Choose your trading style. Scalping, swing or position trading

By Yuriy Bishko Updated November 11, 2022

BikoTrading Academy

Every trader, like any other person, begins his studies at school, where the results of training should choose their specialty: economist, restaurateur, chemist or football player. There are also different specialties in trading, they are called trading styles. This article will help you understand what they are and what style is right for you to trade crypto.

KEY TAKEAWAYS:

- What are the trading styles?

- What are the differences between trading styles

- Is it possible to combine trading styles?

- What is the most profitable trading style?

- How to choose your trading style?

What are the trading styles?

Let’s consider 3 main trading styles or types of trading:

Scalping

Probably the most famous type of trading. It is based on active trading. Active means constant viewing of schedules and searching for opportunities to open a deal.

Scalpers open the shortest transactions for 5 min-1 hour and can earn even with minimal price fluctuations up or down.

The scalper can be compared to a Formula 1 driver. The route is a schedule, and the driver is a trader. Imagine that you are driving a car at a speed of about 250 km/h. Each turn on the track is like a separate scalper trade, where you need to make a quick decision (open a trade), make a turn around the opponent and close the trade. In racing it is important to continue going on the highway and wait for the next opportunity to successfully bypass someone on the turn, and in scalping this means to make a profit.

Swing trading

Swing traders can be compared to snipers who are waiting for the opportunity to make a "shot" and open the best trade. If scalpers pay attention to even minimal price fluctuations, such as 1-2%, then swing traders expect a more global movement of 5-20%. Swing traders can keep the trade from 1 hour to 2-4 days.

A swing trader, like a sniper, can wait a few days or a week to get a better trade and make his "shot", taking a good profit from rising prices. If you are interested in swing trading, start with these lessons.

Position traders

Position traders are focused on opening long-term trades. A feature of position trading is a long time waiting for a better deal with maximum profit. Conventionally speaking, position traders open trades before the largest price movement (50-100%) up or down.

