Why you shouldn't use the Volume Profile on TradingView for scalping

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

Scalping is a trading strategy that aims to profit from short-term price fluctuations in financial markets. For successful trading, it is important to have the right tools and a deep understanding of the market. In this article, we will look at what scalping is, what are the preconditions for trading, how to start trading correctly, and what are the limitations of using the Volume Profile in TradingView for scalping.

KEY ISSUES:

What is scalping in trading?

Scalping is a trading method in which traders profit from small price movements over a short period of time. Scalpers usually enter and exit trades quickly, often within minutes or seconds. The strategy involves frequent trading and relies on accurate timing and quick decision-making to capitalize on small price differences.

What do you need for scalping?

To be successful in scalping on the cryptocurrency market, crypto traders need a user-friendly program and a combination of certain skills, tools, and mindsets.

- First, a deep understanding of technical analysis, including chart patterns, indicators, and candlestick formations, is required to identify short-term price movements.

- Secondly, a reliable and fast trading platform with real-time data and order execution capabilities, such as ATAS, is required.

- In addition, effective risk management skills, discipline, and the ability to make quick decisions are important.

- Also, for crypto traders who use scalping strategies, a calm and focused mindset is key to avoid losing their capital and avoiding typical pitfalls.

How to start trading properly?

To start scalping trading properly, it is very important to set clear trading goals, whether they include short-term profit goals or long-term wealth accumulation. Accuracy is an extremely important component for successful scalping. Even small inaccuracies can have a significant impact on results. Learn technical analysis to identify trends, support, and resistance levels, chart patterns, and indicators that suit your trading style.

Use a demo account to practice trading strategies and gain experience without risking real money. Start with small positions and gradually increase the number of trades as you gain confidence and experience.

Why shouldn't you use the Volume Profile in TradingView for scalping?

