ATAS vs Tradingview. Best platform for chart analysis

By Yuriy Bishko Updated June 13, 2024

BikoTrading Academy

Choosing the right platform is crucial for every trader. In this article, we will compare ATAS and TradingView, crypto trading platforms, analyze their specifics, highlight the differences between these platforms, and help you decide which one suits your trading style best.

KEY ISSUES:

General overview

When trading crypto, TradingView and ATAS offer distinct advantages, catering to different aspects of analysis and providing traders with versatile tools for charting and order flow tracking, respectively.

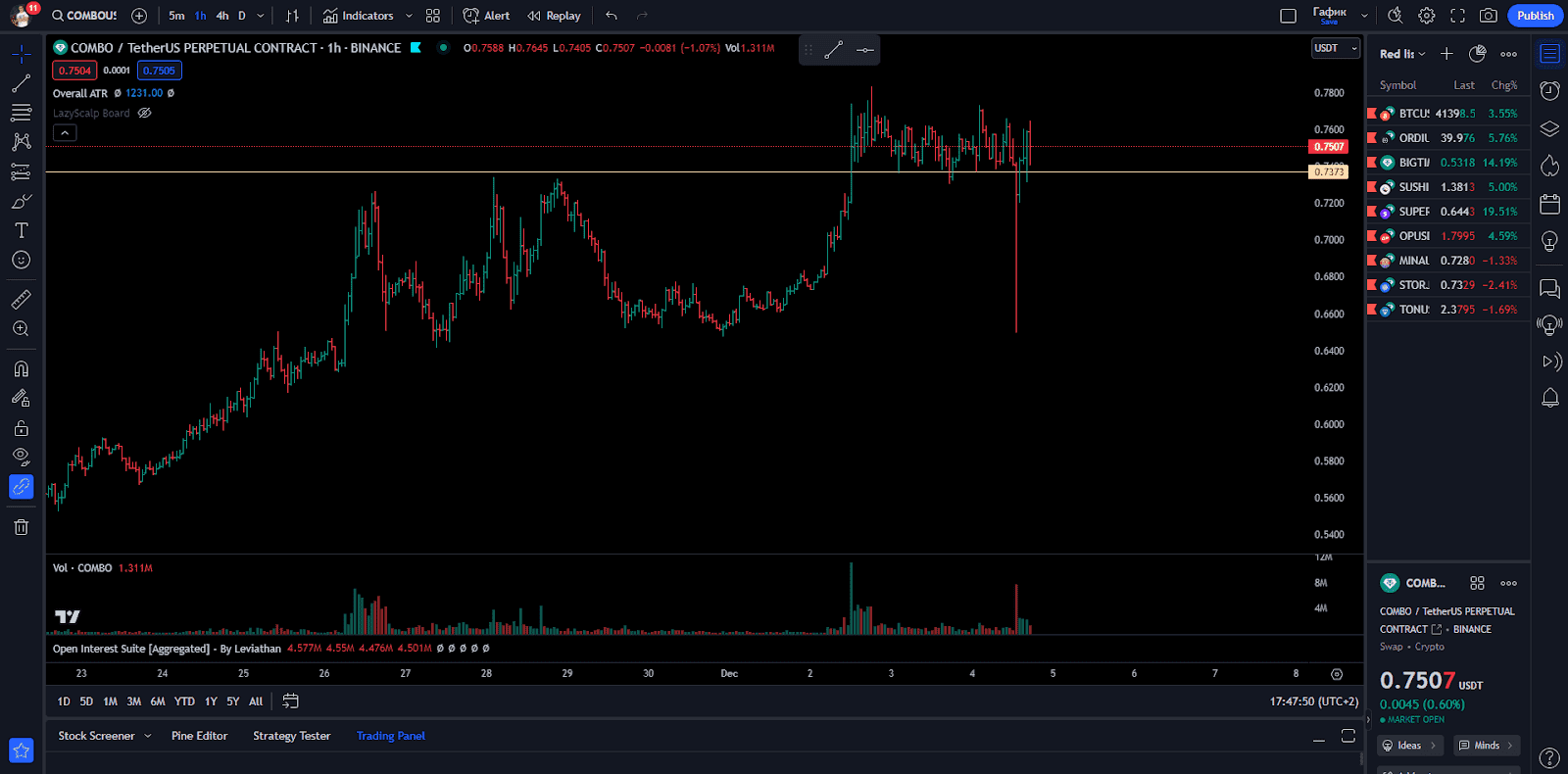

TradingView stands out as a charting powerhouse, offering a user-friendly interface and an extensive array of charting tools. It excels in providing quick access to charts, making it ideal for traders who heavily rely on technical analysis. The platform supports various charting tools for popular cryptocurrencies like Bitcoin, with most of these tools available for free.