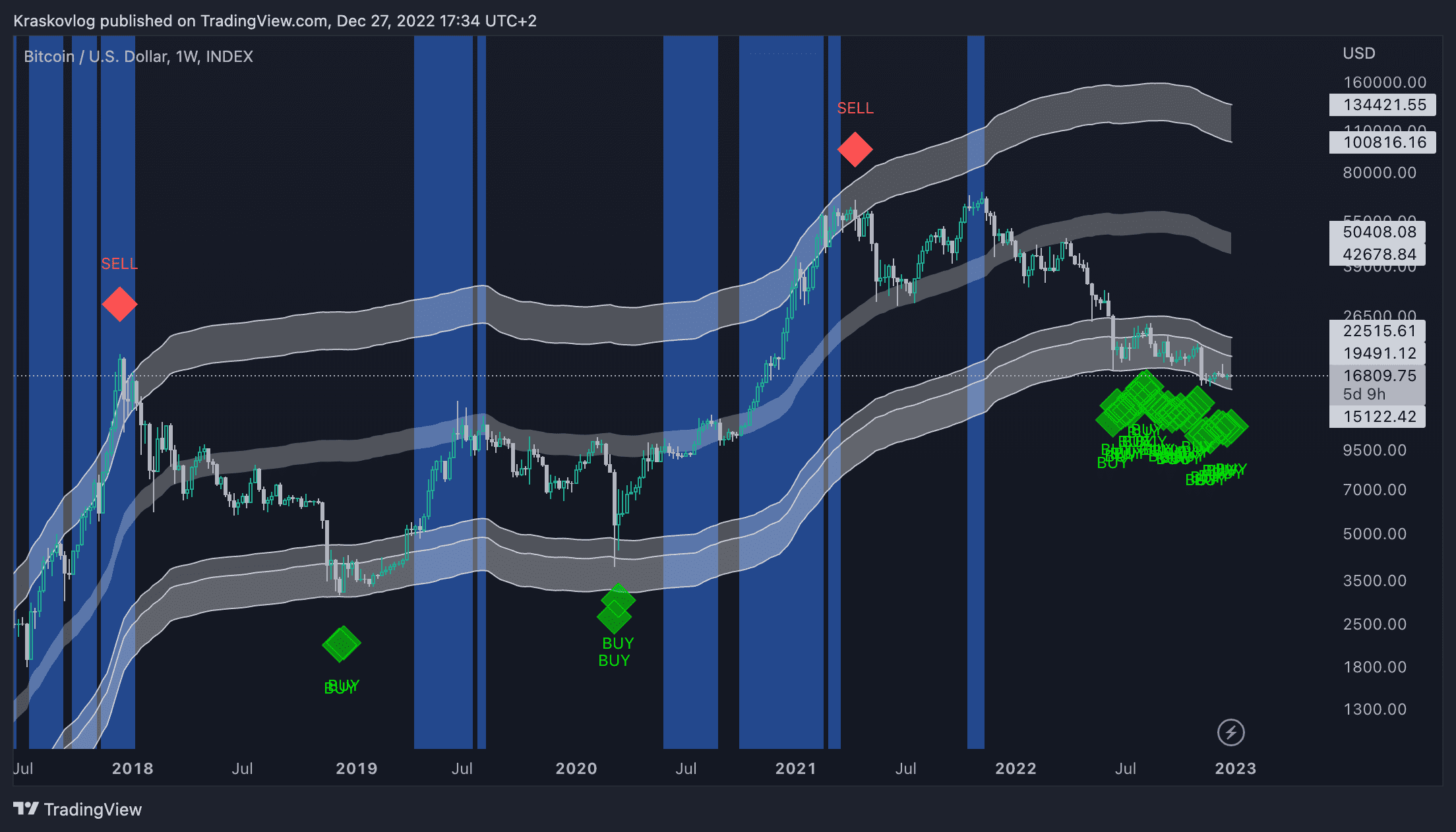

For example, Bitcoin has a minimum price, where they buy crypto at the cheapest price and try to sell as close as possible to the maximum. You can learn more about position trading in the article on the Greenwich indicator.

What are the differences between trading styles?

