Breakout trading strategy with OrderFLow

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

Finding the best strategy for day trading is a unique challenge for traders in the constantly changing cryptocurrency market. A common strategy among day traders looking to profit from notable price movements is breakout trading. Three significant variations of breakouts are examined in this article: post-trap, post-liquidation, and post-absorption breakouts.

KEY ISSUES:

What is a breakout and how does it work?

A breakout is a phenomenon when a price moves within a certain range for a certain time and then abruptly moves outside of it in a clearly defined direction. It looks like an explosion coming out of the stability zone and frequently results in a large rise or fall in price. It is crucial for traders who depend on breakouts to know precisely where and when the price movement will happen. For this, you need to have reliable confirmation based on technical indicators.

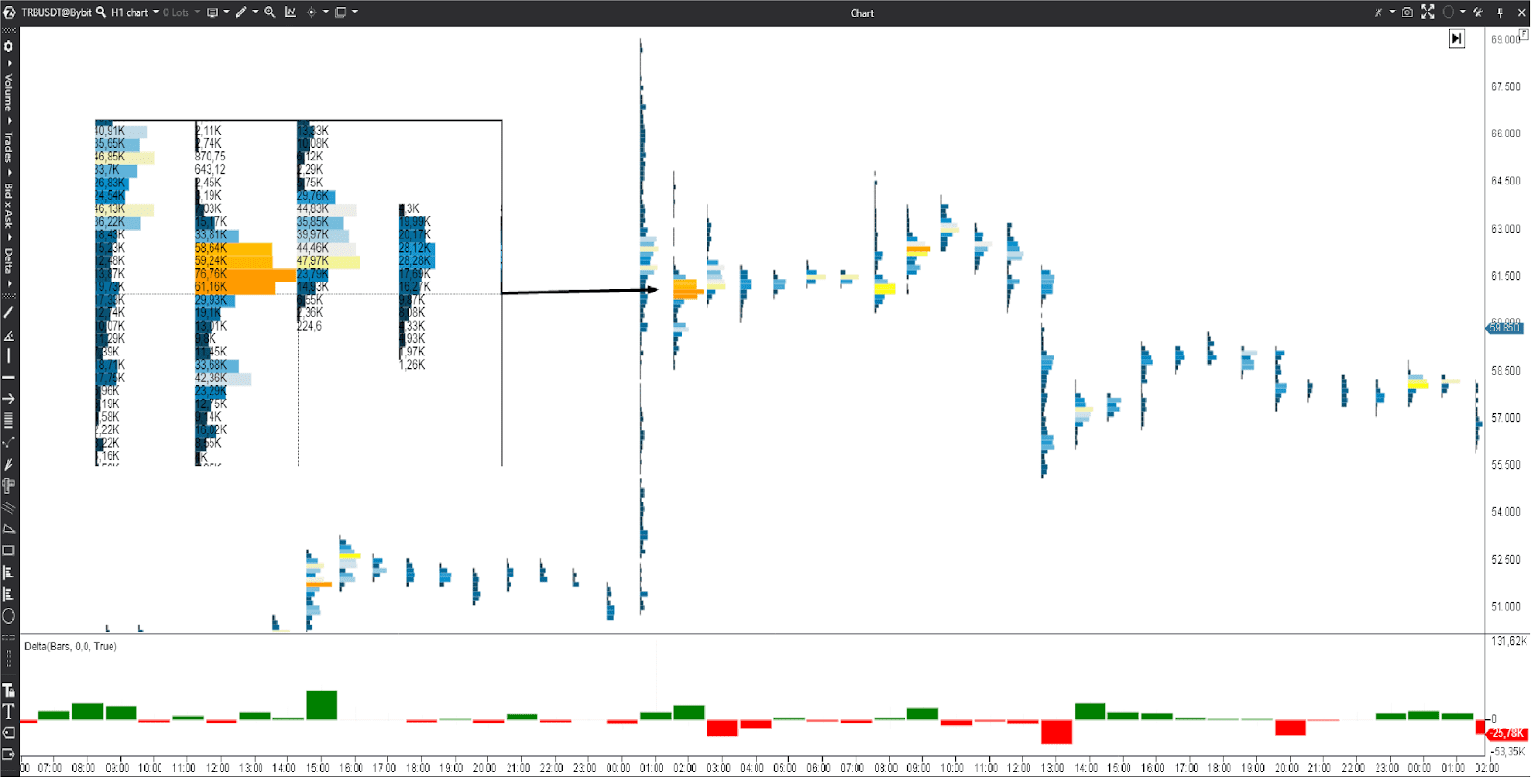

An analysis of order flow can provide additional information about the strength of a breakout. This is real-time data that shows the activity of buyers and sellers in the market, including the volume and price of transactions. During a breakout, a significant flow of orders in the direction of price movement indicates a higher probability of continuation of this trend. For example, if there is a significant increase in buy orders (demand) during a bullish breakout, it means that there is a strong initial force.