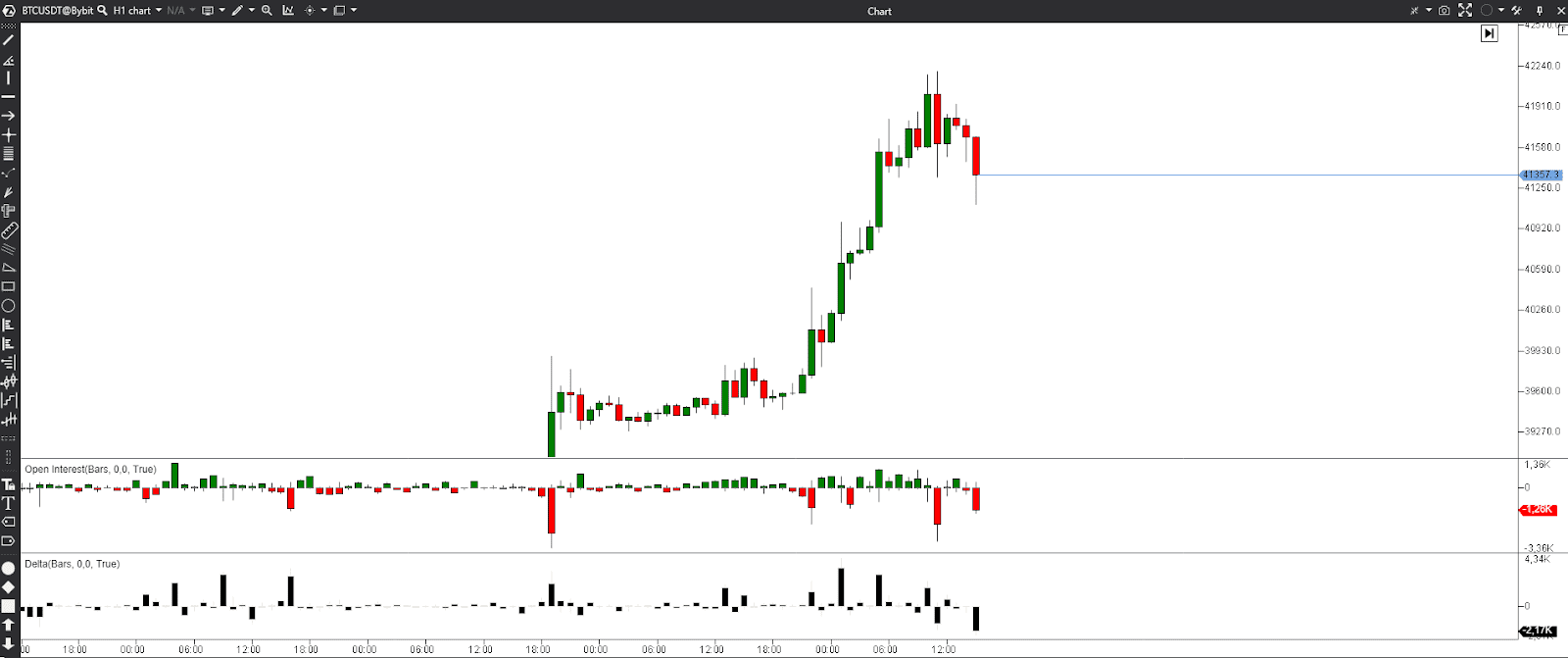

ATAS positions itself as a platform tailored for order flow trading, excelling in providing detailed data on volume, clusters, and the depth of the market (DOM). This makes ATAS a go-to choice for traders who prioritize understanding market dynamics through order flow analysis.

User interface and design

ATAS and TradingView charts both offer user-friendly interfaces, but their designs differ slightly. ATAS features a professional and centralized interface tailored for order flow traders. The platform's focus on order flow is evident in dedicated sections for volume analysis, footprint charts, and depth-of-market (DOM) data.

Unlock exclusive benefits by choosing ATAS through our referral program! Join us and receive unique bonuses as part of our partnership. Make the most of this offer and boost your trading results with ATAS. Don't miss out – sign up now!

TradingView charting, on the other hand, presents a more versatile design, catering to both beginners and experienced traders with an intuitive and easy-to-navigate interface. The platform's strength lies in its flexibility, accommodating various trading styles, and fostering a sense of community through social features.

Charting and technical analysis

One of the key aspects for crypto traders is the ability to perform in-depth technical analysis. ATAS and TradingView excel in this regard, offering a wide range of technical indicators, drawing tools, and chart types.

