ATAS VS TIGER VS CSCALP

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

For crypto traders seeking the optimal platform for trading and scalping, the choice between ATAS, Cscalp, and Tiger Trade can be crucial. In our comparison, we draw insights about all three platforms, providing an experiential perspective on the strengths and limitations of each. The analysis covers crucial aspects such as charting capabilities, footprint functionality, Depth of Market (DOM), additional indicators, processor performance, and hotkeys.

KEY ISSUES:

General overview of platforms used for crypto trading

ATAS is a comprehensive trading and analytical platform designed for professional traders. It offers a range of tools and features to analyze market dynamics, identify trading opportunities, and execute orders efficiently. ATAS provides advanced charting capabilities, order flow analysis, and a variety of technical indicators.

If you are looking for a universal platform to trade, Tiger Trade is a user-friendly trading platform for both beginners and experienced traders. It focuses on simplicity and accessibility, making it an attractive option for those new to crypto trading. Its footprint functionality, providing historical data, sets it apart from others. Join through our referral link with the Bikotrading team to receive a complimentary terminal. Also, enjoy a substantial 25% cashback on fees, making every trade on Tiger.Trade even more rewarding. Tiger.Trade serves not only as a trading platform but also as a hassle-free space for technical analysis. Get a 50% off license on Tiger Trade with our unique promo code biko24, and receive exclusive bonuses from the Bikotrading team.

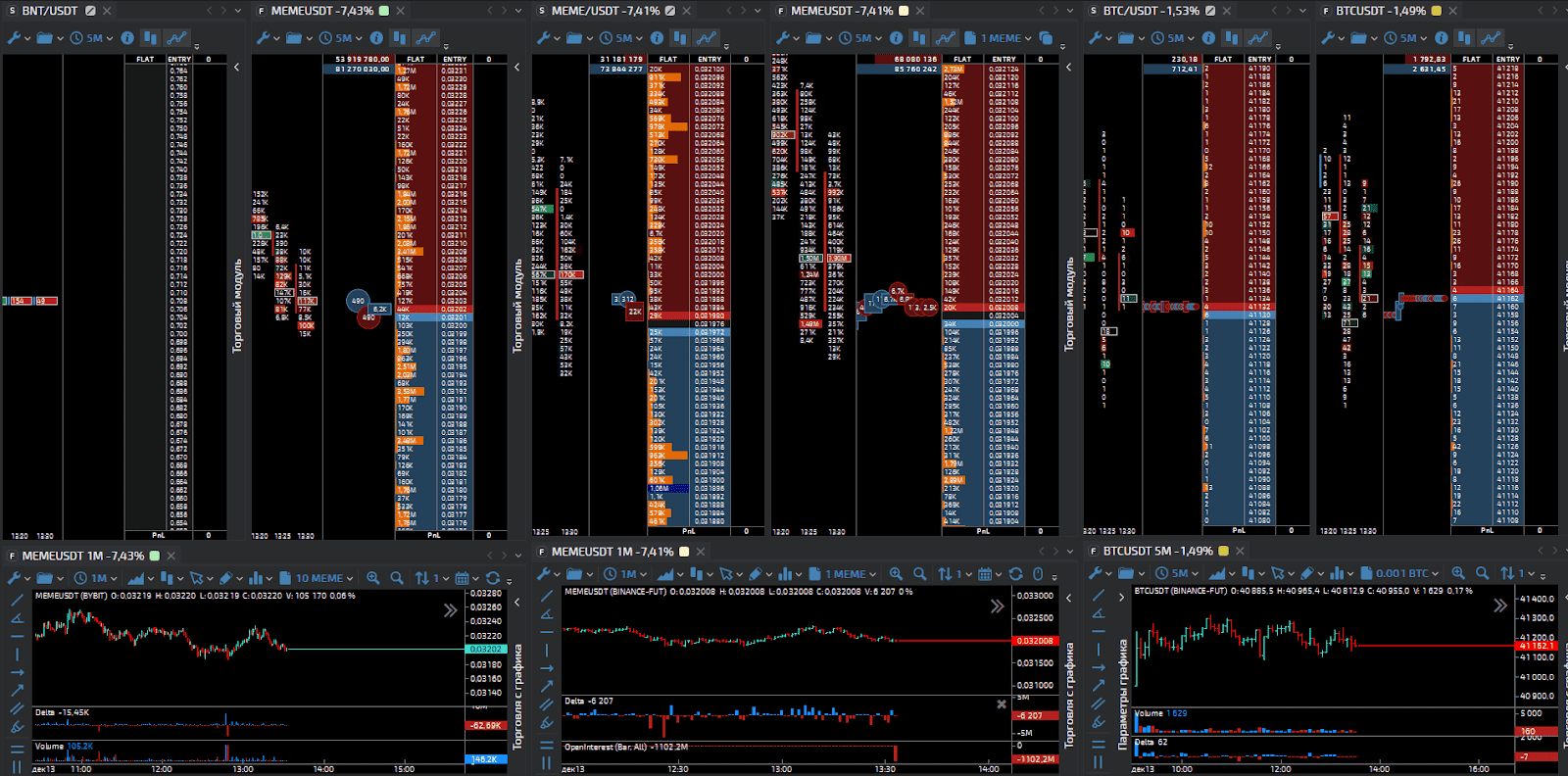

Cscalp is a trading platform known for its simplicity and efficiency. It is designed for day traders and scalpers who require quick and responsive tools for executing trades. Cscalp focuses on speed and minimalism.

Charting capabilities

One of the fundamental aspects crucial for crypto traders is the ability to analyze charts effectively.

