Risk management in crypto trading for beginners!

By Yuriy Bishko Updated November 15, 2022

BikoTrading Academy

Experience, trading strategy and risk management are the three pillars of successful trading. Most beginners become interested in risk control only after losing their deposit. But this is a huge mistake, because before thinking how to get rich faster, you should ask yourself how not to lose your deposit! This is why the risk management system exists.

What is risk management?

Trading is not a lottery and luck, trading is a clear adherence to the established rules, which allows you to gradually increase your capital. Risk management is a system of limiting and controlling losses and profits.

In simple words, a risk management system is a loss limiter that controls: our emotions, excitement and market volatility, which in most cases takes away money. "Does this mean I won't lose anymore?" – one of the most common questions among our subscribers. The answer is simple: "Of course you will lose!" But you should not be afraid of losses, losses are an integral element of trading.

The main task of the risk management system is to bring more money than to lose. I will tell you even more, you can be right in only 10-30% of trades and at the same time be a profitable trader. You will learn how to achieve this in the article below.

Watch NOW on Youtube: A - Z Risk Management Trading pLan

How to control risk and profit?

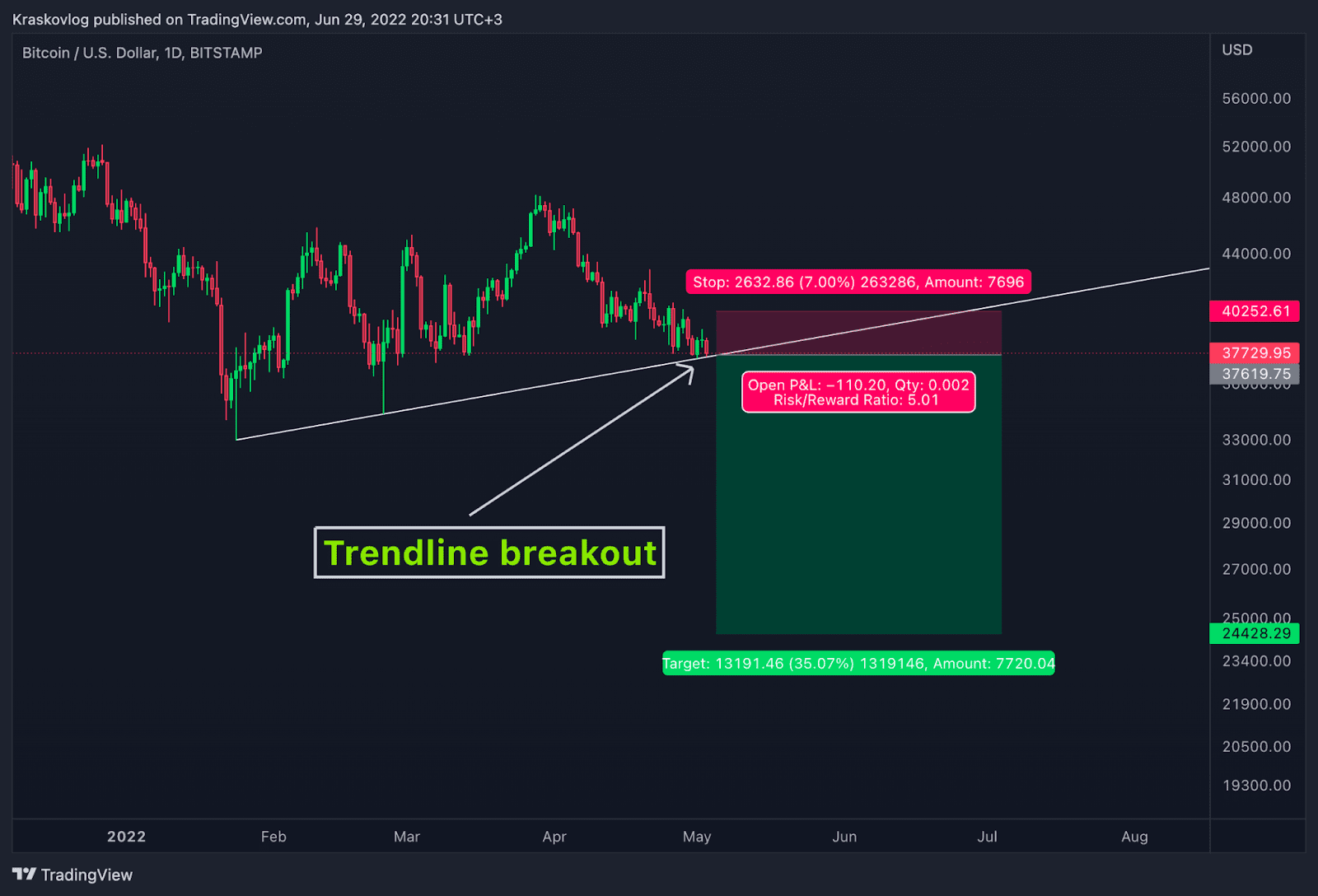

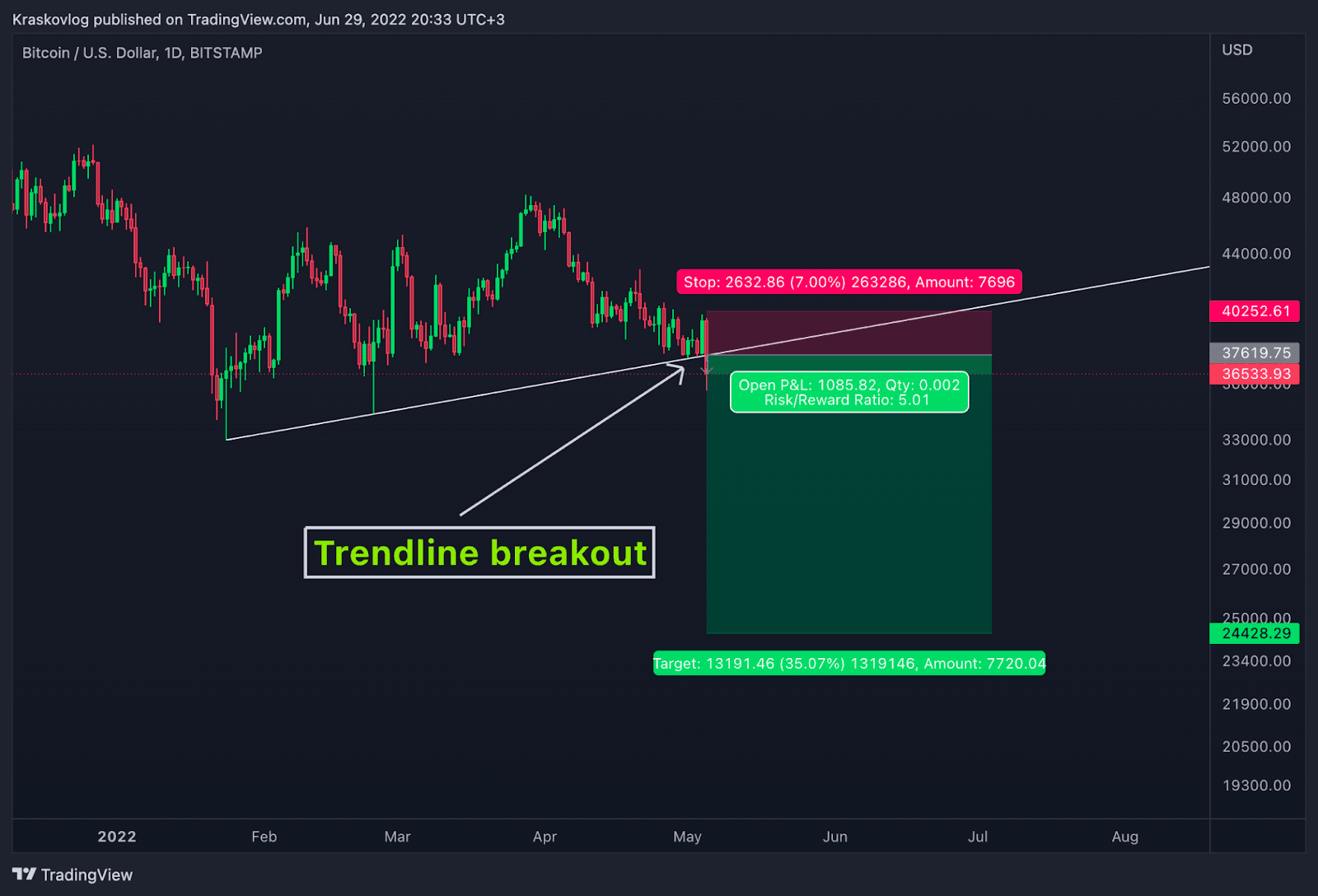

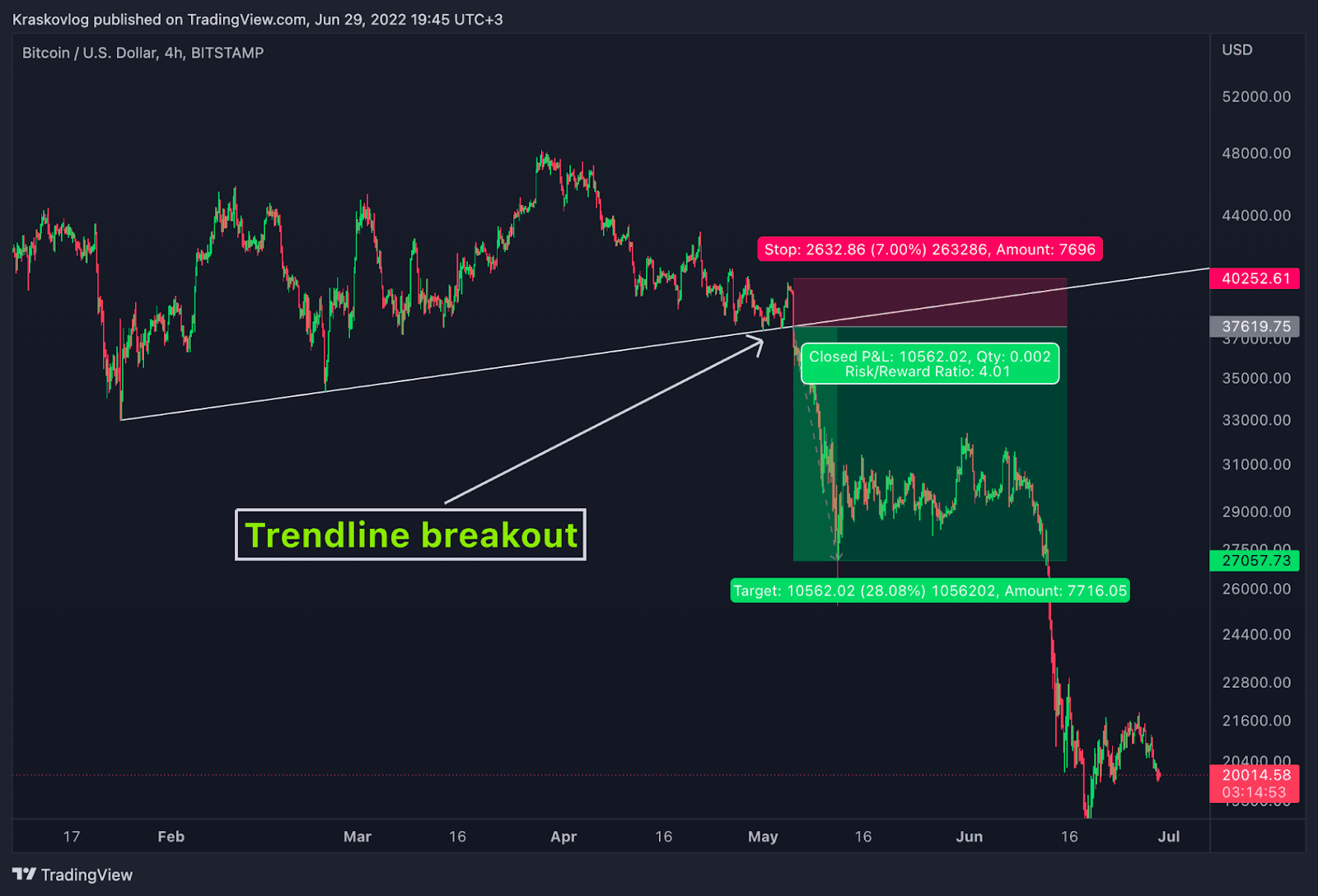

To begin with, we need to understand how risk and profit are controlled. Risk and profit are controlled using stop loss and take profit orders. How does it work? It is best to show with an example. On the chart below, we see a clear trend line, according to all indicators, we expect a trend line breakout and a price drop. We set an order to open a position after breaking the trend line.

There was a breakout of the trend line, our position was automatically opened. We set the stop loss at the level of the local minimum (7%), and the take profit is 5 times larger (35%). The risk per trade is $10. That is, if the stop loss order is triggered, we will lose $10, if the take profit order is triggered, we will receive $50 in profit. In this case, we risk $10 in order to get five times the profit.

The price went in our direction and reached a take profit order. We received +$50 profit. That's how, with the help of stop and take orders, we can control the level of our risk and profit.

How does the risk management system work?

Well, we have figured out how to control risk and profit using stop and take orders. Now let's move on to the most important thing. The risk management system and trading strategy are primarily statistics and mathematical expectations. Let's see how we can earn having 30% profitable and 70% losing trades.