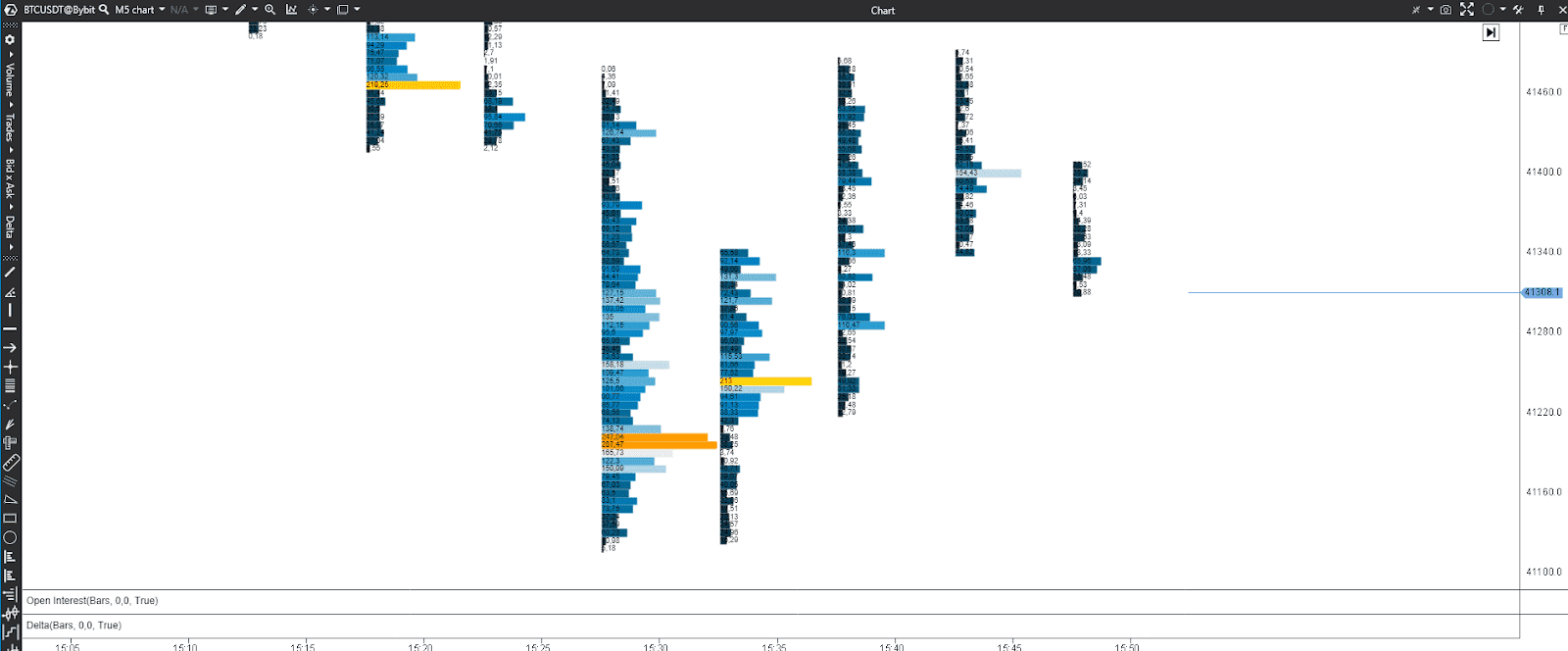

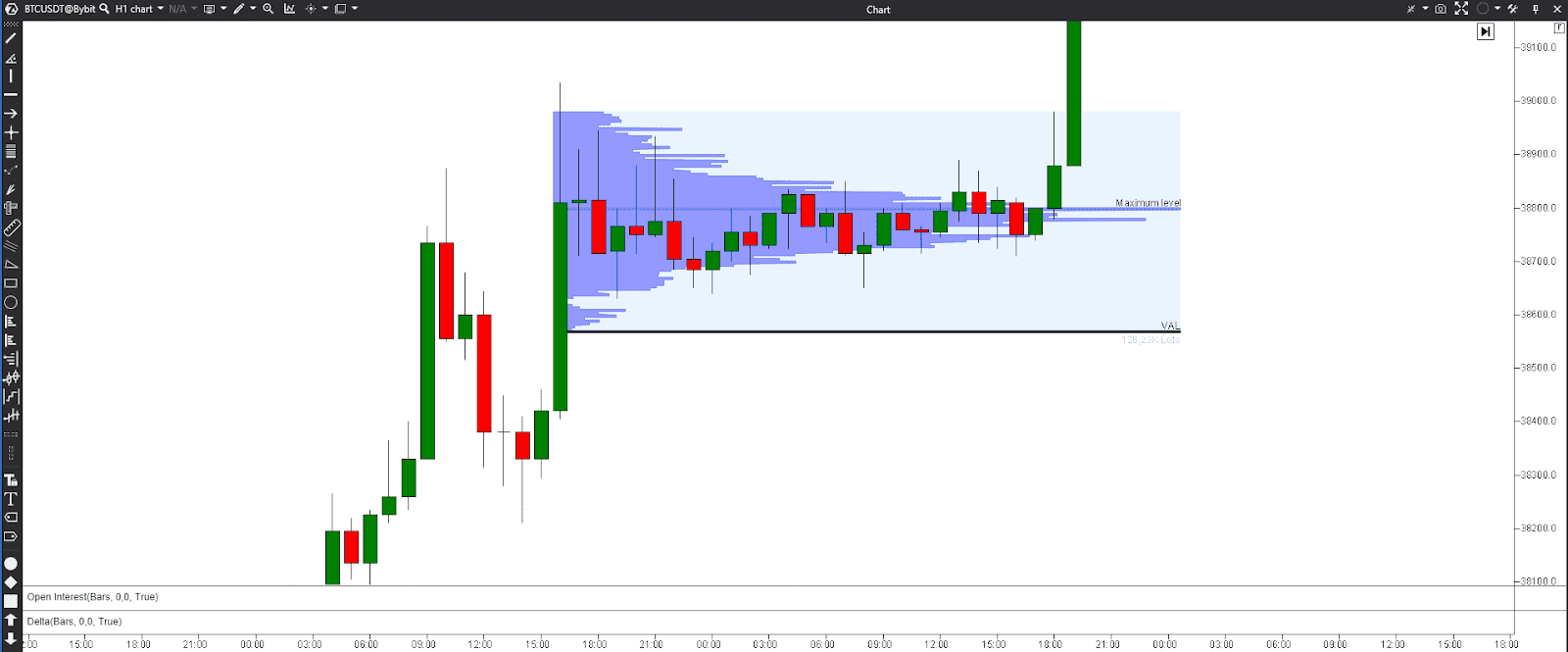

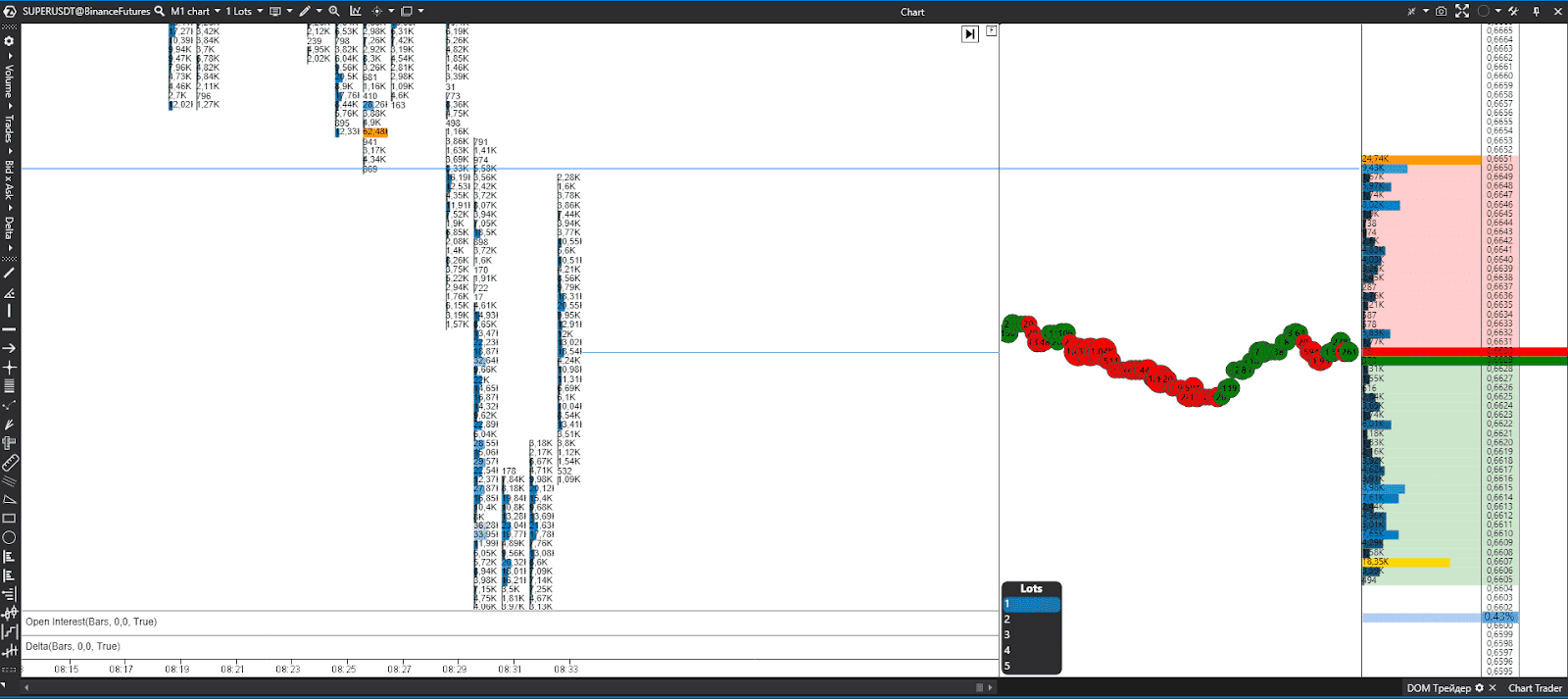

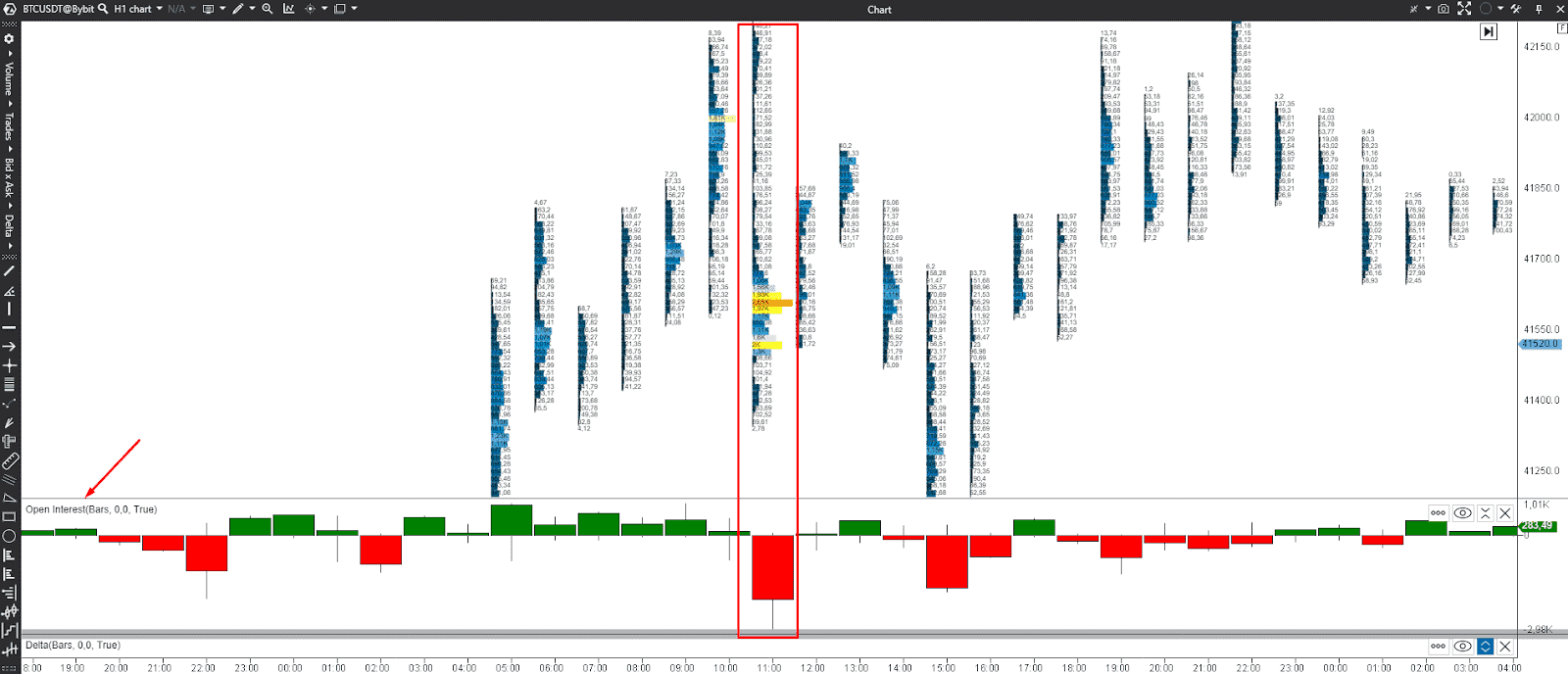

- ATAS includes a Footprint chart that displays the distribution of trading volume at each price level within a specified time frame to identify significant volume clusters. We have a special trading strategy for Footprint, check it out here.

- The Market Profile tool allows traders to analyze price and volume data in a way that visualizes the market's structure. It helps in identifying key support and resistance levels and understanding where the market has spent the most time.