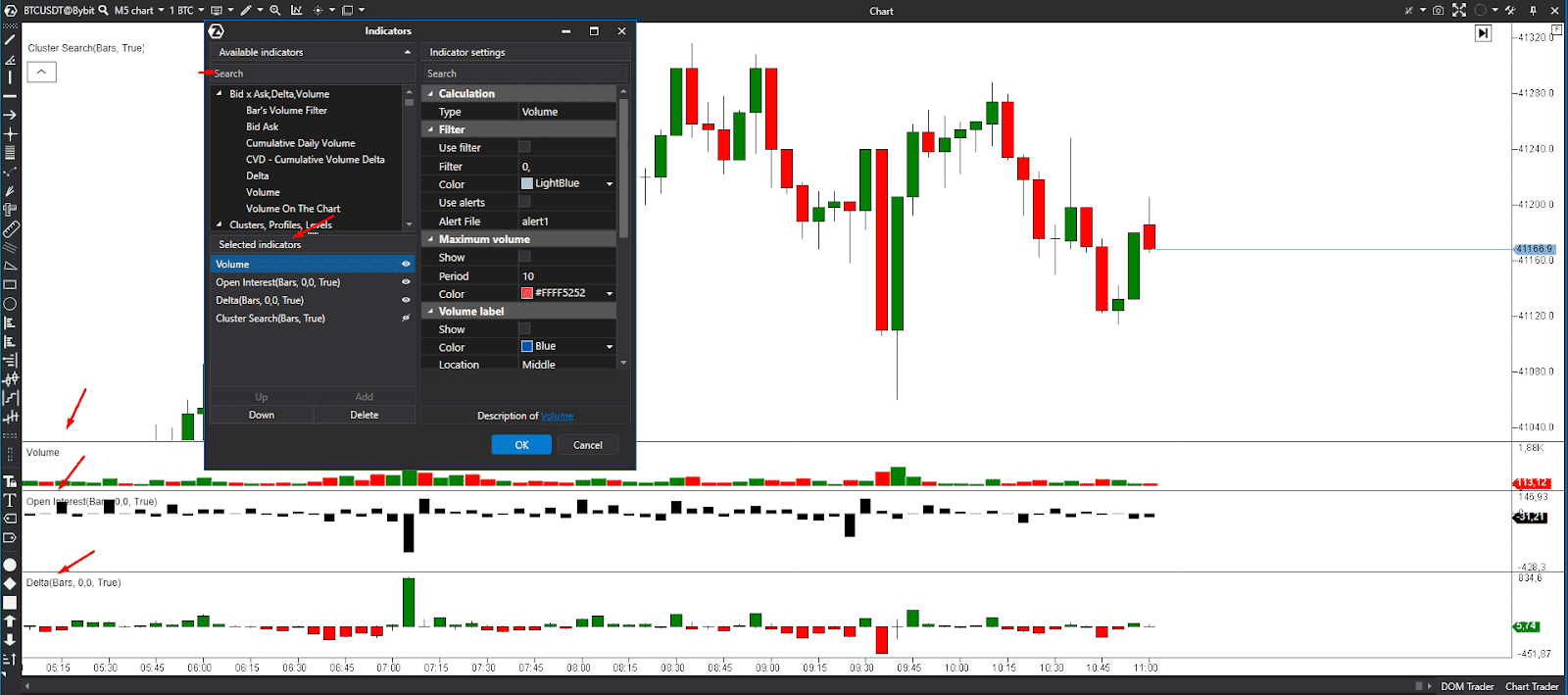

The ATAS online application stands out as the platform with the most advanced charting capabilities according to the user. It provides a comprehensive suite of tools for in-depth technical analysis. Traders can use many features such as the ability to add alerts on specific levels, draw trend lines, and rectangles, and employ various technical indicators. With ATAS order flow trading features, traders can improve their strategies and get better results.

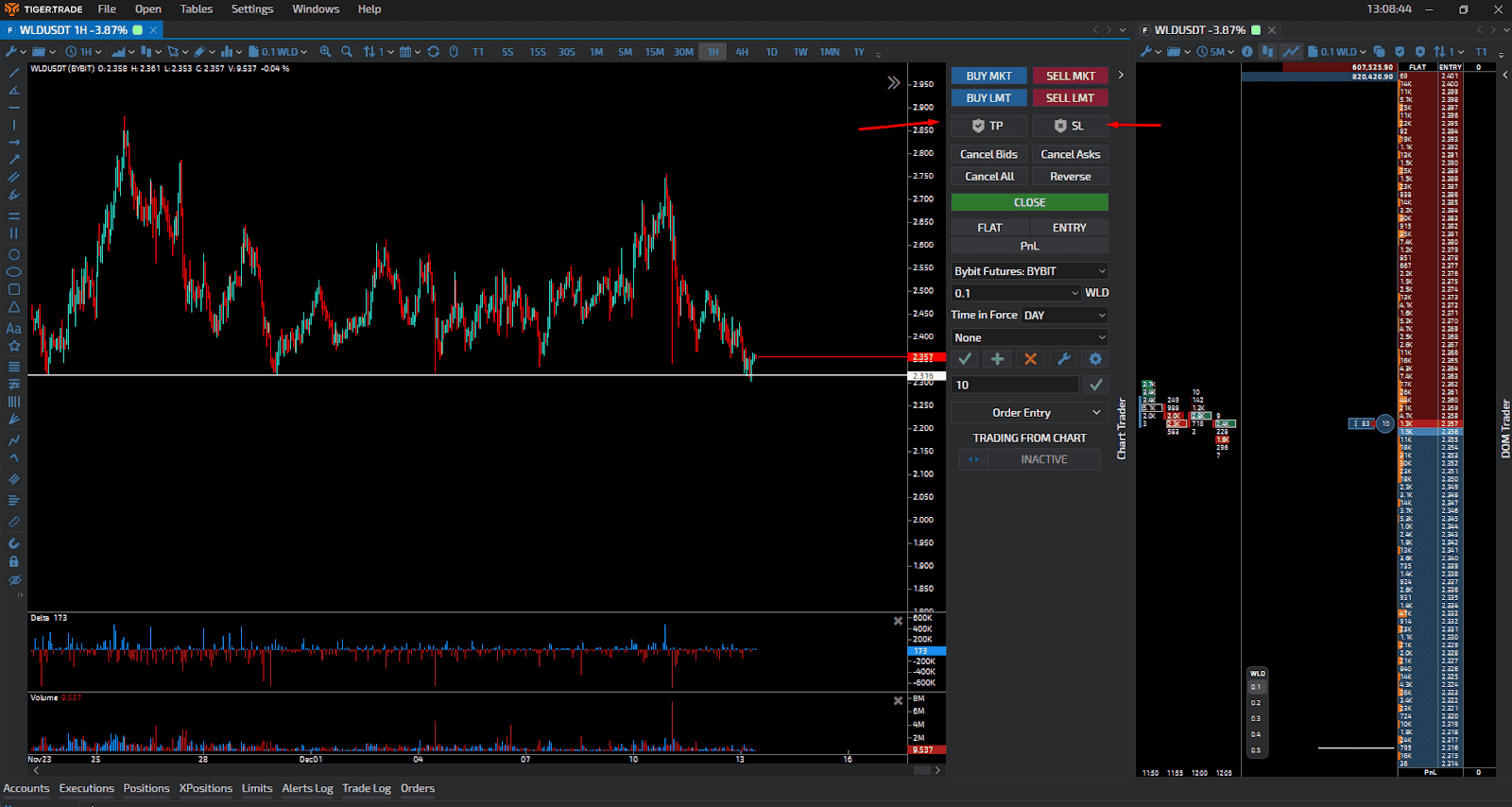

Tiger Trade offers a user-friendly charting interface. On Tiger Trade charts traders can choose data periods and utilize various drawing tools, allowing for a more tailored approach to technical analysis. For example, to put stop loss in Tiger Trade, simply navigate to the order entry screen, select the desired asset, and enter your stop loss price alongside your trading parameters.

Cscalp is described as having limited charting capabilities. There are only a few tools available for building levels or conducting technical analysis. In the example given, focusing on a BTC chart, Cscalp lacks the versatility found in other platforms, particularly in terms of drawing tools and customization options.

