What is risk per trade and how to calculate risk per trade correctly?

By Yaroslav Krasko Updated November 11, 2023

BikoTrading Academy

Risk management is the basis of trading and investment. If you do not control your own risks, then if the market or other factors change, you may lose a significant part of your equity in just one day. You can avoid this by having a profitable trading strategy and control the risk you set for a trade.

What is risk per trade?

In general, the question itself makes it clear that this is the amount or percentage of capital that you risk when opening a trade. It is very correct and conservative to use the risk per trade no more than 1% of total capital, preferably less. If you are just starting out, I recommend taking only $100 and try to double that amount.

Yes, start with just $100. If you can't increase $100, even with $1 million, nothing will change. Let's imagine our deposit = $100, in which case we take the risk on the trade 1% = $1.

Stop-loss orders on the exchange help us to establish the risk. If the price does not go in our direction, the stop-loss order will work and the trade will be closed automatically with the risk set by us, in our case it is $1.

If you take a trade with a risk-to-profit ratio of 1 to 5, then in the case of a stop-loss we will lose only $1, in the case of a take-profit we will receive $5. With a risk-to-profit ratio of 1 to 5, we may be 4 times wrong and only 1 time right, and even in this scenario we will be at no loss. If we are right at least twice out of 5 trades, then in such a scenario we will already be in a good profit.

How to correctly calculate risk per trade?

