Leverage in crypto trading: what is it and how to use it?

By Yuriy Bishko Updated November 21, 2022

BikoTrading Academy

In the last article, we found out that there are different types of trade. Each type of trade has its own characteristics. The main feature of futures trading is leverage.

Many novice traders are often confused at the beginning of their journey and do not fully understand what leverage really is.

MAIN ISSUES:

- What is leverage in crypto trading?

- How does leverage work?

- Is it safe to trade with leverage?

In this article, we will fully address all of these issues. What you find difficult, we will explain in simple words, give real examples and recommendations from personal experience.

What is leverage in crypto trading?

Leverage, in simple words, is a loan that we take on the exchange, which gives us the opportunity to open a position much larger than our own money.

If you are an experienced trader, this tool can increase your capabilities and results much faster.

How does it work?

Let's look at an example and model a conditional situation!

You have completed the entire course for beginners. Learned to work with the exchange terminal, learned how to correctly determine the levels, learned the rules of risk management and learned the basics of breakout strategy. After that, you deposited $100 to the stock exchange.

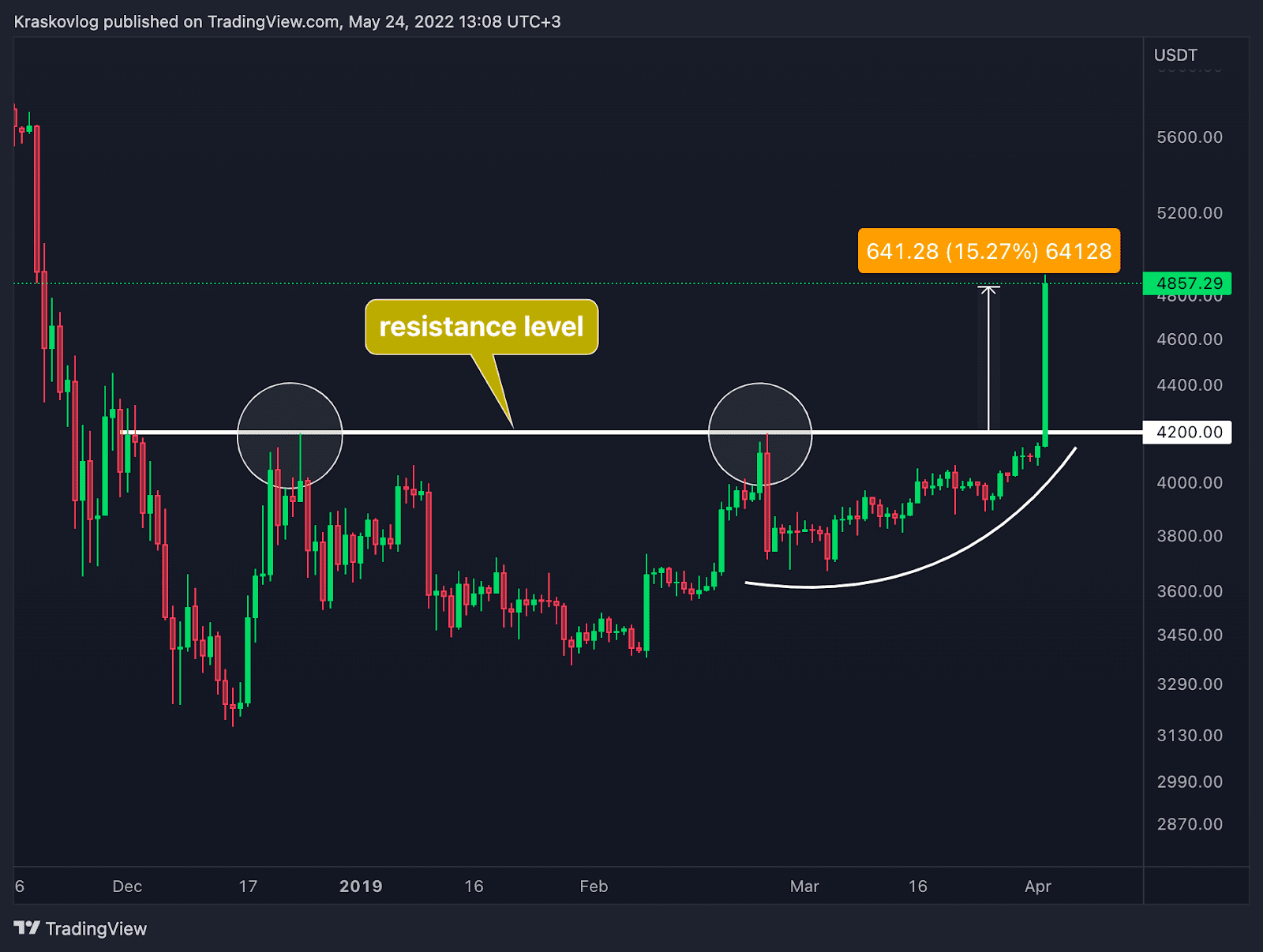

After analyzing the Bitcoin chart, you have found a good scenario. In the chart below, you find that the price of the coin has repeatedly tested the $4,200 level as resistance. At the same time, they additionally noticed that the price gradually began to get closer and closer to this level, which is a positive indicator. Based on this, you have assumed that the price will soon break the resistance level and go up.