Learn more about these platforms in our video

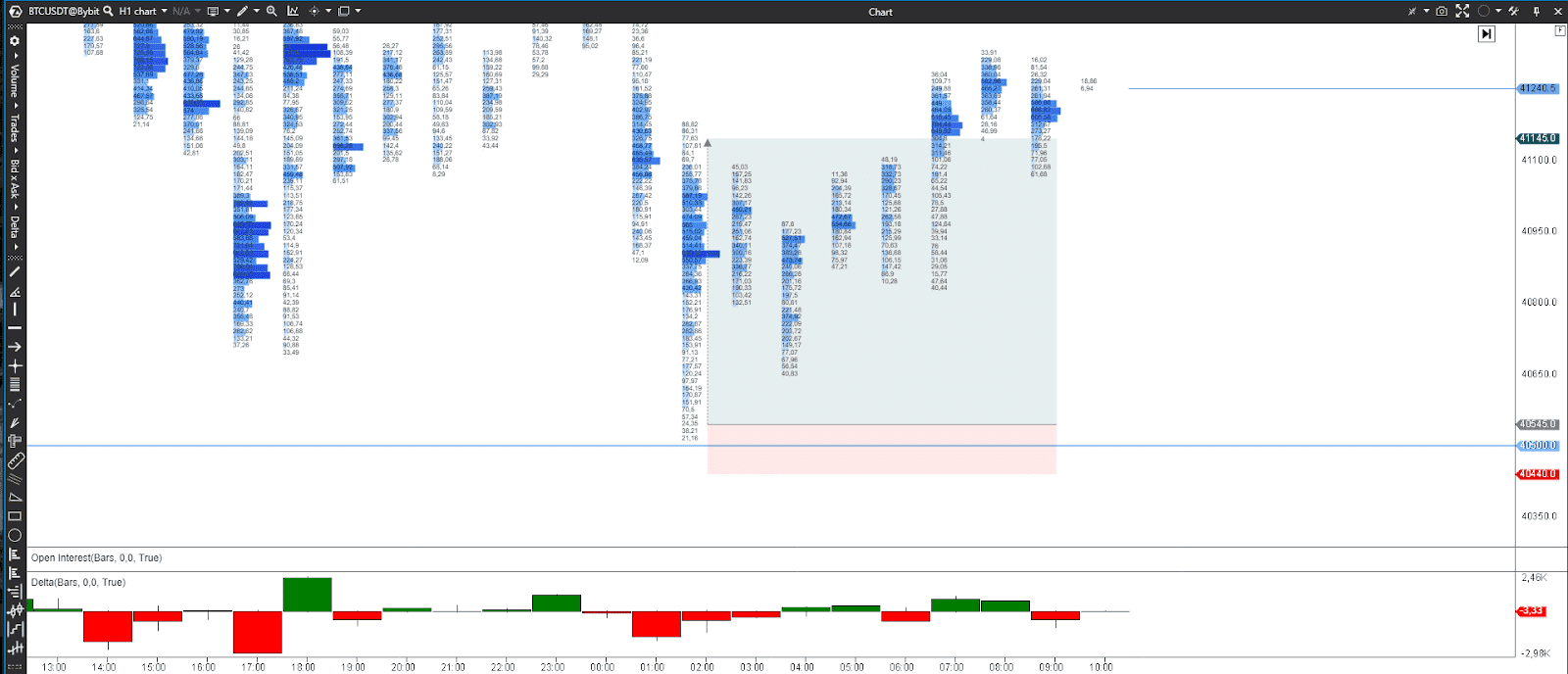

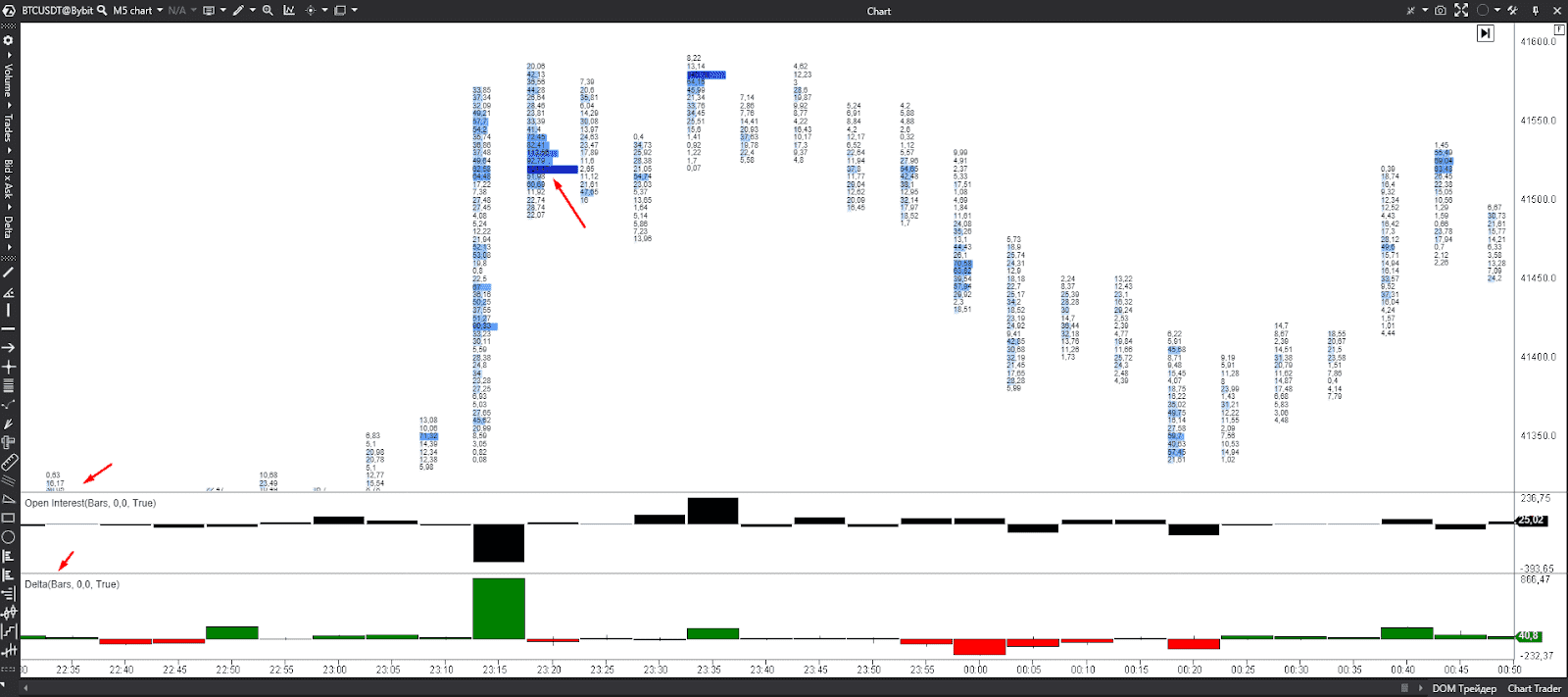

Footprint functionality

Footprint analysis is a critical aspect of trading, providing insights into market dynamics and order flow.

