Why Binance Futures are banned in many countries. Where to trade BTC futures?

By Yuriy Bishko Updated February 29, 2024

BikoTrading Academy

Cryptocurrency traders have witnessed significant growth and interest in Bitcoin (BTC) futures trading, which allows them to speculate on the future price movements of the leading cryptocurrency. However, recent developments have led to the ban of Binance Futures, one of the prominent platforms for trading BTC futures, in several countries. Binance shutting down futures has raised concerns among crypto traders. In this article, we will shed light on the reasons behind the Binance closing futures and provide information on alternative platforms for trading in Europe where traders can continue to trade Bitcoin futures and cryptocurrencies.

KEY ISSUES:

Why are Binance Futures banned?

The ban on Binance Futures in various countries can be attributed to several factors. One primary reason is the concerns raised by financial regulatory authorities, such as the Financial Conduct Authority in the United Kingdom, as well as authorities in Austria, Germany, and other nations. These authorities expressed concerns about Binance Futures offering high leverage, which led to substantial losses for inexperienced traders. The authorities sought to protect investors and maintain market integrity by implementing bans on the platform.

Regulatory concerns

The ban on Binance Futures in the UK and Germany can be attributed to regulatory concerns. Financial regulatory authorities in these countries have raised concerns regarding Binance's compliance with local laws and regulations, particularly in terms of AML and KYC requirements. The authorities aim to protect investors and maintain the integrity of the financial system by ensuring that cryptocurrency exchanges adhere to the necessary regulatory standards.

Lack of licensing

Binance Futures may have faced regulatory challenges due to the absence of proper licenses to operate in the UK and Germany. Regulatory frameworks for cryptocurrency exchanges vary across different jurisdictions, and exchanges are often required to obtain licenses or approvals to offer their services to residents of a specific country. Failure to acquire the necessary licenses can result in bans or restrictions on their operations.

Investor protection concerns

Financial authorities in some countries are concerned about protecting investors from potential risks associated with cryptocurrency trading. The high volatility of cryptocurrencies, including Bitcoin, coupled with the leverage offered in futures trading, can expose investors to significant losses. Regulators may perceive these risks as detrimental to their citizens and therefore restrict or ban platforms that provide such trading instruments.

Where to trade BTC futures?