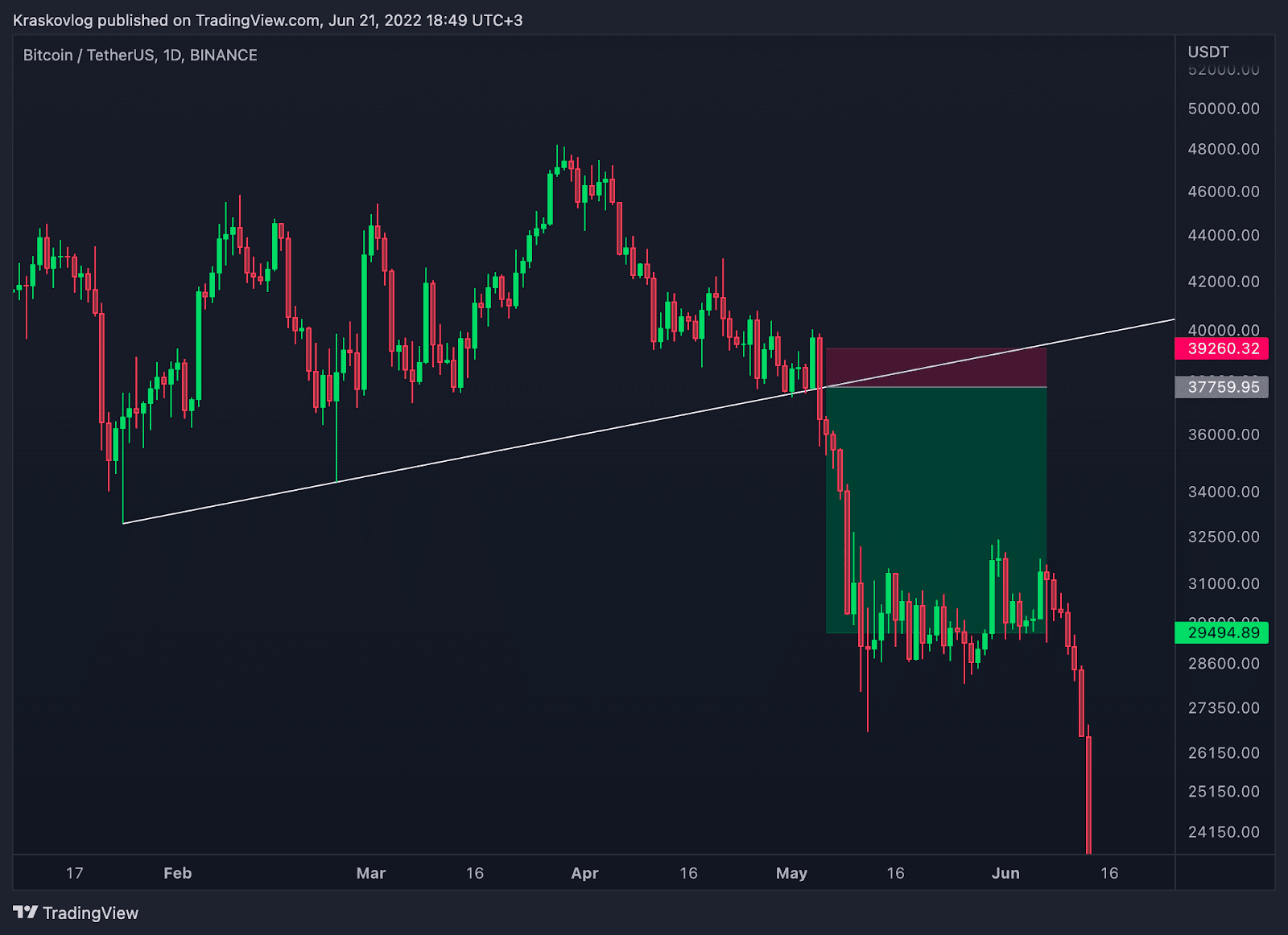

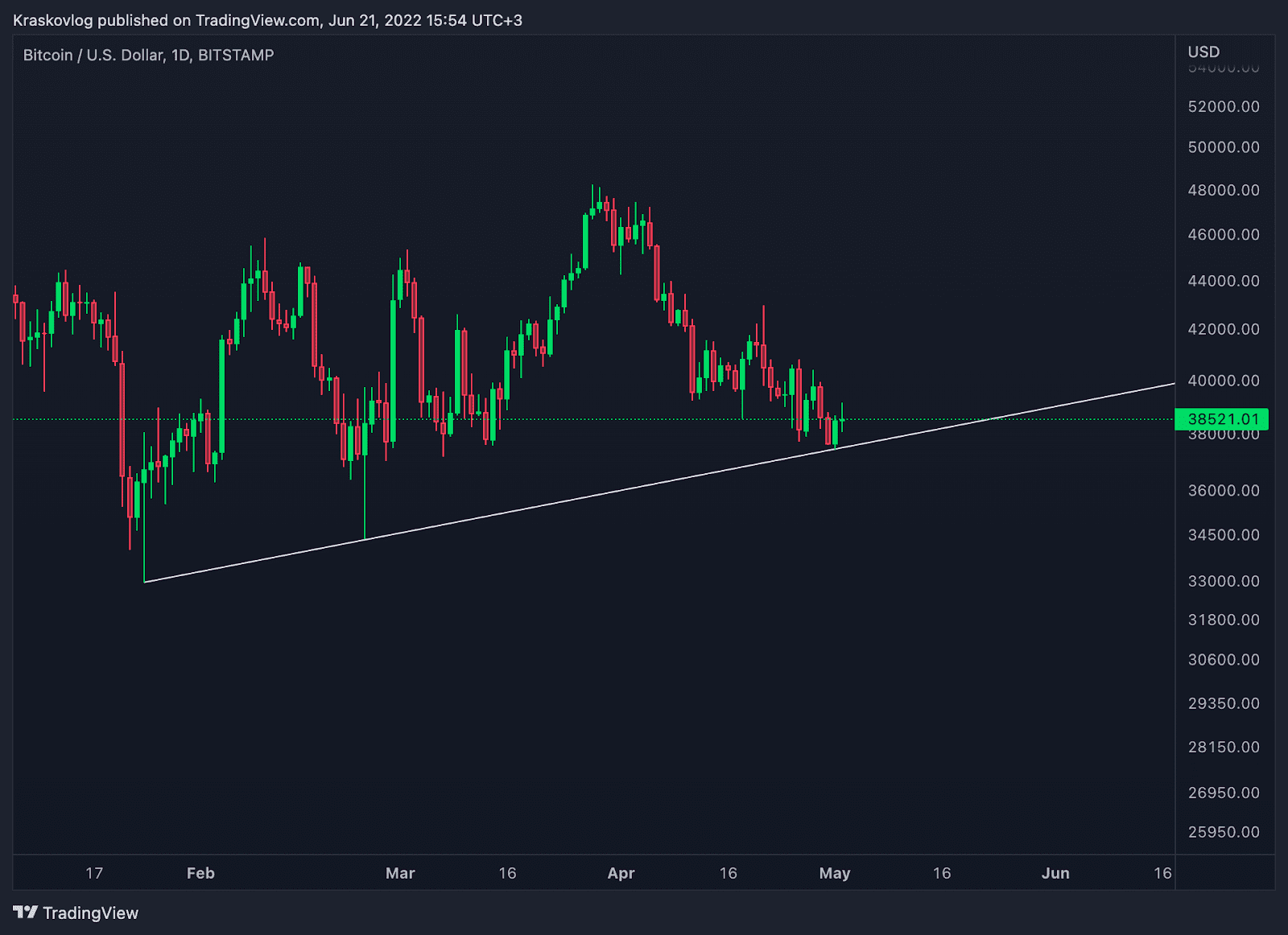

Let's look at an example, the market is in a downward trend, we found a good trading scenario, where the price has long tested the support level.