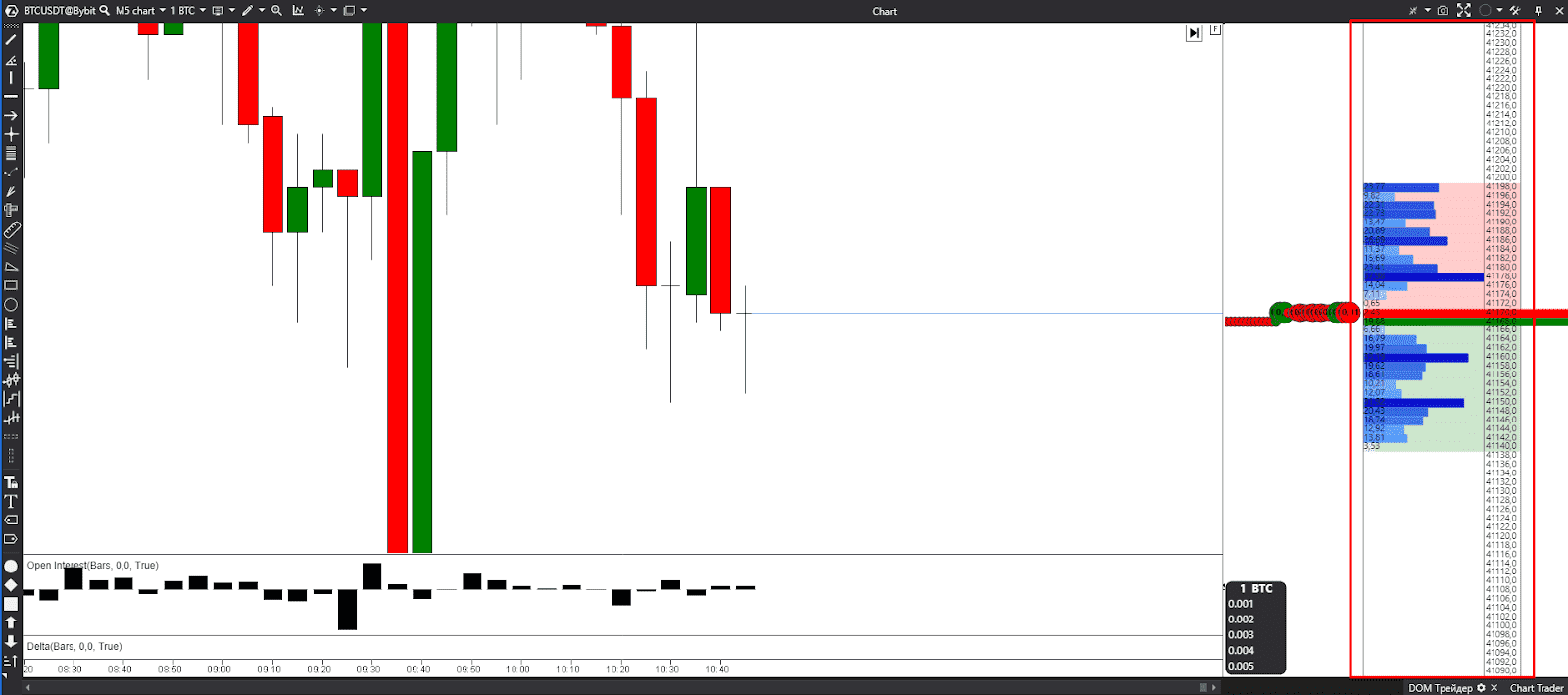

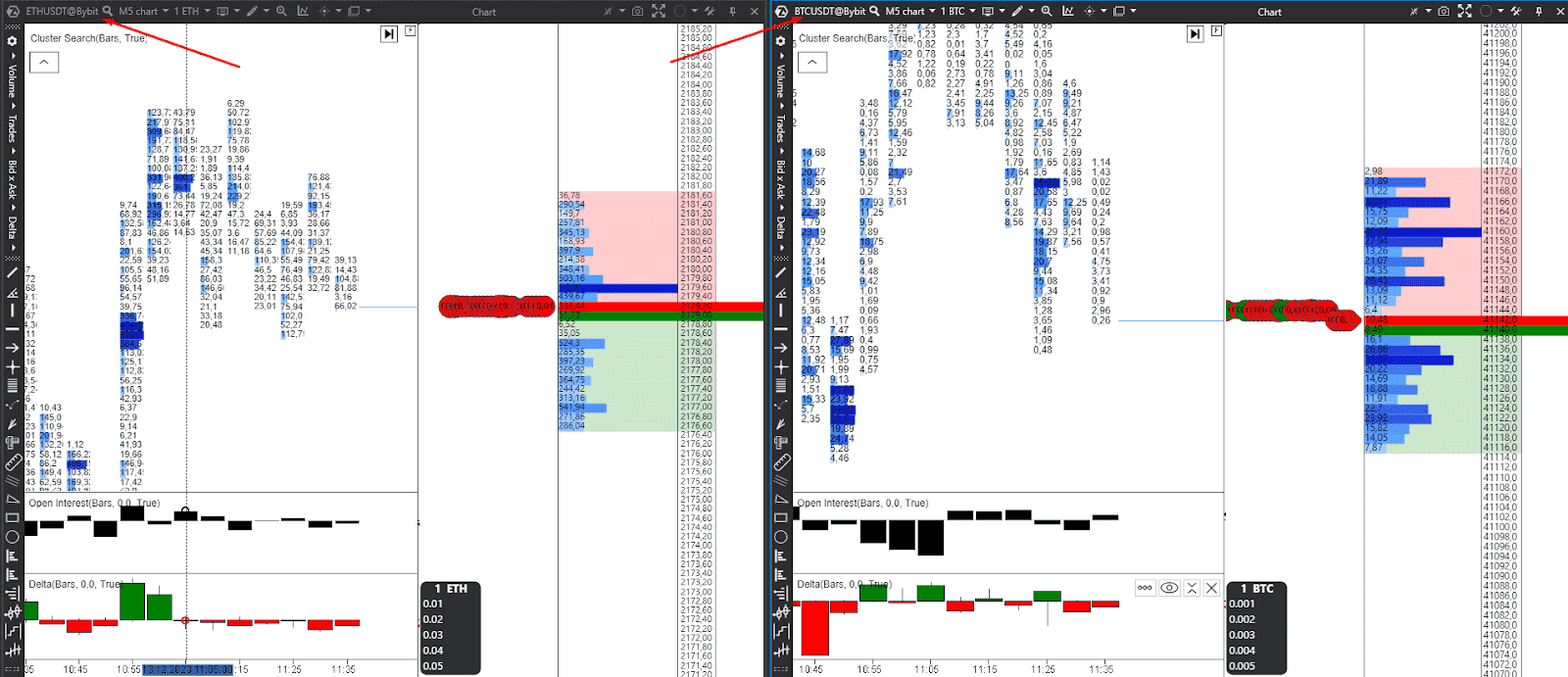

The ATAS crypto platform enables users to get a closer look at the order flow, clusters, and the exact quantity of coins being traded at any given moment. ATAS crypto traders can choose base clusters and apply various indicators specifically designed for footprint trading strategies.

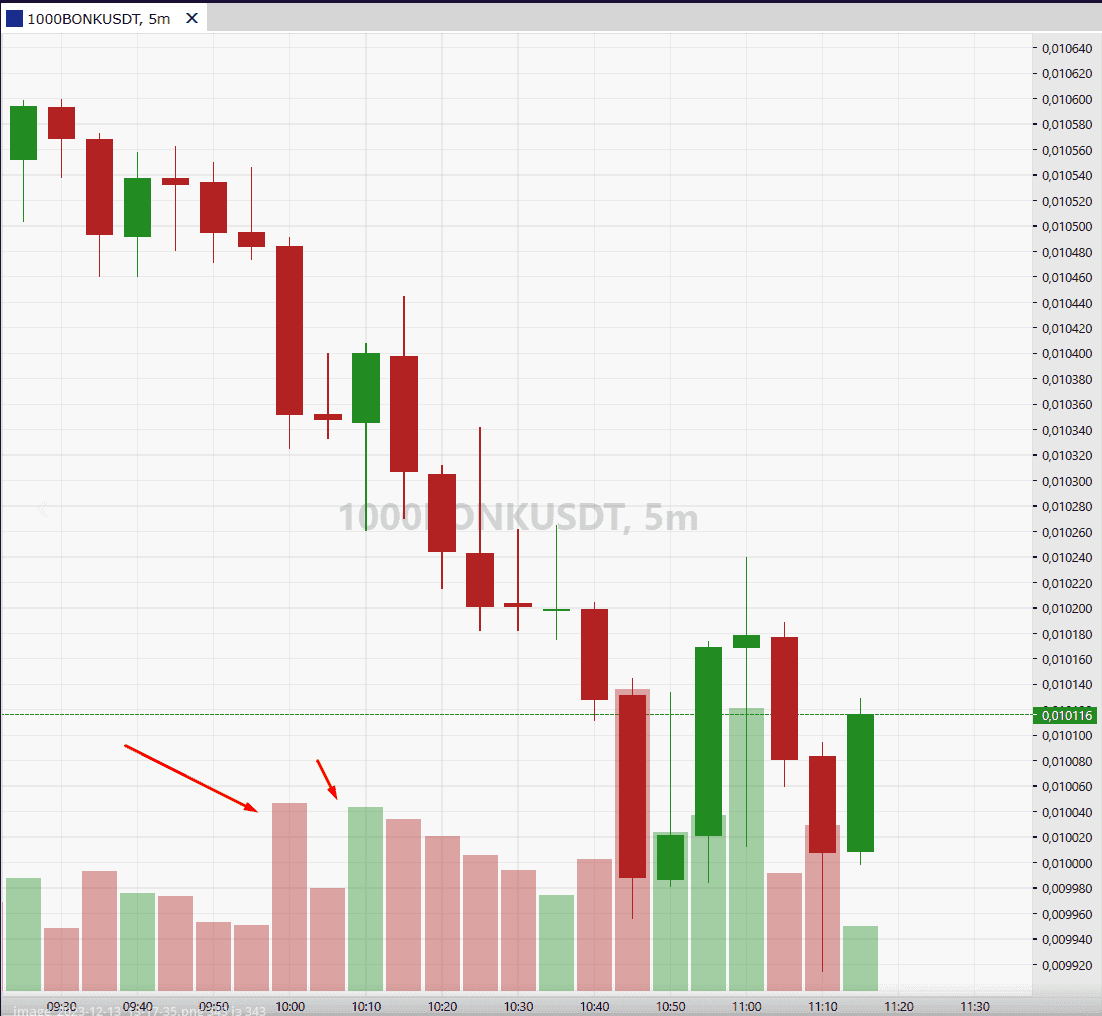

Tiger Trade offers a more flexible approach to footprint analysis. Traders using Tiger Trade can choose different time frames and the number of periods for loading data. This feature gives access to historical data.