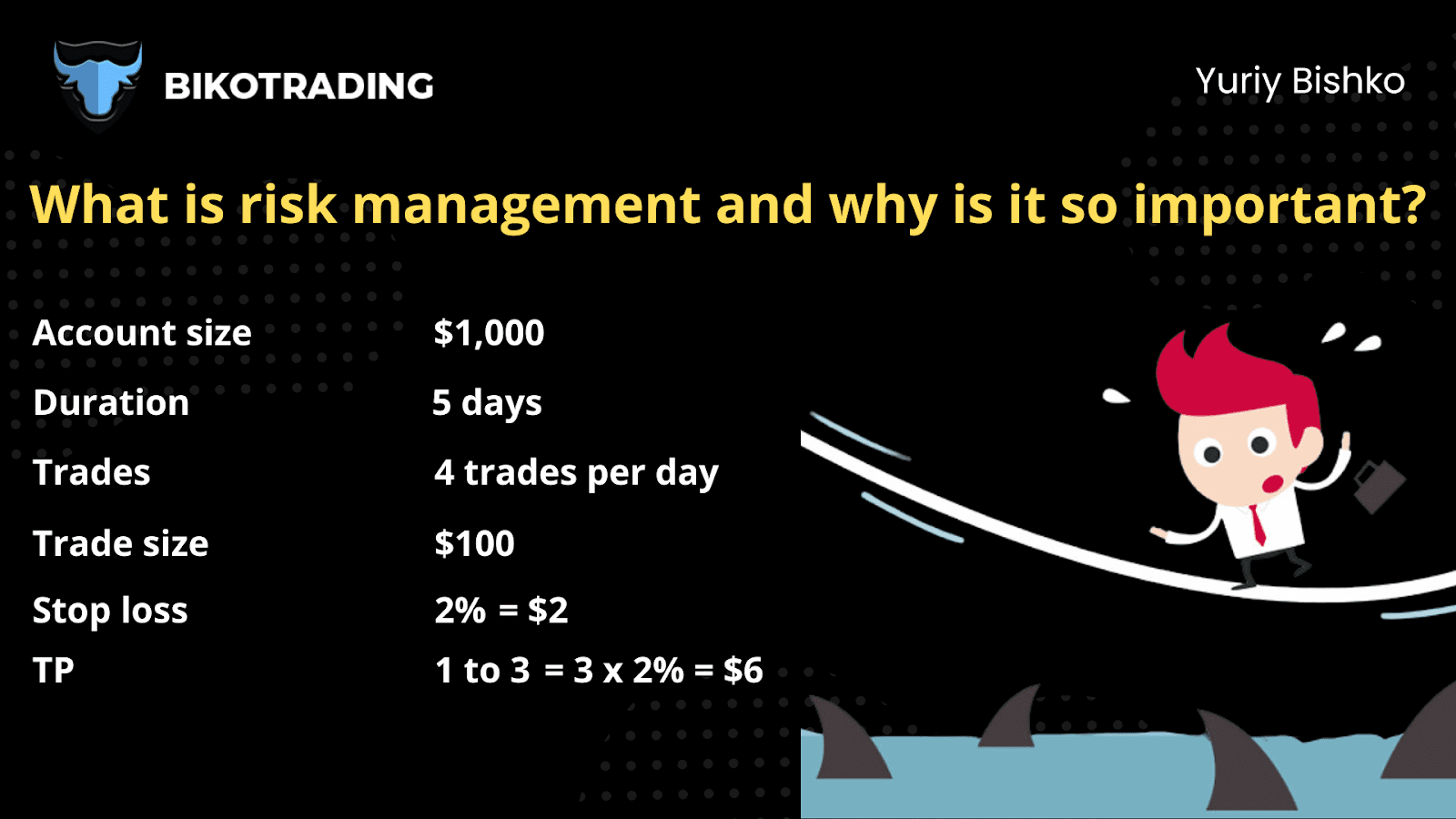

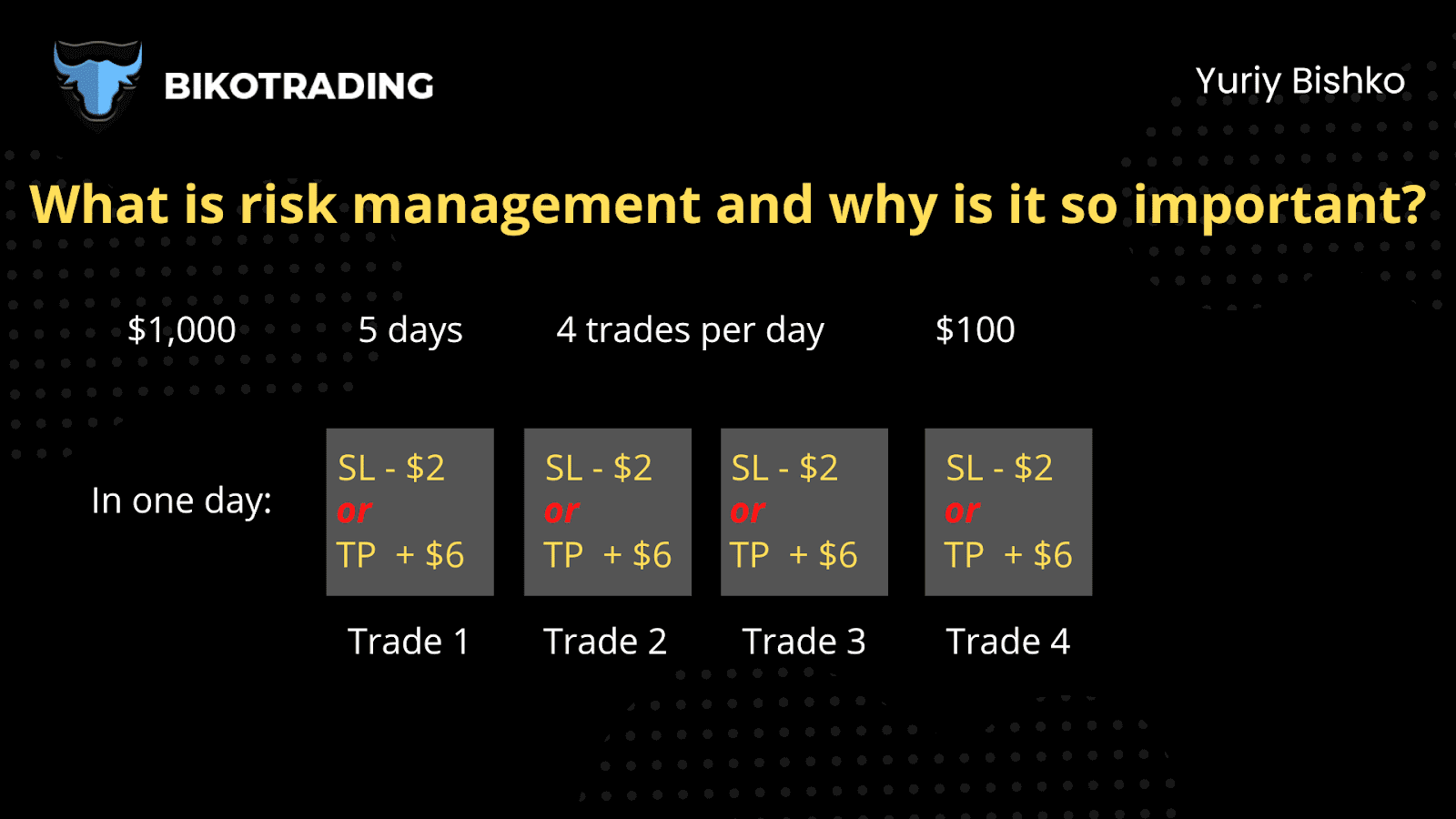

Of course, it is best to consider it with an example. So your balance = $1000. Let's set the trading period - 5 days. We open 4 trades per day. You open each trade for $100. Stop loss = 2%, take profit 3 times larger = 6%. In the case of a successful trade, you receive a profit of $6, in the case of a lossing trade, the stop loss is triggered and you receive a loss of $2.

According to the rules of risk management, in one day you will have 4 trades, in each of which you can receive either $2 in loss or $6 in profit. The maximum loss you can get in one day is $8, and the maximum profit is $24.