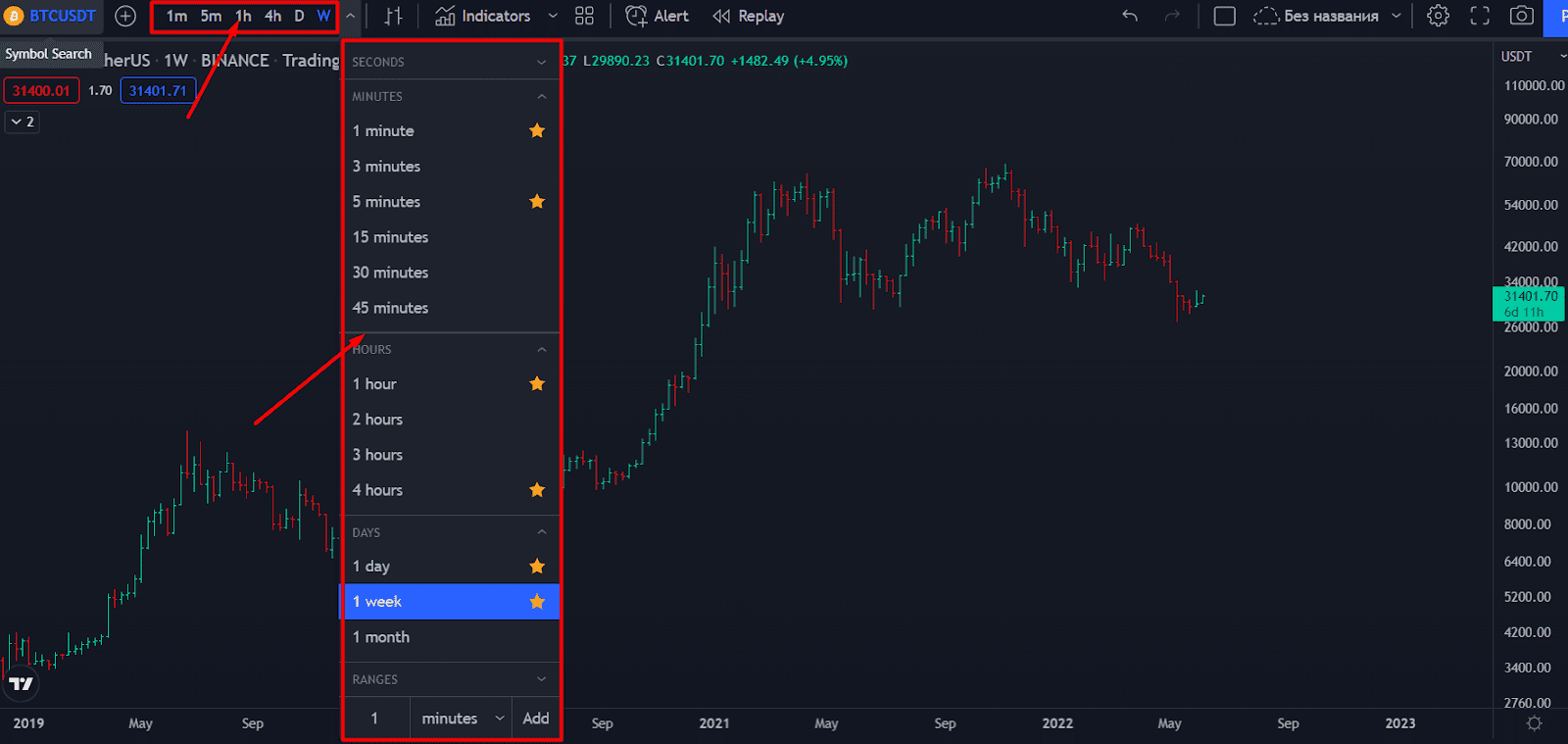

The main difference between these styles is the trading periods used by traders. Trading periods (timeframes) is the period of time in which trading takes place. They are different: from 1 second to 1 hour and 1 month and are displayed on the price chart in the form of candles or bars.

The timeframe can be selected on TradingView by switching between them. There is a separate panel in the upper left corner of the screen.

To make it easier to explain what a timeframe is, I will give the following example. If you look at a usual clock, there is an arrow that corresponds to seconds, minutes and hours. The same goes for the price chart. You can choose to display the price for 1 minute, 1 hour, 1 day, etc. That is, 1 candle/bar will be equal to 1 minute, 60 candles for 1 minute will display 1 hour, and 24 candles for 1 hour will reflect 1 day.