Join Tiger Trade with Bikotrading's referral link and score exclusive bonuses! As part of our community, you'll get special perks that make your trading experience even better. Don't miss out – use our link, join Tiger Trade, and let's trade together

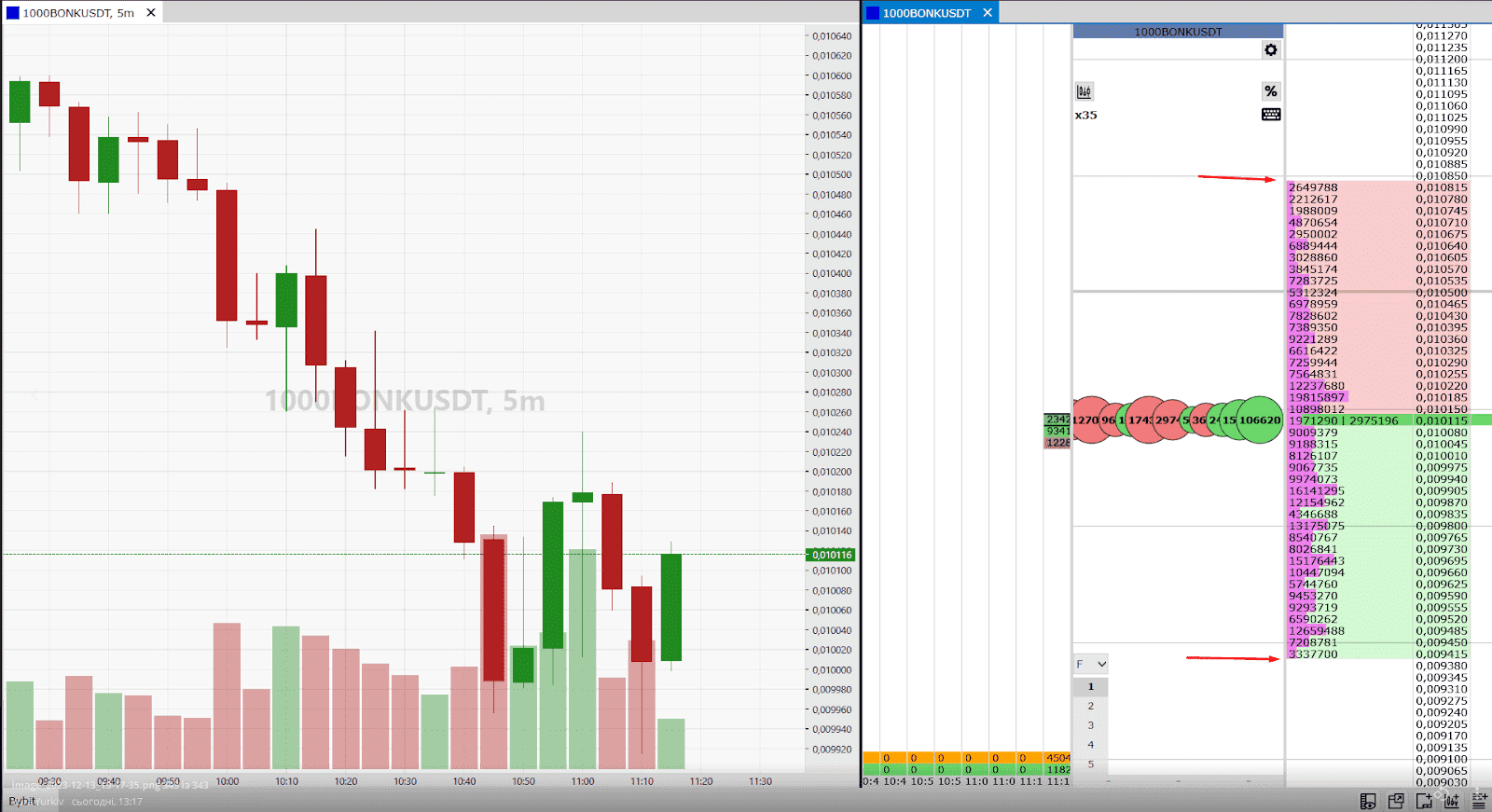

Cscalp provides access to a fixed amount of clusters, limiting traders to a specific dataset that is only available upon opening the platform. In contrast to other platforms, Cscalp lacks historical data for footprint analysis.