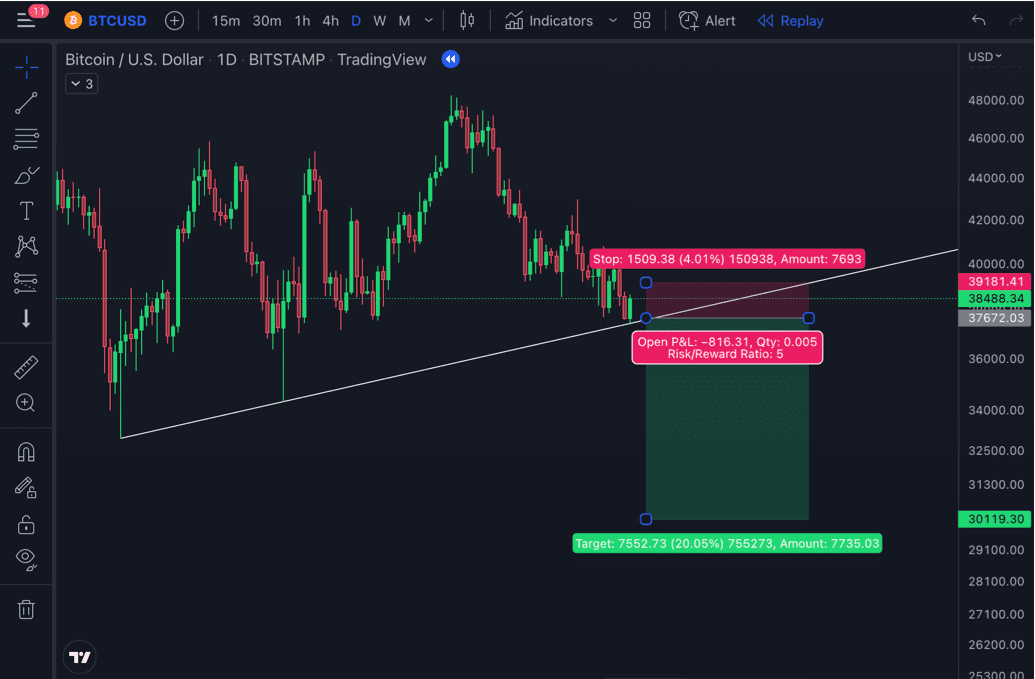

Our strategy is to open a sale order after breakout of the support level . We set a stop loss of 4% and a take profit of 20%. Risk-to-profit ratio 1 to 5. Now the question arises: "How many coins do we need to sell in order to lose only $1 in the event of a stop-loss order?"

