The difference between spot and futures in crypto trading

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

Any trading on the stock exchange begins with choosing a way to buy and sell an asset. In this article, we will take a look at two main cryptocurrency trading instruments: spot and futures, and analyze their differences and suitability for certain needs of crypto traders.

KEY ISSUES:

What is a spot trade?

Spot trading is the buying and selling of cryptocurrencies at the market price with the aim of obtaining the asset immediately or as soon as possible. The spot trading meaning goes from its main idea – you buy on the spot. A spot trade is the most common way for many traders and investors to buy and sell cryptocurrencies.

The spot market is a market where cryptocurrencies are bought and sold at instant (spot) prices, with actual availability of the asset immediately or in the near future. Prices for spot trading are determined at the time of the trade, and they may vary from exchange to exchange and from one moment to the next. The spot price is the price at which a cryptocurrency can be bought or sold on the spot market at a particular moment in time. The spot price is determined by supply and demand in the market and is valid for instant trades in spot trading.

- By choosing the spot market trading, you are actually buying or selling cryptocurrency, and this cryptocurrency can be withdrawn from the exchange to your own wallet.

- You can hold your positions for as long as you wish and you have full control over them.

- Prices when trading spot are determined by supply and demand in the market, and they can be different on different exchanges.

What is futures trading?

Futures are contracts that oblige the buyer to buy or sell a certain amount of cryptocurrency in the future at a predetermined price. Futures provide traders with the opportunity to speculate on cryptocurrency price movements without the need to actually deliver the cryptocurrency. You do not buy or sell physical cryptocurrency, but contracts for that cryptocurrency. When you create a futures contract, you are effectively committing yourself to buy or sell cryptocurrency in the future at a predetermined price. This agreement requires you to have a certain amount of capital in your trading account as hedging.

- Futures provide an opportunity to trade cryptocurrencies using leverage, which allows you to increase potential profits, but also increases the risk of losses.

- Futures have a certain expiration date and can be settled physically (by delivering cryptocurrency) or in cash (by the difference in price) when the position is closed.

- Futures trades have a standardized format, which makes them easier to trade on the exchange with the help of personalized strategies for trading futures.

Futures trading is perfect for active traders who open and close trades on a short time frame. Futures trading crypto approach is suitable for those who have extensive experience and knowledge of the market and are ready to accept sharp price fluctuations in order to make money. Given the potential leverage, a futures trader can face increased risk and may require careful risk calculation and strict risk management. If you want to do futures trading (UK or US), check out our article with detailed instructions.

Do you dream of profitable trading on the cryptocurrency market but don't know where to start? Join our exclusive training and learn all about the secrets of profitable cryptocurrency trading from our professionals! Our training program will help you increase the efficiency of your spot trades and help to profitably trade crypto futures.

Learn more about spot and futures in our video

Which option is better for a crypto trader?

The choice between spot trading and futures depends on your investment strategy, risk profile, and goals. Spot trading crypto is suitable for long-term investors and those looking for physical supply of an asset. Futures can be useful for trading in short-term markets and for speculative trades using leverage.