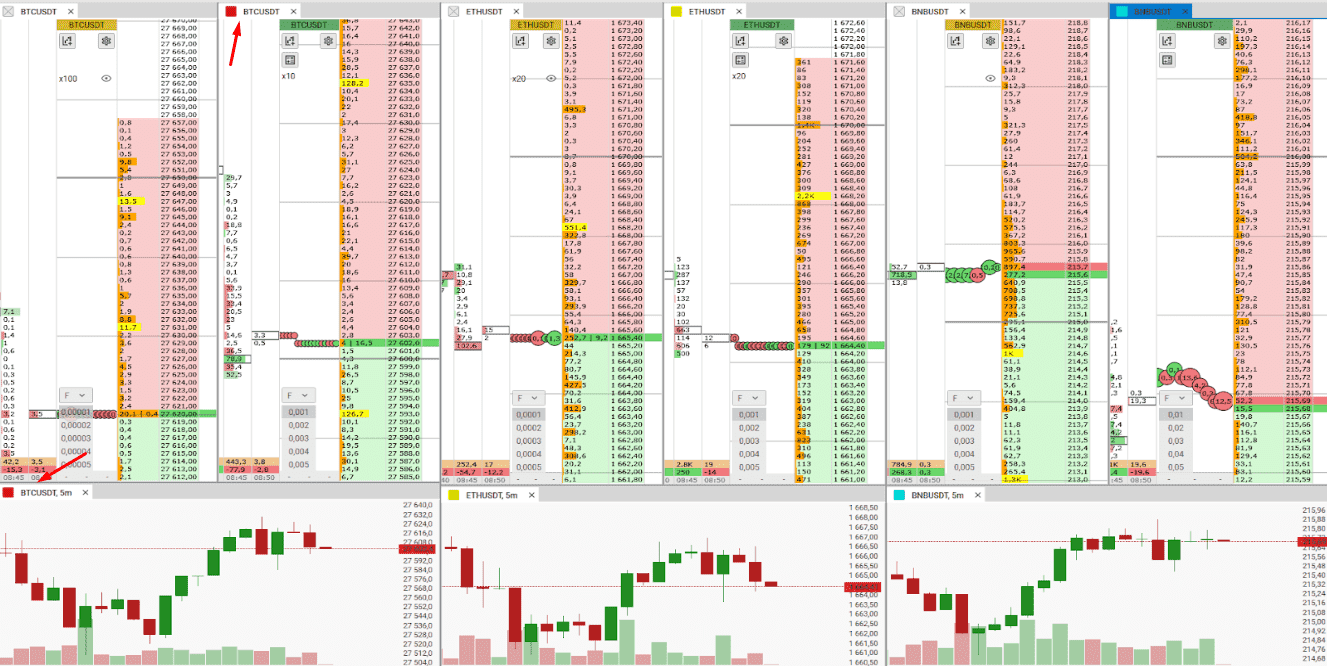

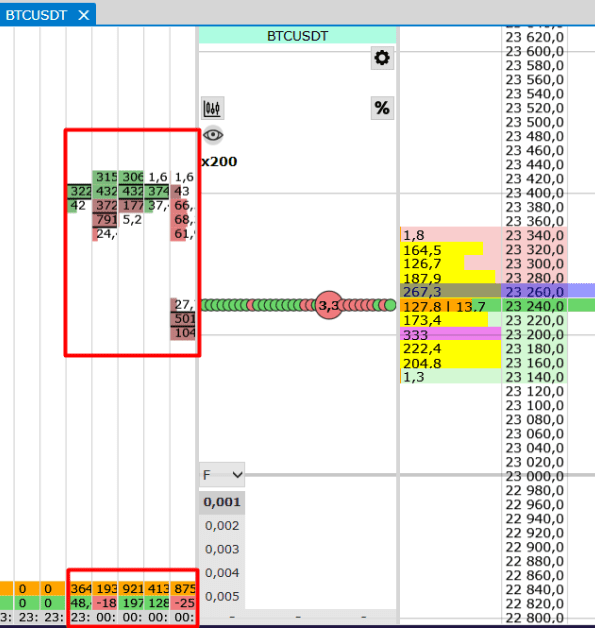

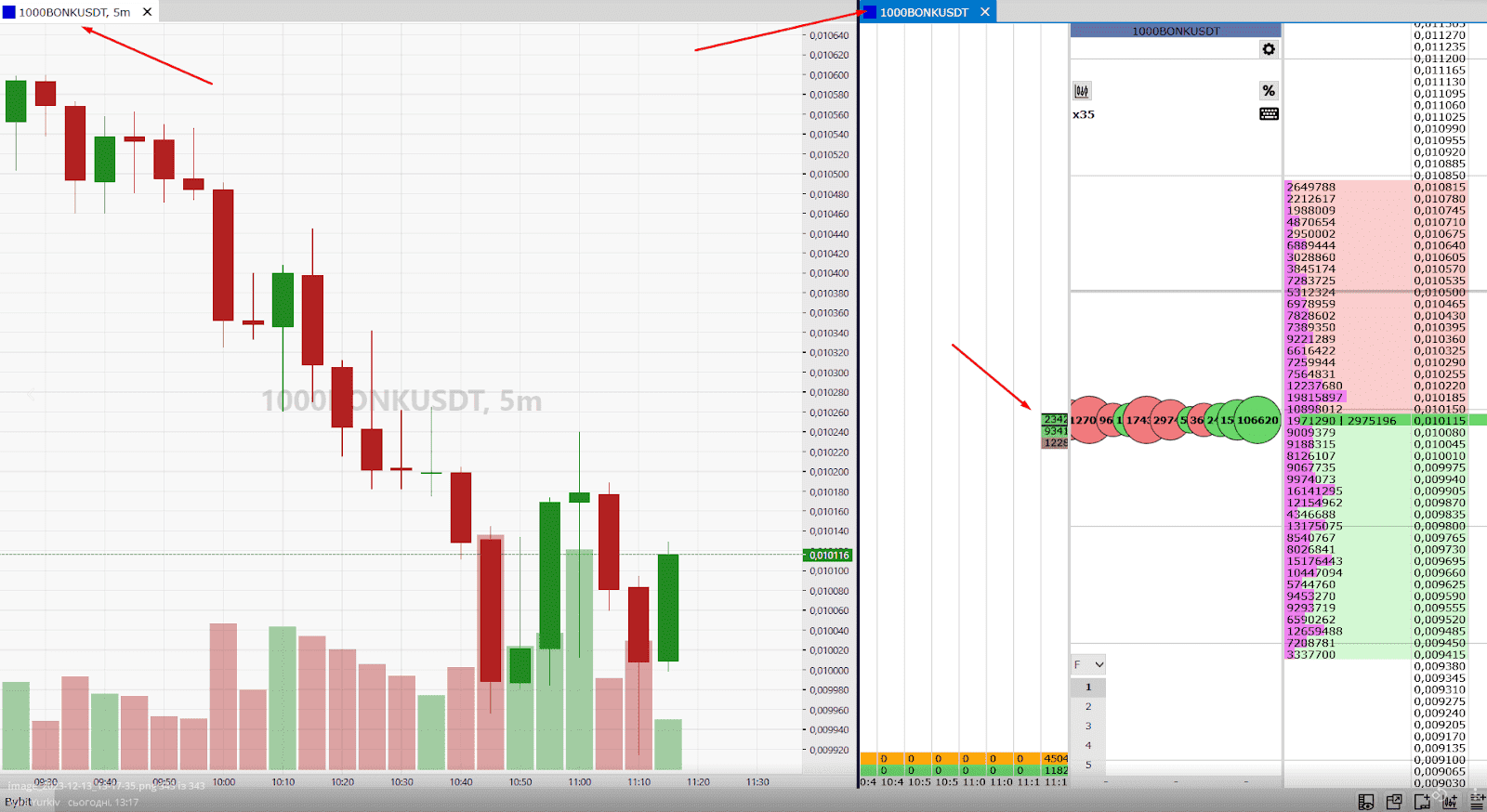

Depth of Market (DOM) analysis

DOM gives insights into the supply and demand dynamics of a particular asset at different price levels.

