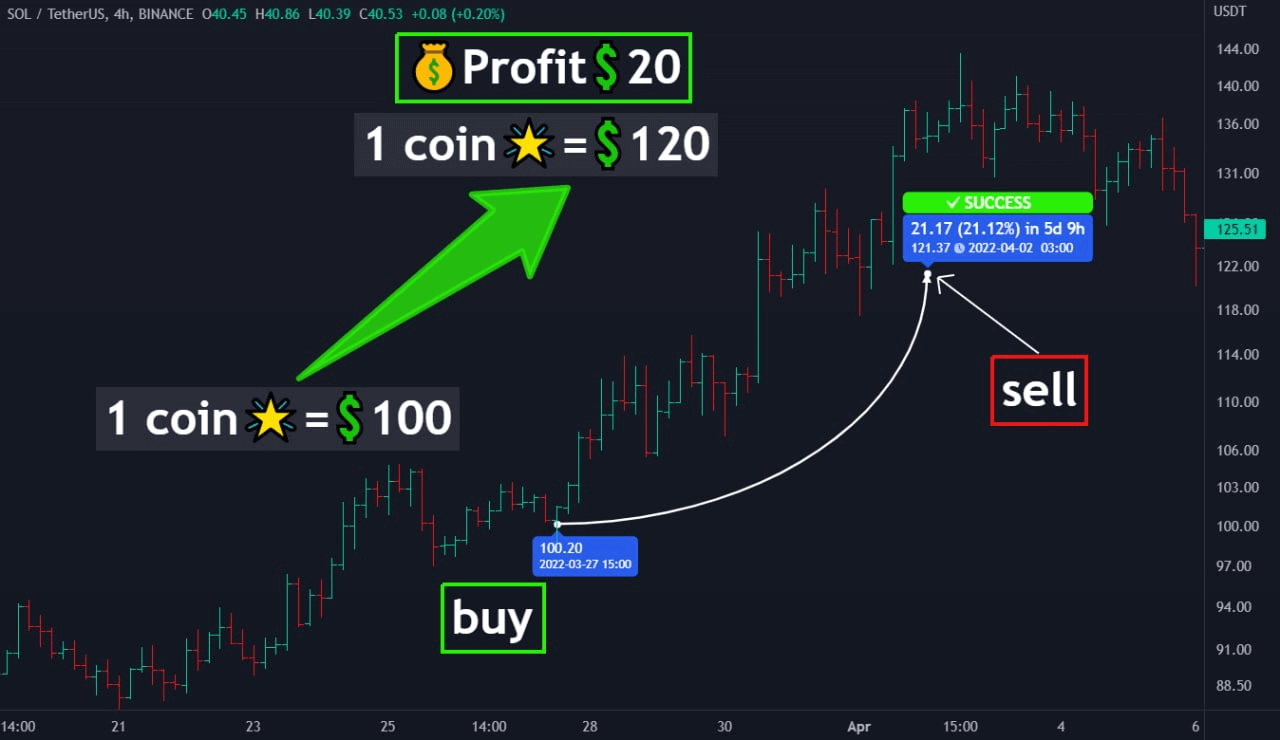

1. Long– a trade to earn on the growth of cryptocurrency. For example, you bought an altcoin for $100 and its price rose by 20% to $120. By selling the same coin, but for $120, you made a profit of $20 for this trade.

2. Short– a trade to earn on the fall of cryptocurrency in price. The principle of the shorts is a little more complicated, but I'm sure you'll understand.

For example, you want to make money on falling of an altcoin. In order to do this you need to:

1. borrow a coin from the exchange, for example, a coin for $100, and sold it for dollars.

2. if the price of the coin falls by 20%, its value will no longer be $100, but $80.

3. now you buy back the same coin, but for $80 and return it to the exchange.

4. so you earned 100-80 = $20 on a falling coin.

When opening a trade in the bear market, it is necessary to give preference to short-term deals, because in a falling market you are more likely to make money by falling. If the market is bullish, then most profitable trades will be in the long run, i.e. on the growth of the market. Pay attention to this when trading on the exchange!

All these opportunities for trading are provided by cryptocurrency exchanges, where you can also buy up to 3,000 different altcoins. Therefore, if you are still looking for a convenient cryptocurrency exchange, you can read about the largest and most convenient of them in this article.