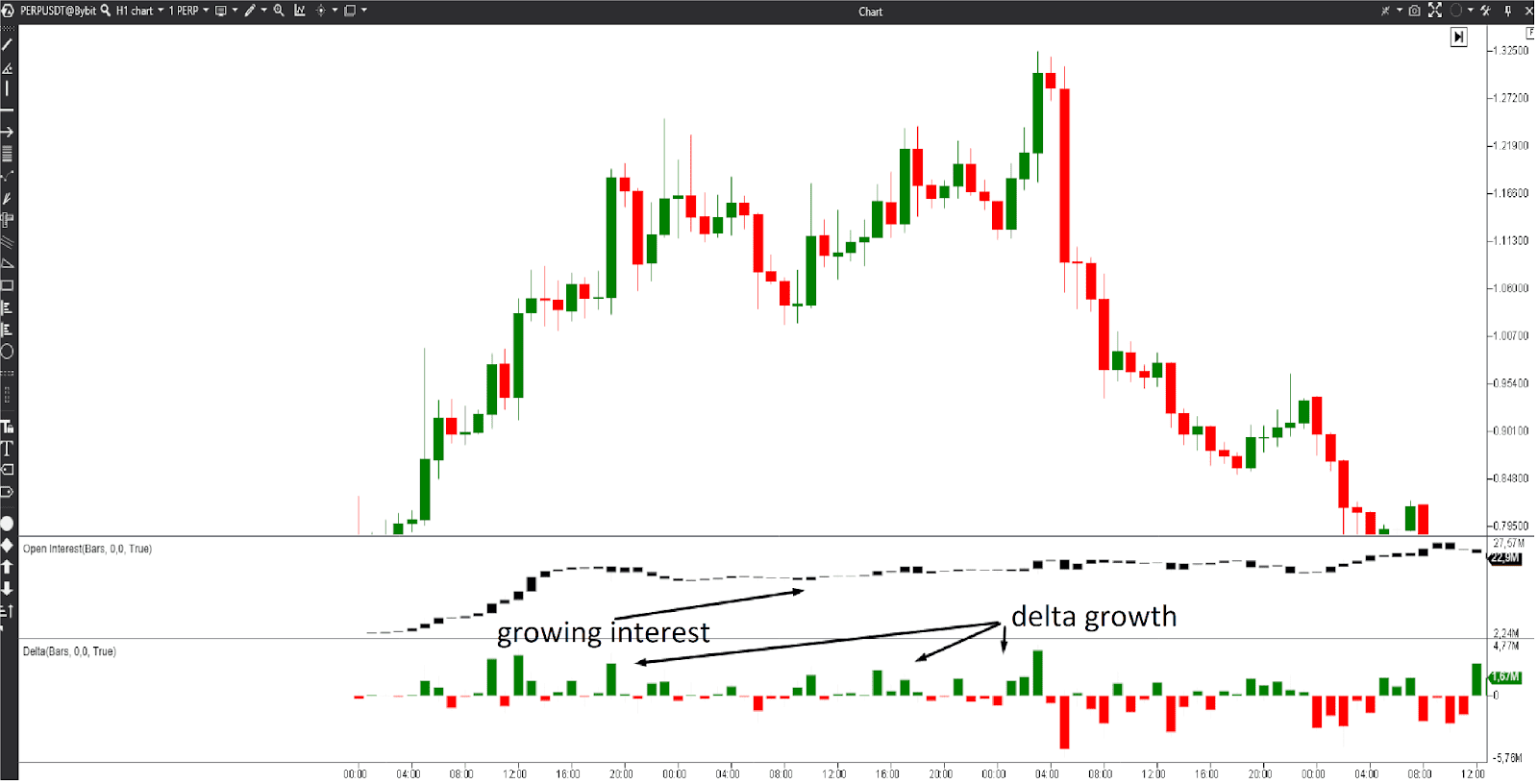

Post-trap trading

A "trap" is a frequent phenomenon in the cryptocurrency market. It occurs when the price moves within a certain range and then suddenly makes a sharp jump in the opposite direction. Retail traders often fall into this trap, buying assets after a significant price increase. Institutional investors essentially absorb these purchases by retail traders, creating a trap, and may open short positions to profit from the upcoming price drop.

To successfully trade such breakouts, you need a variety of confirmation indicators, such as open interest, delta, and volume profile. If you are looking for strategies for trading futures, please refer to the related articles about Open Interest and Delta.

To calculate your position size, you can use platforms such as TradingView, taking into account your risk per position and your account size. It is important to set stop-losses above significant orders that protect the price from rising and to take profits before critical levels are reached to secure your earnings.