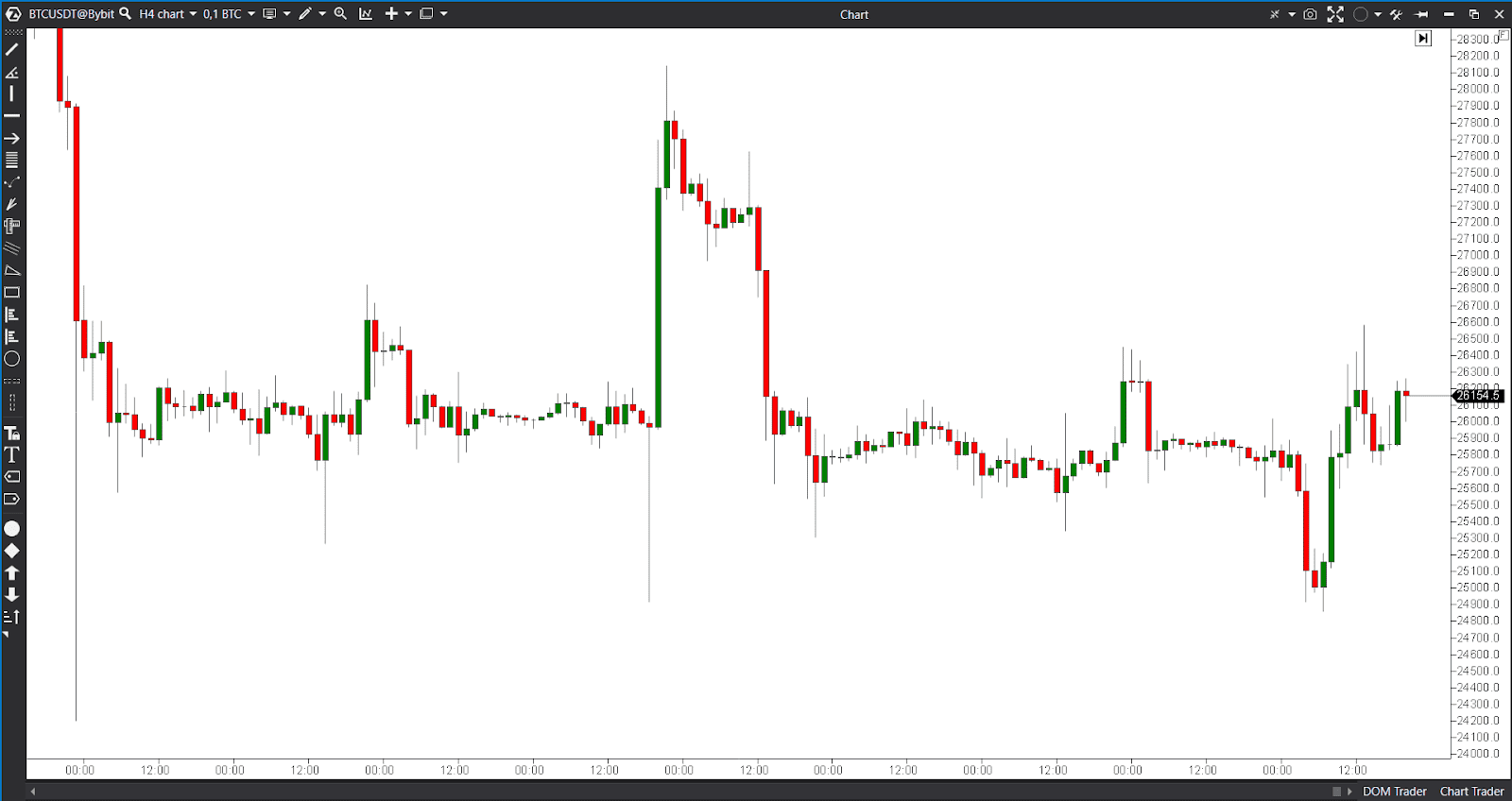

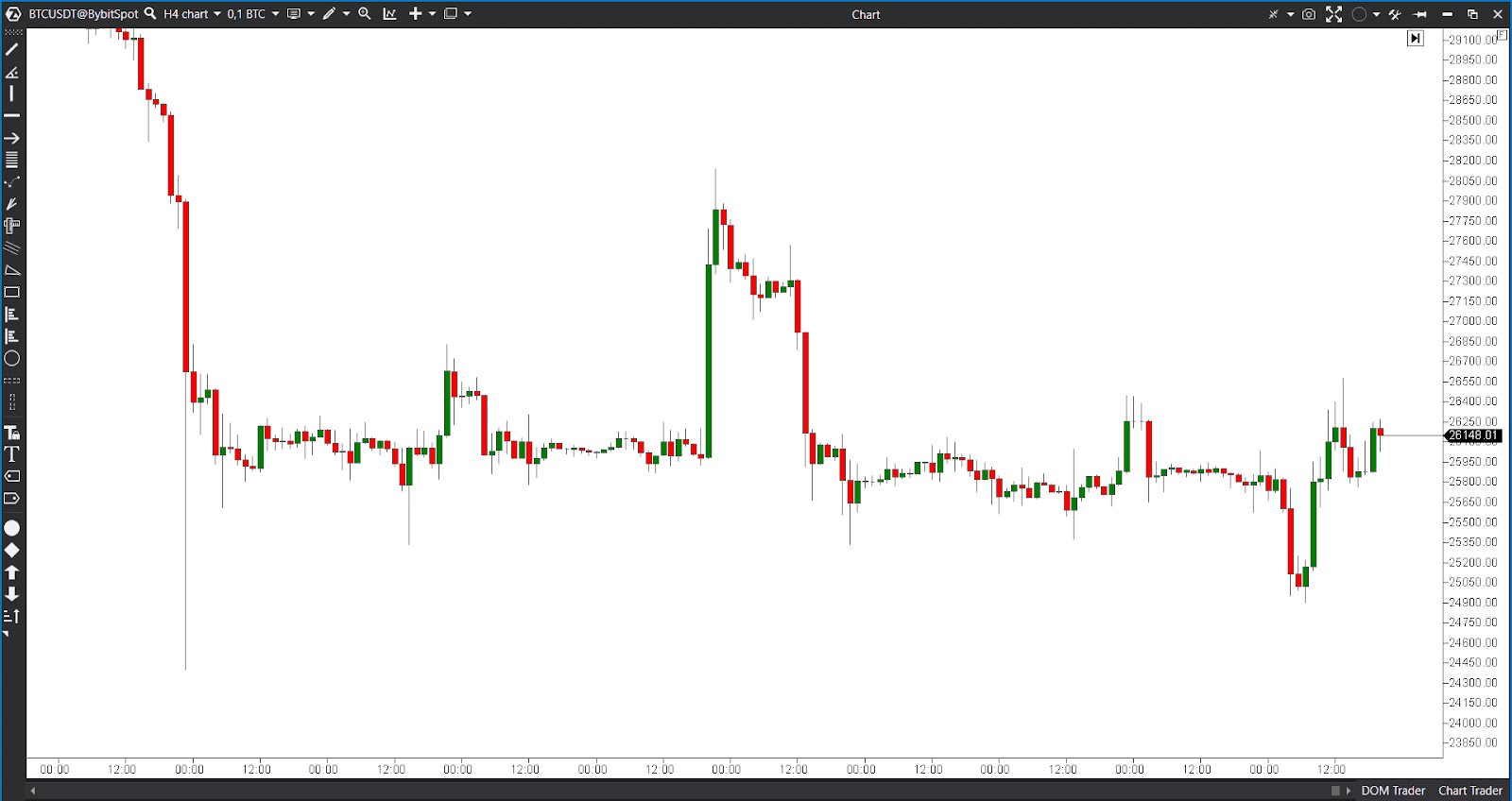

By the way, we use the Bybit exchange, which allows us to trade both spot and futures contracts. By registering through our referral program, you can join the exchange and immediately receive bonuses and access to unique promotions. We think it’s the best crypto exchange for futures trading, and highly recommend it for our students.

Physical supply

In spot cryptocurrency trading, a trader actually buys or sells real cryptocurrency. This means that after concluding a trade, you get access to the asset and can withdraw it to your wallet.

Futures trades do not involve the physical delivery of cryptocurrency. The main idea behind futures is to make a trade on the price of an asset in the future without having to actually buy or sell it.

Timeframes

Spot trading has no time limits. You can hold your positions for as long as you want. There are no set deadlines. A spot contract is a trade in which the parties agree to buy or sell cryptocurrency at an instantaneous price with the aim of physical delivery of the asset immediately or within a short period of time specified in the contract. Crypto spot trading involves the exchange of cryptocurrency without delay.

Futures contracts have a specific expiration date and you have to remember it when developing your futures trading strategies. For example, a bitcoin futures contract can have a term from one month to many months. At the end of the term, the trade must be settled by physical delivery or cash payment.

If your main goal is a long-term investment and holding of cryptocurrencies for capital preservation or potential appreciation, spot trading may be a more suitable option than trading crypto futures.

Leverage