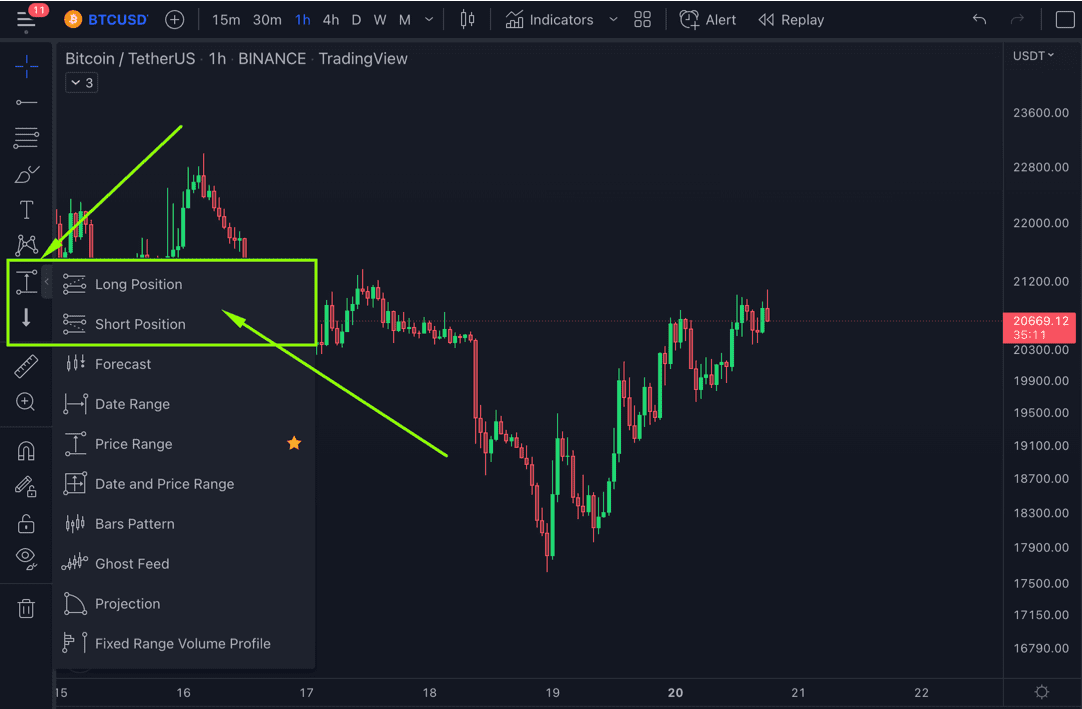

These tools on the TradingView platform will help us with this.

Choose the Short Position tool. We set it at the breakout level where we want to open our trade. The red area is the stop-loss order level, the green area is the take-profit level of the order. We set the stop-loss at 4% and take-profit at 20%.

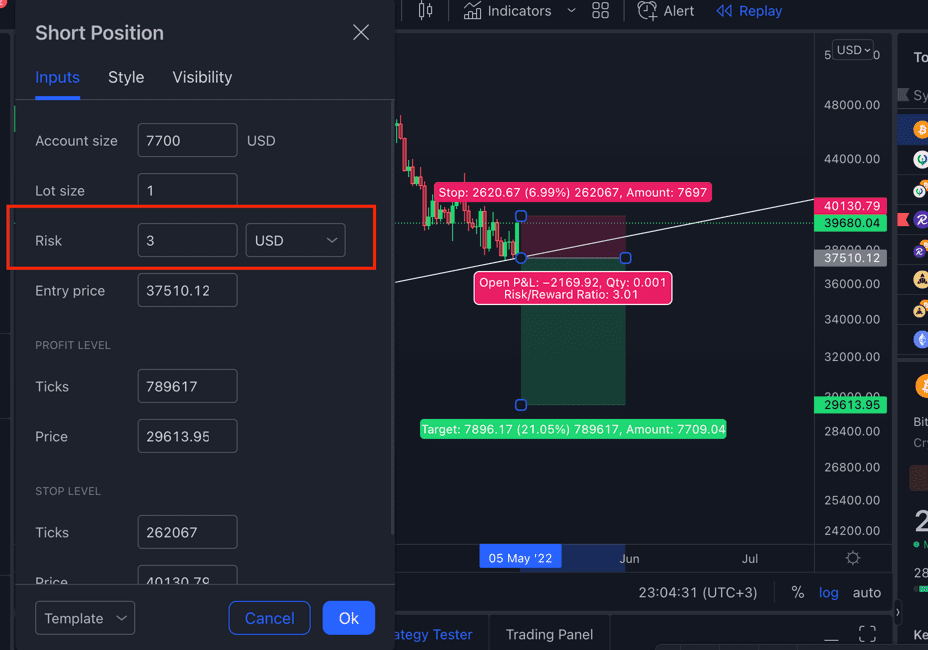

After that, double-click on our tool (Short). We will have a new window with different indicators.

We only need one line in this window, called Risk. In this field we set our risk. In our case, $1.