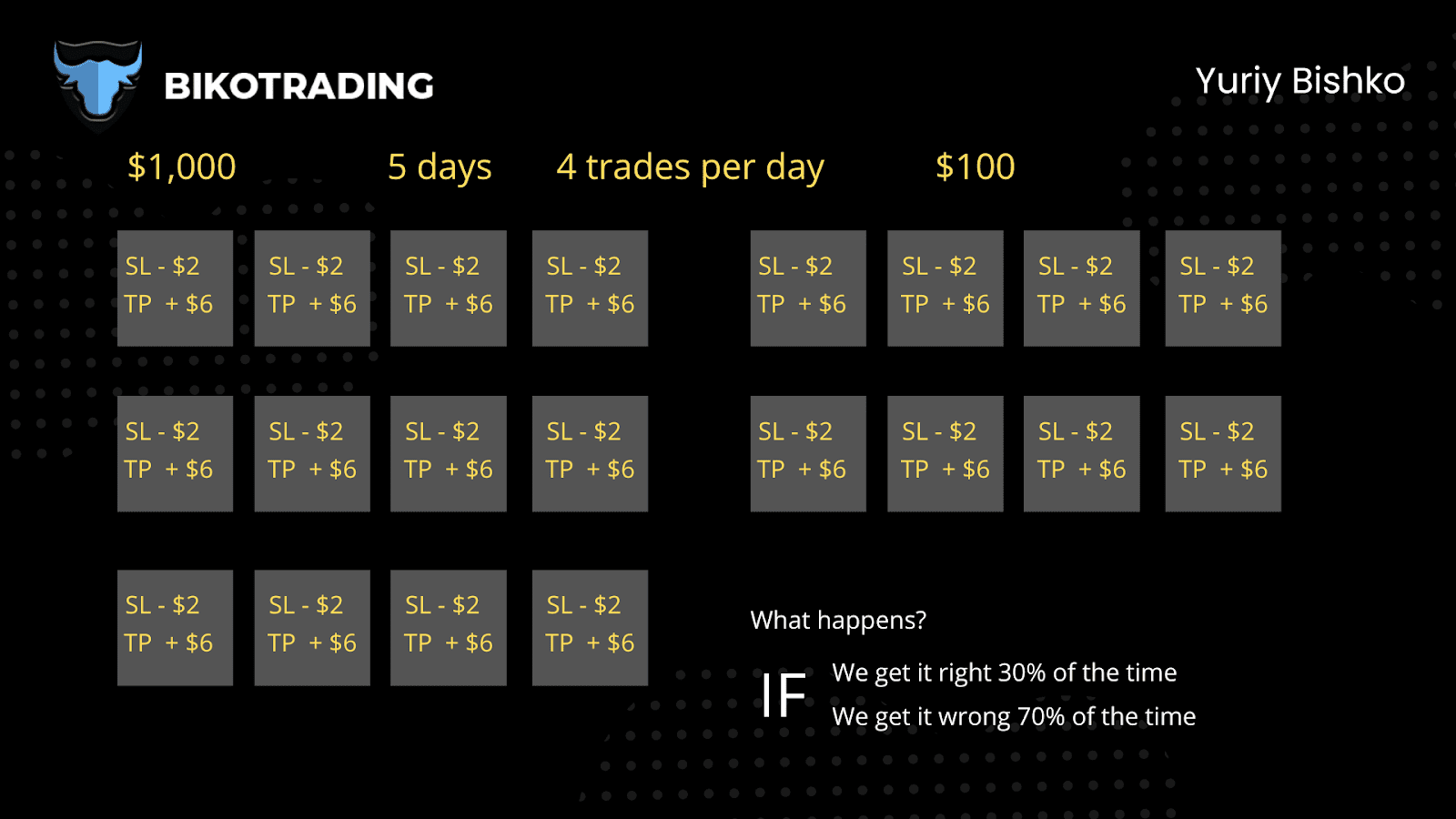

Now let's calculate your statistics and determine what will happen if only 30% of trades are successful and 70% are unprofitable.