Usually, leverage is not used in spot trading. For cryptocurrency spot trading you trade an asset for the full value of your demand.

Futures allow you to use leverage. You can control a bigger position than you have funds. This can increase potential profits, but it also increases the risk of losses. Crypto futures trading for beginners can be a good option if it’s done under the mentorship and guidance of a professional trader.

Price dynamics

Prices for spot trading are determined by supply and demand in the market. Differences in prices on different exchanges can be significant.

Futures prices may differ from spot prices. The difference between futures prices and spot prices may be caused by factors such as contango (when a futures is more expensive than the asset on the spot market) or backwardation (when a futures is cheaper).

Regulation and standardization

Spot trading in cryptocurrency is not regulated or has limited regulation in many jurisdictions. Each exchange may have its own internal rules and standards.

Cryptocurrency futures may be subject to regulation and supervision by financial regulators. In some countries, if you want to trade futures (UK, Germany, USA, etc.), first you have to check if they are not subject to strict standards and rules set by regulators.

Conclusion

In general, the choice between spot trading and futures depends on your goals, risk profile, and level of knowledge and experience in crypto trading. For crypto traders, it is important to understand that spot trades mean the actual exchange of cryptocurrencies, while futures are contracts for the future with cryptocurrencies as the underlying asset, and they can be useful for hedging and speculation in the market. Both instruments have their advantages and limitations, and the right choice depends on your specific situation and strategy.