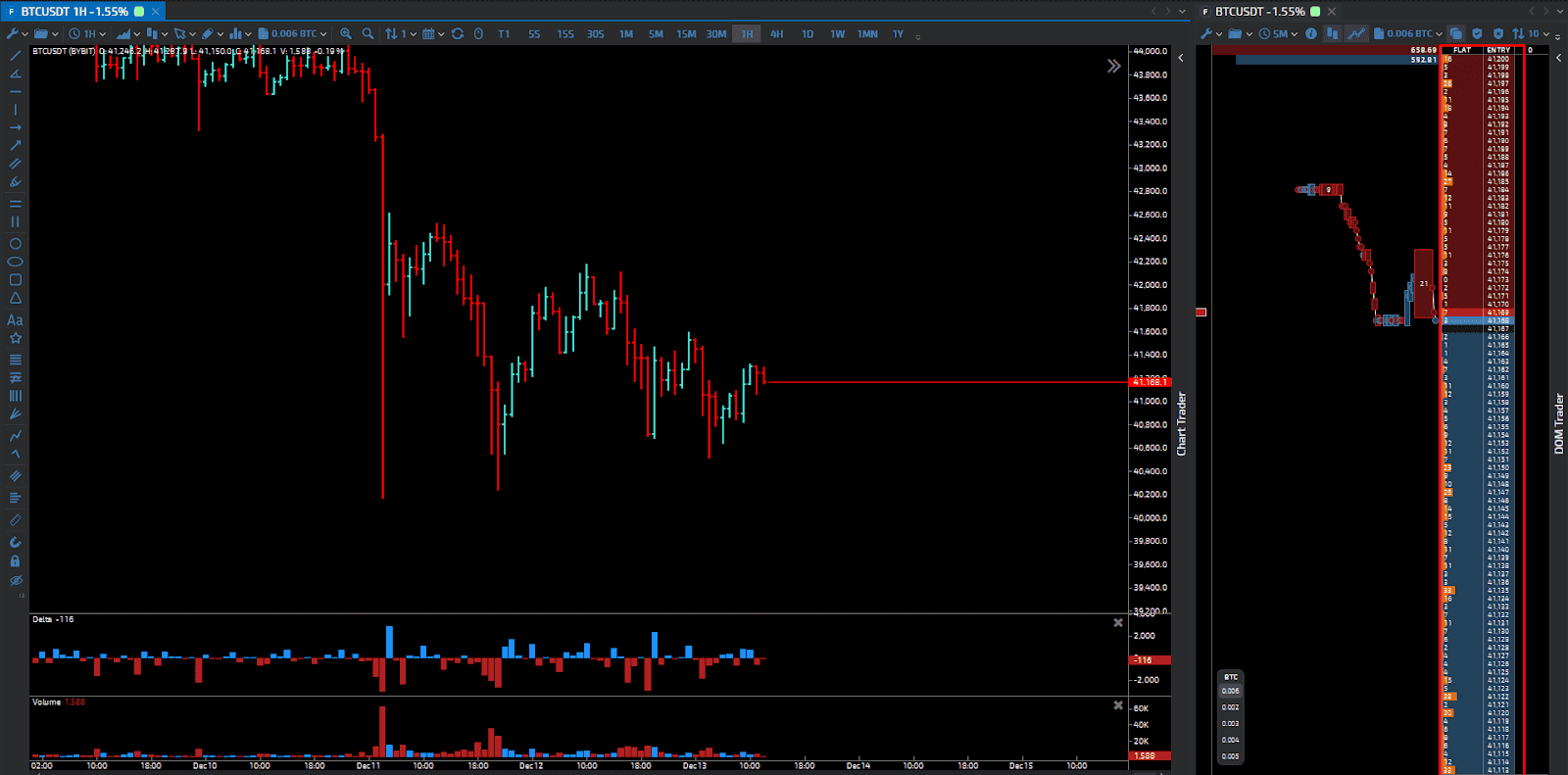

ATAS aligns with Tiger Trade in providing a comprehensive view of the Depth of Market. With the ATAS application tracking your orders is easier, the platform offers detailed information about bid and ask prices across different levels.

In contrast, Tiger Trade provides a more extensive view of the Depth of Market, allowing users to see the entire order book with all data levels up and down. It helps to get a full understanding of the market's liquidity and potential price movements.

Cscalp's DOM has limitations in terms of depth, offering only a view of 1 or 2% up and down from the current market price. Cscalp is chosen for its speed, making it an attractive option for traders who prioritize quick and efficient order execution.

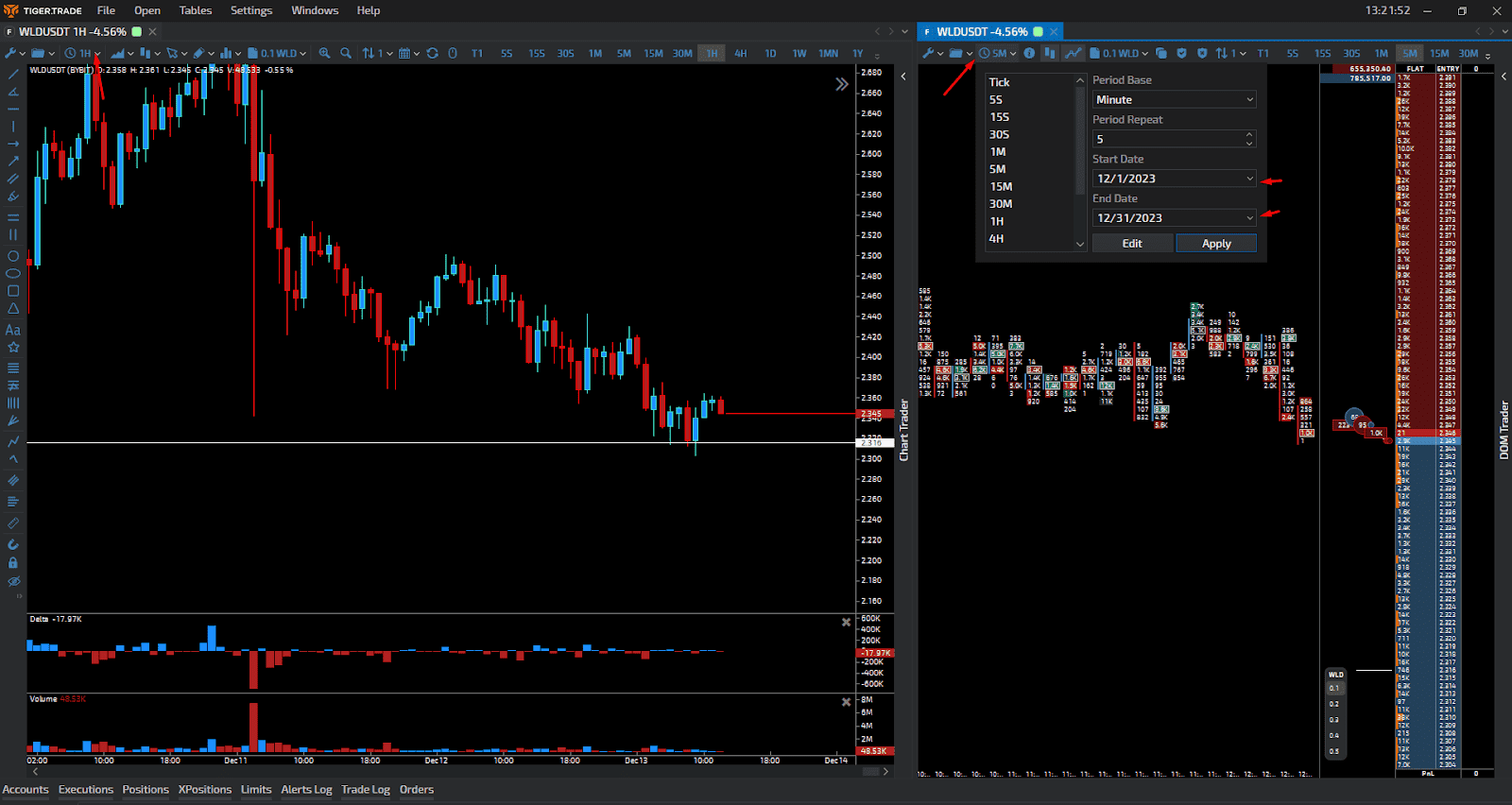

Additional indicators

The ATAS application allows users to customize their charts with indicators such as Delta, open interest, base volume filter, cluster profile, maximum levels, and dynamic levels, among others.