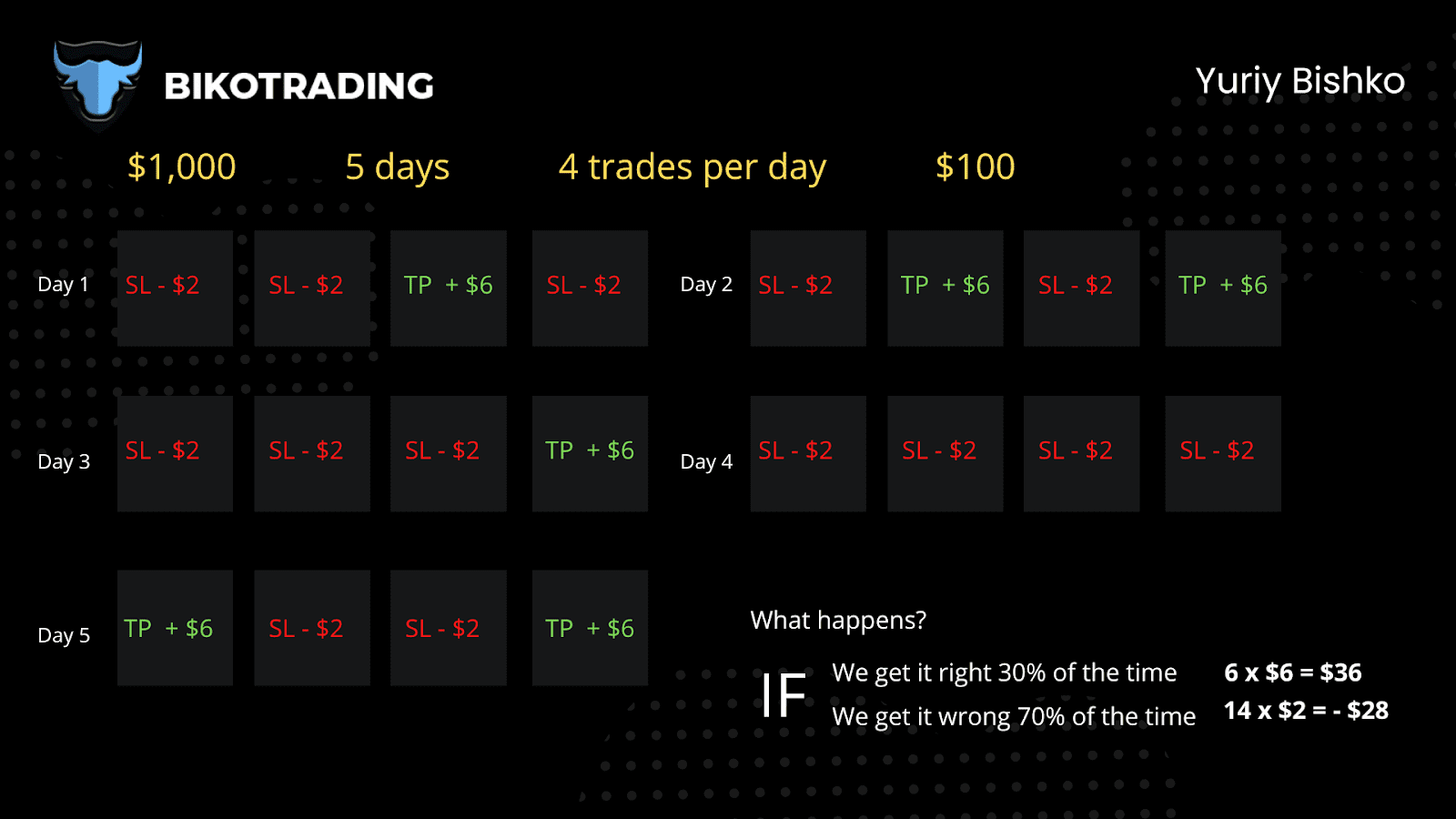

The first trading day - 1 profitable trade (+6$) and 3 losing trades (3х2$ = -6$)

The second trading day - 2 profitable trades (+12$) and 2 losing trades (2х2$ = -4$)

The third trading day - 1 profitable trade (+6$) and 3 losing trades (3х2$ = -6$)

The fourth trading day - 4 losing trades (4х2$ = -8$)

The fifth trading day - 2 profitable trades (+12$) and 2 losing trades (2х2$ = -4$)

In total, in 5 days you opened 20 trades, of which 6 trades were profitable and 14 unprofitable. Let me remind you that you get +$6 profit in the case of a successful trade and -$2 loss in the case of a failed trade.

From 6 successful trades you earned = 6 trades x $6 profit from one trade = $36 profit. Out of 14 losing trades you lost = 14 trades x $2 loss from one trade = -$28 loss.

As a result = $36 profit - $28 loss = $8 profit. That's how in 5 trading days you earned $8 of profit, in a month this result will be equal to approximately $32 of profit. Of course, this is not a large amount, but by increasing your risk per trade, your income can reach tens and hundreds of thousands of dollars. How to calculate the risk per trade, see this article. Risk management based on experience and trading style.

The next thing to focus on is risk management by trading style and experience.

By experience:

- I'm starting from scratch, I‘ve heard something about trading - if you belong to this group of people, immediately put away the thoughts and desire to trade with real money. Statistically, a trader needs 1-3 years of experience to start making serious money. If you just started trading and think that you will start earning right away, then this is a mistake that will only lead you to a complete loss of your deposit. To begin with, we recommend that you start with a demo account. Get to know the basics of trading better and the interface of the trading platform.

- I am actively learning and already know something - if you already understand the basics of trading and how to work with a trading terminal correctly, start with $100-$300. Try to double a small amount first, if you fail to increase $100, then having $1 million will not change anything. Set the risk per trading day to no more than $10.

- I have some experience and have already started earning - if you have already started earning and have positive trading statistics for several months, start gradually increasing the level of risk per trade and trading day.

- Pro - the level of risk depends only on the self-established risk management and the emotional component.

By trading style:

- Scalping is a trading style in which a trader opens a large number of trades during the day. This is a fast trade and there is almost no time to calculate the risk per trade. The scalper works with a set volume, so in this case it is worth setting a clear risk for the day. If you are a beginner, set the risk per day to no more than $10.

- Swing trading - if you use this style of trading, then in this case it will be a little easier for you to control your risk. If you're just starting out, set your daily risk at $10 and divide it between your daily number of trades. If you open 4-5 trades per day, then accordingly set $2-$2.5 risk per trade. If you are already an experienced trader, then start gradually increasing your trading risk.

- Positional trading - this trading style includes a completely individual risk management system, as you can open only a few trades per month.