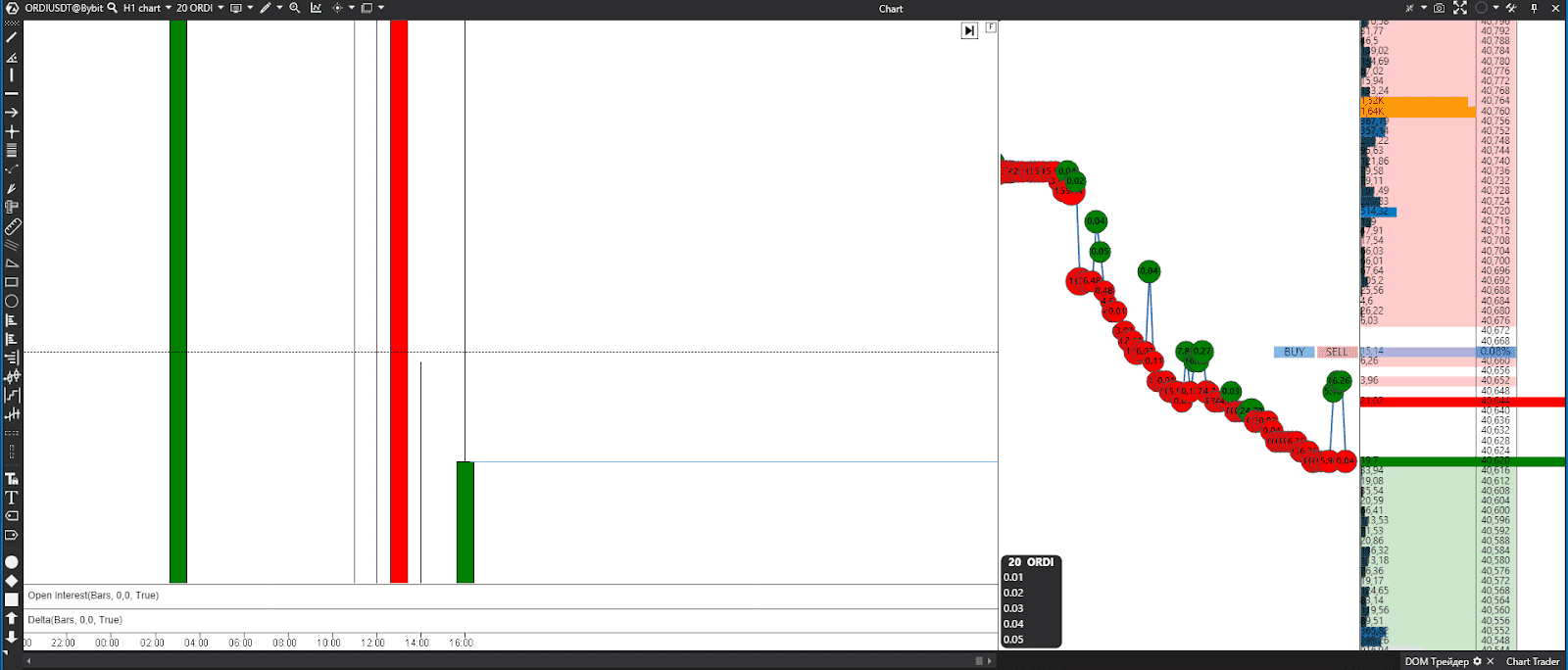

- ATAS provides a detailed Depth of Market, showing the current order book for a particular instrument. Traders can see the buy and sell orders at various price levels, aiding in making informed trading decisions.