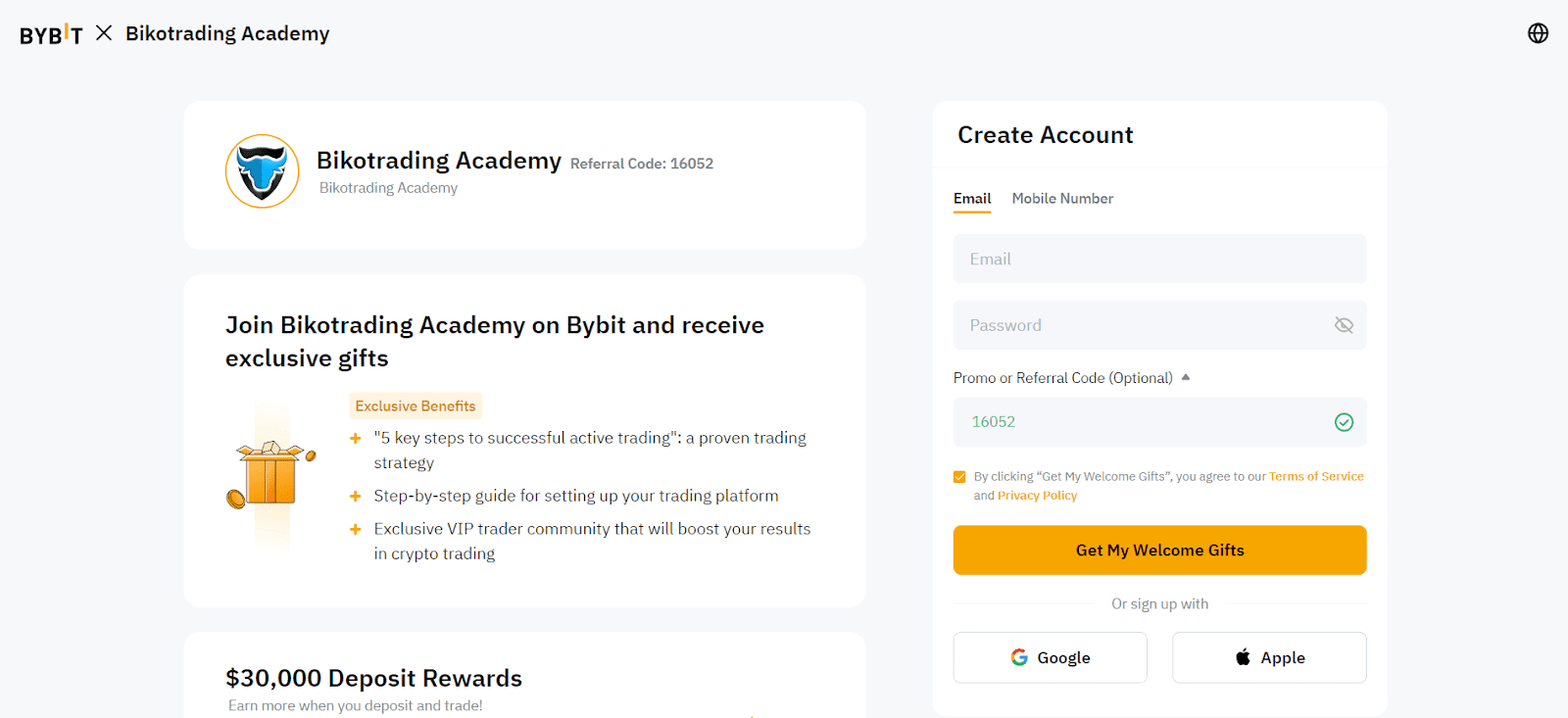

We highly recommend you to use the exchange that we use with my team. Bybit stands out as a reputable and widely used exchange for Bitcoin futures and crypto trading. Its high trading volume, diverse range of instruments, user-friendly software, and robust security measures make it a great choice for traders seeking a reliable platform.

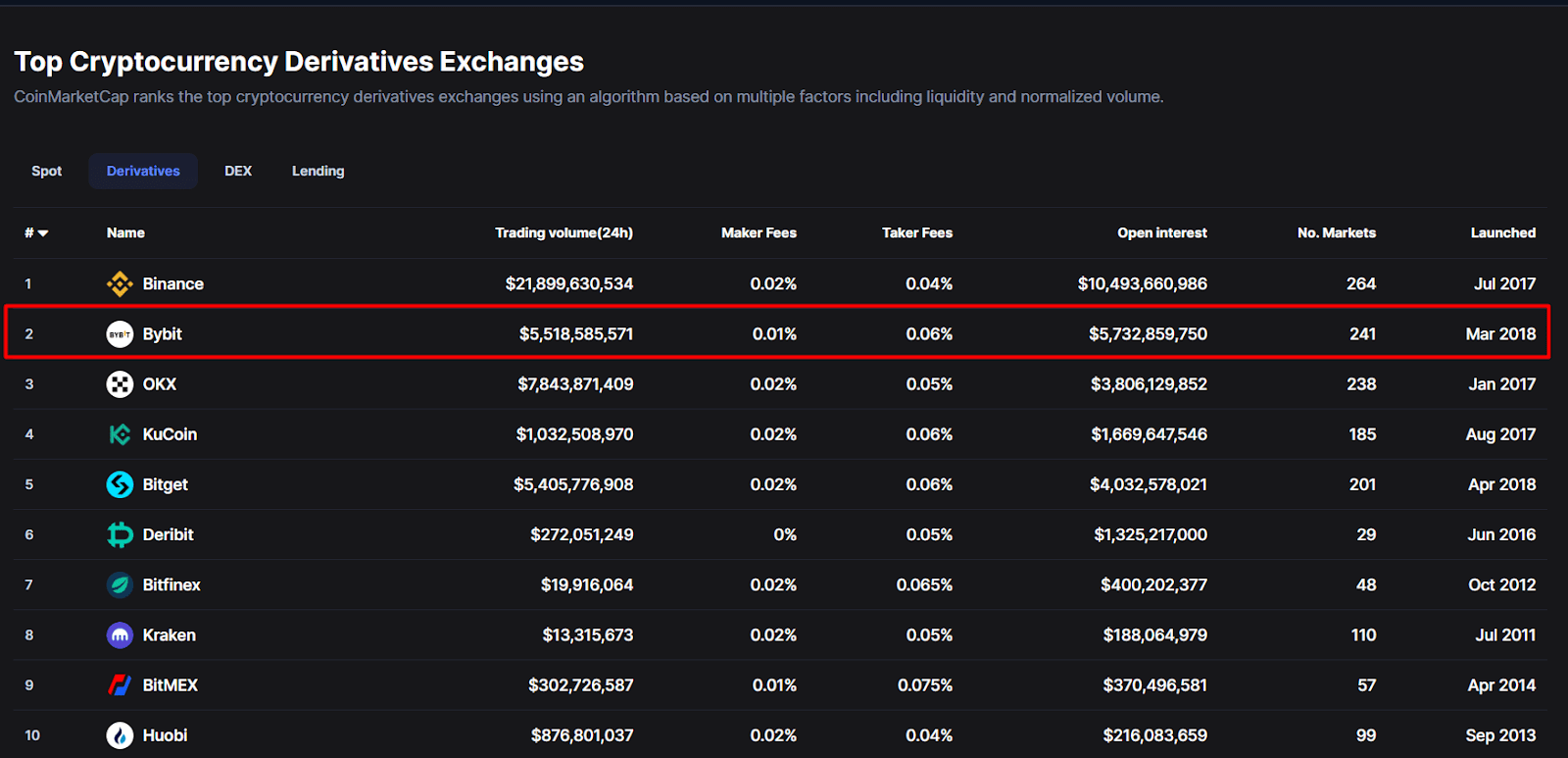

- The exchange ranks prominently in the derivatives market, holding one of the leading position according to CoinMarketCap. Its high liquidity ensures efficient order execution and minimizes slippage.