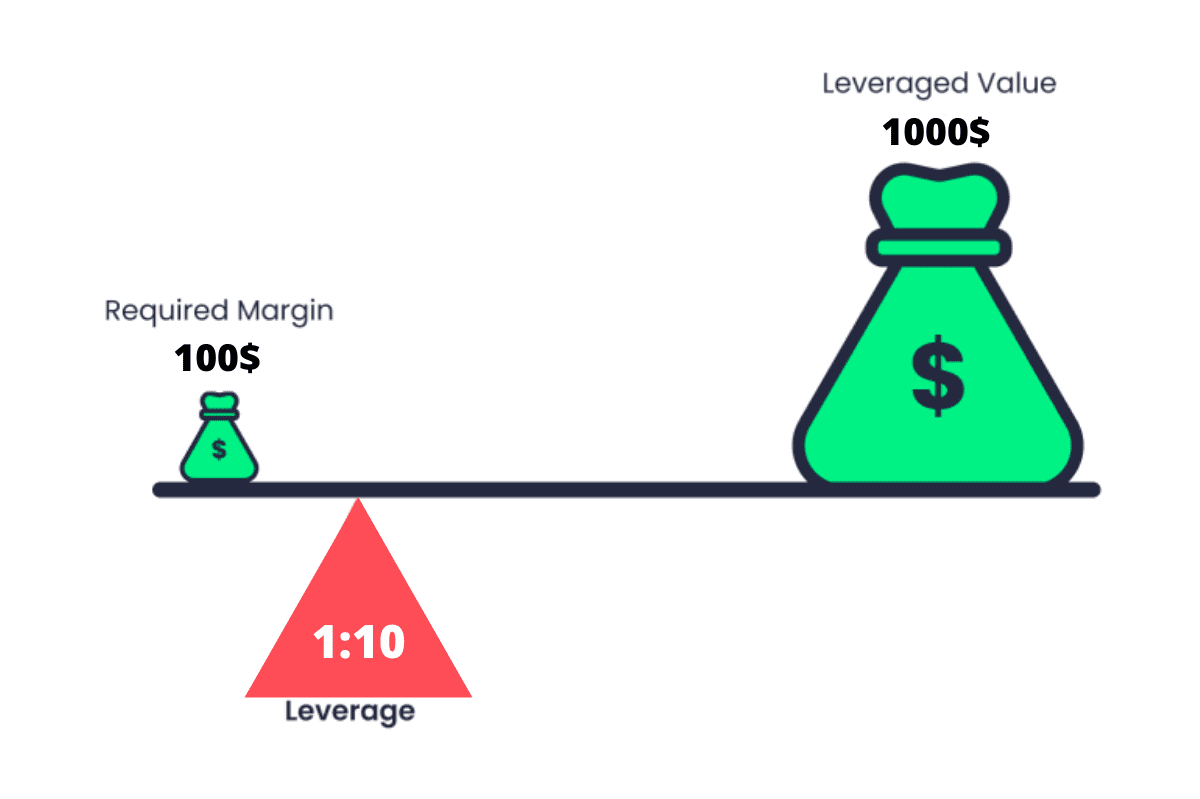

You understand that this scenario can bring a good percentage of profits, but your account is only $100 and therefore decided to open this trade using leverage x10. Leverage of x10 has increased the size of your position 10 times and therefore you can already buy coins not for $100, but for $1,000.

As a result, you have been right, the price broke the resistance level and increased by 15% in one day.

After that, you closed this trade and took your profit. If you had opened this position without using the shoulder, you would have earned only 15%, or rather $ 100 * 15% = $15. But due to the fact that you used leverage that is 10 times higher than your own balance, you got 150% profit, i.e. $100 * 150% = $150 profit. Now you have $250 on your balance.

But this is an ideal scenario, if the price went in the opposite direction, then using leverage x10 each percent down was equal to -10% of your capital. A 10% price drop would completely eliminate your position and your balance would be $0.

That is, with each added leverage you will receive 1% more profit or loss. Thus, when using leverage x2, a 1% price increase will bring you 2% profit, and a 1% price drop will bring you -2% loss. When using leverage x100, 1% up will bring you 100% profit, and 1% down eliminates your position and you will lose all money.

How to use credit leverage properly?

Most newcomers at the beginning of their trading career are not fully aware of how useful and at the same time how dangerous this financial instrument is.

Many newcomers make mistakes that destroy their entire deposit within a few trades. Below we have listed the main mistakes that should be avoided before using leverage.

And how to open a trade?

You have not yet fully understood how the trading terminal works on the exchange, and you are ready to open trades. It seemed a fairly simple and common problem, but the number of such cases is surprising. Before opening a position and using leverage, you should examine each button of the trading terminal.

And what if I take a bigger leverage?

For some reason, novice traders believe that the more leverage, the better, but this is a huge mistake. The largest percentage of losses when using futures is too high credit leverage.

Experience? Thank you, but no, I know everything

Statistically, even after a good level of training and education, traders still lose during the first year of trading. Therefore, lack of experience is another reason for frequent losses of inexperienced traders.

I feel that right now there will be a good chance to open a position with leverage

If you have similar thoughts, you should close the trading terminal and start learning the basics of trading. In order to start trading, you need to fully understand the basic concepts of trading, understand the rules of risk management and have your own profitable trading strategy. Trading is not a lottery, trading is a clear set of rules!

Stop loss? It is very difficult, I am not even going to get into it

Another problem of newcomers’ losses is trading without the use of the stop loss. A stop loss is an order that automatically closes the trade if the price does not go in your direction.

Have you recognized yourself? If you have recognized yourself in one of these issues, you should definitely stop, get a good level of training, and only then return to trading. Every market participant sooner or later returns to this. The sooner you realize that trading is not luck, but work, the sooner you start earning.