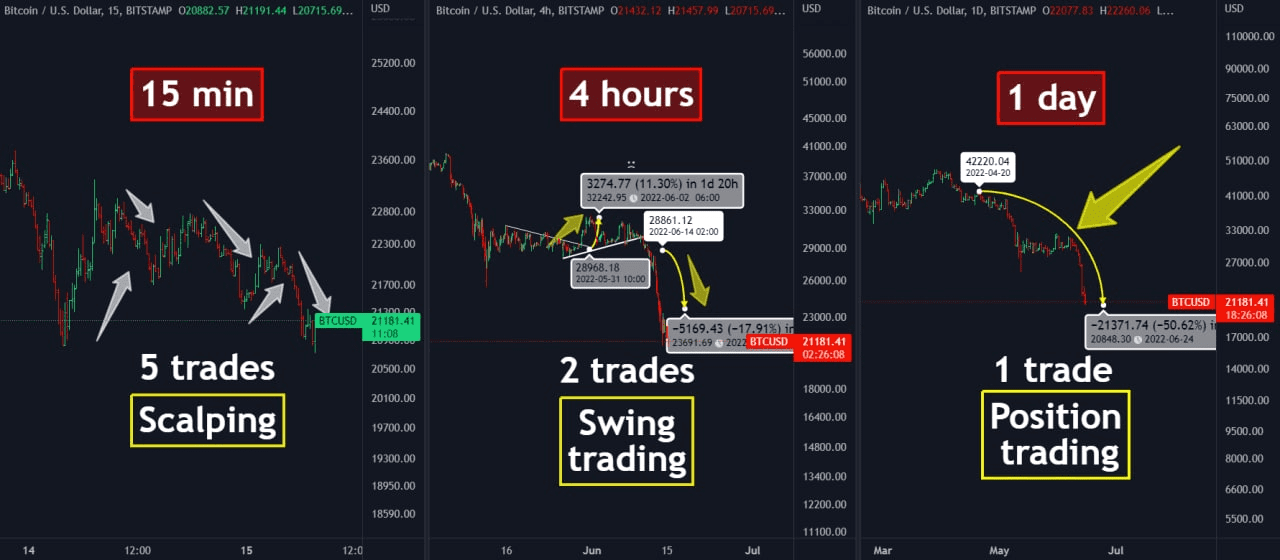

To make it clearer, look at the picture below. May 30, the beginning of the week, is marked with a white line on each chart. In 7 days from the white line, each trader could make a different number of trades:

1. a scalper – 5 trades. For a scalper, 7 days is a good time and using small trading periods (1 min, 5 min, 15 min) They can make more trades. Quick local trades.

2. a swing trader – 2 trades. The swing trader, as a sniper, managed to make 2 accurate "shots" in the same 7 days, but for a longer trading period – 4 hours.

3. a position trader – 1 trade, which was opened 1 month ago when using the trading period of 1 day. For a position trader, 1 week is almost nothing you can see in the picture.

Is it possible to combine trading styles?

Knowing different types of trading is like having 3 different cars: Mini Cooper for the city, Toyota Land Cruiser for off-road and BMW 320, when you want to drive through the night city at speed.

When you know how scalpers, swing and position traders trade – it expands your opportunity in trading and increases the number of profitable trades. In general, you need to know one of the types of trading very well, and use other styles as additional confirmation and, accordingly, have more successful trades.

What is the most profitable trading style?

This is both an easy and a difficult question. For 1 trade a position trader can earn such a profit that scalpers and swing traders earn 3-4 months, but as mentioned earlier in the article, each type of trading has its own characteristics. Scalpers can open trades even when the price falls and rises by 1-2%, while a position trader can wait for a trade for 1 month until the price starts to rise by 20-100%.

Swing trading is something in between these two styles, when you have 1-2 hours of free time a day and are able to open trades more often than a position trader (3-4 trades/week).

The most decisive factor in profitability is the skillfulness of the beginner and the desire to learn, so in most cases it all depends on the trader, how and with whom he learned.

How to choose your trading style?

First, you need to understand how much time you can take for trading and how often you can check the schedule for opportunities to open a trade. Conventionally, if Bitcoin starts to grow by 5%, and you missed the entry into the trade, then the next opportunity may take 1-2 days, and maybe 3-4 weeks, if it is position trading.

For example, a green signal is a signal for a long-term purchase of crypto (1-2 years), and a red signal for a sale using a weekly timeframe (1 candle = 1 week). If you miss the buy signal, you can only get the next signal in 2-3 years.

Secondly, to understand your peculiarities and ask yourself: "Is it comfortable for me to open 3-4 trades in a day?". Here we are talking about the psychology of each trader, with the rest, which is why different types of trading have emerged. One trader is very diligent and can open 5-6 trades a day and he is suitable for scalping, and another trader can manage 3-4 trades a week and do their business while making a profit from the rise or fall of the crypto.

It is important for a beginner to try all styles to choose the one that suits him best, spend 1-2 weeks to understand himself as a trader, open more small trades to feel the price movement, switch between timeframes, draw trading patterns, support or resistance levels.

This learning process can be compared to the first time driving – you need to understand how to turn on the speed, turn the steering wheel and start to "feel" the car, and already having passed the license, choose the car or in our case, the style of trade that suits you best.