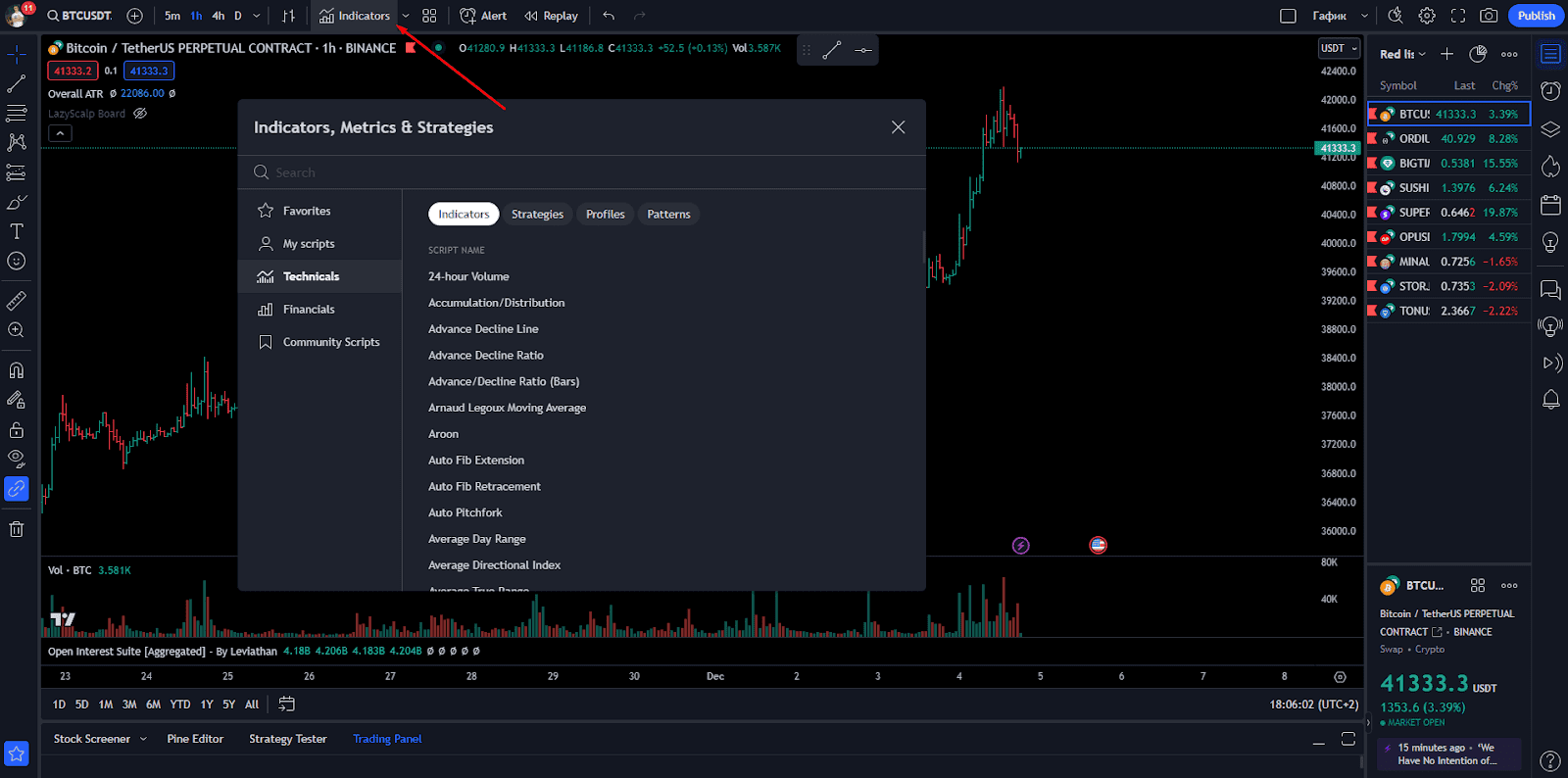

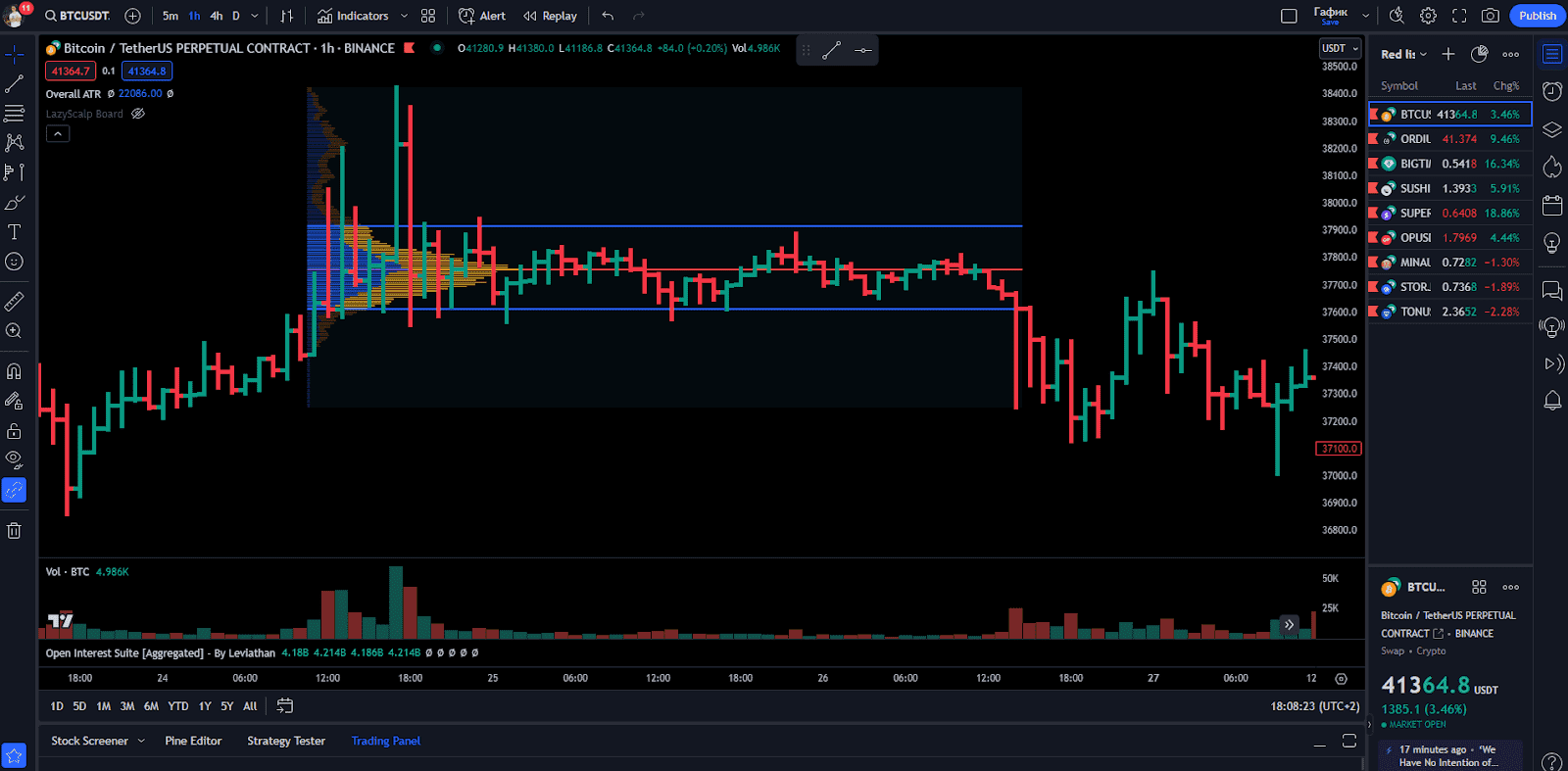

TradingView is popular for its vast array of charting tools. From trendlines and indicators to Fibonacci retracements, it caters to the diverse needs of technical analysts. The platform provides a visually appealing and intuitive interface for charting.

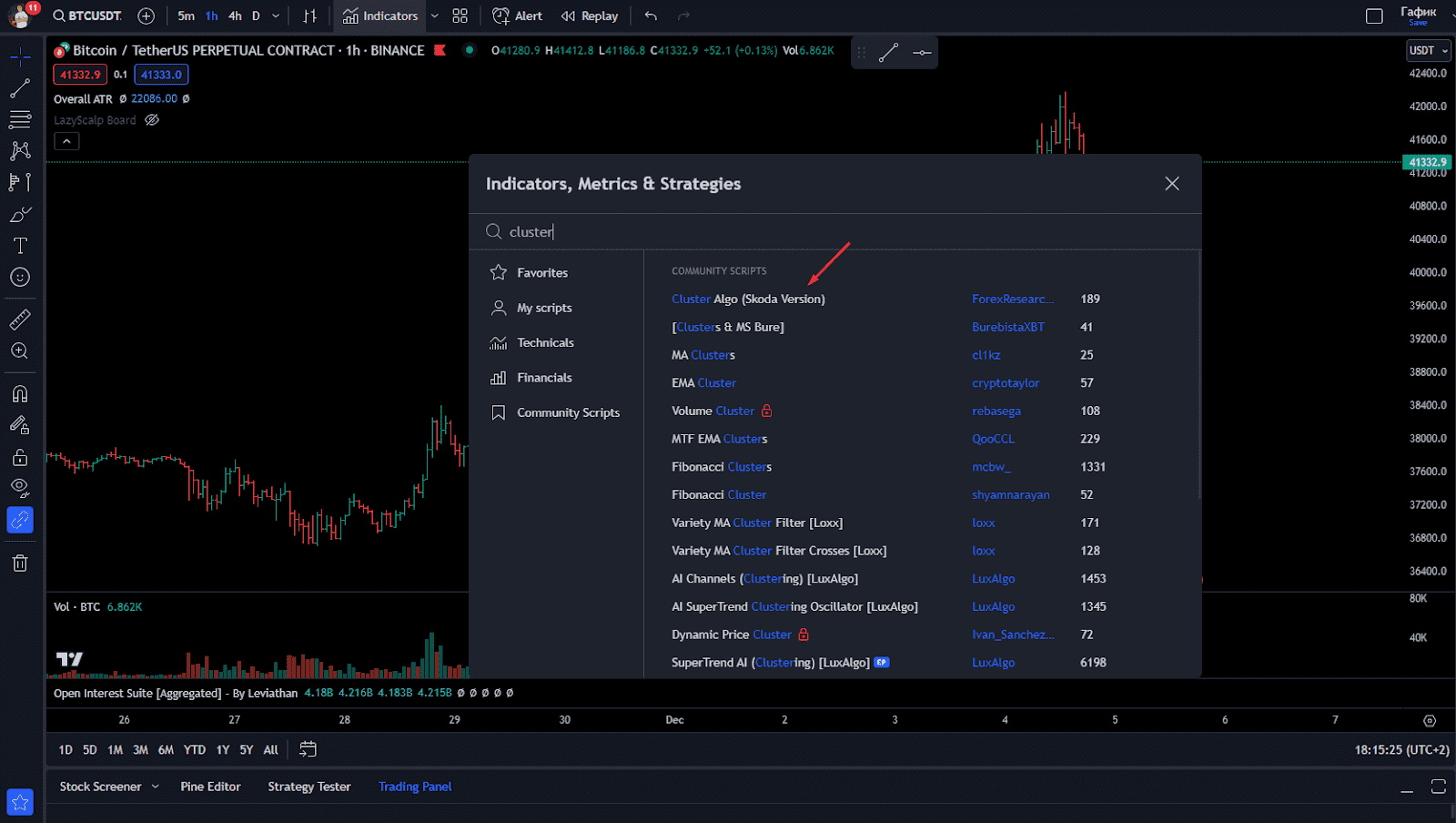

- One of the platform's strengths is its extensive library of community-contributed scripts and TradingView indicators. Also, users can set alerts for specific price levels, ensuring they are notified when the market reaches predefined conditions.