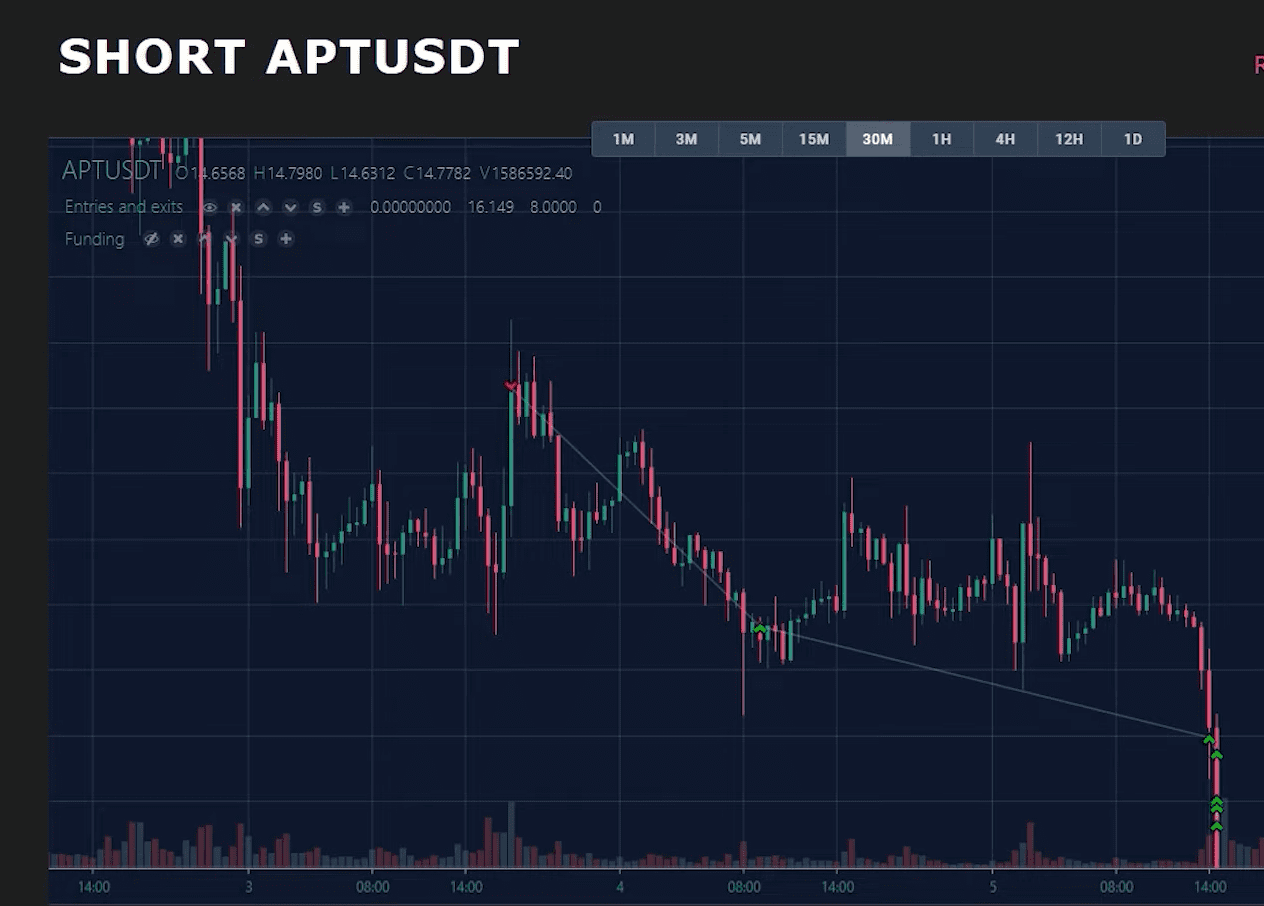

Accuracy and reliable tools are paramount to success. However, there are allegations that the Volume Profile on TradingView is a tool that robs traders of accuracy, leading to poor decisions. Let's look at an example using the APT token to show how the Volume Profile on TradingView steals accuracy and explore the impact it has on trading.