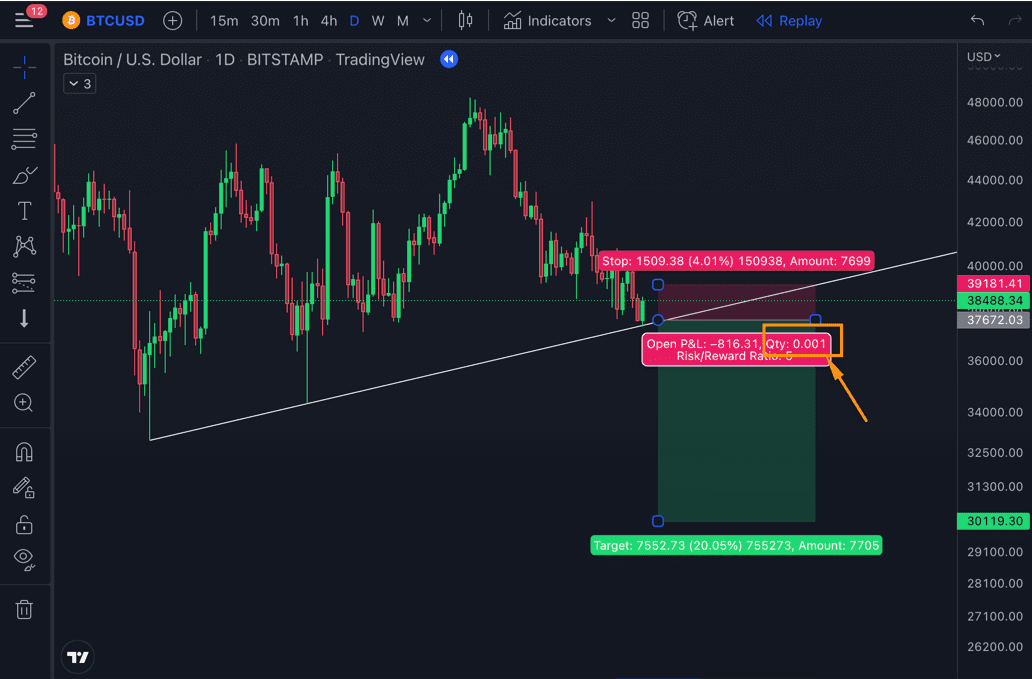

After that, the system will automatically specify the number of coins we need to open for purchase or sale. And so with any coin, this tool calculates how many coins we need to open, both for Bitcoin and Dogecoin. All you have to do is set a stop, take and risk.

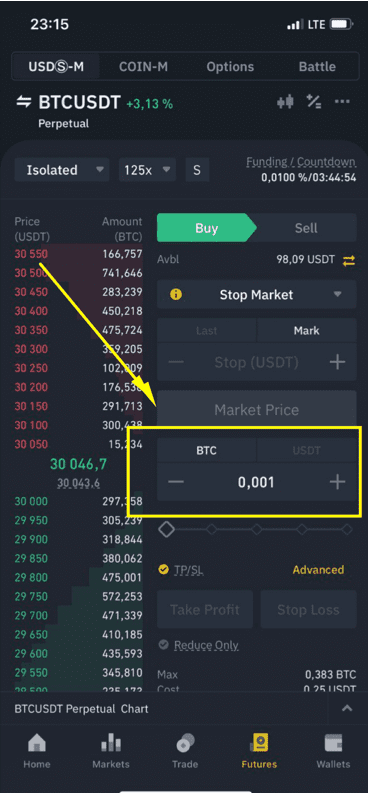

Then go to futures trading on the exchange and specify the required number of coins.

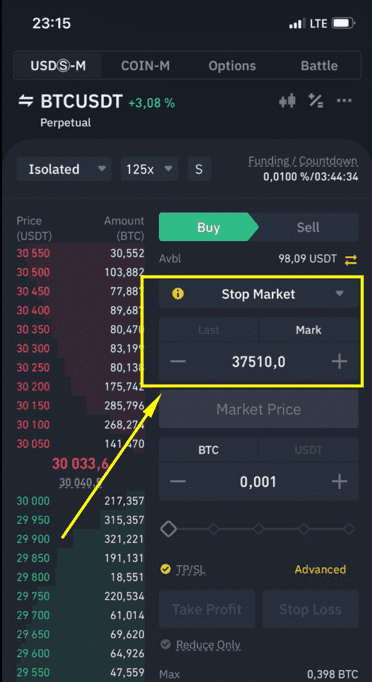

We choose the entry point and the type of order (I chose the stop-market).

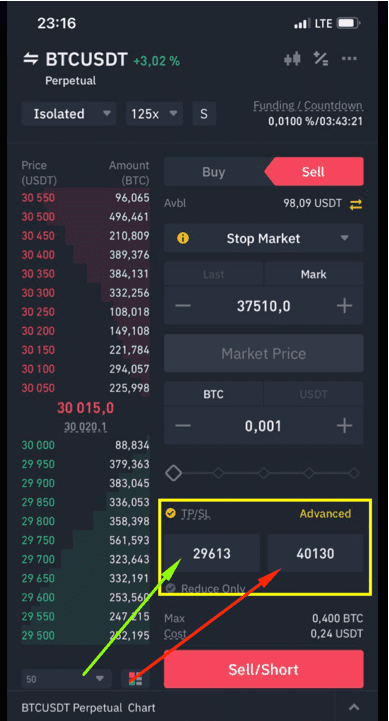

I set a take-profit and a stop loss levels.

That's all, we calculated the required number of coins and set the order on the exchange. After the buy order is triggered, stop and take orders will be automatically installed. If, after the order to open a position is triggered, the price turns around and does not go in our direction, the order to close the position will work out at the set stop loss mark and we will receive a loss of $1. If the price goes in our direction and reaches our goal, the take order will work and we will get $5 profit.