- Volume Profile, as the best TradingView indicator, displays the trading activity over specified price levels, providing insights into where significant volumes have occurred. It helps traders identify key support and resistance levels, potential breakout zones, and areas of interest for future price movements.

- As for the Footprint chart, TradingView offers a comprehensive toolset to visualize clusters of significant volume.

Charts by TradingView fall short in providing advanced tools for order flow trading. Traders who rely heavily on data like footprint, Delta, and open interest may find the platform less suitable for in-depth order flow analysis. To learn more about how to use TradingView, check the article.

ATAS, as a perfect TradingView alternative, specializes in order flow trading, providing detailed data on volume, clusters, and depth of the market (DOM). ATAS's footprint chart is a standout feature, highlighting clusters of significant volume. ATAS allows users to set alerts specifically for significant volumes, adding a layer of automation to the monitoring of order flow data. Learn more about ATAS in our article.

Order execution and trading features

ATAS and TradingView facilitate order execution through integrations with popular exchanges. Both platforms offer a range of order types and advanced trading features.

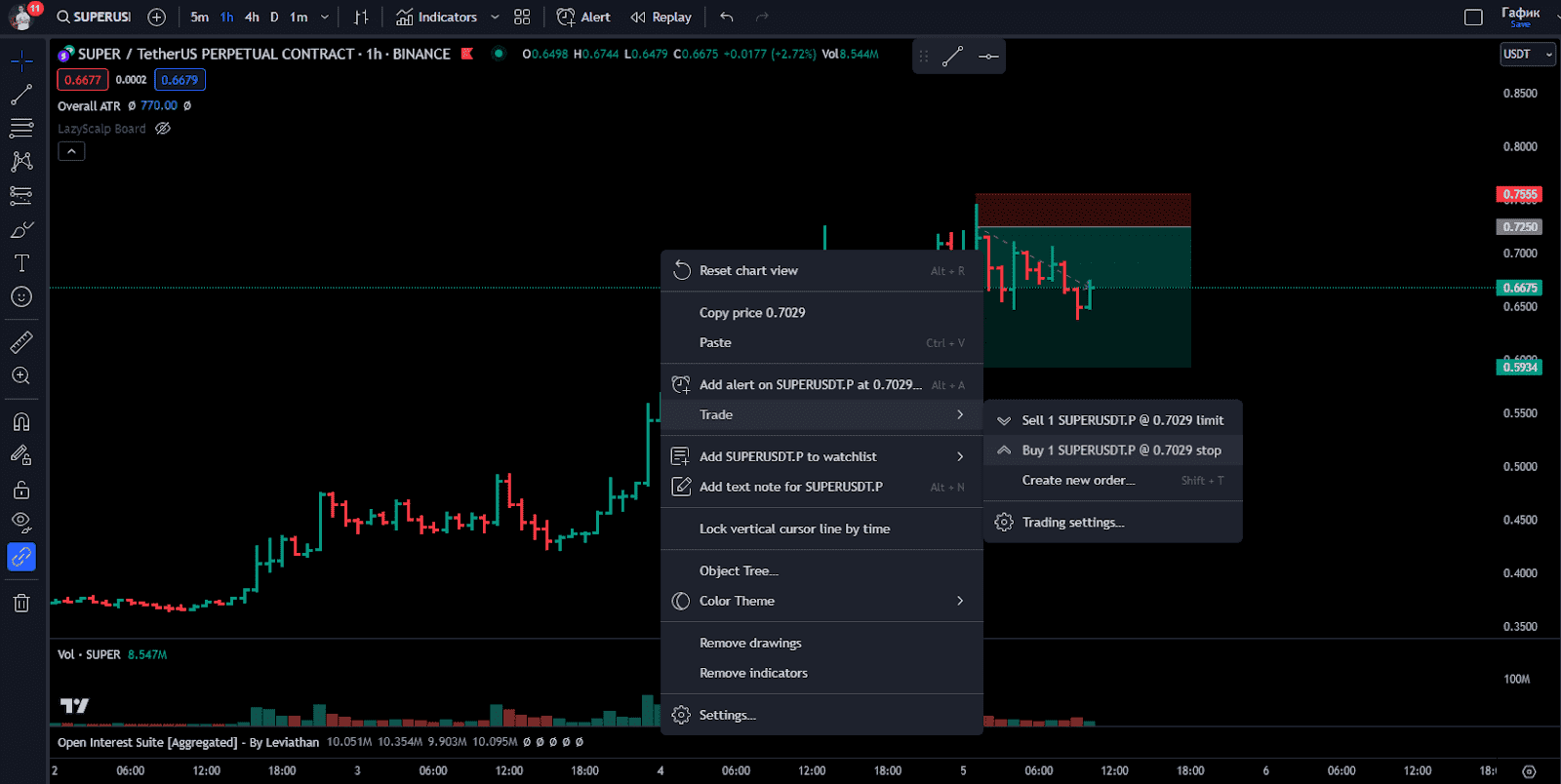

TradingView supports various order types, including market orders, limit orders, and stop orders. It supports algorithmic trading through the use of trading scripts and bots. Traders can create and implement custom algorithms to automate their trading strategies.