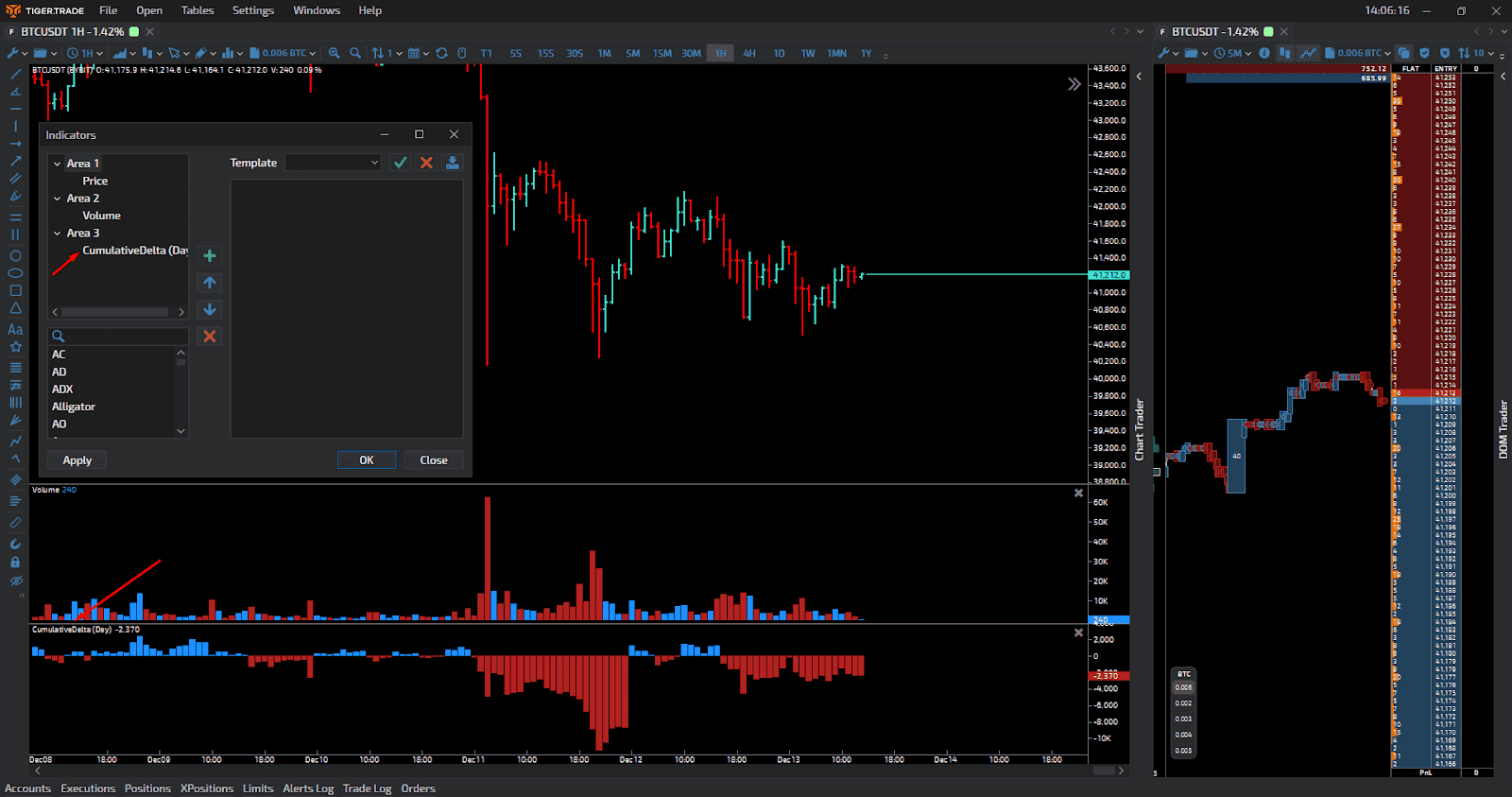

Tiger Trade trading platform steps up the game by providing access to some essential additional indicators. Notable among these is the cumulative Delta indicator, offering traders insights into the net difference between buying and selling orders. Tiger Trade scanner streamlines market analysis providing real-time insights into market trends.

Cscalp does have some limitations when it comes to additional indicators. It lacks access to indicators like open interest Delta, cumulative Delta, and cluster search.

Processor performance

The speed of Tiger Trade and ATAS trading software is comparable, but their efficiency depends on the user's activity. Opening numerous windows or engaging in extensive multitasking can impact the overall speed and responsiveness of both programs. You can download Tiger Trade for Mac and Windows.

Cscalp stands out in terms of processor performance, particularly in scenarios where less data needs to be processed. The platform's efficiency is attributed to its limited footprint, meaning it handles a smaller dataset compared to other platforms.

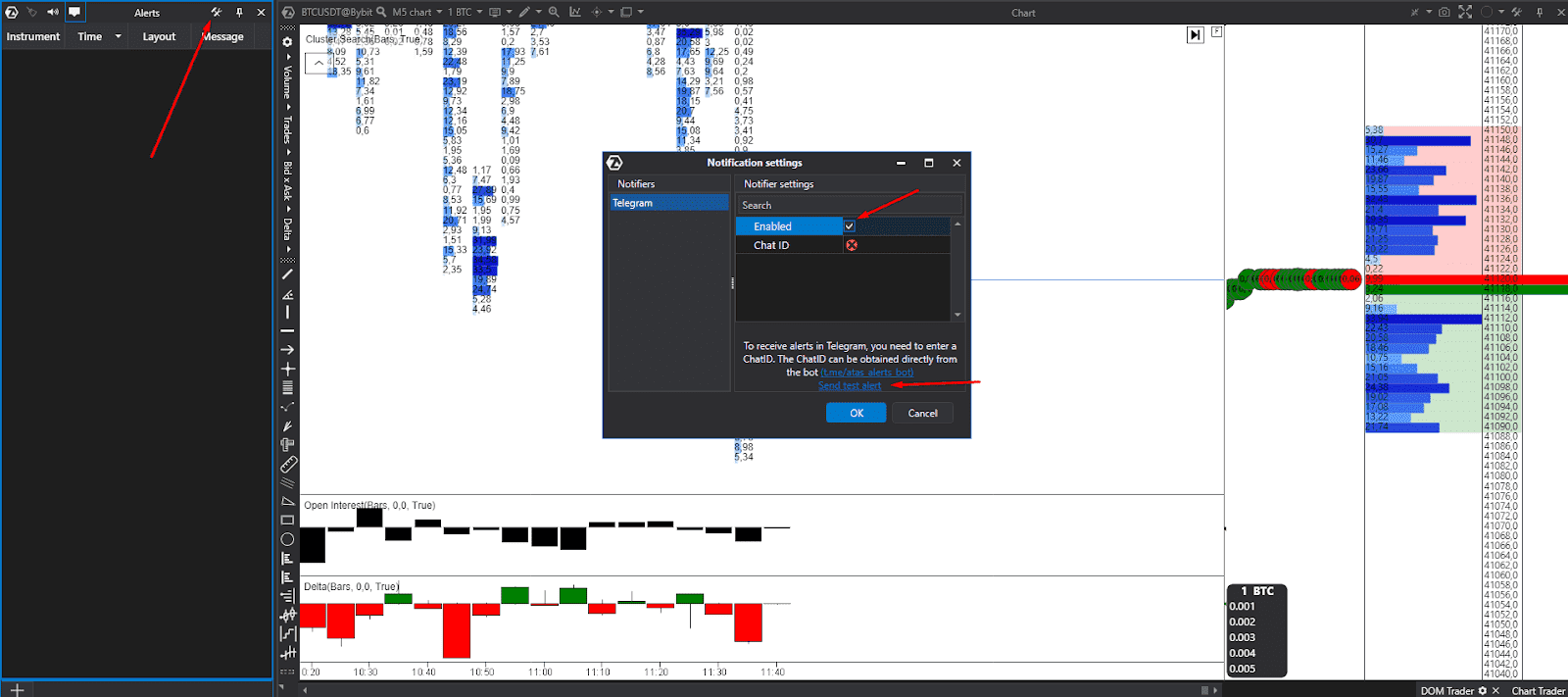

Hotkeys and alerts

All three platforms support hotkeys and alerts. However, ATAS gains an advantage due to its extensive alert system, allowing users to connect a special board in Telegram and receive notifications about significant market events, a feature not as implemented in Cscalp and Tiger Trade software.

What is ATAS and Tiger Trade difference?

The key differences between ATAS and Tiger Trade lie in their features and target audience. ATAS is designed for professional traders with advanced charting tools, order flow analysis, and a wide range of technical indicators. It’s best for those who prioritize in-depth market analysis and have a higher level of trading expertise.

On the other hand, Tiger Trade is a user-friendly platform for both beginners and experienced traders. It offers simplicity, accessibility, and a variety of financial instruments, making it the best choice for those who value ease of use and a broad range of trading options.

Conclusion

Ultimately, the choice between ATAS, Tiger Trade, and Cscalp depends on the specific needs and preferences of individual crypto traders. ATAS caters to professionals with its advanced features, Tiger Trade appeals to those seeking a user-friendly experience, and Cscalp is designed for traders who prioritize speed and efficiency. Assess your individual needs and hardware capabilities when selecting a platform to get an effective and responsive trading experience.