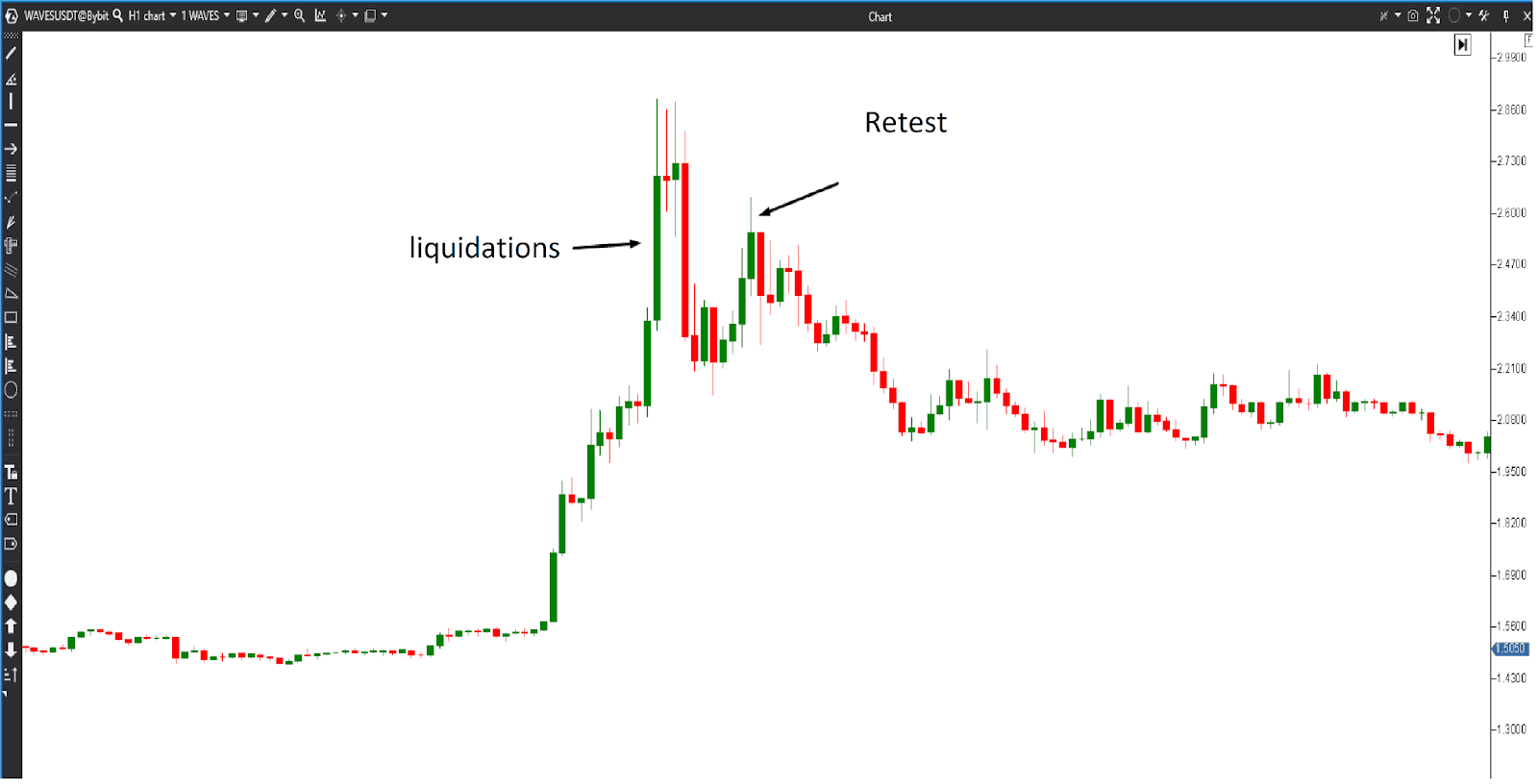

Post-liquidation trading

Liquidations occur when leveraged traders are automatically stripped of their positions by the threat of a margin call. This often leads to significant sell-offs, and sometimes these sell-offs are absorbed by institutional investors. To trade such price breakouts, you need to wait for the price to retest at levels with high trading volumes and set a stop loss just below this retest zone.

Liquidations often lead to a cascade of market orders, which causes a significant flow of orders in the direction of the liquidation. Traders can identify such situations and strategically place orders after retesting important support or resistance levels.