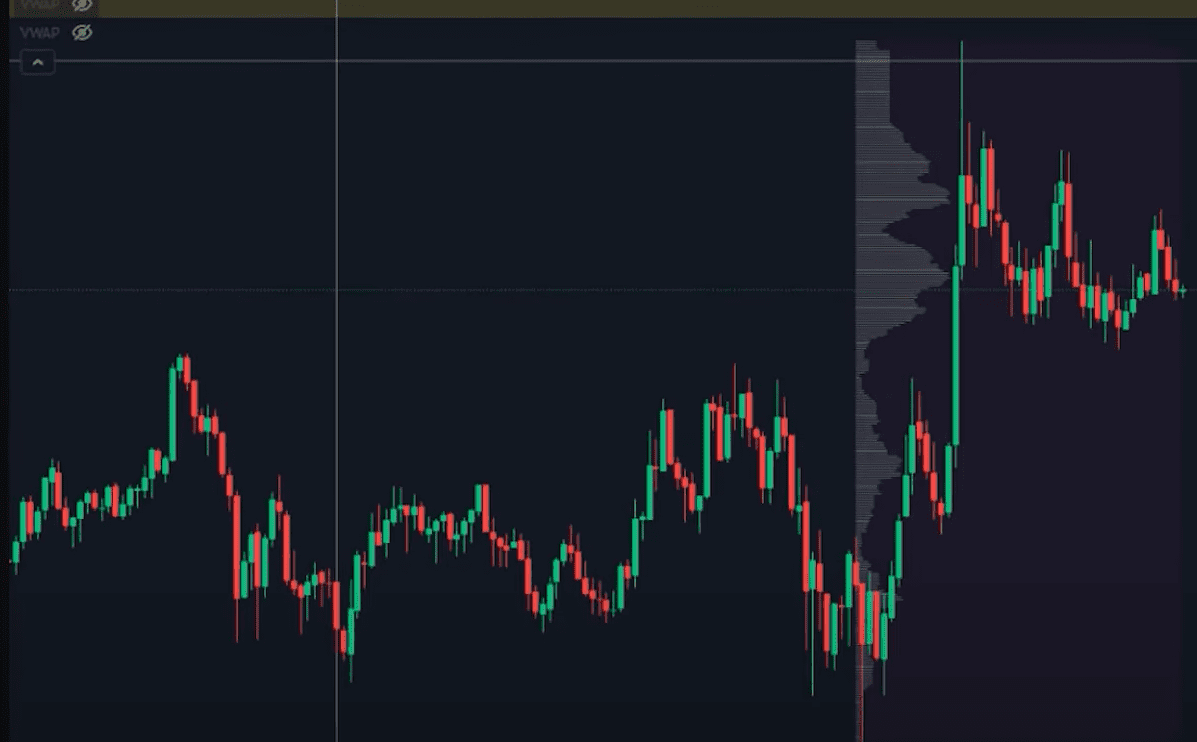

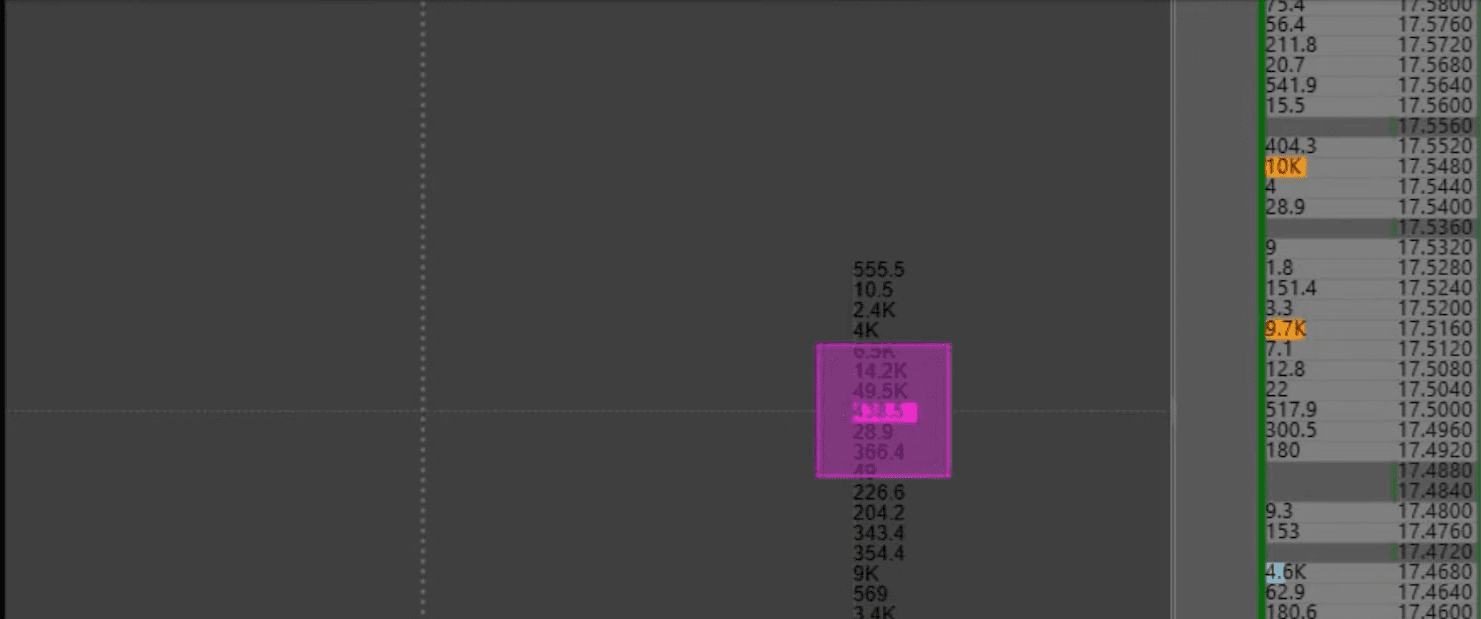

Let's look at the APT token on both TradingView and ATAS. Let's focus on a particular candle that has seen a significant amount of volume enter. On TradingView, the Volume Profile does not highlight anything worth noting, which would seem to indicate that you should not enter trades based on this information.

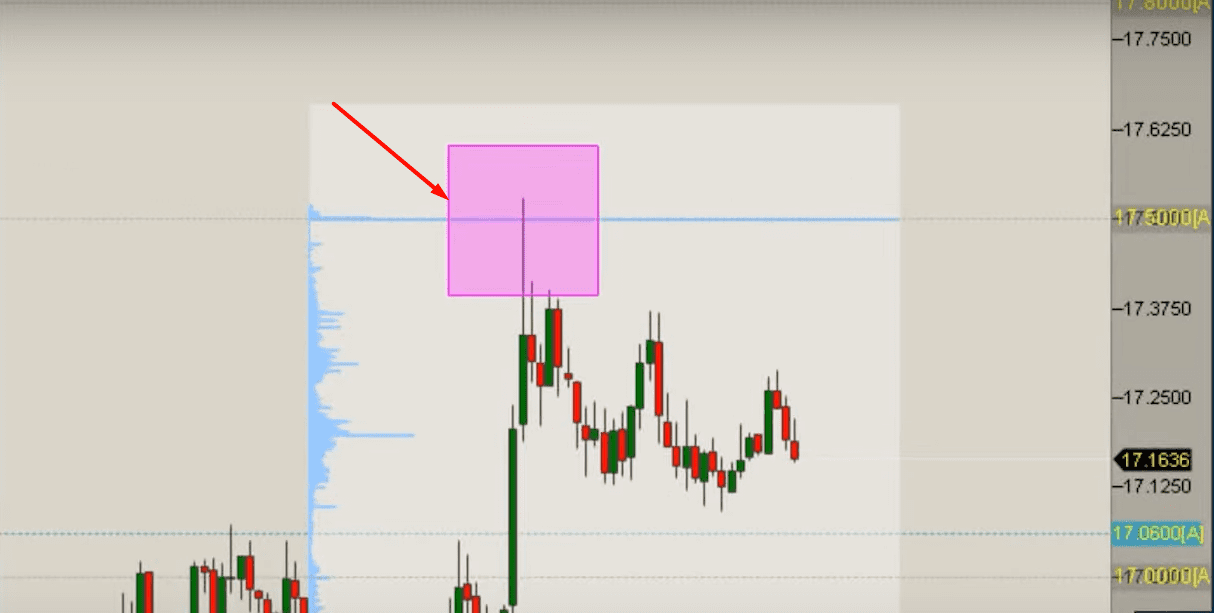

However, ATAS shows a stark contrast. The Volume Profile on this platform shows a very attractive profile, with the highest volume concentrated at a particular level, 17,500. This discrepancy calls into question the accuracy and reliability of TradingView's Volume Profile.

To further emphasize the inaccuracy, we looked at the footprint of the APT token. This analysis reveals an amazing volume of 438,000, which is extremely rare.

Conclusion

While the Volume Profile in TradingView can be a valuable tool for analyzing longer time frames and gaining insight into market sentiment, it may not be the most appropriate approach for scalping. Scalpers need accurate information in real time, taking into account many indicators and factors other than volume. Avoid trading based on unverified or questionable signals, and analyze the market carefully to use only reliable and confirmed signals to open trades.

.png)