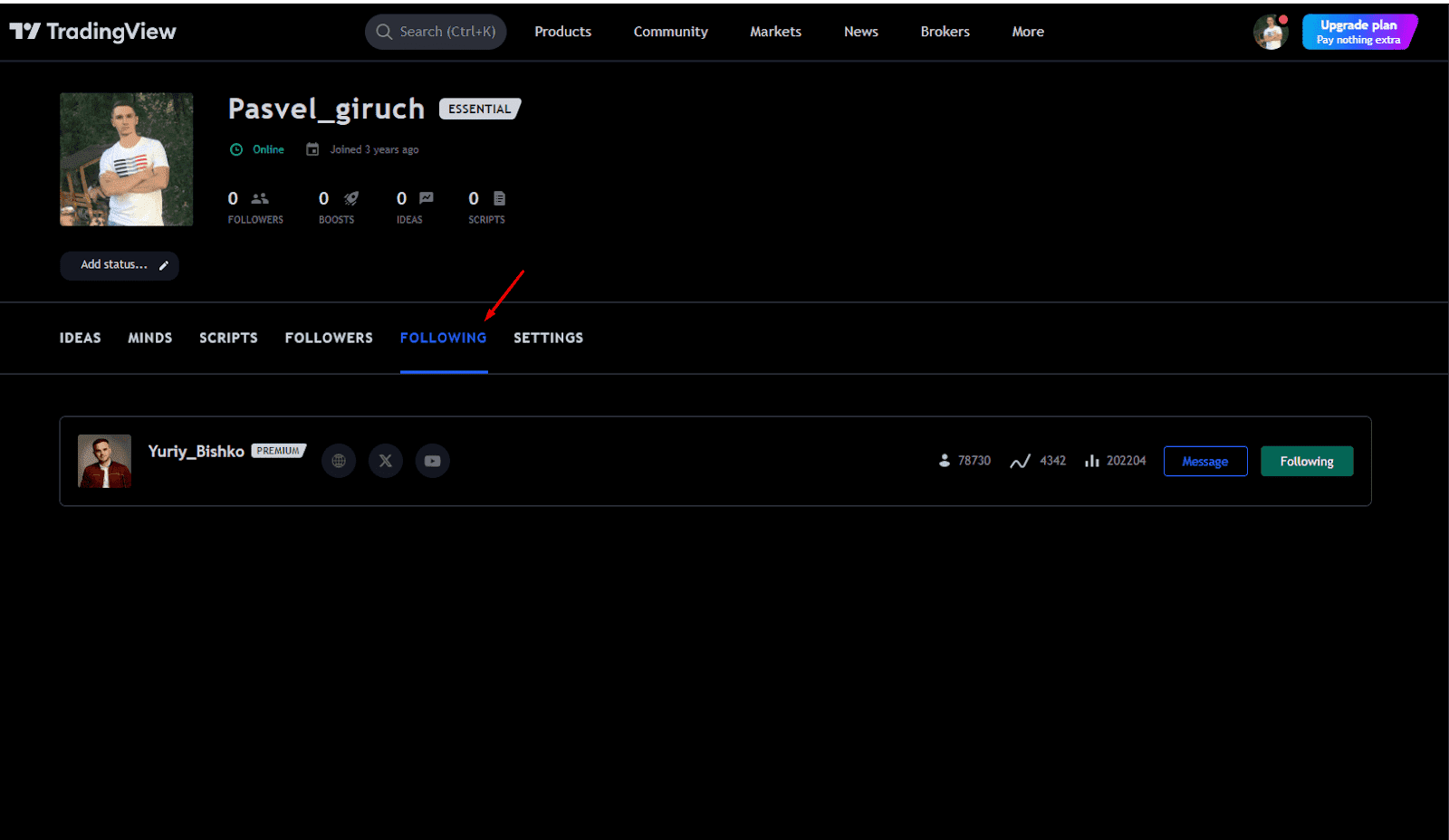

One unique feature of TradingView is the ability to engage in social trading. Users can follow successful traders, share trading ideas, and even copy the trades of experienced individuals.

ATAS specializes in order flow trading, providing tools for in-depth analysis of market orders, bid-ask spreads, and trade volumes. When using ATAS, order flow trading enthusiasts also get detailed data on volume, clusters, and the depth of the market. It offers an advanced DOM that displays the current market depth. Traders can visualize the order book, identify key support and resistance levels, and execute orders precisely.

ATAS trading platform provides insights into volume clusters, indicating areas of significant trading activity. Traders can use this information to identify potential reversal points or areas of increased volatility. The ATAS trading software includes access to Open Interest data, aiding traders in understanding the overall market sentiment and potential areas of market liquidation.

Learn more about ATAS and TradingView in our video

Alerts and notifications

The advantage of TradingView extends to its alert system, allowing traders to set notifications for specific price levels. This functionality extends to notifications via email or the app, offering flexibility to traders on the go. This feature provides the flexibility to step away from the computer without missing crucial market movements.

With ATAS, crypto trading gets easier as it allows to set alerts for significant volumes and provides access to open interest data, a valuable tool for identifying potential areas of market liquidation. With the ATAS application, tracking your trades becomes an easy process.

Community and support

Trading can be a dynamic and sometimes challenging endeavor, making community support and platform responsiveness crucial. TradingView boasts a large and active community where traders share ideas, analyses, and strategies.

As an ATAS crypto trader, you can also get customer support and educational resources, catering to traders seeking a more personalized experience.

Join Advanced Bikotrading Club and receive accurate signals, easy-to-understand Bitcoin insights, and ready-made strategies for more efficient trading. Connect with our friendly community of traders, get support from crypto experts, and attend online meetings with our team. Whether you're a beginner or an experienced trader, the Advanced Bikotrading Club has something for everyone.

Pricing considerations

As for pricing, TradingView has different plans, and if you're using it actively, you'll need at least the Pro Plus plan. ATAS offers competitive pricing, with a notable advantage for crypto traders, as it is currently free for crypto.

Join us in choosing ATAS and take advantage of our partnership to get unique bonuses with our referral program.

Technical requirements

As an order flow-centric platform, the ATAS application may demand more computational power for certain tasks. Analyzing detailed order flow data, including DOM (Depth of Market) and footprint charts, requires a more powerful computer setup, especially if dealing with a high volume of data. It’s important to remember that there is no ATAS online application, traders work on a desktop application.

Trading with TradingView, being primarily a charting platform, tends to be less resource-intensive compared to order flow platforms. Charting, technical analysis, and setting up alerts are generally less demanding tasks.

Conclusion

Choosing between ATAS and TradingView ultimately depends on your trading preferences, strategies, and the importance you place on charting tools versus order flow analysis. If your trading strategy is primarily chart-based, TradingView stands out for its user-friendly interface and accessibility. However, for traders who need more order flow dynamics, especially within the crypto market, ATAS is the frontrunner, offering detailed data and powerful features.