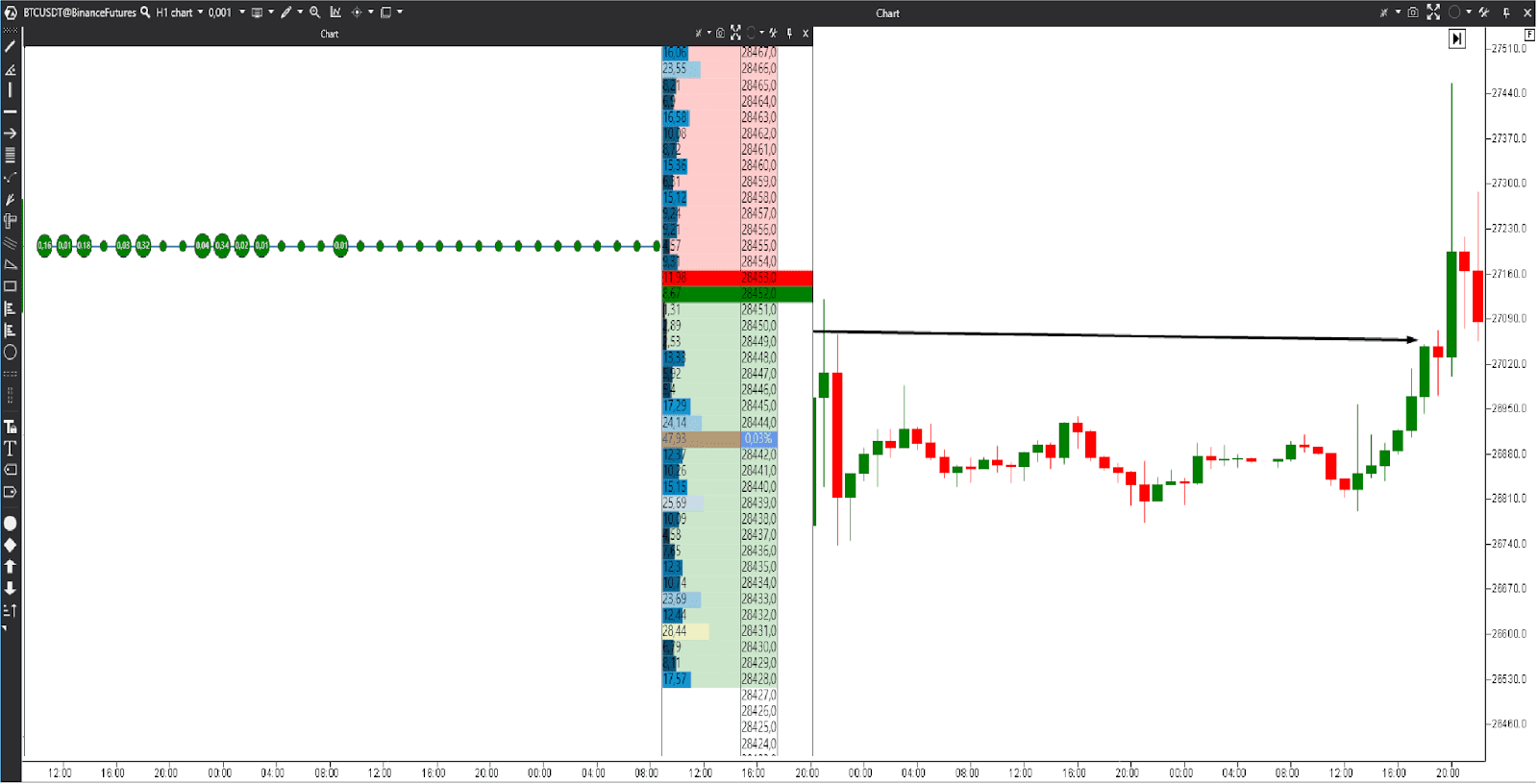

Post-absorption trading

Absorption is an interesting phenomenon in the market when there is a significant accumulation of coins at a certain price. This concentration usually happens before a price breakout. You can trade on such breakouts by paying attention to serious absorption volumes and waiting for the price to retest. Similarly to other types of breakouts, you can set your stop loss just below the area of significant absorption.

Learn more about these breakout strategies in our video

What factors to consider when trading a breakout?

Be sure to pay attention to various indicators such as VWAP, volume profile, and accumulated delta. These indicators will help you identify the best entry points and increase confidence in your trades. For example, data from the Order Flow trading strategy helps traders choose the best entry and exit points. A quick surge in the number of buying or selling orders can signal entry points for traders who want to join the current breakout. By the way, we regularly share many signals in our private community of traders. Join the club and get support from professional traders whenever you need it.

Correctly calculating your position size is critical for effective risk management. Platforms like TradingView can help you determine your trade volume based on your risk per position and account size.

If you want to be among the successful traders, strategies that are breakout-based will require you to analyze more carefully, but at the same time bring more profits. In some cases, you may need to wait for additional confirmations before entering a trade. This may include waiting for the price to retest on significant volume levels, a breakout above the daily VWAP, or other technical analysis patterns that fit your breakout strategy.

Conclusion

Trading on breakouts allows you to capture significant price movements. Learn patterns and indicators to improve your trading accuracy. Don't forget about stop losses and risk management. If you want to learn new crypto trading strategies, join our educational course on Order Flow trading. We offer a comprehensive training program that includes the necessary information, practical tools, and resources for trading.