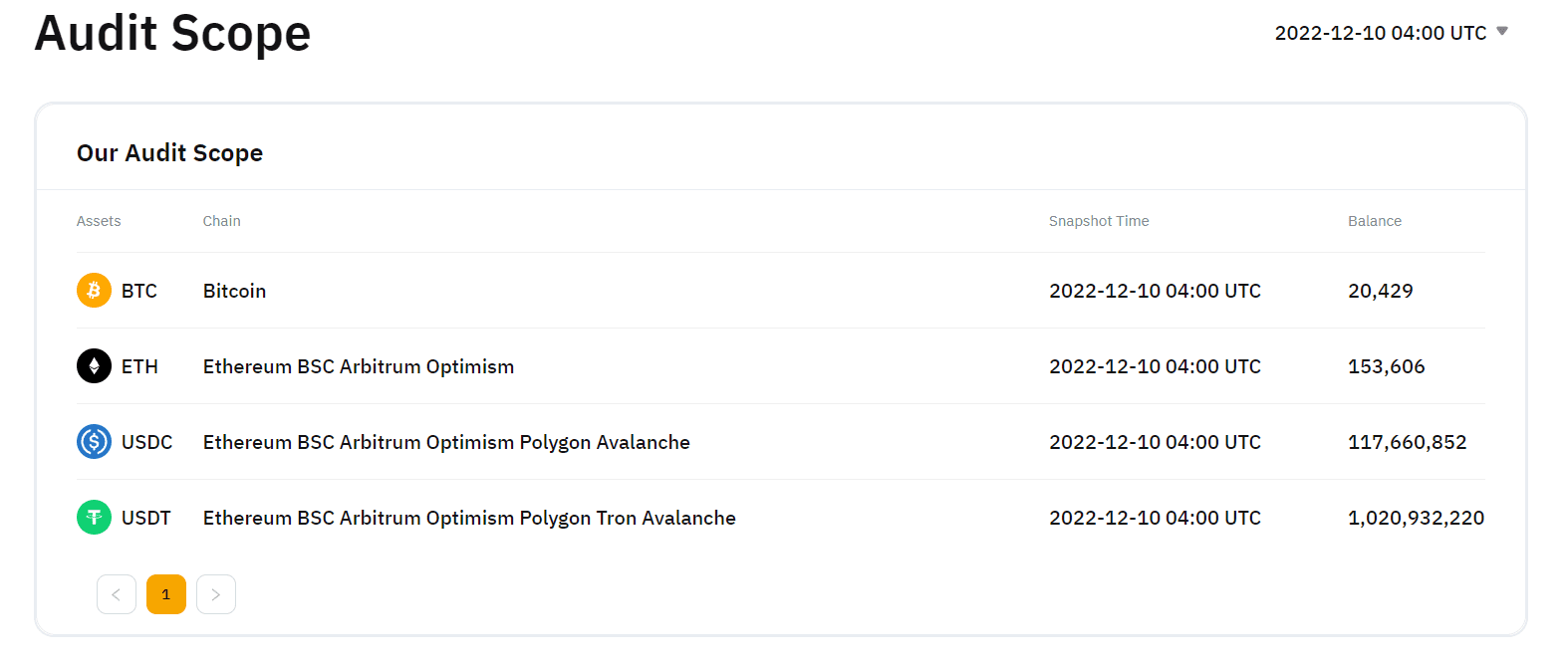

- ByBit maintains a transparent approach to its operations, providing users with visibility into its financial reserves. The exchange publishes data on its reserves, revealing that more than 50% consists of USDT and USDC stablecoins, with the remaining portion held in reputable cryptocurrencies such as BTC and ETH.

- ByBit presents traders with a wide range of opportunities to engage in the cryptocurrency market. In addition to futures trading, ByBit offers services such as P2P trading, a launchpad for new projects, an NFT marketplace, deposits, cryptocurrency conversion, integration with MetaTrader 4, trading bots, and copy trading. This comprehensive suite of options allows users to explore and capitalize on diverse investment avenues.

- ByBit features a fee structure ranging from 0.01% to 0.06%, ensuring competitive pricing for traders. The exchange also offers zero fees for deposits, withdrawals, and various P2P transactions, reducing costs for users. ByBit prioritizes security by employing SSL encryption, anti-phishing measures, and two-factor authentication. Optional cold wallets further enhance the protection of user funds.

And one more important thing is that you can connect your ByBit account to ATAS and view DOM and Footprint indicators based on the exchange's data. By the way, only Binance and ByBit can be connected to ATAS, which is why we chose this exchange with this fact in mind.

Conclusion

ByBit is a reliable and user-friendly platform for cryptocurrency traders, offering high liquidity, transparency, a diverse range of opportunities, accessibility, competitive fees, and robust security measures. As bans on Binance Futures affect traders in multiple countries, ByBit serves as a practical solution for those seeking to engage in futures trading and other cryptocurrency-related activities. Remember to conduct thorough research, evaluate the security measures, fees, trading options, and regulatory compliance of any platform before engaging in BTC futures trading.